(BRA) Setting Up Brazilian Workforce Tables

To set up Brazilian workforce tables, use the Tax Suspension Type BRA (TAX_SUSP_BRA), Admin/Legal Proceedings BRA (LEGAL_PROC_BRA), Establishment ID Type BRA (ESTAB_TYPE_BRA), Establishment BRA (ESTAB_TBL_BRA), Centralization Data BRA (CENTRALIZATION_BRA), Legal Contract Type (CONTRACT_TYPE_BRA), Health Providers (HEALTH_PROV_BRA), Private Fund FAPI Entities (FAPI_PROV_BRA), CBO Codes BRA (CBO_CD_TBL_BRA), City Codes BRA (CITY_CODES_BRA), Special Training Codes BRA (SPECIAL_TRAINI_BRA), and Income Tax Type Abroad BRA (INC_TAX_TYPE_BRA) components.

These topics discuss how to set up Brazilian workforce tables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PROC_PARAM_BRA |

Enable the functionality to maintain proceeding details for tax suspension purposes. |

|

|

TAX_SUSP_BRA |

Define tax suspension types used in administrative or judicial proceedings. |

|

|

LEGAL_PROC_BRA |

Manage administrative or legal proceedings filed for tax reduction or exemption purposes. |

|

|

ESTAB_TYPE_BRA |

Enter types of establishment ID codes and the format for each ID. |

|

|

ESTAB_TBL1_GBL |

Create an information profile for each of your business establishments: Identify the establishment, indicate its regulatory region, and enter the address. |

|

|

ESTAB_TBL2_GBL |

Enter the establishment's telephone, fax machine, and other related numbers. |

|

|

Additional Info - Brazil Page (additional information - Brazil) |

ESTAB_TBL_BRA |

Enter additional information about the establishment that is specific to the country of Brazil. |

|

FPAS_JUD_C_BRA_SEC |

Enter tax entities and any associated judicial proceeding numbers and FPAS suspension codes. |

|

|

FPAS_ENT_BRA_DET |

Review FPAS information for establishments. |

|

|

CENTRALIZATION_BRA |

Group establishments to obtain centralized data for multiple reports such as SEFIP and CAGED. |

|

|

CNT_TYPE_BRA |

Associate contract types with legal contract types. |

|

|

CNT_TYPE_EC_BRA |

Associate employee classes with legal contract types. |

|

|

HEALTH_PROV_BRA |

Define health provider codes. |

|

|

FAPI_PROV_BRA |

Specify private pension funds and associated CNPJ numbers. |

|

|

CBO_CD_TBL_BRA |

Define occupational codes. |

|

|

CITY_CODES_BRA |

Define city codes by state. |

|

|

SPECIAL_TRAIN_BRA |

Define special training codes. |

|

|

INC_TAX_TYPE_BRA |

Define income tax type codes for employees living abroad. |

A company may have several establishments. You must enter data required for reporting purposes for each establishment, such as different ID types.

Note: All Brazilian establishments must belong to a company.

PeopleSoft provides the ability to register and manage administrative and legal proceeding information that influences the calculation of the INSS, IRRF, or FGTS.

Perform these steps to set up the Administrative and Legal Proceedings functionality:

Activate the functionality on the Adm/Legal Proceedings Parameters BRA Page.

Define tax suspension types on the Tax Suspension Type BRA Page.

After the setup is completed, you can create and maintain administrative and legal proceedings of employers, taxpayers, or entities with collective representation of workers against government agencies on the Administrative/Legal Proceedings BRA Page. Prompts become available in fields where you can select the applicable proceeding numbers and suspension codes on establishment and tax exemption pages.

Note: The Administrative and Legal Proceedings functionality is required, if you use Global Payroll for Brazil for the reporting of the S-1070 event in eSocial.

Use the Adm/Legal Proceedings Parameters BRA (administrative/legal proceedings parameters BRA) page (PROC_PARAM_BRA) to enable the functionality to maintain proceeding details for tax suspension purposes.

Navigation:

This example illustrates the fields and controls on the Adm/Legal Proceedings Parameters BRA page.

|

Field or Control |

Description |

|---|---|

|

Enabled |

Select to enable the Administrative and Legal Proceedings functionality. If selected, field prompts become available on pages such as (BRA) Tax Exemption BRA Page, Additional Info - Brazil Page, Judicial Gathering Data Page, and Exemption Proceedings Page, where you can specify proceedings and their suspension codes that are defined on the Administrative/Legal Proceedings BRA Page. Select this option if you use Global Payroll for Brazil to submit proceeding information (which is maintained on the Administrative/Legal Proceedings BRA Page) for eSocial reporting (S-1070). Clear this option if you do not wish to submit S-1070 events to the Government through Global Payroll for Brazil. Field prompts are not available for selecting proceeding numbers and suspension codes on those pages, which means that you have to enter the values manually. |

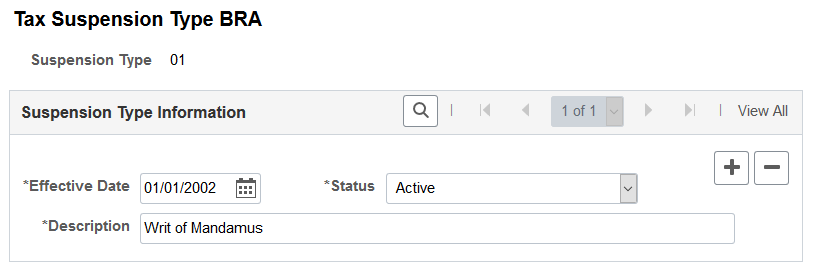

Use the Tax Suspension Types BRA page (TAX_SUSP_BRA) to define tax suspension types used in administrative or judicial proceedings.

Navigation:

This example illustrates the fields and controls on the Tax Suspension Types BRA page.

Global Payroll for Brazil delivers a list of government-provided tax suspension types for use in eSocial reporting.

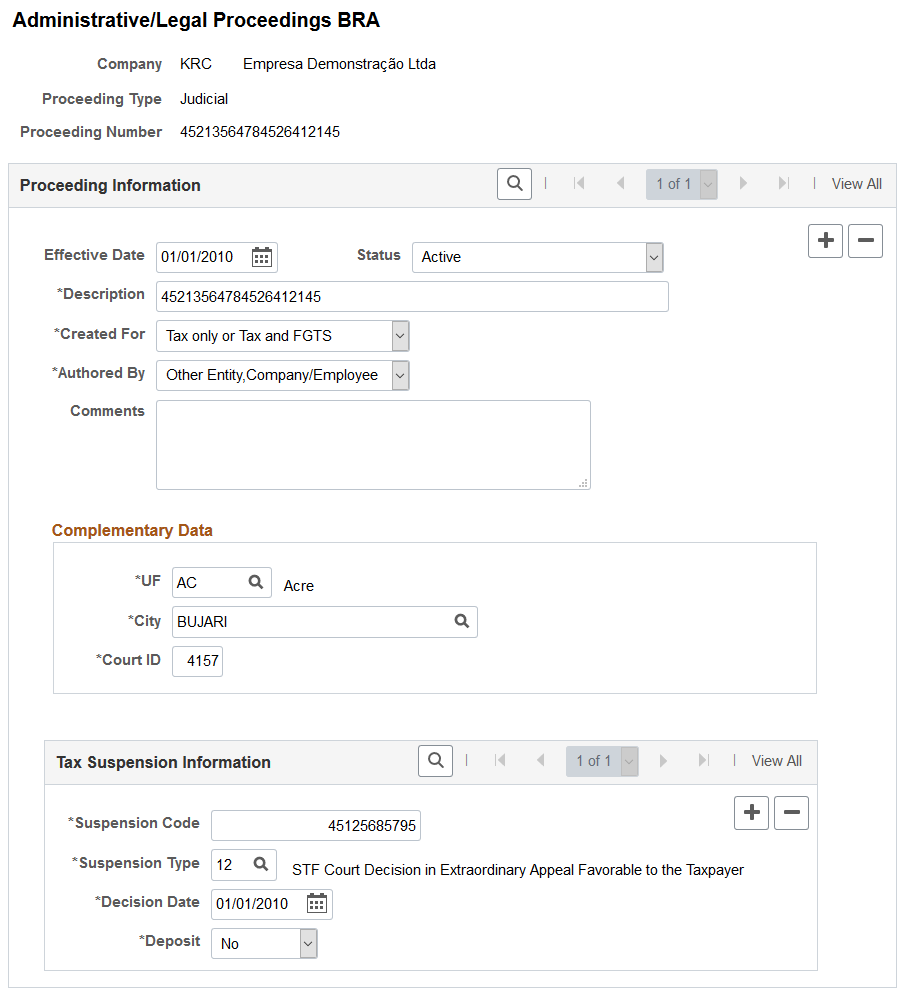

Use the Administrative/Legal Proceedings BRA page (LEGAL_PROC_BRA) to manage administrative or legal proceedings filed for tax reduction or exemption purposes.

Navigation:

This example illustrates the fields and controls on the Administrative/Legal Proceedings BRA page.

Add only proceedings that influence the calculation of taxes or FGTS.

|

Field or Control |

Description |

|---|---|

|

Company |

Displays the company of the proceeding. This is a required field. |

|

Proceeding Type |

Displays the selected type of the proceeding. Values are: Administrative Benefit Number – INSS FAP – Process before 2019 Judicial |

|

Proceeding Number |

Displays the entered proceeding number. This is a required field. Algorithm is in place to validate the proceeding number against the selected proceeding type. The system displays an error if the number cannot be validated successfully. The proceeding number is:

|

|

Description |

Enter a required description for the proceeding. The maximum length is 100 characters. |

|

Created For |

Select the subject or scope of the proceeding. This is a required field. Values are: FGTS only/ Termination Soc Cont (FGTS only, or Termination Social Contribution). Tax only or Tax and FGTS Note: You may see additional Created For values for proceedings there were added to the PeopleSoft system before the eSocial S-1.0 version. |

|

Authored By |

Select the author of the proceeding (for tax reduction or exemption). Values are: Taxpayer: Company or employee who pays the tax. Other Entity,Company/Employee This field is required if the specified proceeding type is Judicial. |

|

Comment |

Enter a description or comment for the proceeding. The maximum length is 255 characters. |

Complementary Data

Select the state and city of where the proceeding was filed, and enter the 4-digit court ID.

This section is required if the specified proceeding type is Judicial and the Created For field value is Tax only or Tax and FGTS.

Tax Suspension Information

This section is required if the Created For field value is Tax only or Tax and FGTS.

Note: If you update the tax suspension information (for example, the suspension code) on the Admin/Legal Proceeding BRA page after the proceeding information was selected on another page (for example, Exemption Proceedings Page) using the field prompt, be sure to also update the same information on that page manually. That way, appropriate events (for example, S-1005, S-1010, S-1020, S-1200, S-2299, and S-2399) can be triggered to report the update to the Government.

|

Field or Control |

Description |

|---|---|

|

Suspension Code |

Enter the tax suspension number, which is 14 digits in length. Do not enter a suspension code more than once for the same proceeding number. |

|

Suspension Type |

Select the type of the tax suspension. The list of available suspension types varies based on the selected proceeding type: If the proceeding type is Administrative, valid suspension types are 03,14, and 92. If the proceeding type is Benefit Number - INSS, all suspension types are available. If the proceeding type is FAP - Process before 2019, the valid suspension type is 14. If the proceeding type is Judicial, valid suspension types are 01, 02, 04, 05, 08, 09, 10, 11, 12, 13, 90, and 92. Suspension types are defined on the Tax Suspension Type BRA Page. |

|

Decision Date |

Enter the date that the tax suspension decision was made. |

|

Deposit |

Indicate if deposit (for tax payment) is available in the bank from the taxpayer during the proceeding. The system automatically sets the value to Yes if the specified suspension type is either 02 or 03, and No if the specified suspension type is 90. The field value is not editable. You can update the Deposit field value for other suspension types. |

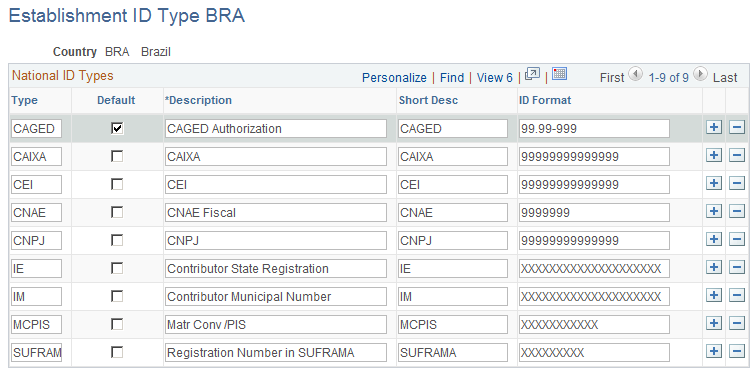

Use the Establishment ID Type BRA page (ESTAB_TYPE_BRA) to enter types of establishment ID codes and the format for each ID.

Navigation:

This example illustrates the fields and controls on the Establishment ID Type BRA page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

Type |

Enter the type of establishment ID code. You can enter ID types that are not legal IDs (national IDs) but are required for certain reports. |

|

Default |

Select to establish this type of ID code as the default for the selected country. |

|

ID Format |

Specify the format of the ID code. Enter a 9 for each digit of the ID number. The system has edit masks that apply special formatting to some of the ID types you enter on this page. The system applies the following formatting to these ID types:

|

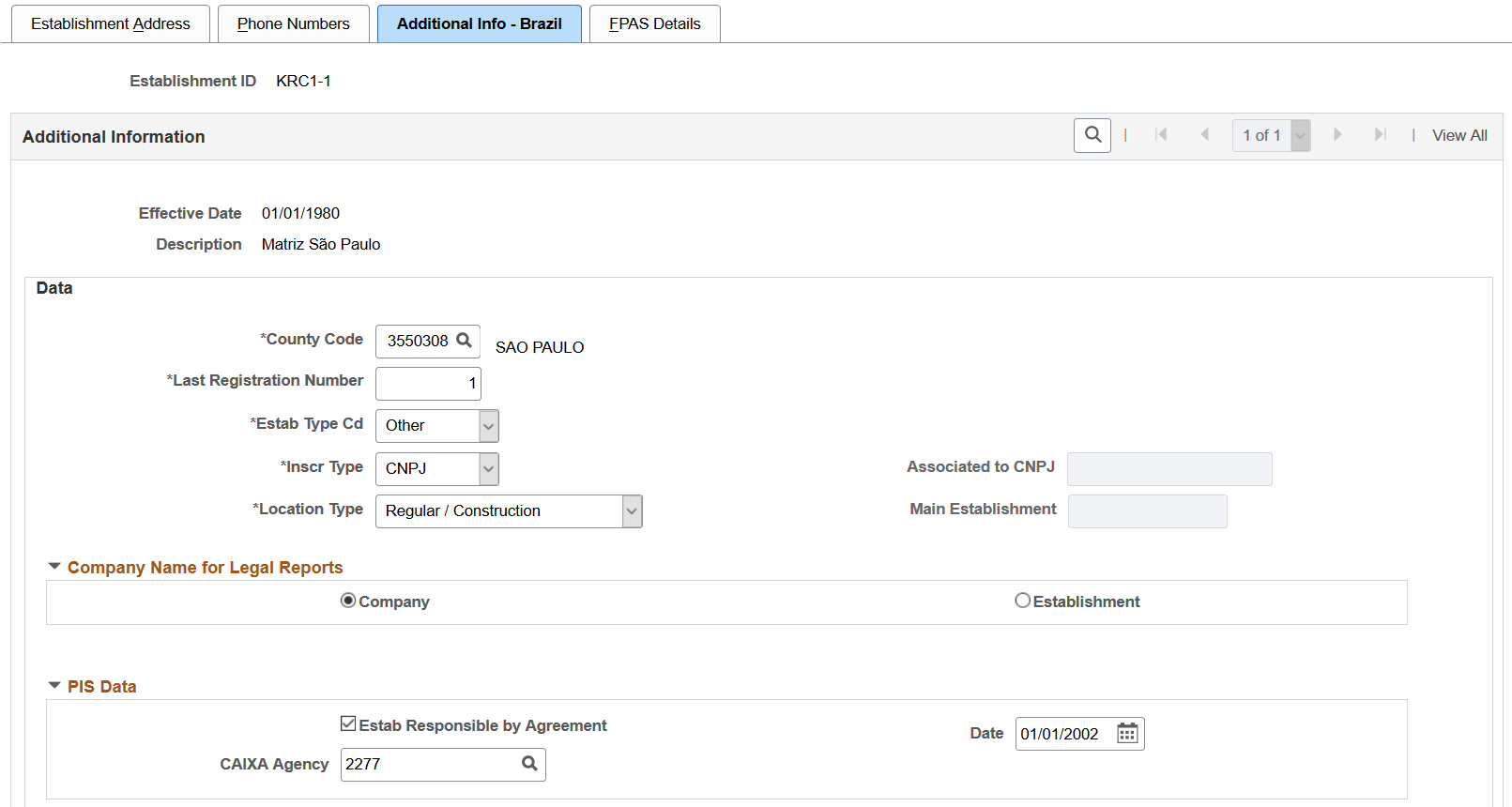

Use the Additional Info - Brazil (additional information - Brazil) page (ESTAB_TBL_BRA) to enter additional information about the establishment that is specific to the country of Brazil.

Navigation:

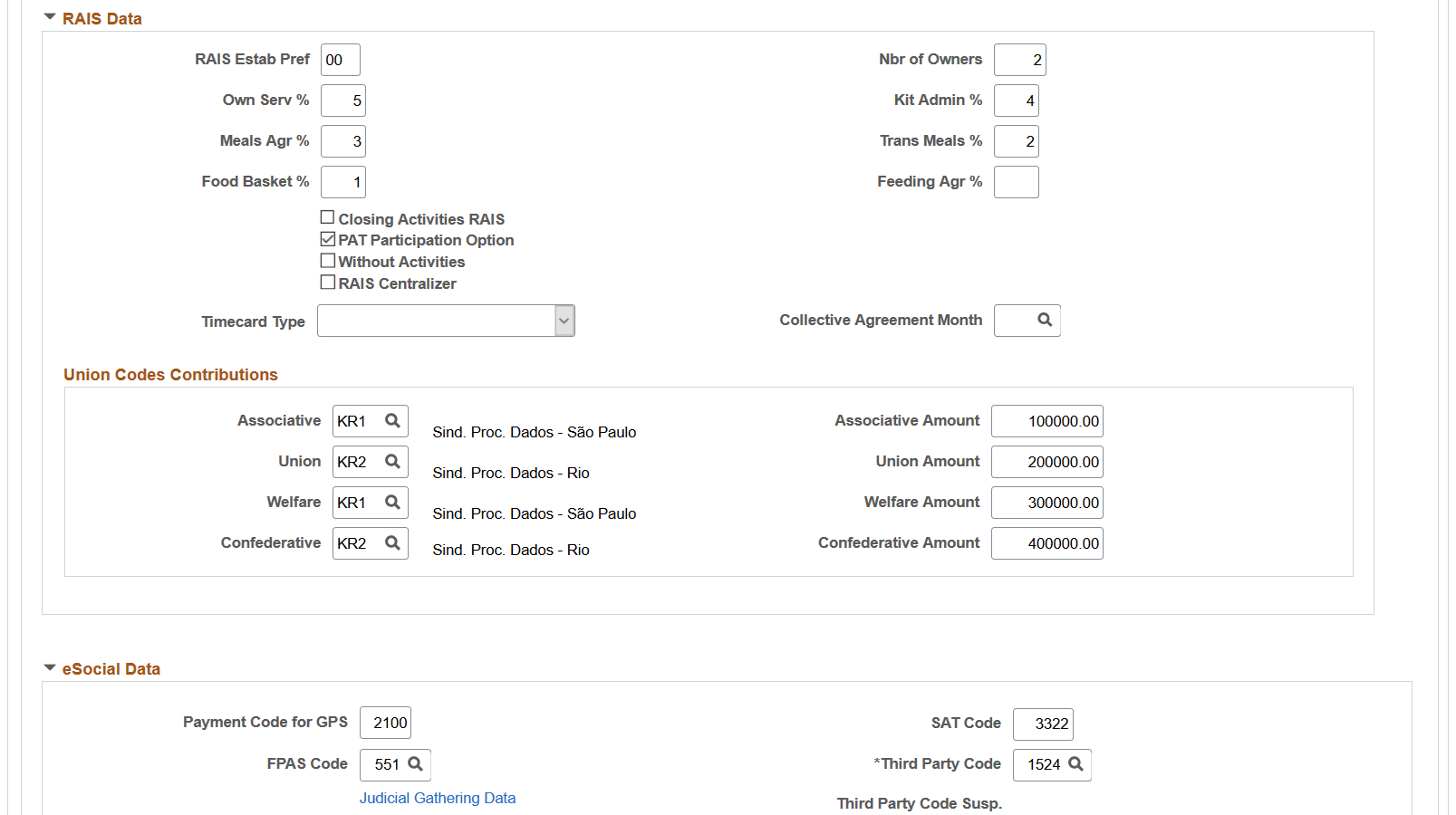

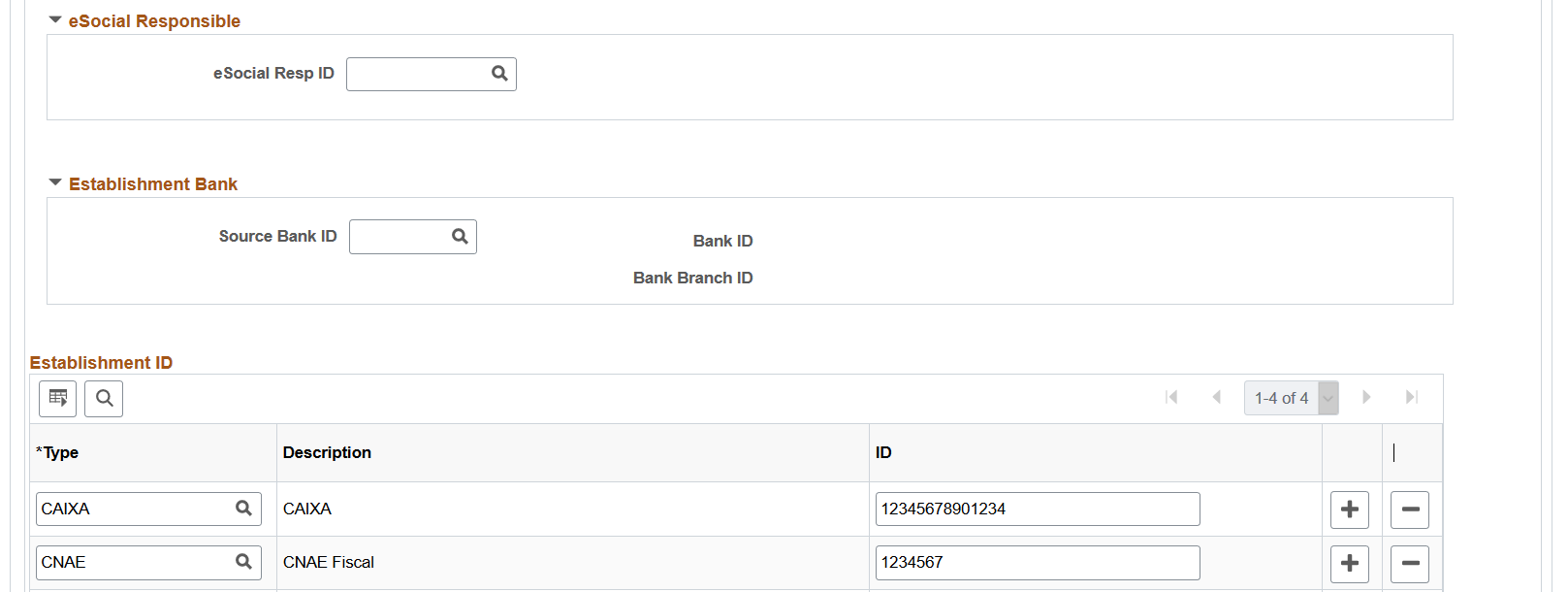

This example illustrates the fields and controls on the Additional Info - Brazil page (1 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Additional Info - Brazil page (2 of 6). You can find definitions for the fields and controls later on this page.

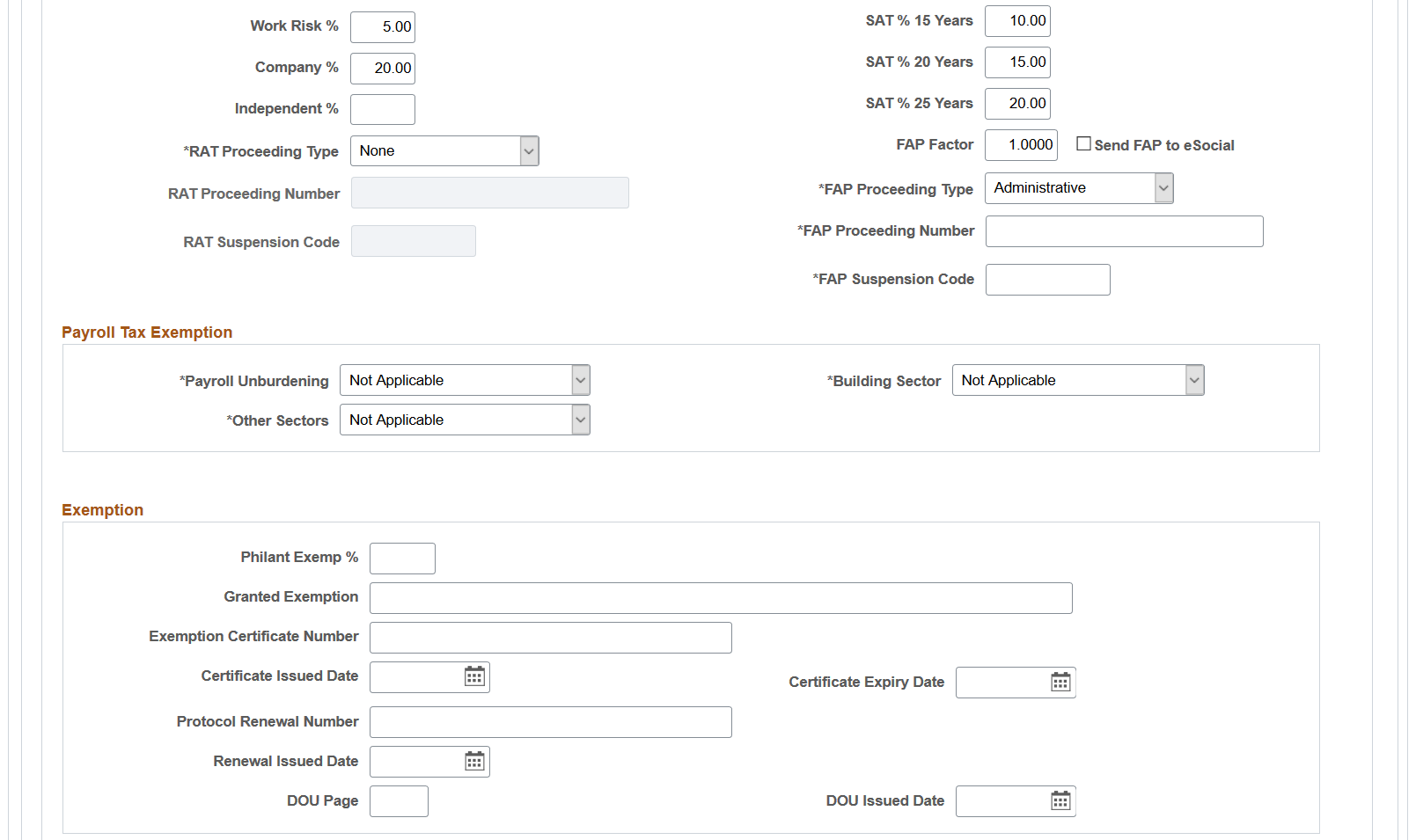

This example illustrates the fields and controls on the Additional Info - Brazil page (3 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Additional Info - Brazil page (4 of 6). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Additional Info - Brazil page (5 of 6). You can find definitions for the fields and controls later on this page.

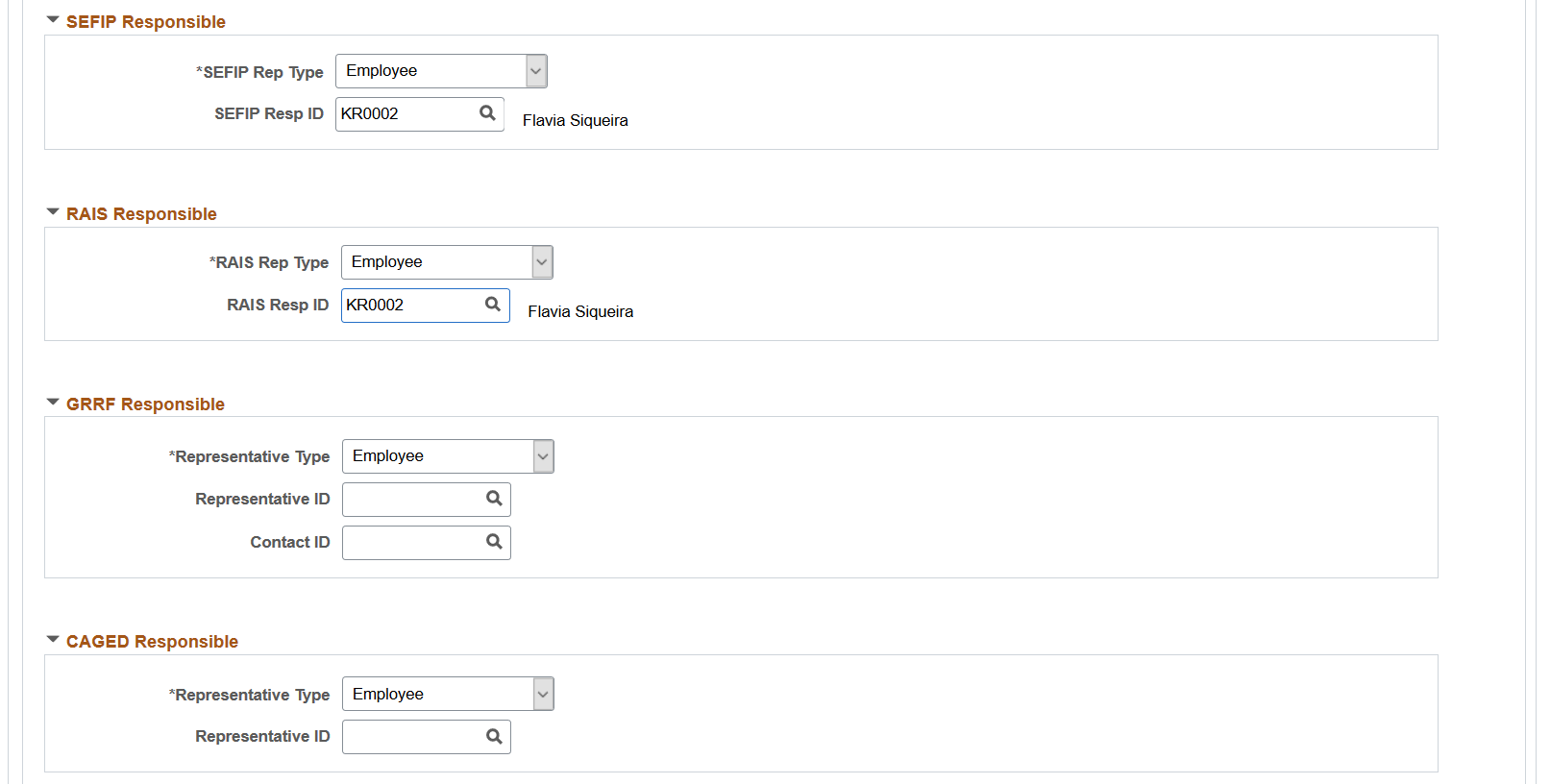

This example illustrates the fields and controls on the Additional Info - Brazil page (6 of 6). You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

County Code |

Enter the county code. |

|

Next Registration Number |

Displays the registration number to be assigned to the next employee who is hired, rehired, or transferred to this establishment. The system automatically increments the last registration number value after the current value has been assigned. This field is not available for edit if the associated company is configured to assign and track registration numbers by company instead of establishment on the Default Settings Page. |

|

Estab Type Cd (establishment type code) |

Select the establishment type code, which is based on the size of the establishment. Values are: Micro, Other, and Small. |

|

Inscr Type (inscription type) |

Select the establishment inscription

type. Values are: CNPJ or CEI.

|

|

Associated to CNPJ |

Select the CNO owner of the establishment. Establishments that are active for the specified company as of the effective date are available for selection. This field becomes editable when the selected inscription type is CEI. |

|

Location Type |

Select the type of taxable location that is applicable to the establishment. Values are: Different FPAS/Third. Use this option if the establishment has the same CNPJ as another establishment but different FPAS and third party codes. When selected, the Main Establishment field becomes available for edits. Location Outside Country Partial Contract Regular/Construction This data is used in eSocial reporting. Note: Only Regular/Construction and Partial Contract are available for selection, if the Construction Indicator field is selected on the (BRA) Company Details BRA Page for the associated company. |

PIS Data

Enter information used to generate the Programa de Integração Social (PIS) report.

|

Field or Control |

Description |

|---|---|

|

Estab Responsible by Agreement (establishment responsible by agreement) |

When you select this check box, the CAIXA Agency field appears. |

|

Date |

The date the Federal Saving Bank generated the TSO file. |

|

CAIXA Agency |

Enter the number of the Caixa Economica Federal (Federal Saving Bank) branch that generates the file with the issued resources for the PIS payment of employees (TSO file). |

RAIS Data

Enter information used to generate the Relação Anual de Informações Sociais (RAIS) report.

|

Field or Control |

Description |

|---|---|

|

RAIS Estab Pref (RAIS establishment prefix) |

Enter the prefix only if the establishment register appears for RAIS as a key differentiation. RAIS assigns the establishment prefix. |

|

Nbr of Owners (number of owners) |

Enter the number of owners working in the establishment. |

|

Own Serv % (owner service percentage) |

Enter the owner service percentage. |

|

Kit Admin % (kitchen administration percentage) |

Enter the kitchen administration percentage. |

|

Meals Agr % (meals agreement percentage) |

Enter the meals agreement percentage. |

|

Trans Meals % (transported meals percentage) |

Enter the transported meals percentage. |

|

Food Basket % (food basket percentage) |

Enter the food basket percentage. |

|

Feeding Agr % (feeding tickets agreement percentage) |

Enter the feeding tickets agreement percentage. |

|

Closing Activities RAIS |

Select to indicate that the establishment closed its activities during the base year (the year for which you are currently reporting). A RAIS report uses this information. |

|

PAT Participation Option (Programa de Alimentação do Trabalhador participation option) |

Select to indicate the establishment participates in PAT. |

|

Timecard Type |

Select a timecard type. Timecard types are mapped for eSocial reporting on the Timecard Type Page. |

eSocial Data

Information entered in this section is used in GPS/SEFIP and eSocial reporting.

|

Field or Control |

Description |

|---|---|

|

Payment Code for GPS |

Enter the company's social security contribution code. The code is displayed in field #3 on the GPS report. |

|

SAT Code |

Enter the work accident insurance code. |

|

FPAS Code |

Enter the FPAS (Fundo de Previdência e Assistência Social) social assistance and pension fund code. The activity type of the company determines this code. The system identifies all third parties and their respective percentages assigned to this code and generates a total percentage of collection for the establishment. |

|

Third Party Code |

Enter the code of the third-party that collected services from the establishment. The system uses these codes to identify the third parties involved in a specific collection. The SEFIP report uses this code to get the GFIP value. |

|

Judicial Gathering Data |

Click to access the Judicial Gathering Data Page to view or enter tax entities and any associated judicial proceeding numbers. |

|

Third Party Code Susp. (third party code suspension) |

Displays the sum of entity codes from rows on the FPAS Details Page in which the Judicial Gathering field is selected. |

|

Work Risk % |

Enter the establishment's identified predominant worth risk percentage. The system uses this percentage to obtain worth risk component of the INSS total amount for collection. |

|

SAT % 15 Years (SAT percentage up to 15 years), SAT % 20 Years (SAT percentage up to 20 years), andSAT % 25 Years (SAT percentage up to 25 years) |

Enter the percentages that apply to only the eligible employees for each case of special retirement (with 15, 20, and 25 years of service). The system uses this percentage to obtain the special retirement component of the INSS total amount for collection. |

|

Company % |

Enter the percentage to use to obtain the company component of the INSS total amount for collection. |

|

Independent % |

Enter the percentage to use to obtain the independent component of the INSS total amount for collection. |

|

Send FAP to eSocial |

Select to always print the FAP Factor value in the XML files that are generated for the S-1005 event. Select this check box only if you have received an error from eSocial regarding an integration failure with the Government's FAP system, and need to resubmit the event with a FAP factor. Clear to print the FAP Factor value in the XML files only if the FAP Proceeding Type value is not None. The Government does not accept any new FAP factor, unless there is an administrative or judicial proceeding number that authorizes its use. By default, the check box is cleared. |

|

RAT Proceeding Type or FAP Proceeding Type |

Select the applicable proceeding type for RAT or FAP. By default, the value is set to None. |

|

RAT Proceeding Number or FAP Proceeding Number |

Select or enter the applicable proceeding number for the specified RAT or FAP proceeding type. Proceeding numbers meeting all these conditions are available for selection:

Note: The field prompt is available for use if the Enabled option is selected on the Adm/Legal Proceedings Parameters BRA Page. Enter the number manually, if the option is not selected. Proceedings are defined on the Administrative/Legal Proceedings BRA Page. |

|

RAT Suspension Code or FAP Suspension Code |

Select the tax suspension code for the specified proceeding number. Suspension codes meeting the same conditions as the proceeding numbers are available for selection. Note: The field prompt is available for use if the Enabled option is selected on the Adm/Legal Proceedings Parameters BRA Page. Enter the code manually, if the option is not selected. |

Payroll Tax Exemption

Information entered in this section is used in eSocial reporting (S-1280 - Complementary Information to Periodic Events).

|

Field or Control |

Description |

|---|---|

|

Payroll Unburdening |

Select the law that the establishment adheres to on payroll unburdening. Values are: Art. 7 to 9 Law 12.546/2011 Not Applicable |

|

Building Sector |

Select the unburdening payroll for the building sector. Values are: Non-Replaced Contribution Not Applicable Replaced Contribution |

|

Other Sectors |

Select the unburdening payroll for other sectors (industries). Values are: Fully Replaced Not Applicable Partially Replaced |

Exemption

|

Field or Control |

Description |

|---|---|

|

Philant Exemp % (philanthropy exemption percentage) |

Enter the percentage to use to obtain the philanthropy exemption component of the INSS total amount for collection. |

|

Granted Exemption |

Enter the granted exemption. The maximum length of this field is 70 characters. |

Disabled People Information

|

Field or Control |

Description |

|---|---|

|

Disabled People Contract |

Select the type of contract for disabled employees. Values are: Exempted by Judicial Process Exempted by Law Mandatory Not Applicable. When selected, the Proceeding Number field is not editable. |

|

Proceeding Number |

Enter an applicable proceeding number. |

Apprentice Information

|

Field or Control |

Description |

|---|---|

|

Apprentice Contract |

Select the type of contract for apprentices. Values are: Exempted by Judicial Process Exempted by Law Mandatory Not Applicable. When selected, both Proceeding Number and Education Entity Contract fields are not editable. |

|

Proceeding Number |

Enter an applicable proceeding number. This value is required if the selected apprentice contract is Exempted by Judicial Process. |

|

Education Entity Contract |

Indicate if this is an education entity contract. By default, the value is set to No. If yes, you must enter a CNPJ ID in the Education Entity Information section. |

Education Entity Information

Specify a CNPJ ID in this section if the Education Entity Contract field is set to Yes.

DIRF Responsible

Complete this group box only for Declaração de Informações à Receita Federal (DIRF) centralizing establishments.

|

Field or Control |

Description |

|---|---|

|

DIRF Rep Type (DIRF representative type) |

Select whether the party responsible for generating the DIRF file is a Company, Employee, or Non Empl (non-employee). |

|

DIRF Resp ID (DIRF responsible ID) |

Enter the company code or employee ID of the party responsible for generating the DIRF file. |

SEFIP Responsible

|

Field or Control |

Description |

|---|---|

|

SEFIP Rep Type (SEFIP representative type) |

Select whether the party responsible for generating the SEFIP file is a Company, Employee, or Non Empl (non-employee). |

|

SEFIP Resp ID (SEFIP responsible ID) |

Enter the company code or employee ID of the party responsible for generating the SEFIP file. |

RAIS Responsible

Complete this group box only for RAIS centralizing establishments.

|

Field or Control |

Description |

|---|---|

|

RAIS Rep Type (RAIS representative type) |

Select whether the party responsible for generating the RAIS file is a Company, Employee, or Non Empl (non-employee). |

|

RAIS Resp ID (RAIS responsible ID) |

Enter the company code or employee ID of the party responsible for generating the RAIS file. |

GRRF Responsible

|

Field or Control |

Description |

|---|---|

|

Representative Type |

Select whether the party responsible for generating the GRRF file is a Company, Employee, or Non Empl (non-employee). |

|

Representative ID |

Enter the company code or employee ID of the party responsible for generating the GRRF file. |

CAGED Responsible

|

Field or Control |

Description |

|---|---|

|

Representative Type |

Select whether the party responsible for generating the CAGED file is a Company, Employee, or Non Empl (non-employee). |

|

Representative ID |

Enter the company code or employee ID of the party responsible for generating the CAGED file. |

eSocial Responsible

|

Field or Control |

Description |

|---|---|

|

eSocial Resp ID (eSocial Representative ID) |

Enter the employee ID of the party responsible for generating eSocial reports. |

Establishment Bank

|

Field or Control |

Description |

|---|---|

|

Source Bank ID |

Enter the establishment's ID. |

Establishment ID

|

Field or Control |

Description |

|---|---|

|

Type |

Enter an establishment ID type. Important! If the establishment is set as a headquarter for its company (the Headquarters Unit field is selected on the Establishment Address page), be sure to specify the CNPJ number of the company to support eSocial processing. |

|

ID |

Enter the establishment's ID. |

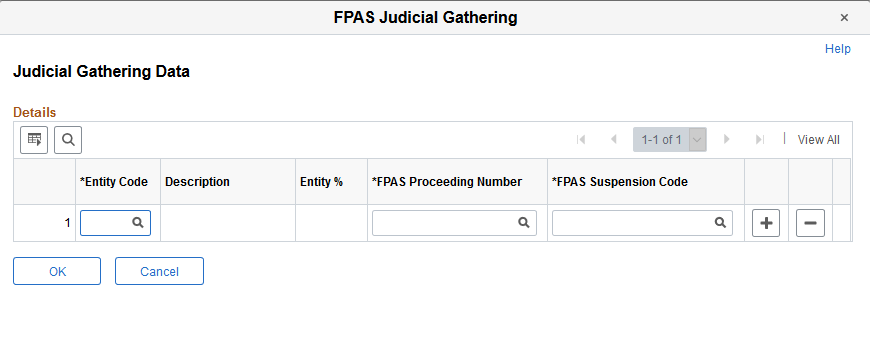

Use the Judicial Gathering Data page (FPAS_JUD_C_BRA_SEC) to enter tax entities and any associated judicial proceeding numbers and FPAS suspension codes.

Navigation:

Click the Judicial Gathering Data link on the Additional Info - Brazil page.

This example illustrates the fields and controls on the Judicial Gathering Data page.

Use this page to enter tax entities for the establishment. If the entity is associated with a judicial proceeding that provides the establishment a tax exemption at the specified percentage, you can specify the proceeding number here. Field prompts are available to the FPAS Proceeding Number and FPAS Suspension Code fields, if the Administrative and Legal Proceedings functionality is enabled on the Adm/Legal Proceedings Parameters BRA Page.

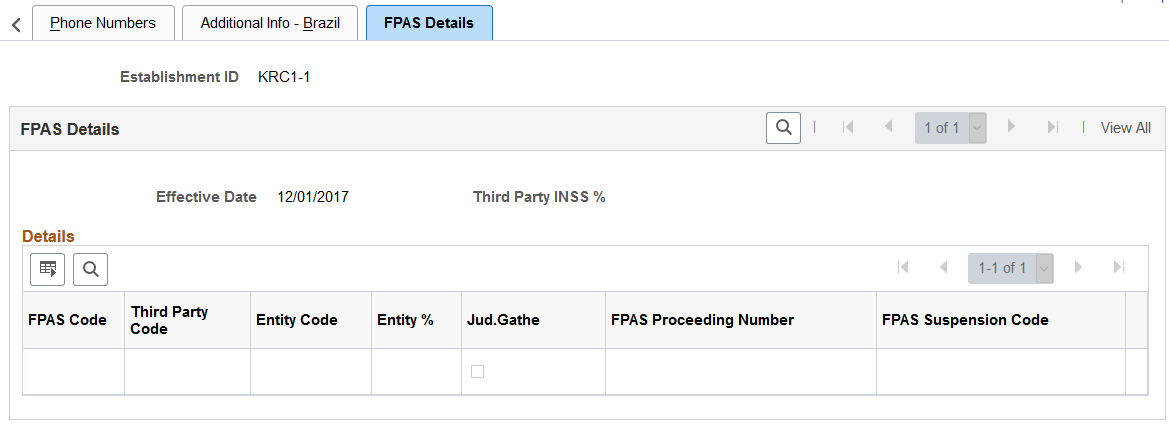

Use the FPAS Details page (FPAS_ENT_BRA_DET) to review FPAS information for establishments.

Navigation:

This example illustrates the fields and controls on the FPAS Details page.

This page lists the FPAS codes that are associated with the establishment.

See Also Judicial Gathering Data Page

Use the Centralization Data BRA page (CENTRALIZATION_BRA) to group establishments to obtain centralized data for multiple reports such as SEFIP and CAGED.

Navigation:

This example illustrates the fields and controls on the Centralization Data BRA page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Description |

|---|---|

|

Process Type |

When you add a record, select the type of data that you want to centralize, such as SEFIP or CAGED. |

|

Centralizer |

Enter the name of the establishment that creates centralized data for reporting purposes. |

|

Establishment ID |

Enter the IDs of all establishments whose data the centralizer collects. |

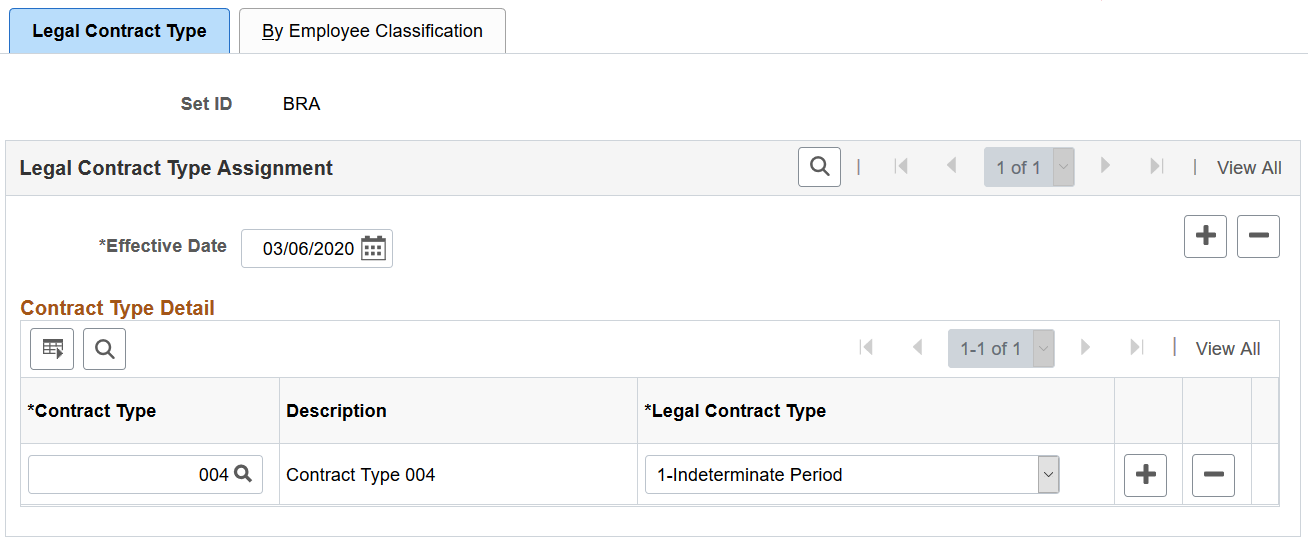

Use the Legal Contract Type page (CNT_TYPE_BRA) to associate contract types with legal contract types.

Navigation:

This example illustrates the fields and controls on the Legal Contract Type page.

Use this page to associate contract types of your workforce that are defined on the Define Contract Types Page or Contract Types for Regulations Page with available legal contract types.

The system uses this information to identify the legal contract type of contracts (available on the Job Information Page), and populates the information on the (BRA) Additional Contract Data Page for workers.

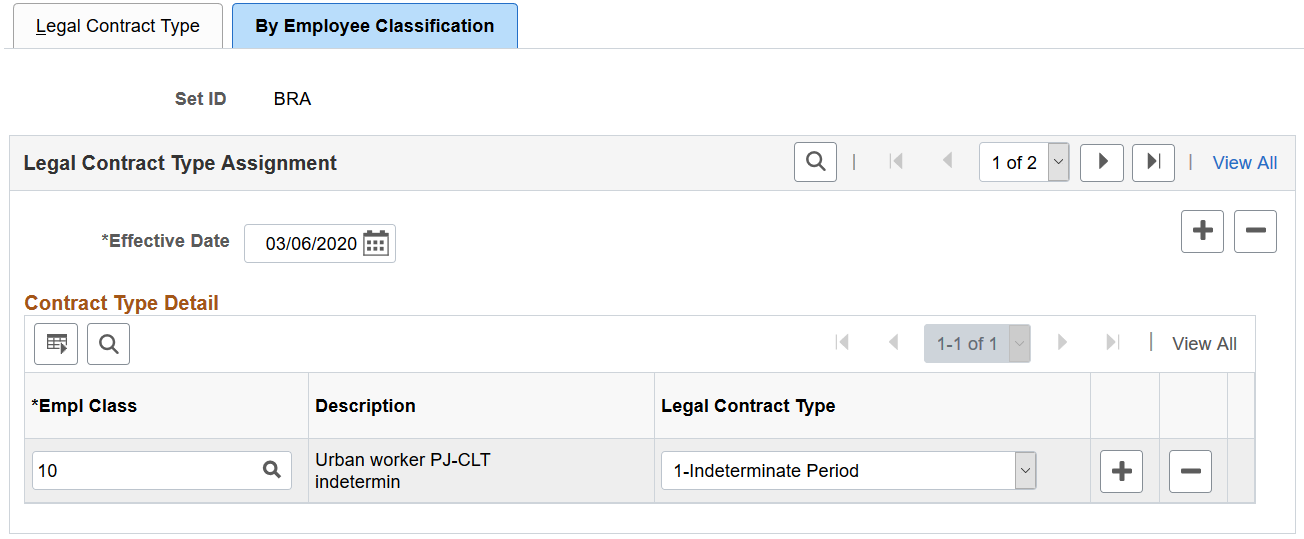

Use the By Employee Classification page (CNT_TYPE_EC_BRA) to associate employee classes with legal contract types.

Navigation:

This example illustrates the fields and controls on the Employee Classification page.

Use this page to associate employee classes that are defined on the Employee Class page with available legal contract types.

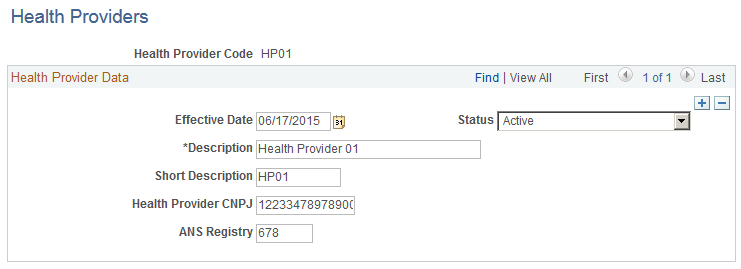

Use the Health Providers page (HEALTH_PROV_BRA) to define health providers.

Navigation:

This example illustrates the fields and controls on the Health Providers page.

Use this page to define health providers for use in the system. Health providers are referenced on the DIRF Parameters BRA Page to generate DIRF reports.

|

Field or Control |

Description |

|---|---|

|

Health Provider Code |

Displays the code that identifies the health provider in the system. The maximum length of this code is 10 characters. |

|

Health Provider CNPJ |

Enter the 14-digit CNPJ (Cadastro Nacional da Pessoa Jurídica), National Registry of Legal Entities, of the health provider. |

|

ANS Registry |

Enter the ANS registry code of the health provider. |

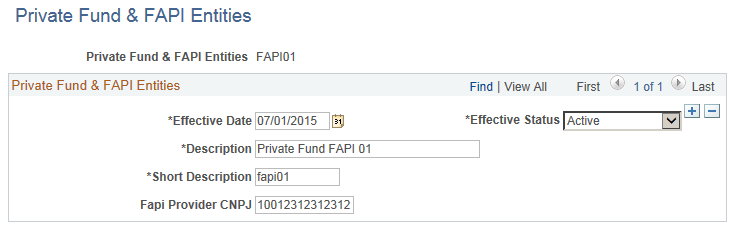

Use the Private Fund & FAPI Entities page (FAPI_PROV_BRA) to specify private pension funds and associated CNPJ numbers.

Navigation:

This example illustrates the fields and controls on the Private Fund & FAPI Entities page.

Use this page to specify private funds and FAPI entities that can be referenced on the IREN Parameters BRA Page.

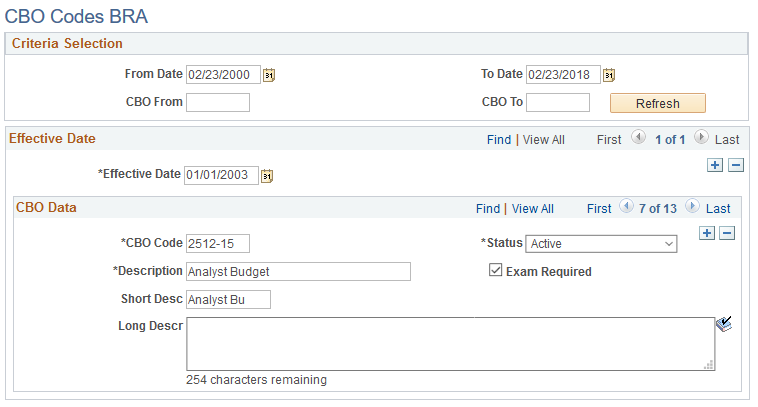

Use the CBO Codes BRA page (CBO_CD_TBL_BRA) to define occupation codes.

Navigation:

This example illustrates the fields and controls on the CBO Codes BRA page.

Codes effective before December 31, 2002 were in the format 99999. Codes effective from January 1, 2003 onward are in the format 9999–99.

Refer to the official website (http://www.mtecbo.gov.br) for a list of CBOs (Brazilian Code of Occupation).

|

Field or Control |

Description |

|---|---|

|

Exam Required |

Select to indicate that drug test is required for this CBO code and occupation. |

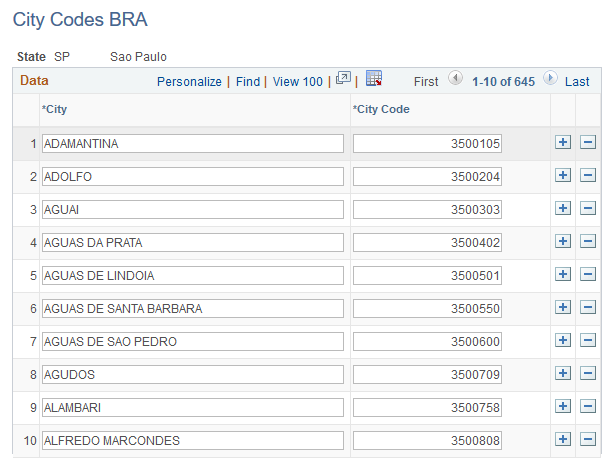

Use the City Codes BRA page (CITY_CODES_BRA) to define city codes by state.

Navigation:

This example illustrates the fields and controls on the City Codes BRA page.

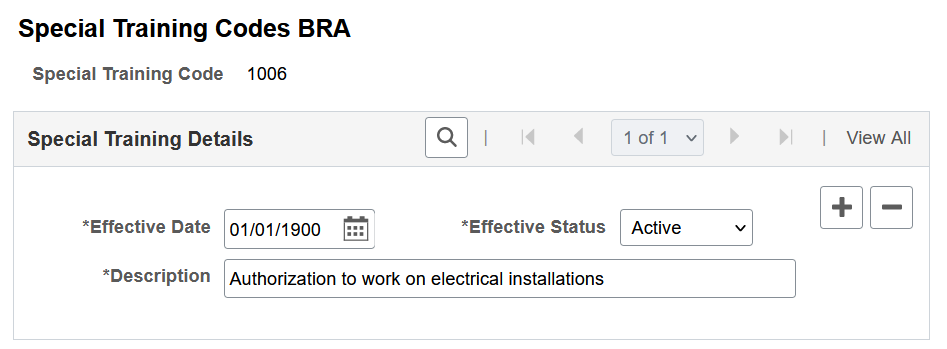

Use the Special Training Codes BRA page (SPECIAL_TRAIN_BRA) to define special training codes.

Navigation:

This example illustrates the fields and controls on the Special Training Codes BRA page.

The system prepopulates this component with special training codes from table 28 in eSocial. Do not add any codes that are not supported in eSocial.

These codes are used in recording special training for employees on the (BRA) Training/Capacity Building BRA Page.

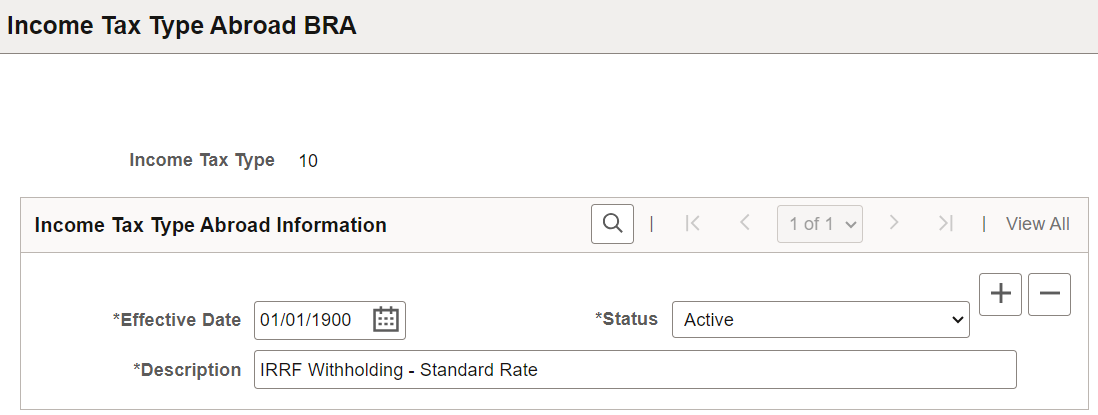

Use the Income Tax Type Abroad BRA page (INC_TAX_TYPE_BRA) to define income tax type codes for employees living abroad.

Navigation:

This example illustrates the fields and controls on the Income Tax Type Abroad BRA page.

The system prepopulates this component with income tax type codes from table 30 in eSocial. Do not add any codes that are not supported in eSocial.

These codes are used in recording the income tax type for employees living aboard on the (BRA) Personal Information BRA Page.