Defining Establishments

To define establishments, use the Establishment (Define Establishment) component (ESTABLISHMENT_DATA) and Controlled Establishment Sumry component (CONTROLLED_ESTABS). Use the ESTABLISHMENT_DATA component interface to load data into the tables for the Establishment component.

These topics provide an overview of establishments and discuss defining establishment data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ESTAB_TBL1_GBL |

Create an information profile for each of your business establishments: Identify the establishment, indicate its regulatory region, and enter the address. |

|

|

ESTAB_TBL2_GBL |

Enter the establishment's telephone, fax machine, and other related numbers. |

|

|

Controlled Establishment Sumry Page |

CONTROLLED_ESTABS |

Shows all establishments that have designated the selected Headquarters Unit as their Controlling Establishment. |

You use the Establishment component to define distinct physical places of business (establishments) within your company, to enter address information, and to enter regulatory reporting information. In PeopleSoft Human Resources, you define establishments that are consistent with the regulatory requirements of your business operations.

In PeopleSoft Human Resources, an establishment:

Has an address.

Is associated with a company.

Is used for regulatory purposes.

An establishment isn't necessarily a single building or location; it could be an entire industrial or office complex, but it is usually a physical place for which information is reported as a consolidated unit.

Two examples of how establishments are used:

Occupational Illness and Injury Record keeping (OSHA 200) and Equal Employment Opportunity/Affirmative Action reporting in the United States.

Social Security and business statistical reporting in France.

Note: (USA) To support AAP reporting, locations and establishments can have a many to many relationship. Set up the relationship between establishments to locations on the Location Profile page (LOCATION_TBL2_GBL). Only establishments that are effective as of the location's effective date are available on the Location Profile page. View the locations associated with an establishment on the Establishment Address page.

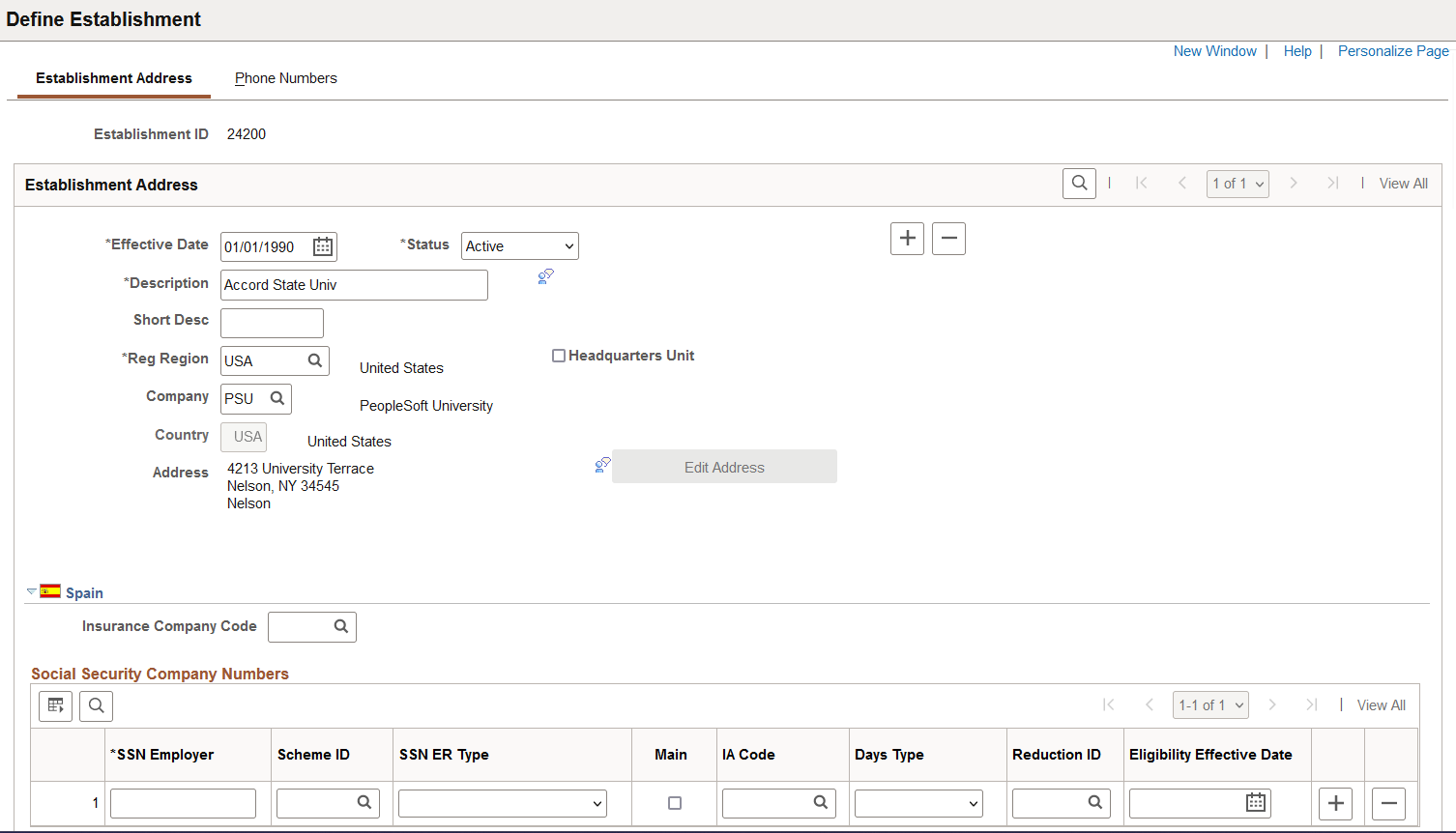

Use the Establishment Address page (ESTAB_TBL1_GBL) to create an information profile for each of your business establishments: Identify the establishment, indicate its regulatory region, and enter the address.

Navigation:

This example illustrates the fields and controls on the Establishment Address page (1 of 5).

This example illustrates the fields and controls on the Establishment Address page (2 of 5).

This example illustrates the fields and controls on the Establishment Address page (3 of 5).

This example illustrates the fields and controls on the Establishment Address page (4 of 5).

This example illustrates the fields and controls on the Establishment Address page (5 of 5).

Field or Control |

Description |

|---|---|

Headquarters Unit |

Select if the establishment that you're defining is your headquarters. Designate at least one establishment in your company as the headquarters. Important! (BRA) To support eSocial processing, specify only one headquarters unit for each company. |

(ESP) Spain

Field or Control |

Description |

|---|---|

Insurance Company Code |

Select the code of the insurance company that represents the establishment (work center) in work-related injuries. These codes are maintained on the Insurance Company page (INSUR_COMP_CD_ESP). |

SSN Employer |

Enter the social security number as assigned by the Spanish government. |

Scheme ID |

Select the scheme id. |

SSN ER Type (social security number employer type) |

Select the SSN type— Apprentice, Regular, or Training —based on the type of contract you have with your employees. |

Main |

Select if the entry in the SSN Employer field is the main number for this establishment (work center). One work center can have more than one employer social security number. |

IA Code (industry activity code) |

Enter the IA code, which is maintained on the Industry Activity page (INDSTRY_ACT_CD_ESP). |

Days Type |

Select the Days type from the available options. |

Reduction ID |

Select the Reduction ID from the available options. |

Eligibility Effective Date |

Enter the effective date of eligibility. |

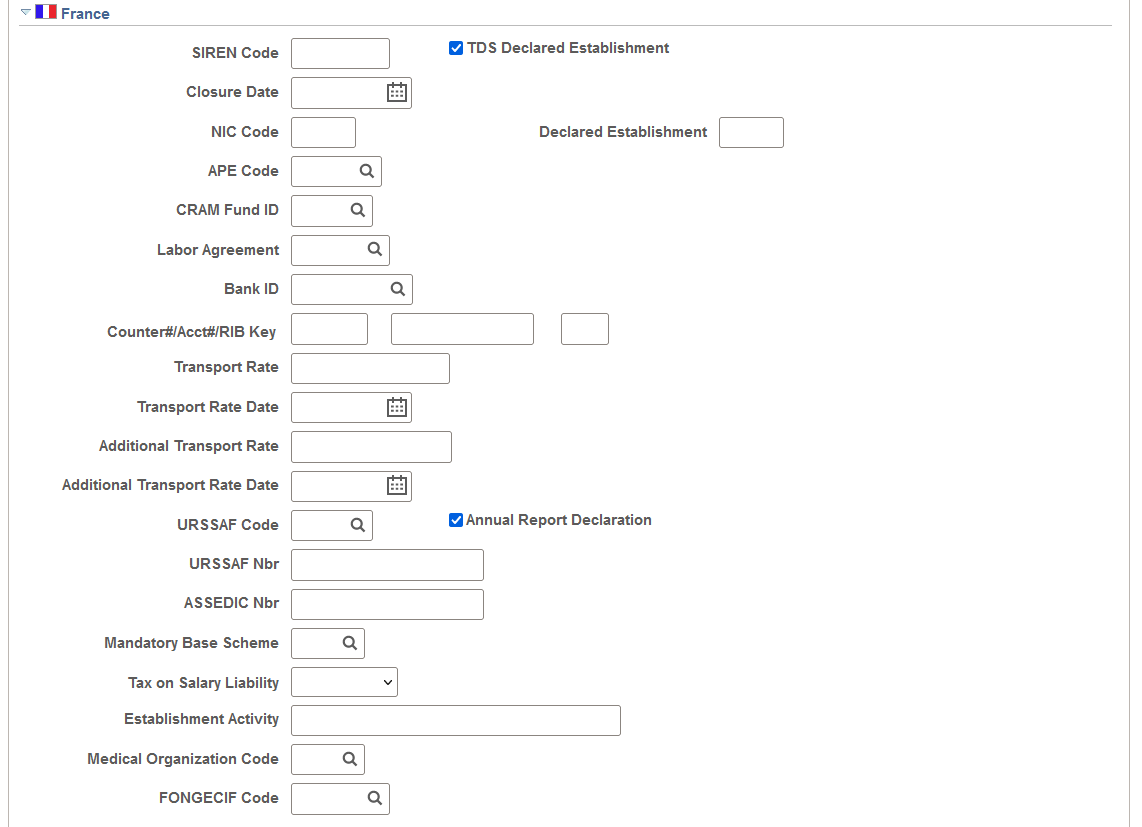

(FRA) France

Field or Control |

Description |

|---|---|

NIC Code (Numero Interne de Classement code). (Internal Number of Filing) |

Enter the NIC code for the establishment. NIC numbers identify the entities that are inside the same enterprise. |

Note: The SIRET number (Systeme Informatique pour le Répertoire des Etablissements, or Electronic List of Entities) is an identifying number that is given to a French business by the INSEE (Institut National de la Statistique et des Etudes Economiques, or National Institute of Statistics and Economics Information). INSEE is an official statistics and economics organization in France. The SIRET number is a combination of the SIREN and NIC numbers and is used by the tax and social security authorities to identify a business enterprise and its entities.

Field or Control |

Description |

|---|---|

CRAM Fund ID (Caisse Regionale d'Assurance Maladie fund ID) |

Select a CRAM fund ID. CRAM is the regional social body that deals with the prevention of and compensation for industrial injuries. The CRAM office oversees the local CPAM (Caisse Primaire d'Assurance Maladie) offices that manage occupational health care coverage. |

Counter#/Acct #/RIB Key (counter number/account number/RIB key) |

Enter the Counter#/Acct #/RIB Key information. |

Transport Rate |

Enter the transport rate. The transport rate is a statutory deduction. Each establishment has a rate, and the URSSAF notifies establishments of this rate on a yearly basis. The region uses this deduction to subsidize transportation and maintain and build roads. PeopleSoft Global Payroll uses the transport rate that you enter here. |

Transport Rate Date |

Enter the date of the last update to the Transport Rate. This date is reported in the DUCS report provided in PeopleSoft Global Payroll for France. |

Additional Transport Rate |

Enter the additional transport rate if applicable. The transport rate is a statutory deduction and is defined by local regulations. PeopleSoft Global Payroll for France uses the additional transport rate that you enter here. |

Additional Transport Rate Date |

Enter the date of the last update to the Additional Transport Rate. This date is reported in the DUCS report provided in PeopleSoft Global Payroll for France. |

URSSAF Code (Union de Recouvrement de la Securite Social et des Allocations Familiales code) and URSSAF Nbr (URSSAF number) |

Enter an URSSAF code and number. The URSSAF is responsible for ensuring payment of Social Security contributions by all French employers. |

Mandatory Base Scheme |

Select the Social Security code for DADS. |

Tax on Salary Liability |

Indicate if the tax on salary liability is complete, partial or if there is no liability to this tax. |

Establishment Activity and Medical Organization Code |

Enter an establishment activity and select a medical organization code. Medical organization codes are defined on the Medical Organizations page (). These fields are used for Single Hiring Statement reporting. |

Establishment Fund Membership

This scroll area displays details of the pension/contingency funds defined for the establishment on the Pension/Contingency Contracts page. Click the Membership Number link to view the pension/contingency contract definition.

Establishment Risk

Field or Control |

Description |

|---|---|

Risk Code |

Enter the risk code. The various rates are associated by the risk code that is used at the department level to specify the work accident rate for the department. |

AT SECTION (Section Accident du Travail section) (Work Accident Section) |

System-displayed information that you need to identify the risk code by establishment. |

Standard Rate |

Enter the standard rate information. The various rates are associated by the risk code that is used at the department level to specify the work accident rate for the department. |

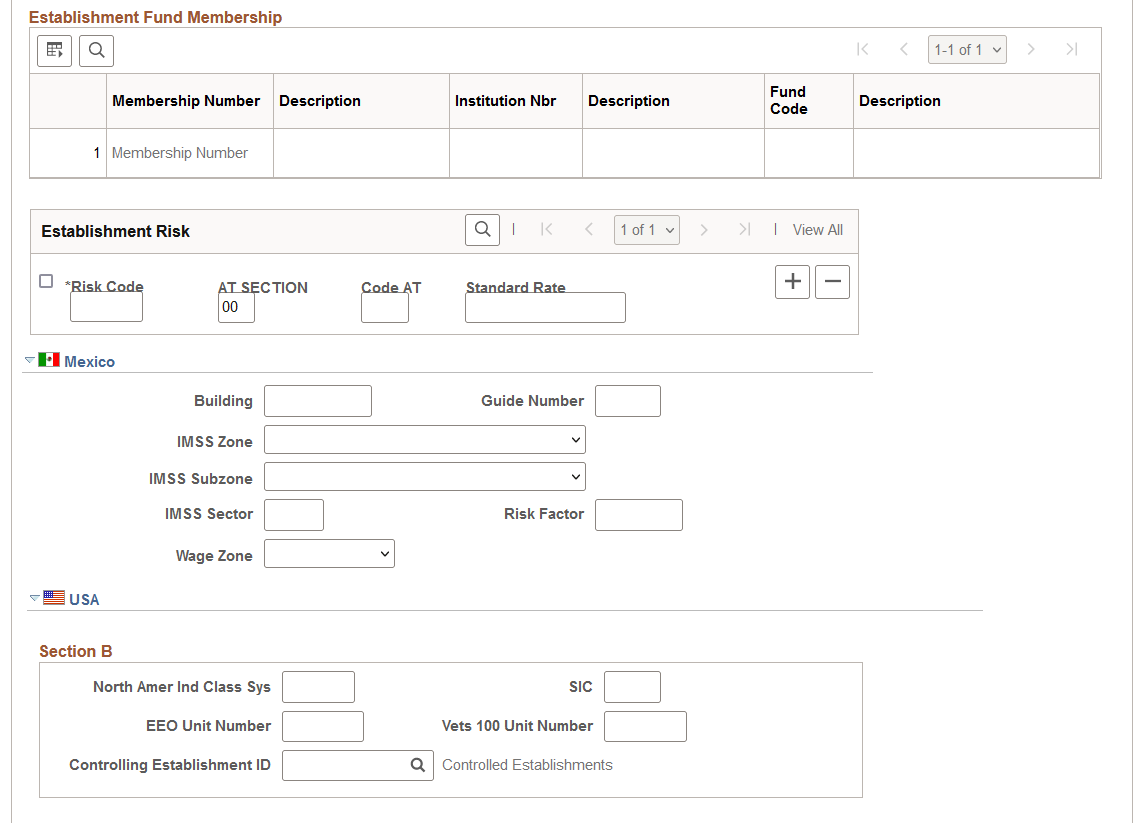

(MEX) Mexico

Enter the Registros Patronal information required for social security and tax purposes.

Field or Control |

Description |

|---|---|

Building |

Enter the building for your establishment's address. |

Guide Number |

Enter the number provided by the IMSS authority. The guide number is used as a reference when you submit reports to the IMSS. |

IMSS Zone, IMSS Subzone, and IMSS Sector |

Select the IMSS zone, subzone, and sector for your establishment's location. The IMSS zone, IMSS subzone and IMSS sector indicate the office where you can make your payments. |

Risk Factor |

Enter the risk factor that's used for IMSS tax calculation. |

Wage Zone |

Select the economic zone for your company's location. Wage zones dictate minimum wages. Valid values are A Zone, B Zone, and C Zone. |

(USA) USA

Enter information in the following USA-specific sections.

Section B

Field or Control |

Description |

|---|---|

North Amer Ind Class Sys [North American Industrial Classification System (NCIS)], Controlling Establishment ID, SIC (Standard Industrial Classification), and Vets 100 Unit Number |

Enter the NAICS code, controlling establishment ID, SIC code, and Vets 100 unit number, if any apply to this establishment. |

Section C

Field or Control |

Description |

|---|---|

EEO-1 Minimum 100 Employees and EEO-1 Company Affiliated |

Select if they apply to this establishment. |

EEO-1 Filed Previous Year |

Selected by default. If you didn't file an EEO-1 report for this establishment last year, deselect this check box. |

|

Unique Entity ID |

Note: This field is required if the employer is a federal contractor. Enter the Unique Entity ID (UEI) for any headquarter or non-headquarter establishment that is designated as a federal contractor (i.e., Federal Contractor Designation). |

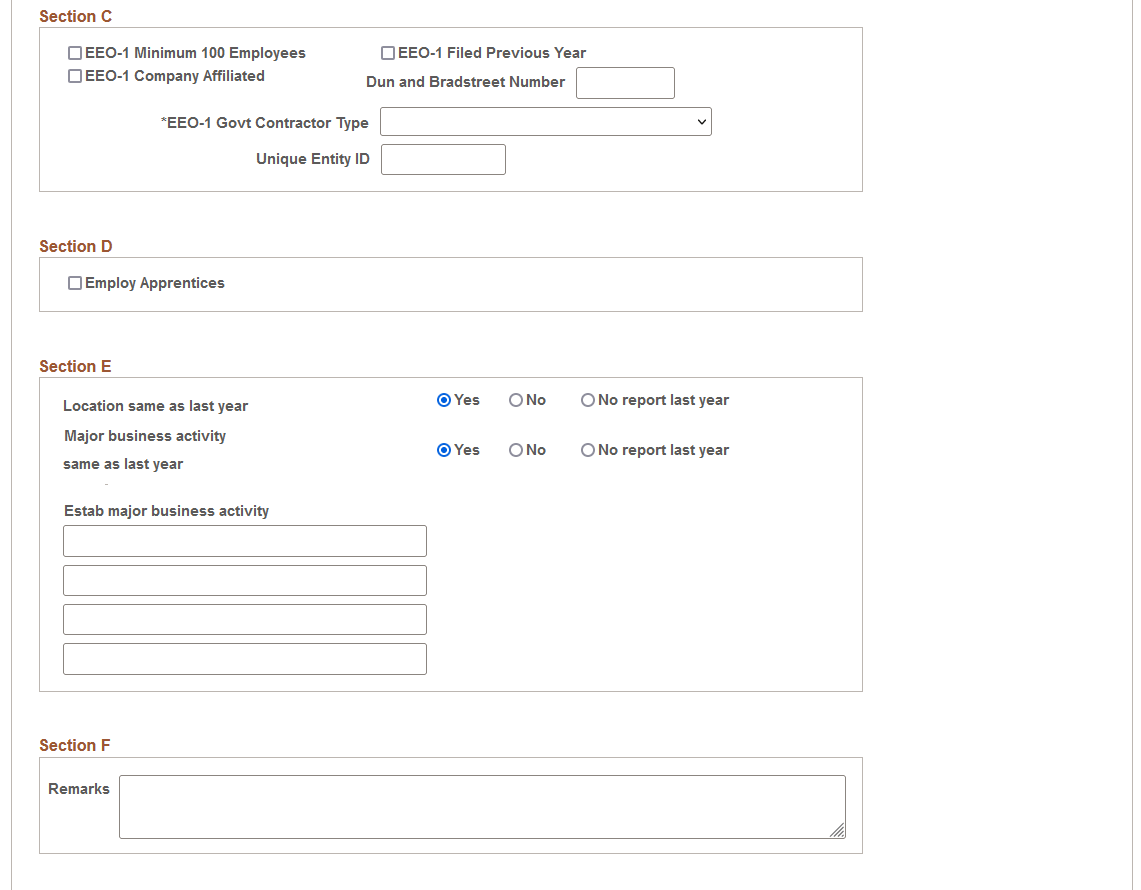

Section E

Field or Control |

Description |

|---|---|

Location same as last year |

Select Yes or No to indicate whether your location is the same as last year, or select No Report if you made no report last year. |

Major business activity: same as last year |

Select Yes or No to indicate whether your business activity is the same as last year; or, select No Report if you made no report last year. |

Estab major business activity (establishment's major business activity) |

Enter a description of the establishment's major business activity. The description is limited to the four lines that appear on the page. |

Section F

Use the Remarks group box to enter comments.

Note: Commas are not permitted in this section.

Note: To maintain historical information, you should add a new effective dated row for the establishment when you make changes to the comments.

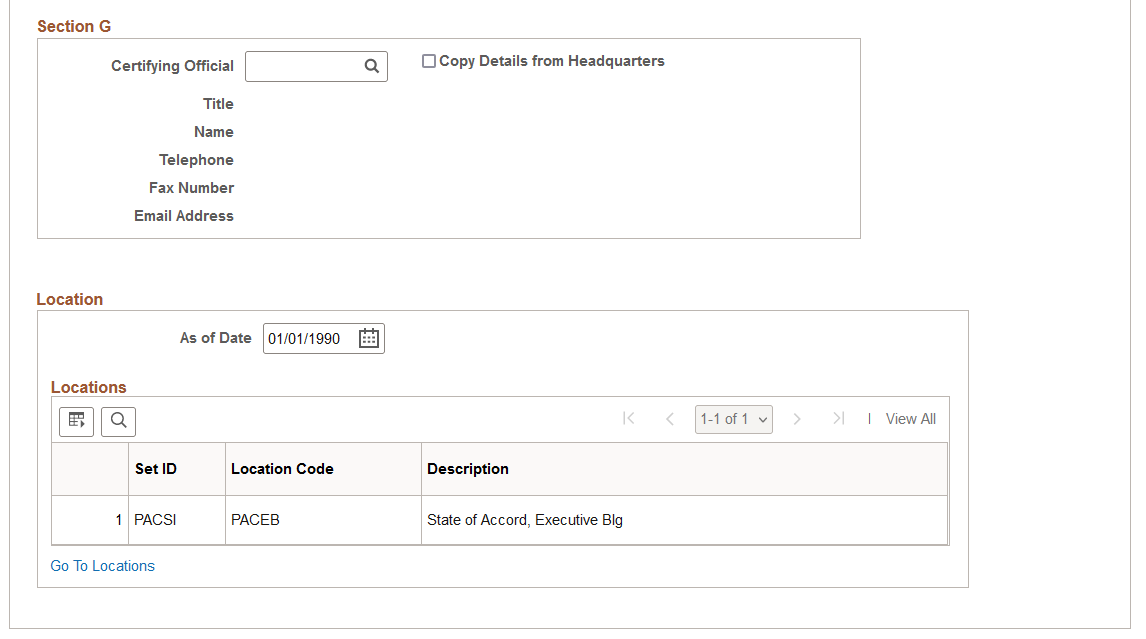

Section G

Field or Control |

Description |

|---|---|

Certifying Official |

Select the name of the certifying official. |

Copy Details from Headquarters |

Select to copy details from headquarters. |

Location

Field or Control |

Description |

|---|---|

As of Date |

Select a date to view which locations are associated with this establishment at a certain point in time. |

Set ID, Location Code, andDescription |

View the location codes associated with this establishment on the Location Profile page. |

Go To Locations |

Click to access the Location component. The system will open the component with the same action you are in on the Establishments component. When you save or cancel your changes on the Locations component, the system returns you to the Establishment (Define Establishment) component. |

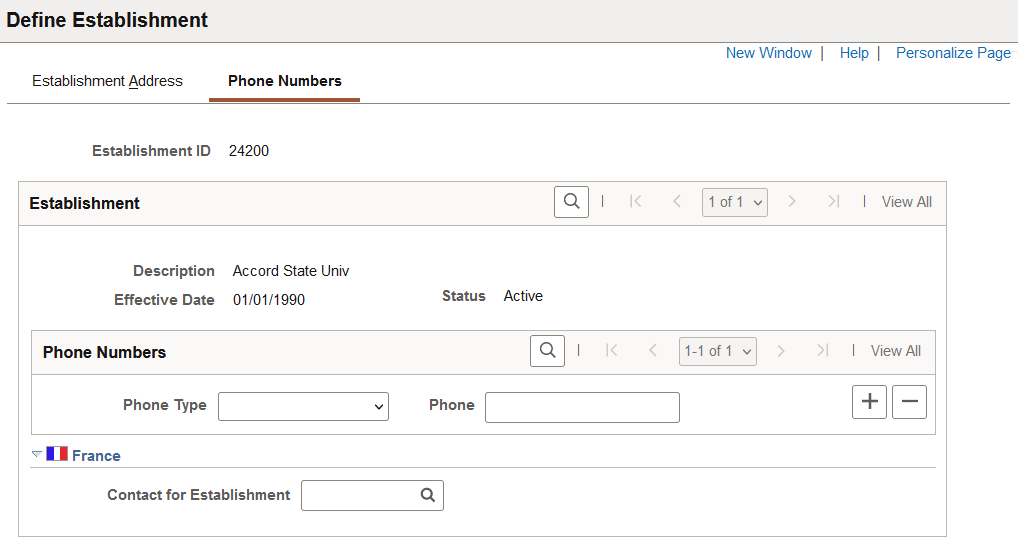

Use the Phone Numbers page (ESTAB_TBL2_GBL) to enter the establishment's telephone, fax machine, and other related numbers.

Navigation:

This example illustrates the fields and controls on the Phone Numbers page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Phone Type and Phone |

Enter phone information for this establishment. |

(FRA) France

Field or Control |

Description |

|---|---|

Contact for Establishment |

Select the contact for this establishment. |