Creating PeopleSoft Asset Management Business Units

To set up business units, use the Business Unit Definition component (BU_DEFN).

This topic describes how to set up Business Units.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_TBL_AM |

Create an asset management business unit and specify its default processing options. |

|

|

OPEN_PERIOD_SINGLE |

Define in which periods transactions can be posted for Asset Management. |

|

|

Warehouse Mapping Page |

AM_WAREHOUSE_MAP |

Establish the default ChartField mapping rules necessary to accommodate asset component changeout transfers for this business unit. |

|

VAT_DEFAULTS_DTL |

Specify VAT Defaults Setup. |

|

|

Copy VAT Defaults From Page |

VAT_DFLT_SRCH_COPY |

Copy VAT default specifications from another key combination for the same VAT driver. |

|

BU_BOOK_DEFN_01 |

Define required books, book options, and accounting entry options for each book that the business unit will use. You must first complete the AM Business Unit Definition page and define your asset books on the Asset Book page. |

|

|

ROUND_OPTIONS_SEC |

(JPN) Select options for rounding depreciation amounts for the book. |

|

|

MR_AM_DEPR_CLOS |

Review the years and periods for which depreciation has been closed. |

|

|

BUS_UNIT_JPN_SEC |

Select the options to process tax and depreciation for Japan. To activate theJPN Info link, you must first specify JPN as the Localization Country within User Preferences - Overall page |

|

|

BU_BOOK_FEATURE |

Enable book and book options and (optionally) impairment and revaluation options for a business unit. |

|

|

BU Book ChartFields Summarize Page |

BU_BOOK_GRP_SUM |

(Optional) Select the ChartFields that will be used for group member asset summarization. |

|

BUS_UNIT_INTFC_OPT |

Establish product and application interface default processing options for Payables, Purchasing, Billing, Lease Administration, and Maintenance Management You must enable all PeopleSoft products you want to integrate with on the Installation Options page (INSTALLATION) before integration options will be available within the Business Unit component (BU_DEFN). |

Before you set up business units, you must decide on your TableSet structure and set up SetIDs.

See "Planning Records, Control Tables, and TableSets" section in the PeopleTools: PeopleSoft Application Designer Developer's Guide.

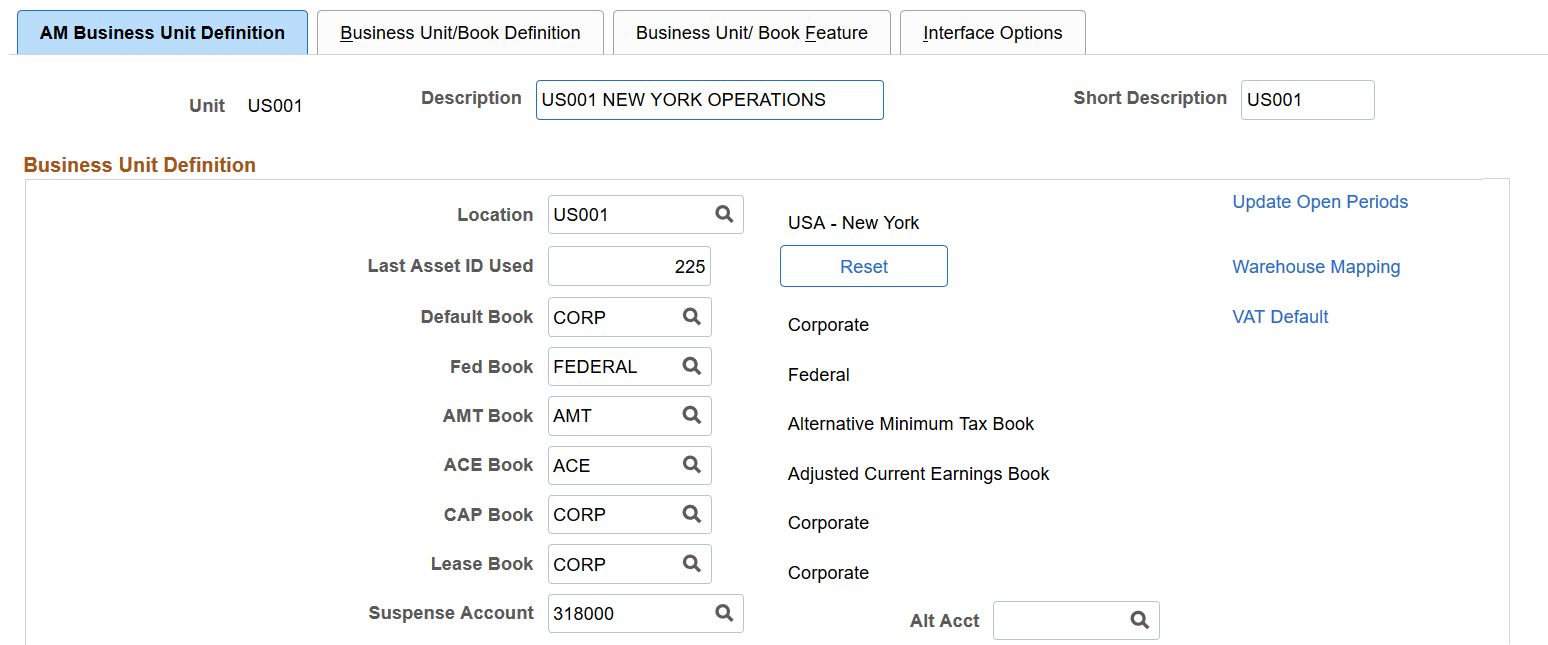

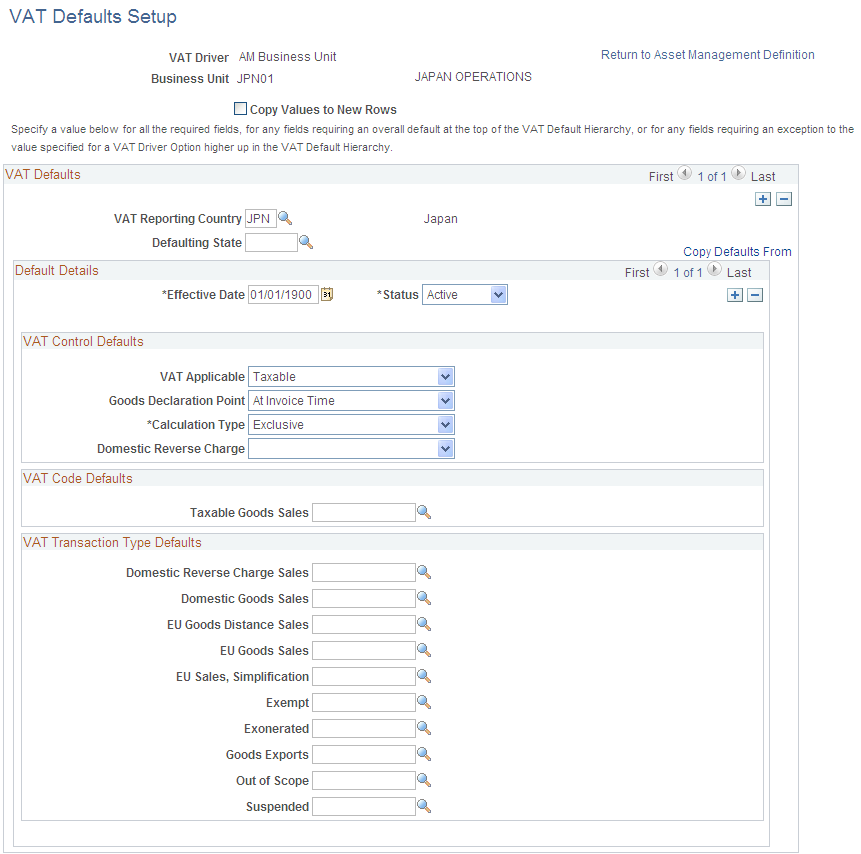

Use the AM Business Unit Definition page (BUS_UNIT_TBL_AM) to create an asset management business unit and specify its default processing options.

Navigation:

.

This example illustrates the fields and controls on the AM Business Unit Definition page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the AM Business Unit Definition page. You can find definitions for the fields and controls later on this page.

Note: When you create a business unit, PeopleSoft Asset Management automatically defines TableSet defaulting for the business unit so that it copies the TableSet that you entered on this page. You can verify TableSet sharing by using the PeopleTools Utilities TableSet Control Group pages.

See "Planning Records, Control Tables, and TableSets" section in the PeopleTools: PeopleSoft Application Designer Developer's Guide

Field or Control |

Description |

|---|---|

Unit, Description, and Short Description |

Enter descriptive information to uniquely identify the business unit during set up. These fields are already populated when you select an existing business unit for update. |

Business Unit Definition

Define the book to be used as the default book for general ledger entries for the business unit and all secondary books, including Corporate and Tax books (both state and federal).

Field or Control |

Description |

|---|---|

Location |

Select a location for this business unit. Locations available are defined on the location page table. |

Last Asset ID Used |

The last asset ID used displays here or the value is zero by default. To increment automatically from some other starting point, enter your starting point into the Last Asset ID Used field and click the Reset button. If there are no assets for this business unit, this will reset the last asset ID to zero. The Next value displays on the Asset Basic Add, Operational Asset Definition or Express Add pages when you use automatic numbering of asset ID. When the record is saved, the assigned asset ID displays and the value is incremented on this page. |

Default Book |

Select the book that is used by default when you enter assets. (This book is required for subsequent processing.) Note: PeopleSoft strongly recommends making the primary book in the ledger group in PeopleSoft General Ledger the same as the default book in PeopleSoft Asset Management in order to maximize synchronicity of transactions. |

Fed Book (federal book) |

Select the book to calculate the federal tax. |

AMT Book (alternative minimum tax book) |

Select the book to calculate the alternate minimum tax. |

ACE Book (adjusted current earnings book) |

Select the book to calculate the adjusted current earnings. |

CAP Book (capital acquisition planning book) |

Select the book used for capital acquisition planning (CAP). |

Lease Book |

Select the book where leased assets are primarily recorded. |

Suspense Account and Alt Acct (alternate account) |

Enter the translate account and alternate account here. If you have any transactions in a foreign currency within this business unit and want to enable the feature to translate currencies. If you do not have transactions outside of your local currency, you do not need to define these values. See Defining Journal Processing Options for a Business Unit. |

BU Setup Options

Field or Control |

Description |

|---|---|

Keep all books in synch |

Select this check box to keep all adjustments synchronized. Deselecting this check box enables you to create adjusting entries to affect particular books while excluding others. If you select this option in conjunction with a business unit that is also enabled for impairment and revaluation processing, you will have an option to create zero impairment and revaluation costs for other books. This occurs when working in the Impairment Worksheet page, the Revaluation Worksheet page, or the batch run control page and you select the Copy To Other Books check box. Warning! If you use this method to make adjusting entries, you must reselect the option before starting normal asset processing. Deselecting or selecting this option does not enable retroactive adjustments. The function is applied from the point selected going forward until and unless you change it again. |

Default tag # from asset ID (default tag number from asset ID) |

Select this check box to use the same number for the tag as the assigned asset ID. |

Allow duplicate tag numbers |

Select this check box when you are processing physical inventory. This enables you to take physical inventory and process assets that may have the same tag number. |

Joint Venture Unit |

Select if this is a joint venture business unit. Note: You cannot perform interunit transfers on joint venture business units. |

Use JV Participant Bk Profile (use joint venture participant book profile) |

Select this option for participant level. Joint venture participant business units are governed by the book for the participant level business unit or by the book for the overall joint venture business unit. You can use this feature to maintain joint venture participant business units with separate profiles that enable different depreciation methods, conventions, calculation types, and so on, as required. |

Use Parent-Child Defaulting |

Select to enable automatic parent-child inheritance processing for this business unit. For example, when you create a child asset and you want it to inherit the tag or department number from the parent asset (as specified on the Profile Child Asset Inheritance page), select this check box. For more responsive performance of Express Add, Basic Add, and Transaction Loader processes, deselect this check box. General parent-child asset processing is still enabled. |

Auto-Retire Fully Depr Assets (automatically retire fully depreciated assets) |

Select to enable automatic retirement of fully depreciated assets for this business unit. You must also enable the option at the book level. |

Reversal Reason Required |

Select this option to require that users select a transaction reversal reason when reversing transactions. |

Use Add Conv. for all TXNs (use add convention for all transactions) |

Select this option to inherit the same convention used when you added an asset for any new transaction. |

Use Cap Threshold (use capitalization threshold) |

Select to enable Capitalization Threshold processing at the business unit level. You must also enable the Capitalization Threshold feature at the system level from Installation Options. |

For more information, see Accounting for Asset Retirement Obligations

Asset Retirement Obligation Options

Use this section to define asset retirement obligation (ARO) processing parameters.

See Understanding Accounting for Asset Retirement Obligations (ARO) for more information.

Field or Control |

Description |

|---|---|

Use ARO (asset retirement obligation) |

Select this option to enable asset retirement obligation (ARO) processing for the asset business unit. Then, upon creating an asset, you designate it as an ARO-eligible asset within the Basic Add component. ARO functionality provides asset retirement obligation measurement and reporting in compliance with Financial Accounting Standards for leased assets, group assets, and asset impairment. You can enable ARO processing at the asset profile level, the business unit level, and the asset level. When you select this option, the following fields appear:

You can select either US GAAP Standards or IFRS Standards, but not both—all ARO assets within the business unit must adhere to the same processing method. |

US GAAP Standards (U.S. Generally Accepted Accounting Principles) |

Select this option to process ARO using Generally Accepted Accounting Principles. If you select this option, no adjustments are made to the risk-adjusted rate over the life of the ARO asset; the obligation is adjusted only for changes in the amount or timing of cash flows (the obligation continues to be measured using the rate when the decommissioning obligation was incurred). |

IFRS Standards (International Financial Reporting Standards) |

Select this option to process ARO using International Financial Reporting Standards. If you select this option, the risk-adjusted rate is used at the outset, but the rate is adjusted at each reporting date thereafter (the decommissioning obligation is re-measured each reporting period giving consideration to changes in the amount or timing of cash flows and changes in the discount rate). |

Include ARC in Impairment Test (include asset retirement cost in impairment test) |

Select this check box to include the asset retirement cost in the impairment process calculation. This option appears if you have selected the Use ARO field. |

ARO Prefix (asset retirement obligation prefix) |

Enter a prefix to be used for accounting entries that are related to asset retirement obligations. The prefix is for the asset ID that will be created to store the ARO Information (ARO-eligible asset). |

Last ARO Id (last asset retirement obligation Id) |

Specify the numerical value after which the count should be added for each subsequent ARO ID. This works in combination with the prefix. Suppose the prefix is “ARO”, when you start using the feature, the Last ARO Id will be zero. Since Asset ID has 8 characters, the first ARO created will be ARO00001. |

InterUnit Transfer Defaults Options

Select the default asset information to be shared between the business units when you make interunit transfers. The information is derived from the Asset Information component. The selections made here are the default options for the Asset Cost IU (interunit) Transfer (ASSET_COST_02) page.

Field or Control |

Description |

|---|---|

Asset Acquisition Info |

Select to include information derived from the Asset Acquisition Detail (ASSET_ACQ_DETAIL) page and links (ASSET_ACQ_DET_AP, ASSET_ACQ_DET_VAT). |

Asset Attributes Info |

Select to include information derived from the Asset Location/Comments/Attributes (ASSET_IMAGE) page. |

Asset License/Register Info |

Select to include information derived from the Asset Custodian/License/Manufacturer page (ASSET_CUSTODIAN) and links (ASSET_LIC_ADDR_SEC). |

Asset Lease Info |

Select to include information derived from the Leased Assets component pages (ASSET_LEASE_01, ASSET_LEASE_02, ASSET_LEASE_05, ASSSET_LEASE_03). |

Asset Non-Capitalized Cost |

Select to include information derived from the Asset Acquisition Detail (ASSET_ACQ_DETAIL) page and links (ASSET_ACQ_DET_AP, ASSET_ACQ_DET_VAT). |

Asset Maintenance Info |

Select to include information derived from the Track Service and Repairs component pages (ASSET_MAINT_01, ASSET_MAINT_01_S) and meter readings. |

Asset Comments |

Select to include information derived from the Asset Location/Comments/Attributes (ASSET_IMAGE) page. |

Asset Warranty Info |

Select to include information derived from the Asset Custodian/License/Manufacturer page (ASSET_CUSTODIAN) and links (ASSET_WARRANTY). |

Asset Insurance Info |

Select to include information derived from the Asset Custodian/License/Manufacturer page (ASSET_CUSTODIAN) and links (ASSET_INSURANCE). |

Asset Inspection Info |

Select to include information derived from the Asset Custodian/License/Manufacturer page (ASSET_CUSTODIAN) and links (ASSET_INSPECTION). |

Asset Component History |

Select to include asset component history (AM_AST_COMP_HIST) information. |

Asset Attribute Groups Info |

Select to include asset attribute groups (AM_ASSET_SD) information. |

Open Transaction Processing Options

Open transactions are asset events such as depreciation and accounting entries that require processing. PeopleSoft Asset Management assigns each open transaction a unique open transaction ID whenever a processing option is requested. For example, changing asset cost, adding or retiring assets, or changing asset depreciation attributes all create open transactions. Depreciation must be calculated, or recalculated, and allocated for each transaction before it is considered closed. An open transaction has a Pending status until it is processed.

Field or Control |

Description |

|---|---|

Auto Increment Open Trans ID (automatically increment open transaction ID) |

If you want to process a large number of transactions as a group, you should deselect the Auto Increment Open Trans ID check box. For example, you enter 300 new computers into PeopleSoft Asset Management, and rather than process depreciation and distribution in 300 separate requests, you want to process all in a single request. To do so, establish an open transaction ID that identifies a single processing request for all 300 computers that you entered. In this case, you should deselect the Auto Increment Open Trans ID check box. |

Open Trans ID (open transaction ID) |

The Open Trans ID field helps you keep track of open transaction processing status. You can enter a beginning open trans ID, or you can have PeopleSoft Asset Management assign it. You can specify that PeopleSoft Asset Management automatically increment the ID value each time a transaction is added to the open transaction table by selecting Auto Increment Open Trans ID. The next processing request that you enter is automatically assigned a number that is one greater than the last assigned value. Subsequent open transaction ID numbers will be incremented by one. |

Approval Options

Use the options in this group box to enable the asset approval workflow using PeopleSoft Fluid User Interface:

Enable Adjustment Approval: Select this option to enable cost adjustment, line addition, and revaluation approvals for the selected business unit.

Enable Transfer Approval : Select this option to enable cost recategorization and ChartField transfer approvals for the selected business unit.

Enable InterUnit Approval: Select this option to enable cost fixed price markup and interunit transfer approvals for the selected business unit.

Enable Reversal Approval: Select this option to enable asset addition, adjustment, transfer, and interunit transaction reversal approvals for the selected business unit.

Enable MTM Approval (Enable Mass Transaction Manager Approval): Select this option to enable mass transaction manager approvals for the selected business unit.

The selection criteria on the Run Mass Transactions run control uses business unit to determine whether approval is triggered.

Enable Upload Approval: Select this option to enable approvals for the import data by spreadsheet process (for the selected business unit).

See: Pages Used to Approve Asset Transactions in the PeopleSoft Fluid User Interface

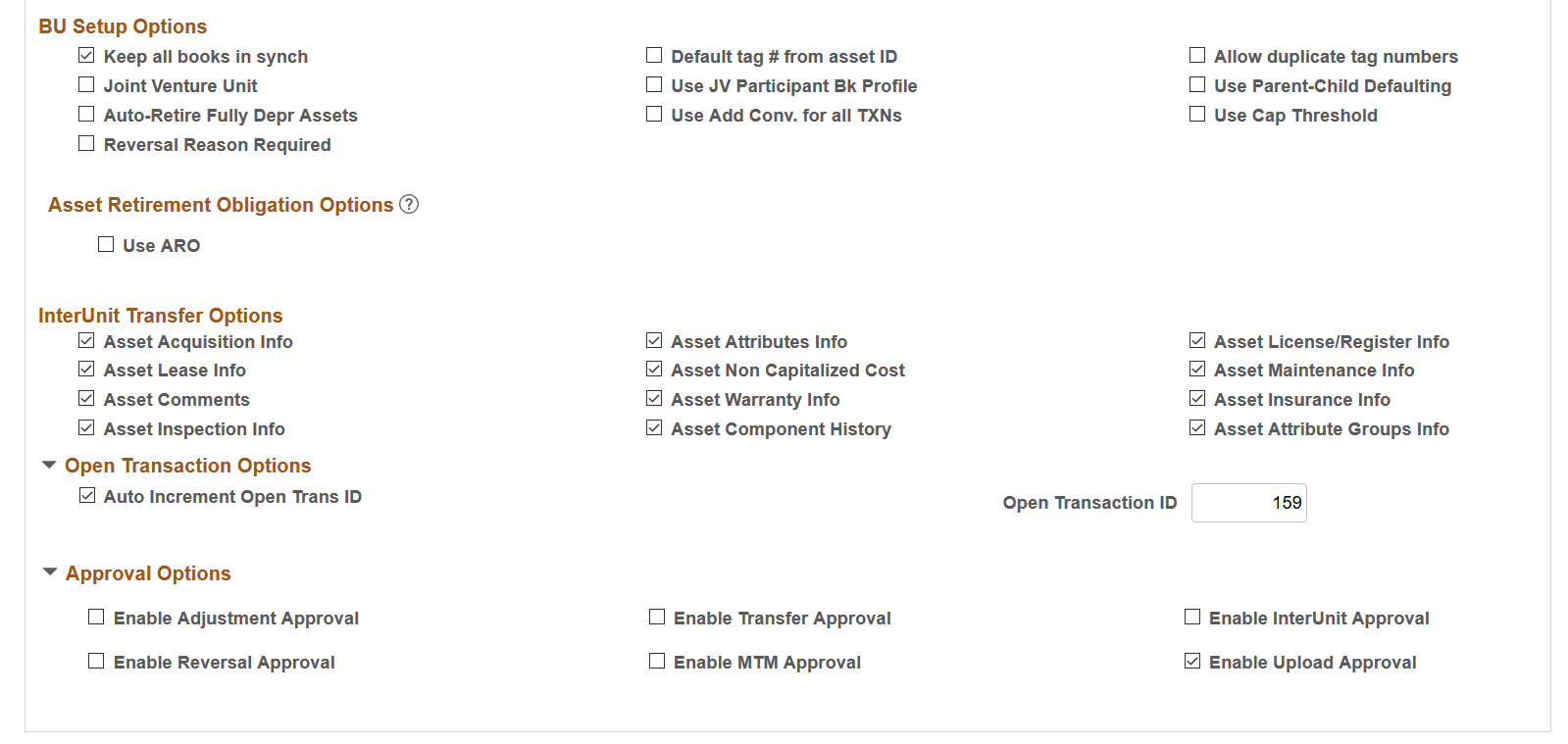

Use the Open Period Update page (OPEN_PERIOD_SINGLE) to define in which periods transactions can be posted for Asset Management.

Navigation:

Click Update Open Periods on the AM Business Unit Definition page. Open Period Update page

This example illustrates the fields and controls on the Open Period Update page. You can find definitions for the fields and controls later on this page.

The Update Open Periods page enables you to define which periods are open (periods in which transactions can be posted) for PeopleSoft Asset Management. These can be defined in relation to, but not strictly governed by, the corresponding open period in General Ledger (GL).

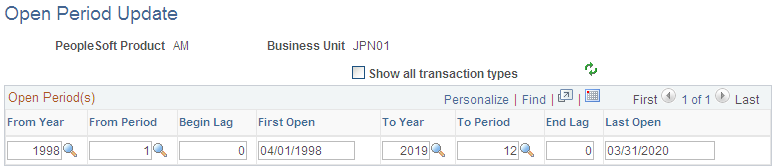

Use the VAT Defaults Setup page (VAT_DEFAULTS_DTL) to specify VAT Defaults Setup.

Navigation:

Click VAT Default on the AM Business Unit Definition page. VAT Defaults Setup page

This section provides an overview of VAT processing options and describes how to set up VAT processing defaults by business unit for PeopleSoft Asset Management.

Understanding VAT Drivers, VAT Driver Keys, and the Defaulting Hierarchy for VAT Defaults

The following table lists the PeopleSoft Asset Management-related VAT drivers and associated VAT driver keys in VAT default hierarchy sequence from most specific to least specific for the VAT Defaults component. The table also indicates which drivers control defaults for the Services VAT Treatment:

|

VAT Driver |

VAT Driver Keys |

Country |

State |

Applicable to Regular VAT Defaults |

Applicable to Services VAT Treatment Defaults |

|---|---|---|---|---|---|

|

ASSET_CLASS_TBL Asset Class |

Asset SetID Asset Class |

Optional |

Optional |

Yes |

No |

|

CUST_ADDR_SEQ Customer Location |

Customer SetID Customer ID Address Sequence Number |

Optional |

Optional |

Yes |

Yes |

|

CUSTOMER Customer |

Customer SetID Customer ID |

Optional |

Optional |

Yes |

Yes |

|

BUS_UNIT_TBL_AM AM Business Unit |

Business Unit |

Optional |

Optional |

Yes |

No |

|

VAT Entity Registration |

VAT Entity Country |

Not applicable |

Optional |

Yes |

No |

|

VAT Country |

Country |

Not applicable |

Optional |

Yes |

No |

Establishing the VAT Environment

For your system to track and process VAT, you must first set up basic information by defining VAT transaction types, VAT codes, and their associated VAT accounting templates, VAT countries, VAT entities, and VAT defaulting. Each piece builds upon the next; therefore, for your basic setup, it is important to implement each piece in the following order:

VAT transaction types.

VAT rates, VAT codes, and VAT accounting information.

VAT countries.

VAT entities.

VAT defaults.

In addition to the information you must set up, PeopleSoft delivers multiple account types for your VAT accounting and reporting with every application. You cannot add your own.

See Understanding VAT.

VAT Defaults Setup Page

This example illustrates the fields and controls on the VAT Defaults Setup Page. You can find definitions for the fields and controls later on this page.

Specify the VAT driver and any VAT driver keys as applicable. You can insert rows for any or all of the VAT driver keys as well as the VAT country or state. You can also delete any existing rows.

Field or Control |

Description |

|---|---|

Copy Values to New Rows |

If you are inserting a row for a VAT driver key, select this check box to copy all the VAT defaults from the previous row to the new row. Otherwise, all VAT default fields for the new row will be blank. |

VAT Defaults

Field or Control |

Description |

|---|---|

VAT Reporting Country |

Select the VAT reporting country or countries for which you are defining VAT defaults. For service VAT treatment defaults, defaults are obtained for the supplier's location country. PeopleSoft Asset Management does not use VAT for services, only goods. |

Defaulting State |

As applicable, enter the state for which you want to define defaulting values. (Optional depending on VAT Country) |

Copying VAT Defaults

Access the VAT Defaults Copy page (Click Copy Defaults From on the VAT Defaults Setup page.

Field or Control |

Description |

|---|---|

Copy From Search Criteria |

Enter the criteria on which you want to search. When copying defaults for the PeopleSoft Asset Management business unit driver, you can search by business unit, VAT reporting country, and defaulting state. |

Search |

Select to retrieve the results based on the criteria entered. The results display in the Copy From Results group box. |

Copy From Results |

In the Copy From Results group box, select the link for any of the results returned to view the details of the VAT setup from which to copy on the Copy VAT Defaults Setup page. Once you have viewed the details, you can select Copy to copy the VAT setup. The system returns you to the VAT Defaults Setup page with the copied fields. Or you can select the appropriate option for any of the results returned and select Copy to copy from the selected row. The system returns you to the VAT Defaults Setup page with the copied fields. |

Default Details

Enter the effective date and status.

The remaining fields on the page vary based on the combination of VAT driver and VAT driver keys. Depending on the combination of PeopleSoft products you are implementing and the VAT transactions conducted between your local country and other countries, you may require some variation in set up. The PeopleSoft Global Options and Reports product documentation explains these variations in working with VAT in greater detail.

You may define the following defaults for the PeopleSoft Asset Management business unit:

VAT Control Defaults

Field or Control |

Description |

|---|---|

VAT Applicable |

Select the appropriate VAT status. Values are: Exempt (not subject to VAT) Outside of Scope of VAT Taxable |

Goods Declaration Point |

Select when you want VAT transaction information for goods to be recognized for reporting purposes. Values are: At Accounting Date: VAT is recognized at the accounting date. At Delivery Time: VAT is recognized at time of delivery. At Invoice Time: VAT is recognized at time of invoice. At Payment Time: VAT is recognized at time of payment. |

Calculation Type |

Select the type of calculation you want the system to use. Values are: Exclusive: VAT is calculated on top of the entered transaction amount, because it excludes any VAT. Inclusive: VAT is calculated from within the entered transaction amount, because it already includes the VAT. |

(UK) Domestic Reverse Charge |

Select Yes to enable the domestic reverse charge default at the business unit level. This default indicates that the goods on transaction lines associated with the VAT Driver are domestic reverse charge goods. |

VAT Code Defaults

You use VAT codes to specify the rate at which VAT is calculated.

The VAT rate is frequently the key to reporting VAT because VAT amounts must often be reported separately by VAT rate on a VAT return. Therefore, the VAT code is part of the reporting definition.

Field or Control |

Description |

|---|---|

Taxable Goods Sales |

Select the VAT code to be used for taxable sales within this VAT reporting country |

VAT Transaction Type Defaults

You use VAT transaction types to classify and categorize transactions at a more detailed level for both VAT reporting and accounting. These are specified for each transaction line when you enter a transaction.

You define the VAT transaction types you need for your VAT setup. PeopleSoft also delivers a set of VAT transaction types with your system as sample data.

Field or Control |

Description |

|---|---|

Domestic Reverse Charge Sales |

Select the transaction type default to be used for domestic reverse charge sales. |

Domestic Goods Sales |

Sale of goods within the same country. |

EU Goods Distance Sales (European Union goods distance sales) |

Sale of goods between European Union (EU) countries in which the supplier is registered in an EU country and the purchaser is not registered in an EU country. The VAT rate charged is the rate applicable in the supplier's country. |

EU Goods Sales (European Union goods sales) |

Sale of goods within the European Union. |

EU Sales, Simplification |

This treatment is used for the transaction between an intermediary and the purchaser in cases when there is a sale of goods between European Union (EU) countries involving three parties: the purchaser, an intermediary (bill-from) supplier, and the actual goods supplier. Each party is located in a different EU country and registered in his own country, and not in either of the other two countries. The only difference between this VAT treatment and that applied to normal EU sales is that the supplier is required to print a different message on the invoice referencing the statute that applies to triangulation, rather than the one that references the statute for normal EU sales. |

Exempt |

Not subject to VAT. |

Exonerated |

Subject to exoneration from VAT. |

Goods Exports |

Export sales of goods. |

Out of Scope |

Outside of the scope of VAT. |

Suspended |

Subject to suspension of VAT. |

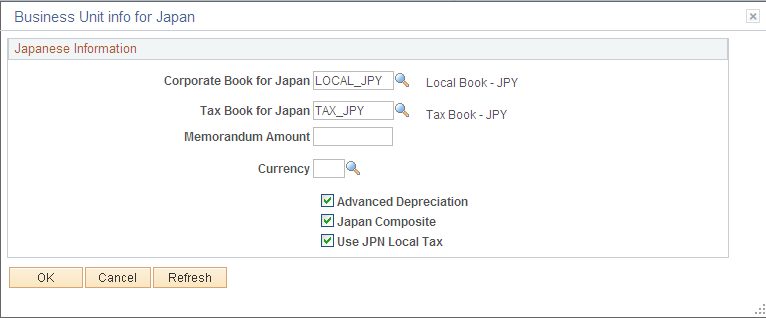

Use the Business Unit Info for Japan page (BUS_UNIT_JPN_SEC) to Select the options to process tax and depreciation for Japan.

Navigation:

Click the JPN Info link from the AM Business Unit Definition component.

The JPN Info (Japan information) link appears on the AM Business Unit Definition page when you set up the overall options for user preferences (OPR_DEF_TABLE_FS1) in the Common Definitions component: Set the Localization Country value to JPN (Japan).

This example illustrates the fields and controls on the Business Unit info for Japan page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Corporate Book for Japan |

Select the corporate book for Japan. |

Tax Book for Japan |

Select the tax book for Japan. Note: PeopleSoft recommends that you select the primary book in the ledger group in PeopleSoft General Ledger to be the same as the default book in PeopleSoft Asset Management. As tax books do not usually send accounting entries to PeopleSoft General Ledger this maximizes synchronicity of transactions. |

Memorandum Amount and Currency |

Enter the memorandum amount at the end of the useful life of the asset as required by the Japanese tax regulation. This value is used in conjunction with the following depreciation methods:

The memorandum amount reflects the currency of the tax book for Japan as the default. For books that use one of the aforementioned depreciation methods in a currency other than JPY, the memorandum amount is translated to the respective book's currency. The memorandum value is established for each asset management business unit. |

Advanced Depreciation |

Select if advanced depreciation is used. |

Japan Composite |

Select if composite assets are used. |

Use JPN Local Tax |

Select if local tax reporting is enabled. |

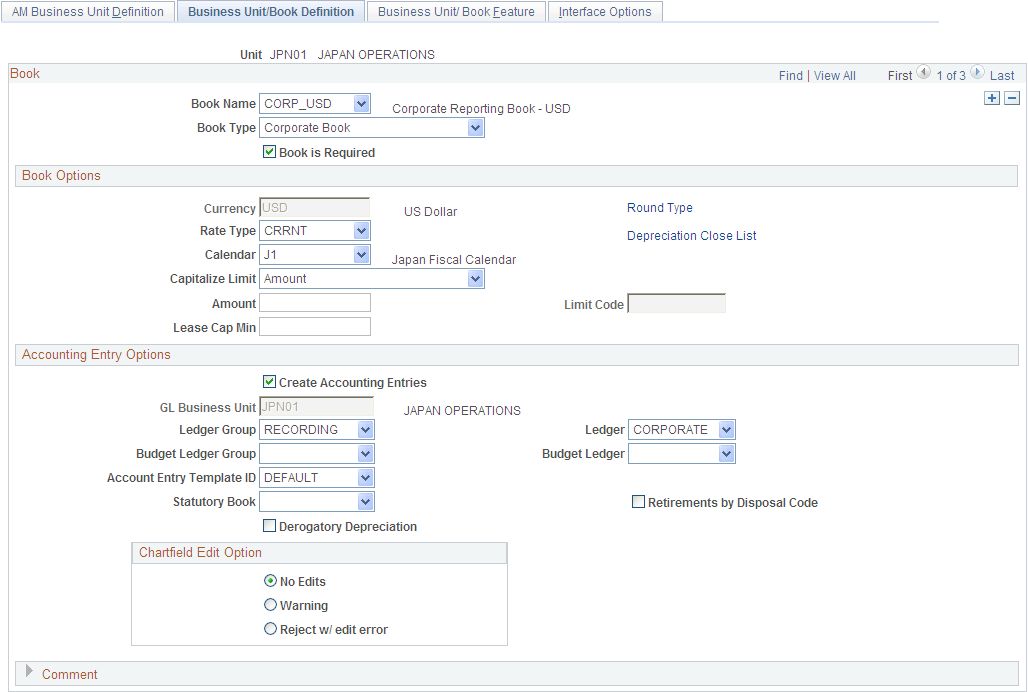

Use the Business Unit/Book Definition page (BU_BOOK_DEFN_01) to define required books, book options, and accounting entry options for each book that the business unit will use.

Navigation:

This example illustrates the fields and controls on the Business Unit/Book Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Book Name |

The Book Name field is used during asset and profile entry to designate book processing. At least one financial book for each business unit to record asset data in the general ledger is required. You may have other federal, state, and foreign tax or financial books as well. Transactions can be tracked in multiple currencies by designating the currency code within each transaction entry. Note: If there is a need to add books to an existing business unit once assets have been added, you should use the Add/Copy Asset Book feature to avoid possible impact to existing assets in the business unit. |

Book Type |

Specify the type of asset book processing. This feature acts as a filter for tax and financial options when you define tax and depreciation information for asset transactions. For example, if you define the CORP book as a Corporate book, you will not be able to select any tax attributes for processing when you add an asset to this book. Select Corporate w/Tax Info if you maintain separate tax records for this business unit in the book. You can use this option to specify tax processing rules and track tax information for your assets. The Tax option enables you to maintain tax information for government reporting. The US AMT option enables you to maintain alternative minimum tax information for government reporting. This option enables you to separately track alternative minimum tax information. |

Book is Required |

Select Book is Required to ensure that this book will added for every asset in this business unit. |

Note: If you maintain multiple currencies you must define the exchange rate. Even if you use only one currency in PeopleSoft Asset Management, you must still set up a one-to-one exchange rate and rate type to exchange that currency with itself. For example, to use U.S. dollars you must set up an exchange rate for U.S. dollars to U.S. dollars with an exchange rate of 1. To make changes, go to

See Understanding Foreign Currency Processing.

Book Options

Field or Control |

Description |

|---|---|

Currency |

Displays the default currency for this business unit. |

Rate Type |

Select the currency exchange rate. Note: Even if you are using only one currency in PeopleSoft Asset Management, you still need to set up a one-to-one exchange rate and rate type to exchange that currency with itself. For example, to use US Dollars you must set up an exchange rate for USD to USD with an exchange rate of 1. |

Calendar |

Select the accounting period calendar for this book and business units. General Ledger supports multiple calendars, so you can keep separate calendars for actual accounting activity, for budget and forecast activity, and for special reporting or transitional needs. For example, you can easily manage a conversion to different accounting periods or to a new fiscal year by maintaining two calendars. However, only one calendar can be active for a ledger group at a given time. A book must use the same calendar as the ledger. See Understanding Accounting Calendars Based on Open and Close Periods. |

Capitalize Limit, Amount, and Limit Code |

Define these limits either by selecting Amount and entering a minimum, or by selecting Table Lim and selecting a Cost Limit Code. If you select Amount, you cannot add an asset with a cost that is less than the specified limit. If you select Table Lim, you may encounter an error or a warning, based on the actions that you set up in the Capitalization Limit table, when you try to add assets below the amounts in the table. |

Lease Cap Min (lease capitalization minimum) |

Define the lease cap as a minimum cost of the asset lease. (When you enter a leased asset with total cost below the lease cap, you will receive an error.) |

Accounting Entry Options

Your business unit accounting entry options enable you to associate an asset management business unit with a general ledger business unit and default ledger.

Field or Control |

Description |

|---|---|

Create Accounting Entries |

Select this check box to make the accounting entry options available for selection. |

Retirements by Disposal Code |

Select the check box to enable retirement of assets based upon disposal code. The Transaction Code field on the Retirement page will be populated with the appropriate disposal code. See Understanding Asset Retirement Using the Disposal Worksheet. |

Translate Gain/Loss |

If the ledger specified is a translate ledger, this check box appears. When you process accounting entries (AM_AMAEDIST), the gain or loss amount that is the result of a currency exchange transaction is converted from the primary book to the translate book. |

GL Business Unit |

The General Ledger business unit associated with this book displays here. |

Ledger Group, Budget Ledger Group, Ledger, and Budget Ledger |

A ledger is a set of posted balances that represents a set of books for a business unit. Ledger templates and detail ledgers can be added to the appropriate ledger group. A ledger group can have one primary ledger and zero to nine secondary ledgers. Each ledger within the ledger group shares a common physical structure based on the ledger template, as well as unique characteristics (such as its own base currency). The Ledger Group andBudget Ledger Group fields for PeopleSoft Asset Management enable you to associate a ledger or ledger group to this business unit. In sync accounting entries are a group of accounting entries for one transaction that the system distributes to different ledgers. In conjunction with the Keep all books in sync option, you define how a transaction is posted. If the Keep all books in sync option is selected, then one transaction will post to all ledgers in the group. If the Keep all books in sync option is deselected, the system posts transactions only to those ledgers with transaction entries. One book will post to one ledger, but you can set up other books to point to the other ledgers in the group. If you will be generating budget accounting entries, specify the Budget Ledger Group and Budget Ledger to which you want to post them. If you leave ledger and budget ledger fields blank, the accounting entries will be made to the primary ledger. |

Book Code Distrib. Grp (book code distribution group) |

If the Book Code option is activated from the Installation Options page, this field appears. The book code is an Account attribute and a balancing ChartField. You can use book codes to simultaneously generate sets of entries to record related transactions according to multiple GAAPs for the same business unit in the same ledger. The book code distribution group defines a set of book codes to be used when distributing accounting entries for multiple GAAPs within one book. Using the book code distribution group restricts the duplication of accounting entries being passed to General Ledger. The book code distribution group value is defined on the Book Code Distribution Group page. Select from the available book code distribution groups defined for your organization. See Setting Up Application-Specific Installation Options. See Creating PeopleSoft Asset Management Business Units. See Understanding Accounting Entry and Financial Processing. See Book Code Page. |

Account Entry Template ID |

Enter the account entry template ID. The accounting entry template ID provides the option to associate different books with different charts of accounts. To use derogatory depreciation for France, select the account entry template ID that corresponds. You must also select the Derogatory Depreciation check box. |

(FRA) Derogatory Depreciation |

Select this check box to process derogatory depreciation with the derogatory account entry template ID. If this box is selected, you must use the appropriate account entry template ID associated with derogatory depreciation. You must also select the statutory book to which this book will be compared. This can be designated on the AM Business Unit Definition page as the federal book. See (FRA) Using PeopleSoft Asset Management Options to Meet French Requirements. |

(FRA) Statutory Book |

Select the statutory book to which derogatory depreciation transactions stored in the book you are defining will be compared. When Derogatory Depreciation has been selected, you must also define statutory book. |

ChartField Edit Options

Select the ChartField combination editing option default at the business unit level for Asset Management. Choose one of the following options:

No Edit: No ChartField combination editing is performed.

Warning: A warning is issued for ChartField combination editing errors. You can save online transactions with ChartField combination errors, correct the errors, or process the transaction with warning. The batch process loads transactions that fail with warning edits. A message is included in the Process Scheduler Message Log.

Reject: Transactions that do not pass ChartField combination editing are rejected from processing until the error is corrected.

Use the Round Options page (ROUND_OPTIONS_SEC) to (JPN) Select options for rounding depreciation amounts for the book.

Navigation:

Click Round Type on the Business Unit/Book Definition page.

Field or Control |

Description |

|---|---|

Round Rule and Round Type |

Select the rounding rule and type that apply to this book. The rounding rules delivered with PeopleSoft Asset Management are: Down Nat Rnd Up The rounding types delivered with PeopleSoft Asset Management are: Currency: Generic |

Round Precision |

The number of places to the right or left of the decimal point to which the amount or number will be rounded. If you select Currency as the round type, the system automatically determines round precision from the currency code. |

Rounding Factor |

The number to which the amount will be rounded. For example, if you select Nat Rnd as the rounding rule and enter a rounding factor of 25, amounts will be rounded to the nearest multiple of 25; for example, an amount of 130 will be rounded to 125, and an amount of 140 will be rounded to 150. If you select Currency as the round type, the system will automatically determine the rounding factor from the currency code. |

Truncation Precision Flag |

The Truncation Precision Flag check box works with the round precision value. When you select it, amounts that contain many decimal places are truncated to one decimal place to the right of the rounding precision position before rounding is performed. If you deselect it, the entire amount is rounded. This example illustrates truncation precision:

With the Truncation Precision Flag check box selected, the system truncates the fifth decimal place and rounds 10.0343. With the check box deselected, the system rounds the entire amount. Actual rounding results would depend on the selected rounding rule and round type. |

Use the Depreciation Close List page (MR_AM_DEPR_CLOS) to Review the years and periods for which depreciation has been closed.

Navigation:

Click Depreciation Close List on the Business Unit/Book Definition page.

View the years and periods for which depreciation has been closed. You cannot open or close periods from this page.

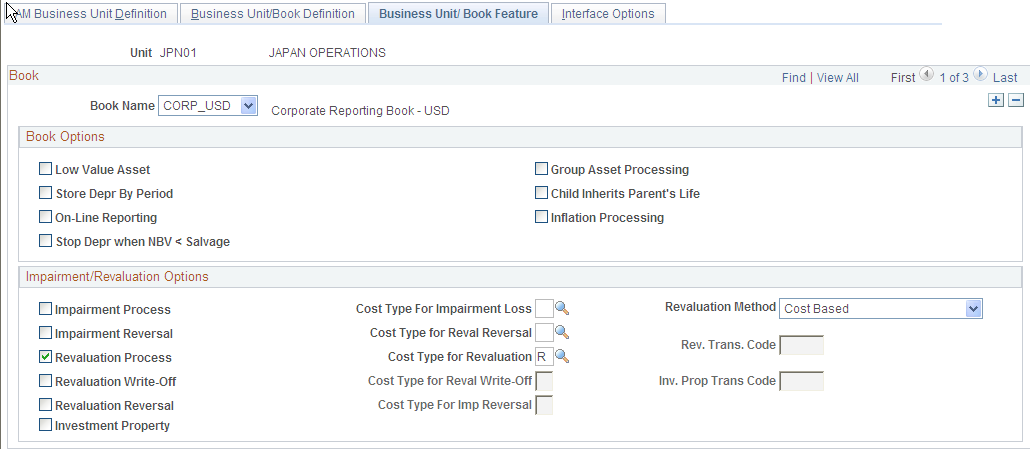

Use the Business Unit/Book Feature page (BU_BOOK_FEATURE) to enable book and book options and (optionally) impairment and revaluation options for a business unit.

Navigation:

This example illustrates the fields and controls on the Business Unit/Book Feature page. You can find definitions for the fields and controls later on this page.

This page provides the book, impairment and revaluation options available for the books that have been defined within this business unit definition. The Impairment/Revaluation Options group box displays only when Impairment Processing and Revaluation Processing are selected on the Installation Options page for Asset Management.

See Installation Options - Asset Management Page.

Book Options

Field or Control |

Description |

|---|---|

(DEU) Low Value Asset |

Select to enable low-value asset processing. In Germany, assets marked as low value should be depreciated in one year. PeopleSoft Asset Management checks the capitalization limits against the amounts that are stored by code in the capitalization limit table. See (DEU) Using PeopleSoft Asset Management Options to Meet German Requirements. |

Group Asset Processing |

Select to enable group asset processing. If checked, the Summary link displays on the Chartfield Summarization page. The system applies asset transactions at the group member level. |

Store Depr by Period (store depreciation by period) |

Select to store depreciation by period for the current fiscal year. Note: If you store depreciation entries by period, you increase the table size and decrease depreciation processing performance. For optimal depreciation processing performance and greater table efficiency, PeopleSoft recommends storing depreciation entries by fiscal year rather than by period. |

Child Inherits Parents Life |

Select to pass on the asset life of the parent asset to the child asset. |

Auto-Retire Fully Depr Assets (automatically retire fully depreciated assets) |

Select to enable the automatically retire fully depreciated assets feature. This field appears only if you select the Auto-Retire Full Depr Assets option on the Asset Management Business Unit Definition page. |

Online Reporting |

Select to enable online reporting features. Note: You must run Load Depreciation Reporting process for at least one asset after this option is selected to be able to view online reporting for this business unit/book. |

(ARG, BRA, and MEX) Inflation Processing |

Select Inflation Processing if you want to enable the inflation processing feature. This optional feature is used for Argentina, Brazil, and Mexico to adjust assets for inflation associated with a particular inflation index appropriate for a country or currency. It provides for periodic inflation adjustment transactions (transaction type INF) that adjusts asset balances (cost, period depreciation, year-to-date depreciation, and accumulated depreciation) for inflation. The default is blank. (This field is available when you enable the corresponding installation options.) |

Calculation Type |

This option appears when you select the Inflation Processing check box. Select the calculation method for inflation processing. The available options are:

|

Stop Depr when NBV < Salvage (stop depreciation when net book value is less than salvage value) |

Select to stop the depreciation calculation when the net book value of an asset is less that its salvage value. This is in compliance with International Accounting Standards. This field appears only if you select the Stop Depr when NBV < Salvage option on the Installation Options - Asset Management page. |

Impairment/Revaluation Options

Field or Control |

Description |

|---|---|

Impairment Process |

Select this check box to enable impairment processing within this business unit book. |

Cost Type For Impairment Loss |

Select the default Cost Type for the impairment loss from the list of valid cost types. |

Revaluation Method |

Select the default method to be used for revaluation processing on the Revaluation Worksheet. The available options are:

Note: You can override this value on the Revaluation Worksheet. |

Impairment Reversal |

Select this check box to enable impairment reversal processing within this business unit book. |

Cost Type for Reval Reversal (cost type for revaluation reversal) |

Select the default Cost Type for the impairment revaluation reversal from the list of valid cost types. |

Revaluation Process |

Select this check box to enable revaluation processing within this business unit book. |

Cost Type for Revaluation |

Select the default Cost Type for the revaluation process from the list of valid cost types. Cost Type for Revaluation must be defined if the Revaluation Process check box is selected. Note: The Cost Type for all books in the same ledger group are automatically set as the same value as long as the keep ledgers in synch (KLS) option is enabled for the ledger group.

|

Revaluation Write-Off |

Select to use this as the default revaluation method for the Revaluation Worksheet. If this check box is not selected at the business unit level, it is not available for selection at the Revaluation Worksheet level. |

Rev. Trans. Code: (revaluation transaction code) |

Select the default Transaction Code for the revaluation process from the list of valid transaction codes. This is the transaction code to be used for the write-off of accumulated depreciation and is required when theRevaluation Write-Off check box is selected. |

Cost Type for Reval Write-Off |

Select the default Cost Type for the revaluation write-off process from the list of valid cost types. Note: The Cost Type for all books in the same ledger group will be automatically set as the same value. |

Revaluation Reversal |

Select to choose another Cost Type to deal with transactions where they decrease the amount of a prior impairment. In accordance with International Accounting Standards, you must first reverse any prior impairment loss before calculating the revaluation surplus. |

Investment Property |

Select to enable the Investment Property feature at the business unit level. This feature provides an easy way to identify Investment Property in compliance with International Accounting Standards. This check box appears only when the Revaluation process is activated on the Installation Options - Asset Management page. See Understanding Accounting Entry and Financial Processing. |

Cost Type for Imp Reversal (cost type for impairment reversal) |

Select the default Cost Type to track impairment reversals from the list of valid cost types. Note: The Cost Type for all books in the same ledger group are automatically set as the same value. PeopleSoft strongly recommends that you do not change the cost types once they are established, because this may cause defective calculations. |

Inv. Prop Trans Code (investment property transaction code) |

Select the default Transaction Code from the list of valid transaction codes. This transaction code is to be used for processing investment property assets and is required when the Investment Property check box is selected. |

Note: Only cost types selected for impairment and revaluation are visible from this page. Modifying the cost types after performing revaluations and impairments may cause inaccurate calculations in future revaluations or impairments. PeopleSoft strongly recommend that you do not change the cost types once transactions have been completed.

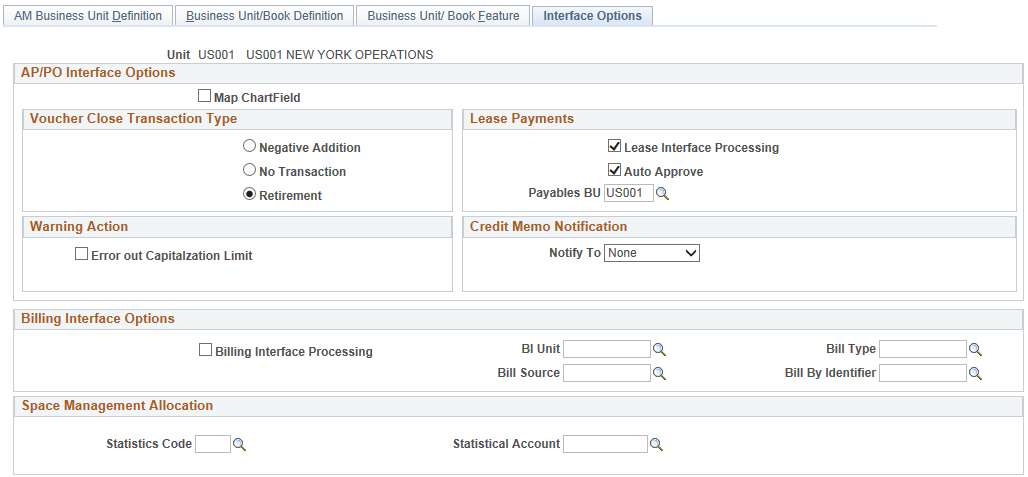

Use the Interface Options page (BUS_UNIT_INTFC_OPT) to enable mobile physical inventory and establish product and application interface default processing options for Payables, Purchasing, Billing, Lease Administration, and Maintenance Management.

Navigation:

This example illustrates the fields and controls on the Interface Options Page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Interface Options Page (2 of 2). You can find definitions for the fields and controls later on this page.

This page provides the options available for interfacing with Payables, Purchasing, Billing, Lease Administration (space management allocation), and Maintenance Management applications.

AP/PO Interface Options

Field or Control |

Description |

|---|---|

Map ChartField |

Select this check box to enable ChartField mapping for Payables and Purchasing asset processing. |

Voucher Close Transaction Type

When a new asset is created from a PeopleSoft Payables voucher and sent to PeopleSoft Asset Management, a new asset is created. If the payables voucher is then closed you have to post the voucher again. The default Voucher Close Transaction is Retirement.

Note: If a voucher is unposted the load type will result in a negative ADD (Load type AAD).

Field or Control |

Description |

|---|---|

Negative Addition |

Results in a negative addition (AAD) to the asset that was originally created by the voucher. |

No Transaction |

No transaction is generated for this event, and the process to remove it from PeopleSoft Asset Management must be entered manually. You can remove the created transaction from open transactions if depreciation has not been run. If depreciation has been run, and the asset has been set up in the system and posted to GL, you must enter a retirement or negative addition transaction to remove it from the books. Acquisition detail will still be inserted for the closed voucher for audit purposes, but no cost rows or financial transaction will be generated. |

Retirement |

Creates a retirement transaction (RET) to retire the asset that was originally created by the voucher. If any depreciation has been taken during the interim period, it will be reversed and removed from the corporate books. Gain and loss will be calculated. This is the default if no other option is specified. |

Note: If either Negative Addition or Retirement are selected and both the first posting and the unposting of the voucher are processed in the same run of the AP/PO Interface (AMPS1000), no assets are created. The two transactions cancel each other out. The load status for both transactions is set to Consolidated.

Lease Payments

Use this group box to enable the options related to the integration between PeopleSoft Asset Management and PeopleSoft Payables for lease payments. This integration enables automatic generation of vouchers for lease payments that are calculated in Asset Management, including both capital and operating leases. In addition, the lease payment schedule segregates the principal and interest of each payment and is used by the AMDPCLOS process to generate the payment accounting entries. The payments can be allocated on a monthly basis, depending upon your setup of payment schedules.

Select the appropriate options for processing automatic vouchers for lease payments in the Lease Payments group box.

The lease payment integration sends to PeopleSoft Payables the information that is stored in the book defined as Lease Book on the AM Business Unit Definition page.

Note: If you have migrated your Asset Management lease data into Lease Administration (per PeopleSoft’s compliance with ASC 842 and IFRS 16 lease accounting standards), you should not utilize the fields in this group box.

For more information, see:

Understanding the Data Migration and Transition Process

Field or Control |

Description |

|---|---|

Lease Interface Processing |

Select to enable the lease payment interface options at the lease entry level. This integration provides the automatic generation of vouchers in PeopleSoft Payables for lease payments that are calculated in Asset Management, including both capital and operating leases. Selecting this check box also activates the other fields in the Lease Payments group box. Note: Lease Interface Processing is deselected by default as the selection of this option makes mandatory certain fields at the lease entry level that are otherwise optional. |

Auto Approve |

Select to enable automatic approval. When selected, the lease payments do not require manual approval before processing to PeopleSoft Payables. |

Payables BU: |

Enter the Payables business unit to be used by default when creating lease schedules for integration to PeopleSoft Payables. |

Warning Action

Field or Control |

Description |

|---|---|

Error Out Capitalization Limit |

Select to receive warning if amount exceeds capitalization limit. |

Credit Memo Notification

Set up Notification of asset-applicable credit memos from PeopleSoft Payables.

Field or Control |

Description |

|---|---|

Notify To |

Select one of the following options to define notification recipients:

|

|

This field only appears if you select the E-Mail Notify To option. Supply an email address of the intended recipient of the credit memo notification. |

|

Roleuser |

This field only appears if you select the Role Notify To option. Select a specific role. Users associated with this role receive credit memo notifications. |

Operator Id |

This field only appears if you select the User Notify To option. Select a specific user ID. Those logged in with the selected user ID receive credit memo notifications. |

See also Load Assets Request Page

Billing Interface Options

Complete the appropriate definitions for processing billing transactions in the Billing Interface group box. The information entered here appears on the Create Bill tab of the Retirement page. The physical nature from PeopleSoft Asset Management is Goods but can be changed in Billing.

Field or Control |

Description |

|---|---|

Billing Interface Processing |

Select to establish processing between PeopleSoft Asset Management and PeopleSoft Billing. This activates integration between the two applications and enables the Create Bill option on the Asset Management Retirement page. Note: PeopleSoft Billing is the only billing interface that is supported by this feature. |

BI Unit |

Select the Billing default business unit. The available Billing business units are established during the Billing application implementation. You can override the BI Unitas needed. Only BI Unitcan be overridden on the retirement page for other PeopleSoft Billing business units whose general ledger business unit matches the PeopleSoft Asset Management business unit. |

Bill Source |

Select the billing source, such as Assets. Available options are established during the Billing application implementation. You cannot override Bill Source. |

Bill Type |

Select the Billing Bill Type, such as AM . Available options are established during the Billing application implementation. You cannot override Bill Type. |

Bill By Identifier |

Select the Billing Bill By Identifier such as Assets . Available options are established during the Billing application implementation. The Bill By Identifier will vary if the business unit is VAT enabled. You cannot overrideBill by Identifier. Note: If the Bill By Identifier should consider VAT transactions, PeopleSoft strongly recommends using the following fields: BUSINESS_UNIT_AM, BILL_SOURCE_ID, VAT_TREATMENT_GRP, COUNTRY_VAT_BILLFR, COUNTRY_VAT_BILLTO, COUNTRY_SHIP_FROM, COUNTRY_SHIP_TO, PHYSICAL_NATURE, SHIP_TO_CUST_ID, RATE_MULT, RATE_DIV, CUR_RT_SOURCE, SHIP_TO_ADDR_NUM. Otherwise: BUSINESS_UNIT_AM, BILL_SOURCE_ID, PHYSICAL_NATURE, RATE_MULT, RATE_DIV, CUR_RT_SOURCE. |

See Integrating with PeopleSoft Billing.

See Understanding PeopleSoft Billing and Asset Management Integration.

Space Management Allocation

Complete the appropriate definitions for processing Lease Administration space allocation transactions in the Space Management Allocation group box. The information entered here creates the default tree name, statistics code, and statistical account for this business unit in the Lease Administration space allocation application.

Field or Control |

Description |

|---|---|

Statistics Code |

Select the statistics code value associated with this space allocation. |

Statistical Account |

Select the statistical account value associated with this space allocation. |

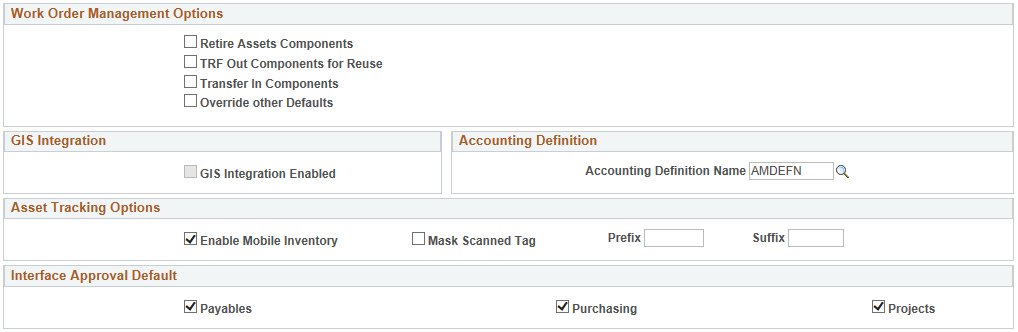

Work Order Management Options

When you integrate PeopleSoft Asset Management with PeopleSoft Maintenance Management, you can define work order transfer default options.

Field or Control |

Description |

|---|---|

Retire Assets Components |

Select this check box to enable retirement processing for components from work orders. |

TRF Out Components for Reuse |

Select this check box to enable component transfers out for reuse from work orders. |

Transfer In Components |

Select this check box to enable component transfers in from work orders. |

Override Other Defaults |

Select this check box to allow default overrides from work order. This option is used for making the set up defined at BU level prevail over set up at other levels. |

GIS Integration Enabled |

Select to enable the integration of a Geographic Information System (GIS) with PeopleSoft Maintenance Management. This check box is available for selection when GIS Integration has been enabled at the system level first (Installation Options - Overall page.) See Installation Options - Overall Page. You must also complete the required setup on the GIS Setup page (Set Up Financials/Supply Chain, Common Definitions, GIS, GIS Setup.) |

Accounting Definition

Enter a value for the Accounting Definition Name field for the selected business unit.

This field provides a default value for the Accounting Definition Name field on the:

Pending Journal Generator page (AM WorkCenter)

Create Accounting Entries page

Close Depreciation page

Note: This field is optional for the Create Accounting Entries and Close Depreciation pages, but required for the Pending Journal Generator page in the AM WorkCenter. The Pending by Business Unit grid requires this default value and Journal Generator cannot be run from the page without it.

Asset Tracking Options

Field or Control |

Description |

|---|---|

Enable Mobile Inventory |

Select the Enable Mobile Inventory option to enable mobile physical inventory for a business unit. |

Mask Scanned Tag |

Select to mask the scan value when tag numbers are scanned in the asset tracking tiles. The Mask Scanned Tag check box is available for selection only when Enable Mobile Inventory check box is selected. You can also provide a prefix or suffix if Mask Scanned Tag check box is selected. Note: If you are using the prefix and/or suffix values, then you need to have the barcode labels attached to the assets replaced with labels that include the prefix and/or suffix values. |

Interface Approval Default

Select the check box to set the Auto Approval Status in the Interface Financial and Physical tables. The Auto Approval status is set at the Business Unit level based on which product the transaction is coming from. The Load Transaction into AM process use this value to validate the transactions and send them to the Asset transaction tables.