Generating Declaration of Withholding Tax (DIRF) Reports

To set up parameters for DIRF reporting, use the DIRF Parameters BRA (GPBR_PARM_DIRF) component.

This topic provides an overview of DIRF reporting and discusses how to produce DIRF reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_PARM_DIRF |

Enter DIRF parameters for a company. The parameters are used to produce the annual DIRF report. |

|

|

GPBR_RC_DIRF_MENS |

Generate a monthly DIRF report for a company or establishment. |

|

|

GPBR_RC_ANNDIRF |

Generate a company's annual DIRF report. |

|

|

GPBR_AU_DIRF |

Enter company’s annual income and tax contributions for autonomous workers. |

|

|

GPBR_AU_DIRF_HS |

Enter company’s annual health care contributions for autonomous workers. |

You can use Global Payroll for Brazil to produce a monthly report (GPBRDI01) that shows each individual's taxable income, deductions, and withholding tax for the reported month. The system can also generate the annual DIRF report (GPBRDI02, Declaração do Imposto Retido na Fonte).

Note: To identify who is responsible for producing the DIRF report for an establishment, use the Additional Info - Brazil page in the Administer Workforce business process of PeopleSoft HR.

See (BRA) Setting Up Brazilian Workforce Tables.

Monthly DIRF Report

You can generate the monthly DIRF report for an entire company or a selected establishment. You can select the run types or pay groups to consider and can include employees, contingent workers, or persons of interest. When you run the report, you identify the elements that store the values for the taxable income, deductions, and withholding tax amounts that appear in the report.

This is simply a control report, once the DIRF is an annual and legal Brazilian report. This report enable you to have monthly control of the taxes and taxable amounts.

Annual DIRF Report

Before you can produce a company's annual DIRF report, you must use the DIRF Parameters page to select the default establishment and contact person responsible for submitting the report, and any additional data, such as employee ID and establishment ID, that will help you identify the individuals listed in the report. You also select the earnings and deductions to include in the report, and specify which elements represent taxable income, deductions, or withholding tax. (When you run the report, you can override the default values for the responsible establishment, company, or DIRF contact.)

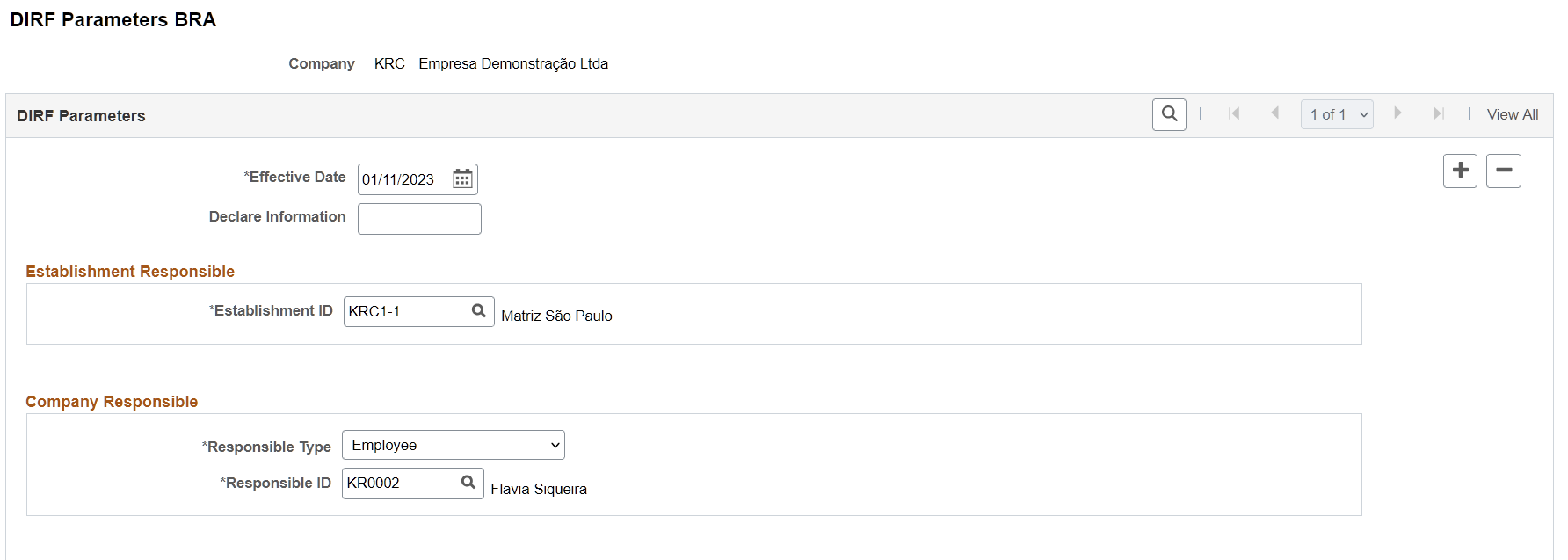

Use the DIRF Parameters BRA page (GPBR_PARM_DIRF) to enter DIRF parameters for a company.

The parameters are used to produce the annual DIRF report.

Navigation:

This example illustrates the fields and controls on the DIRF Parameters BRA page (2 of 2).

Establishment Responsible

Field or Control |

Description |

|---|---|

Establishment ID |

Select the establishment that is responsible for producing the company's DIRF report. |

Company Responsible

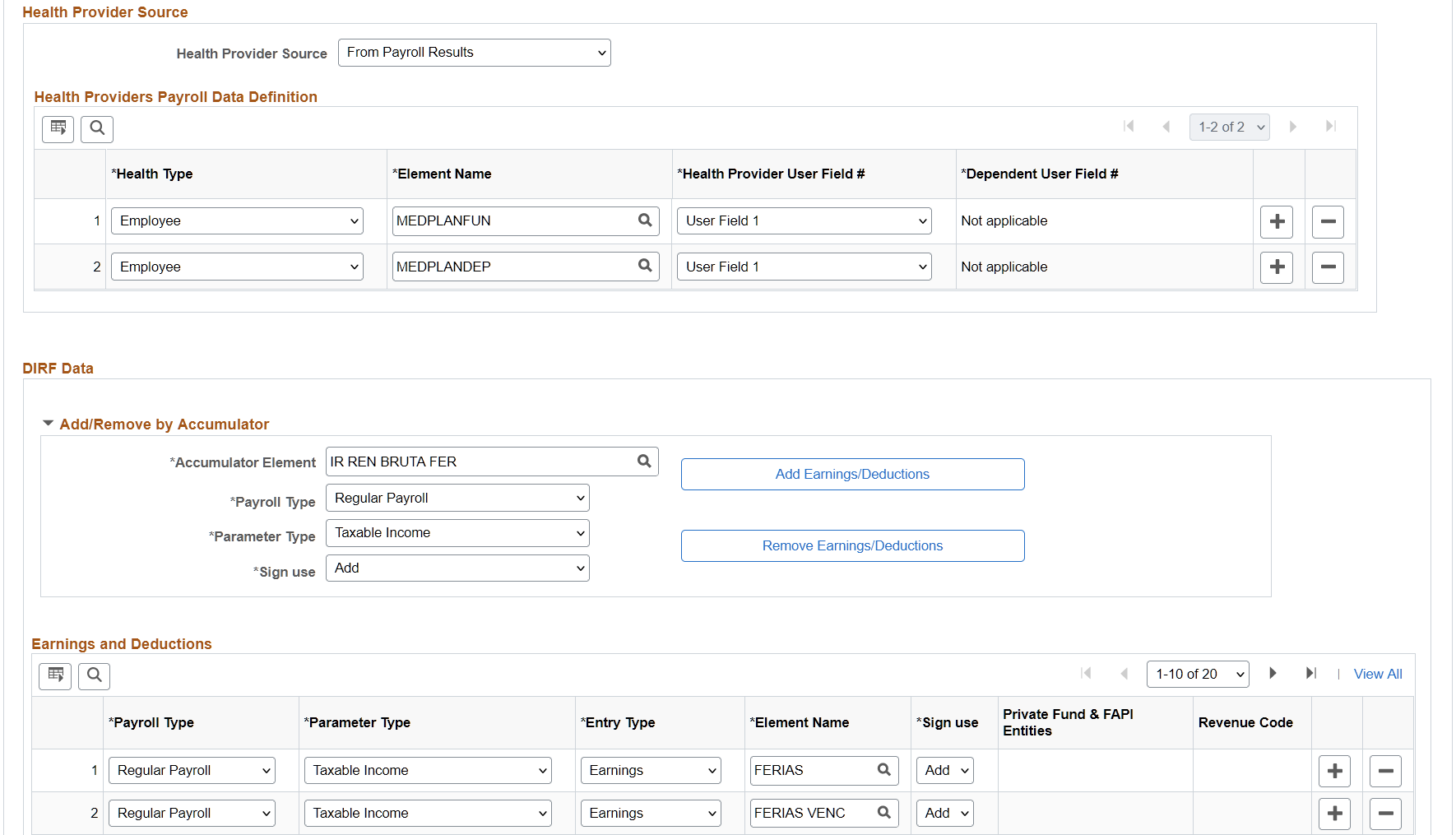

Health Provider Source

Use this section to enter health care-related payee and dependent information. The system uses this information to determine where to look for the health care information to be displayed in the DIRF report. The same information is also collected for use in the IREN report.

Field or Control |

Description |

|---|---|

Health Provider Source |

Select the source from which the system collects health provider information for the report. Values are:

Leave the field blank if you don’t want to report health provider information. |

Health Providers Payroll Data Definition

Enter information in this section if From Payroll Results or Both is selected as the health provider source.

Note: Be sure to add element ASSMEDICADEP for the Dependent health type.

Field or Control |

Description |

|---|---|

Health Type |

Specify the health type, Dependent or Employee. |

Element Name |

Select an element. Note: Be sure to prepare health provider deductions with user field variables. Then, override the character value of the variables on the Element Assignment By Payee - Element Detail Page. These values must be overridden before the calculation of payroll. |

Health Provider User Field # (health provider user field number) |

Specify the field where health provider name is stored in payroll calculation, User field 1 through 6. |

Dependent User Field # (dependent user field number) |

Specify the field where dependent ID is stored in payroll calculation, User field 1 through 6. This field is available for edits if the selected health type is Dependent. |

DIRF Data

You can add or remove the appropriated earnings or deductions to the report based on an accumulator by selecting the appropriate values in the Payroll Type andParameter Type fields of the page. Then, click the Add Earnings/Deductions button or theRemove Earnings/Deductions button and the system adds or removes the appropriate earnings or deductions, based on the accumulator you specified.

Use these fields to identify the earnings and deductions that are to be included in the report.

Field or Control |

Description |

|---|---|

Payroll Type |

Select the payroll type for the earning or deduction: 13th. Salary, Profit Sharing Program or Regular Payroll. |

Parameter Type |

Identify whether the value represents: >=65 Non Taxable Prt Incme Alimony Credit Vacation Dependents Late Payment Interest Received Official Welfare Other Non-Taxable Income PLR - Alimony PLR - Taxable Income PLR - Withholding Tax Per Diary & Cost Allowances Private Welfare and FAPI Supp Fund by Disease Carrier Taxable Income Termination Indemnity Withholding Tax |

Entry Type |

Specify whether the listed payroll type is an earning or a deduction. |

Private Fund & FAPI |

Select the private fund and FAPI entity if the selected parameter type is Private Welfare and FAPI. Private fund and FAPI entities are defined on the Private Fund & FAPI Entities Page. |

|

Revenue Code |

Enter a 4-digit revenue code for the entry if the selected parameter type is Late Payment Interest Received or Supp Fund by Disease Carrier.. This code needs to be recognized by the Federal Revenue of Brazil. |

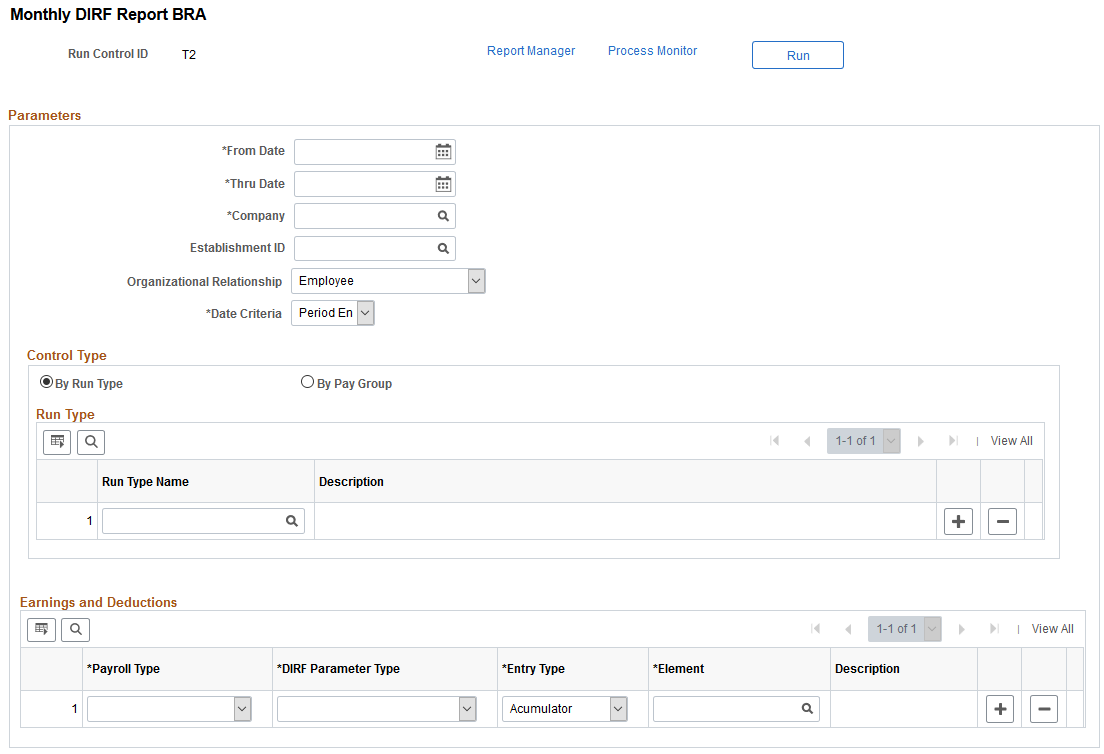

Use the Monthly DIRF Report BRA page (GPBR_RC_DIRF_MENS) to generate a monthly DIRF report for a company or establishment.

Navigation:

This example illustrates the fields and controls on the Monthly DIRF Report BRA page.

Parameters

Field or Control |

Description |

|---|---|

Company |

Select the company to which the report pertains. |

Establishment ID |

To include data for a specific establishment only, select the establishment here. |

Organizational Relationship |

Specify whether you are running the report for employees, contingent workers, or persons of interest. |

Date Criteria |

Select the date used for gathering payroll result information for the report. Values are: Payment Date: The payment date of the calendar group. Period End Date: The end date of the calendar group. |

Control Type

To produce the report for all pay groups that are associated with particular run types, select By Run Type and enter the run types. To produce the report for selected pay groups, select By Pay Group and enter the pay groups and associated run types.

Earnings and Deductions

Use these fields to identify the earnings and deductions that are to be included in the report.

Field or Control |

Description |

|---|---|

Payroll Type |

Select the payroll type for the earning or deduction: 13th. Salary, Profit Sharing Program or Regular Payroll. |

DIRF Parameter Type |

Identify where each value is to be reported. The report contains the following categories:

|

Element |

Select an element for the specified payroll type. |

Entry Type |

Specify whether the value represents an accumulator, deduction, or earning. |

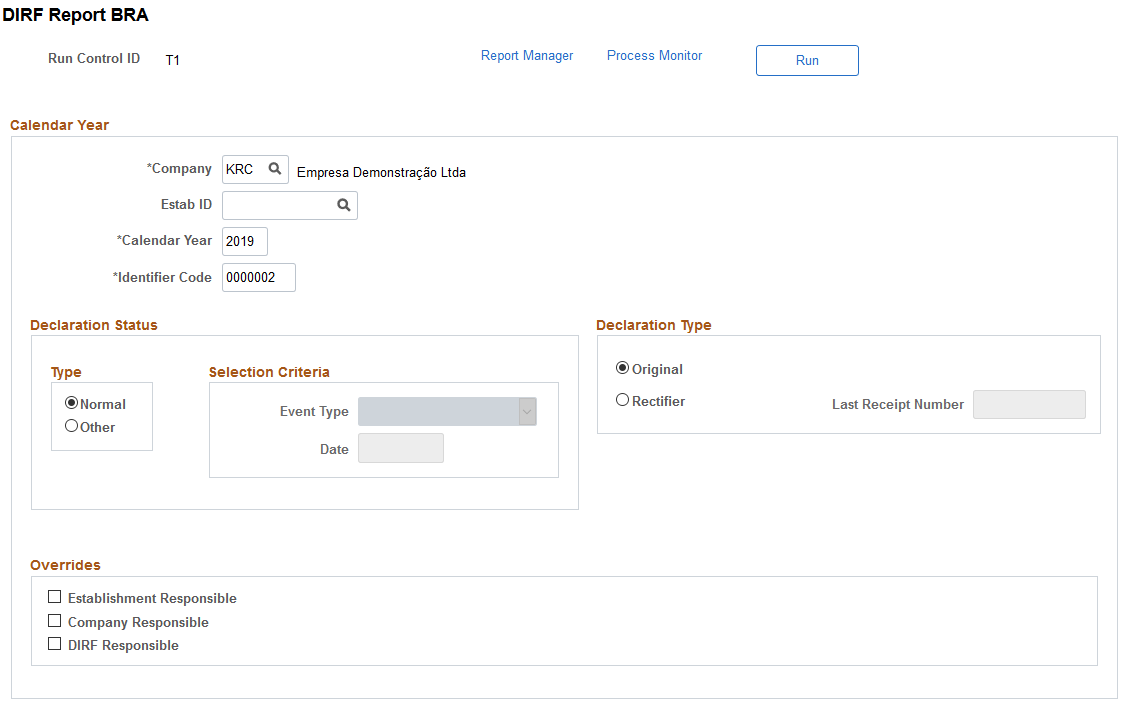

Use the DIRF Report BRA page (GPBR_RC_ANNDIRF) to generate an annual DIRF report for a company or establishment.

Navigation:

This example illustrates the fields and controls on the DIRF Report BRA page.

Field or Control |

Description |

|---|---|

Company |

Enter a company for which the DIRF report is run. |

Estab ID (establishment ID) |

Enter a company establishment for which the DIRF report is run. If no establishment is specified, the report includes all establishments of the selected company. |

Calendar Year |

Enter the year for which you are reporting data. |

Identifier Code |

Enter a 7-character DIRF report code provided by the Government for the specified calendar year. |

Declaration Status

Select Normal or Other.

If you select Other as the declaration status, identify the event type, Dispossession or Termination, and enter the date.

Declaration Type

Select Original if this is the first time you are submitting this report. Select Rectifier if this report corrects one that was previously submitted. Enter the receipt number for the previously submitted report.

Overrides

Use this section to enter instructions for overriding the responsible establishment or company that is identified on the DIRF Parameters BRA Page. The information that you enter here is used for this instance of the report only.

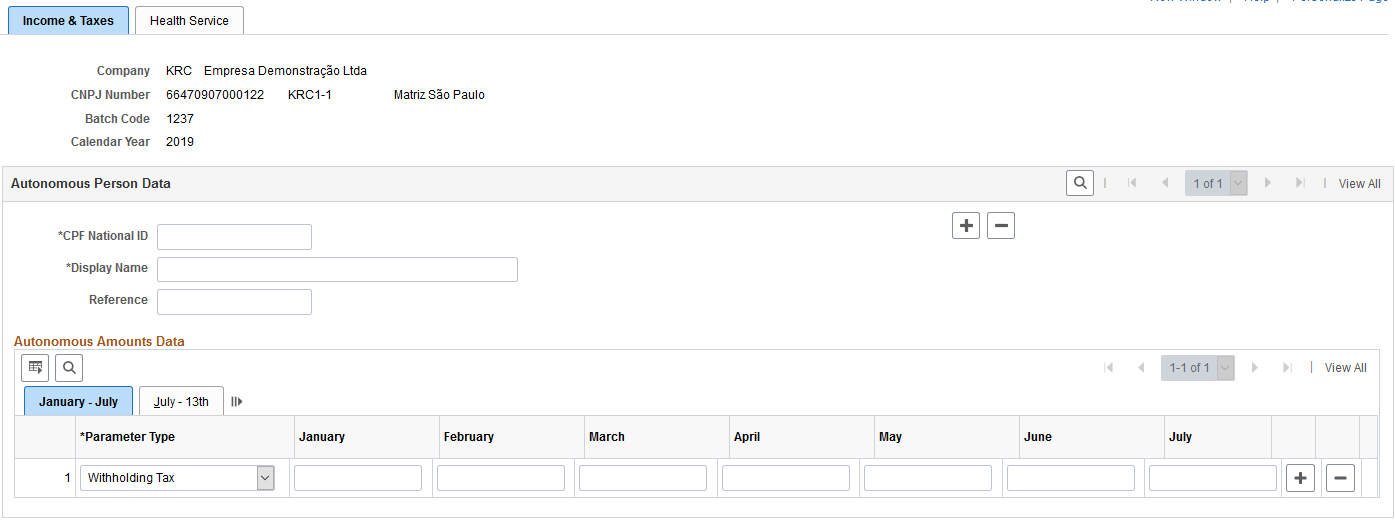

Use the Income & Taxes page (GPBR_AU_DIRF) to enter company’s annual income and tax contributions for autonomous workers.

Navigation:

This example illustrates the fields and controls on the Income & Taxes page.

Autonomous persons are workers who perform their jobs without establishing employment relationships with employers.

Autonomous Person Data

Field or Control |

Description |

|---|---|

CPF National ID |

Enter the CPF national identifier of the autonomous worker. |

Display Name |

Enter the name or title to be printed on the report. |

Reference |

Enter the reference information for the report. |

Autonomous Amounts Data

Field or Control |

Description |

|---|---|

Parameter Type |

Select the type for the amount values entered for the month fields. |

January through 13th |

Enter an amount for one or more months plus the 13th salary. |

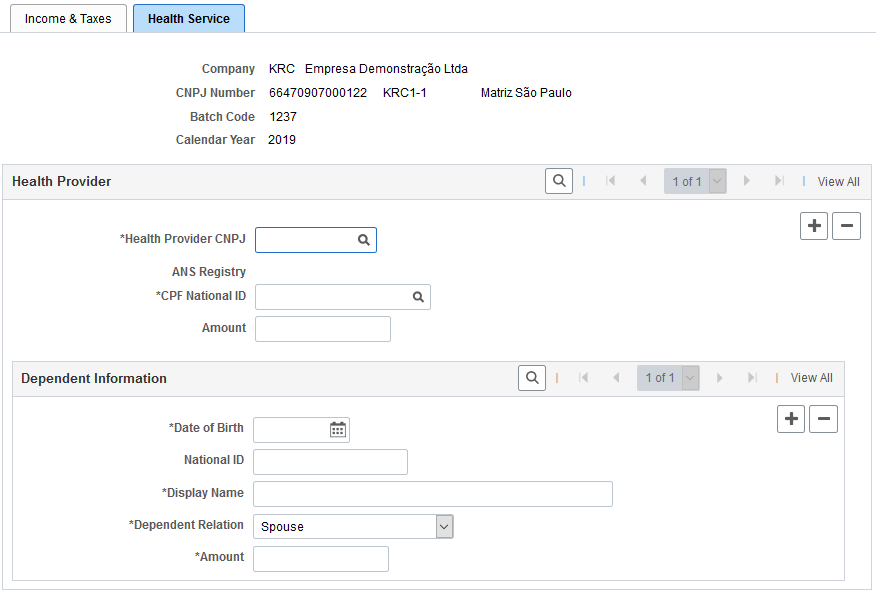

Use the Health Service page (GPBR_AU_DIRF_HS) to enter company’s annual health care contributions for autonomous workers.

Navigation:

This example illustrates the fields and controls on the Health Service page.

Health Provider

Use this section to enter health care-related information for autonomous workers.

Field or Control |

Description |

|---|---|

Health Provider CNPJ |

Select a health provider code. Health provider codes are defined on the Health Providers Page. |

CPF National ID |

Select a CPF national ID. CPF national IDs are defined on the Income & Taxes Page. |

Dependent Information

Use this section to enter health care-related information for dependents of autonomous workers.