Defining Procurement Controls for General Ledger Business Units

Once you have defined the general ledger business units, you must define the procurement accounting controls for each general ledger business unit that is associated with the PeopleSoft Payables business units. These settings determine how the PeopleSoft Payables business units interfaces with the general ledger. You define these controls in the Procurement Control component.

To set up your procurement controls, use the Procurement Control component (BUS_UNIT_INTFC2).

To load data into the tables for the Procurement Control component, use the EM_BUS_UNIT_INTFC component interface.

Note: The Document Types page appears only if document sequencing is enabled for the general ledger business unit.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_INTFC1 |

Specify how accounting entries are processed. |

|

|

BUS_UNIT_INTFC3 |

Define proration, allocation, and expensing options for nonmerchandise charges. |

|

|

BUS_UNIT_INTFC6 |

Specify the payables journal templates. |

|

|

BUS_UNIT_INTFC5 |

Enable ERS processing for the general ledger business unit and select the self-billed invoice (SBI) document option. |

|

|

BU_WTHD_JUR |

Specify general ledger business unit withholding setup options. The withholding process uses this information to determine the withholding entities to which you report or for which you act as a collection agent. |

|

|

WTHD_BU_CF |

Set up accounting ChartField parameters. Specify general ledger information for each withholding class; indicate where the withholding amounts are going with respect to general ledger. |

The General Controls page in the Procurement Control component contains numerous options for setting up accounting controls for discounts lost. This section discusses how to use some of these options.

Discount Lost Accrual

The Accrue Discounts Lost check box on the General Controls page in the Procurement Control component enables you to accrue at net but also to accrue the potential discount lost. If you take the discount later, the system reverses the discount lost.

When accounting at net in PeopleSoft Payables, you can account for lost discounts in one of two ways:

Account for lost discounts during payment posting.

Account for lost discounts during voucher posting.

If you account for lost discounts during payment posting, both the accounts payables offset account and the expense distribution accounts are recorded during the accrual entry net of discount. When the payment is made for this voucher, if the discount is still available, no additional entries are necessary beyond the normal payment entries. If the discount is not taken, a discount lost is recorded to a discount lost control account. The system creates accounting entries as follows:

|

Event |

Account |

Debit Amount |

Credit Amount |

|---|---|---|---|

|

Voucher Entry |

Accounts Payables |

1,080 |

|

|

Expense |

1,080 |

||

|

Payment with discount taken |

Accounts Payables |

1,080 |

|

|

Cash |

1,080 |

||

|

Payment without discount |

Accounts Payables |

1,080 |

|

|

Cash |

1,100 |

||

|

Discount Lost (Expense) |

20 |

If you account for lost discounts during voucher posting, the accounts payable offset account is booked at the gross amount, while the expense distribution accounts are booked at the net amount. This method of accounting is specifically designed to meet German and Austrian accounting requirements, but other countries may need to use it as well. The difference is booked to the discount lost control account. If the discount is not taken, no additional entries are necessary beyond the normal payment entries, because the discount lost has already been booked. If the discount is taken, then an offset to the discount lost must be created to ensure that no discount lost has been booked. The system creates accounting entries as follows:

|

Event |

Account |

Debit Amount |

Credit Amount |

|---|---|---|---|

|

Voucher Entry |

Accounts Payables |

1,100 |

|

|

Expense |

980 |

||

|

VAT Input |

100 |

||

|

Discount Lost (Expense) |

20 |

||

|

Payment without discount |

Accounts Payables |

1,100 |

|

|

Cash |

1,100 |

||

|

Payment with discount taken |

Accounts Payables |

1,100 |

|

|

Cash |

1,078 |

||

|

Discount Expense |

22 |

||

|

VAT Adjustment (VIDR) |

2 |

||

|

Discount Adjustment (VIDA) |

2 |

Discount Memo Account

The Record Discount Memo Account check box on the General Controls page in the Procurement Control component enables you to set up the system to post discount entries at the time of payment using memo accounts. Using this method, if users accrue at gross but later lose the discount, the system generates entries to the discount lost and discount lost memo accounts. You can set up the system to generate similar entries to the discount earned and discount earned memo accounts when accruing at net.

You can post discount entries using memo accounts in one of two ways:

Accounting at gross.

Accounting at net.

If you account at gross for a general ledger business unit (using the vouchering general ledger business unit) the system creates accounting entries as follows:

|

Event |

Account |

Debit Amount |

Credit Amount |

|---|---|---|---|

|

Voucher Entry |

Accounts Payables |

1,000 |

|

|

Expense |

1,000 |

||

|

Payment without discount |

Accounts Payables |

1,000 |

|

|

Cash |

1,000 |

||

|

Discount Lost |

20 |

||

|

Discount Lost Memo |

20 |

||

|

Payment with discount taken |

Accounts Payables |

1,000 |

|

|

Cash |

980 |

||

|

Discount Earned |

20 |

If you select accounting at net for a general ledger business unit (using the vouchering general ledger business unit), the system uses the Record Discount Memo option in conjunction with the Accrue Discount Lost option to determine the accounting entries:

Example 1: Voucher Entered at Net with 2 Percent Discount:

In this scenario, it is assumed that the Accrue Discount Lost check box is not selected.

|

Event |

Account |

Debit Amount |

Credit Amount |

|---|---|---|---|

|

Voucher Entry |

Accounts Payables |

980 |

|

|

Expense |

980 |

||

|

Payment without discount |

Accounts Payables |

980 |

|

|

Cash |

1,000 |

||

|

Discount Lost |

20 |

||

|

Payment with discount taken |

Accounts Payables |

980 |

|

|

Cash |

980 |

||

|

Discount Earned |

20 |

||

|

Discount Earned Memo |

20 |

Example 2: Voucher Entered at Net with 2 Percent Discount:

In this scenario, it is assumed that the Accrue Discount Lost check box is selected.

|

Event |

Account |

Debit Amount |

Credit Amount |

|---|---|---|---|

|

Voucher Entry |

Accounts Payables |

1,000 |

|

|

Expense |

980 |

||

|

Discount Lost |

20 |

||

|

Payment without discount |

Accounts Payables |

1,000 |

|

|

Cash |

1,000 |

||

|

Payment with discount taken |

Accounts Payables |

1,000 |

|

|

Cash |

980 |

||

|

Discount Lost |

20 |

||

|

Discount Earned |

20 |

||

|

Discount Earned Memo |

20 |

Note: This method of accounting is specifically designed to meet German and Austrian accounting requirements, but other countries may need to use it as well.

Before defining procurement accounting controls for PeopleSoft Payables business units, you must:

Define a posting method on the Installation Options - Payables page.

Define journal templates on the Journal Generator Templates pages.

Define a combination edit template for vouchers and set up ChartField combination editing.

Define standard cost charges on the Misc Charge / Landed Cost Defn (miscellaneous charge/landed cost definition) page.

Set up withholding entities, types, and jurisdictions, as well as withholding business unit categories

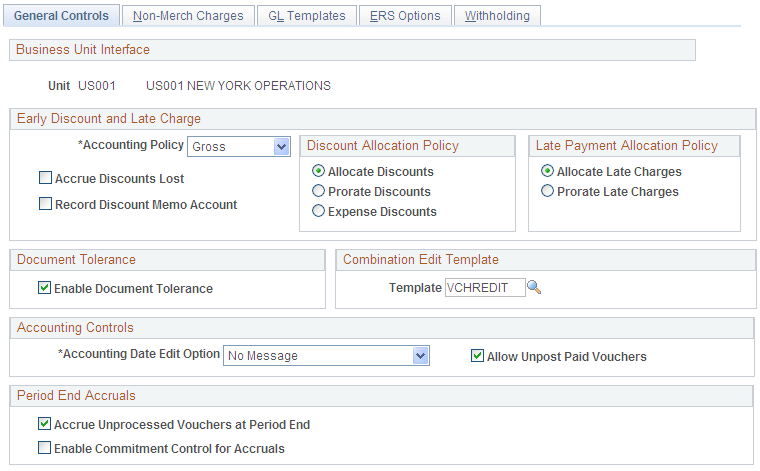

Use the Procurement Control - General Controls page (BUS_UNIT_INTFC1) to specify how accounting entries are processed.

Navigation:

This example illustrates the fields and controls on the Procurement Control – General Controls page. You can find definitions for the fields and controls later on this page.

Early Payment Discount and Late Payment Charges

All of the fields in this group box are used during posting and none can be overridden, except the accounting policy, which you can override when you create a voucher.

Field or Control |

Description |

|---|---|

Accounting Policy |

Select an option to use as a default for vouchers. You can override the accounting policy when you create a voucher. Options are: Gross: The system uses the gross amount of vouchers as the basis for accounting; any discounts taken are recognized as discounts earned. Net: The system uses the net amount of vouchers as the basis for accounting. Any discounts that you lose are recognized as discounts lost. |

Accrue Discounts Lost |

Select to account at net per German and Austrian requirements. If you select this option, the system accounts for lost discounts during voucher posting. If you don't select this option, the system accounts for lost discounts during payment posting. |

Record Discount Memo Account |

Select this option to record both discount earned and discount lost at payment creation regardless of whether you account at net or gross. |

Discount Allocation Policy

Use the fields in this group box to determine how discounts are charged.

Field or Control |

Description |

|---|---|

Allocate Discounts |

Select to have the system use the account from the accounting entry template and create all other ChartFields based on the inheritance rule for the SetID associated with the general ledger business unit of the distribution line. (The system uses the PeopleSoft Payables distribution-level entries inheritance group). The discount lines inherit the general ledger business unit of the distribution lines. |

Prorate Discounts |

Select to have the system create discount entries on separate lines using the account and all other ChartFields on the distribution lines for the voucher. The discount lines inherit the general ledger business unit of the distribution lines. |

Expense Discounts |

Select to have the system use the account from the accounting entry template and create all other ChartFields based on the inheritance rule for the SetID associated with the general ledger business unit of the vouchering business unit. (The system uses the PeopleSoft Payables header-level entries inheritance group). The discount line uses the general ledger business unit of the vouchering business unit. Note: This option is available only if you use the summary control posting method. |

Late Payment Allocation Policy

Use the fields in this group box to determine how late charges are applied.

Field or Control |

Description |

|---|---|

Allocate Late Charges |

Select to allocate late interest charges. Allocate Late Charges allows for further classification beyond the standard Accounting Entry Template (that is, changing of chartfields like the GL Account to record interest penalty) including Fund and Business Event Type Code (BETC). Processing US Federal payments requires that Late Interest Charge Chartfield Override setup is established when selecting the Allocate Late Charges option. Payment Posting and Cash Clearing will utilize Late Interest Charge Chartfield Override setup when processing late interest charges for payments. Paycycle will encounter an error if Allocate Late Charges is selected but Late Charge Override is not defined. |

Prorate Late Charges |

Select to prorate late interest charges. If you select this option, the system creates late interest charge entries on separate lines using the account and all other ChartFields on the distribution lines for the voucher. The late interest lines inherit the general ledger business unit of the distribution lines. |

Document Tolerance

Field or Control |

Description |

|---|---|

Enable Document Tolerance |

Select to enable document tolerance checking for the selected general ledger business unit. |

Combination Edit Template

Field or Control |

Description |

|---|---|

Template |

Select the combination edit template that the Voucher Build Application Engine process (AP_VCHRBLD) uses. This is used only for batch voucher editing and is not necessary for online voucher entry because the system handles combination editing for online entry differently. |

Accounting Controls

Field or Control |

Description |

|---|---|

Accounting Date Edit Option |

Specify whether future-dated accounting entries are allowed. Options are: Error Message: Select to control which users have the authority to enter accounting dates beyond the current date for vouchers. No Message: Select to enable all users to enter accounting dates beyond the current date for vouchers without receiving a warning or error message. Warning Message: Select to display a warning message when users enter accounting dates beyond the current date for voucher. |

Allow Unpost Paid Vouchers |

Select to enable users to unpost vouchers that have been partially or fully paid. |

See UnPost Voucher Page.

Period End Accruals

Field or Control |

Description |

|---|---|

Accrued Unprocessed Vouchers at Period End |

Select this check box to enable the system to accrue documents that have not been posted during the normal accounting flow. If the user enables this option, they must also select a journal generator template for period end accruals. |

Enable Commitment Control for Accruals |

Select this check box to enable accrual documents created during the Period End Accrual process and that impact encumbrance to be budget checked by PeopleSoft Commitment Control. |

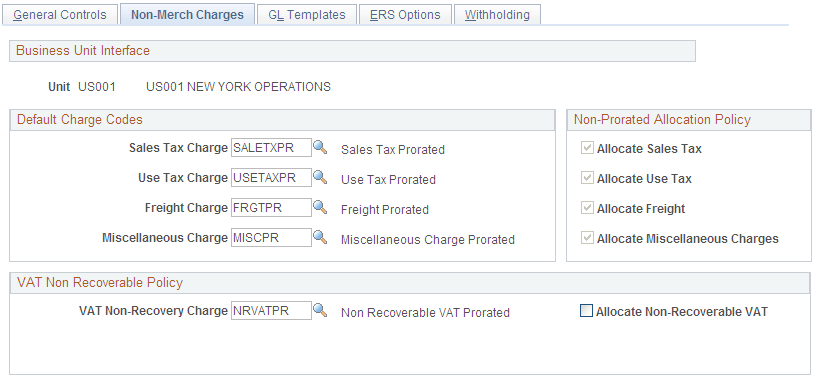

Use the Procurement Control - Non-Merch Charges (procurement control - nonmerchandise charges) page (BUS_UNIT_INTFC3) to define proration, allocation, and expensing options for nonmerchandise charges.

Navigation:

This example illustrates the fields and controls on the Procurement Control - Non-Merch Charges page.

Proration and Allocation of Nonmerchandise Charges

To understand the options on this page, you need to understand how proration and allocation of nonmerchandise amounts work.

During voucher entry, nonmerchandise amounts are prorated to each distribution line based on some ratio of total expense to the merchandise or other value on the distribution lines of the voucher, or they are not prorated. This depends on the charge code, which you set up in the Misc Charge/Landed Cost Defn (miscellaneous charge/landed cost definition) component (CM_LC_COMPONENT). If non merchandise amounts are not prorated, you can specify on the Procurement Control - Non-Merch Charges page whether to allocate them to separate accounting lines or to record them to summary expense accounts. This table describes what happens when you prorate, allocate, or expense (neither prorate or allocate) nonmerchandise charges:

|

Action |

Result |

|---|---|

|

Prorate |

Records the prorated amount along with the merchandise amounts on the distribution line. If you prorate nonmerchandise amounts, the amounts charged to the distribution lines are added to merchandise amounts on the distribution lines, and the total is posted to the distribution ChartFields. |

|

Allocate |

Creates separate accounting entries for the nonmerchandise amount for the distribution line. If you allocate nonmerchandise amounts, the amounts charged to the distribution lines are posted to the appropriate nonmerchandise accounts from the accounting template, and the other ChartField values are based on the inheritance rules. ChartField inheritance is defined at the ledger group level and on the ChartField Inheritance page. |

|

Expense (non-prorate/non-allocate) |

Records the amounts to summary expense accounts. If you use summary control posting, you have two options for nonprorated charges. You can either expense the charges at the header, or allocate them to the distribution lines. You allocate them by selecting the Allocate check box on the Non-Merch Charges page in the Procurement Accounting Controls component. If you use detail offset posting, you have only one option for nonprorated charges. You must allocate them. For this reason, the Allocate check box is selected and unavailable for entry on the Non-Merch Charges page in the Procurement Accounting Controls component. |

Default Nonmerchandise Charge Codes

Use the fields in this group box to set the defaults for the nonmerchandise charges on the voucher. The charge codes that you select here are automatically populated in the vouchers that you create for the business unit. They determine where the nonmerchandise amounts are charged.

Each of the fields in this group box has a drop-down list box that displays the available charge codes for that nonmerchandise charge. You define the codes for these nonmerchandise charges on the Misc Charge/Landed Cost Definition page. When you select a charge code, you define the proration. The available charge codes are prorated (PR) or not prorated (NP), unless you have defined more charge codes on the Misc Charge/Landed Cost Definition page.

Note: The charge codes that you select here are only defaults. You can override these charge codes on the voucher itself.

Non-Prorated Allocation Policy

The fields in this group box determine whether a nonprorated nonmerchandise charge is allocated or charged as a nonprorated expense for a particular general ledger business unit.

If you use detail offset posting, this check box is automatically selected and display-only because you cannot expense nonmerchandise amounts with detail offset posting.

If you use summary control posting, you can select this check box to allocate the nonmerchandise charges to the distribution line, or you can deselect the check box to expense the charges to the header.

Note: Unlike the charge codes, the allocation options cannot be overridden at voucher creation time. If you select a nonprorate option as the default here or on the voucher, the system uses the allocation option that you select here to either allocate or expense the nonmerchandise amount.

Field or Control |

Description |

|---|---|

Allocate Sales Tax |

Select to have the system create separate accounting entries for nonprorated sales tax amounts for the distribution line; the appropriate ChartFields are inherited. |

Allocate Use Tax |

Select to have the system create separate accounting entries for nonprorated use tax amounts for the distribution line; the appropriate ChartFields are inherited. |

Allocate Freight |

Select to have the system create separate accounting entries for nonprorated freight amounts for the distribution line; the appropriate ChartFields are inherited. |

Allocate Miscellaneous Charges |

Select to have the system create separate accounting entries for nonprorated miscellaneous charge amounts for the distribution line; the appropriate ChartFields are inherited. |

VAT Non Recoverable Policy

Use the fields in this group box to set the defaults for the nonrecoverable VAT charges on the voucher. The charge code that you select here automatically appears on the vouchers that you create for the business unit. You can override it on the voucher.

Field or Control |

Description |

|---|---|

VAT Non-Recovery Charge |

Select from the delivered options or additional charge codes that you define on the Misc Charge/Landed Cost Definition page. Options are: NRVATNP (do not prorate nonrecoverable VAT): Nonrecoverable (taxable) VAT is not prorated to the distribution line ChartFields. NRVATPR (prorate nonrecoverable VAT): Nonrecoverable VAT is prorated to the ChartFields on the distribution line. |

Allocate Non-Recoverable VAT |

Select to have the system create separate accounting entries for the nonrecoverable VAT amount for the distribution line. This check box applies only to nonprorated nonrecoverable VAT charge codes. The VAT nonrecoverable amount is posted to the account defined on the VAT accounting template (VAT Code - Accounting Information page), and the other ChartField values appear automatically based on the ChartField inheritance rules. If you are using summary control posting and you want to expense nonprorated nonrecoverable VAT charges at the voucher header, then do not select this check box. You can override this option when creating vouchers. |

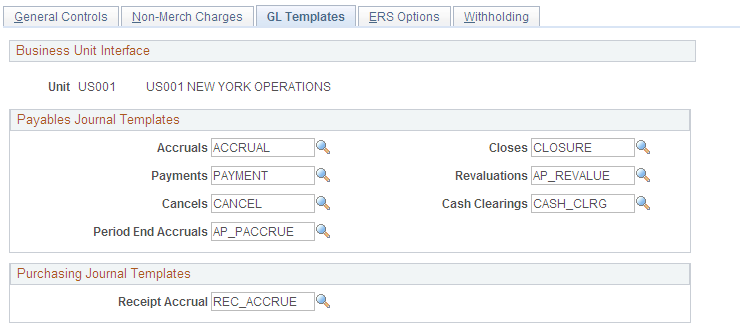

Use the Procurement Control - GL Templates (procurement control - general ledger templates) page (BUS_UNIT_INTFC6) to specify the payables journal templates.

Navigation:

This example illustrates the fields and controls on the Procurement Control - GL Templates page. You can find definitions for the fields and controls later on this page.

Payables Journal Templates

Specify the PeopleSoft Payables journal templates to use for the general ledger business unit. These templates define the summarization rules for creating journals that are passed to the general ledger. The PeopleSoft Payables system creates one journal each for accruals, payments, payment cancellations, manual closures, revaluations, and cash clearings; you must specify a different journal template for each.

Purchasing Journal Templates

Field or Control |

Description |

|---|---|

Receipt Accrual |

Select the journal template to use for receipt accrual in PeopleSoft Purchasing. The standard template that is provided for receipt accrual is REC_ACCRUE. |

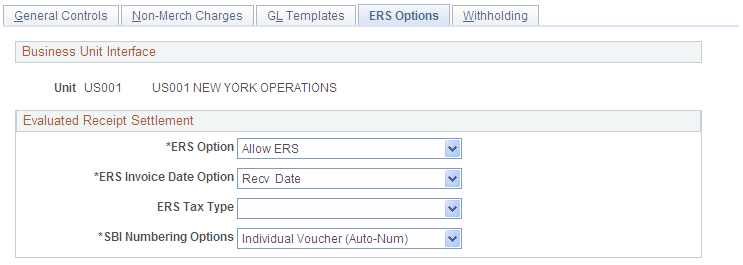

Use the Procurement Control - ERS Options (procurement control - evaluated receipt settlement options) page (BUS_UNIT_INTFC5) to enable ERS processing for the general ledger business unit and select the self-billed invoice (SBI) document option.

Navigation:

This example illustrates the fields and controls on the Procurement Control - ERS Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ERS Option |

ERS is a process by which the Voucher Build process builds vouchers from procurement receipt records. If you plan to use the Voucher Build process to create ERS vouchers for business units associated with this general ledger business unit, then you need to set the ERS option to Allow ERS. |

ERS Invoice Date Option |

Select the method that the system uses to create the ERS voucher invoice date. Options are: Frt Terms (freight terms): The freight terms determine whether to use the receipt or the shipment date as the invoice date. Recv Date (receiver date): The system uses the receiver data. |

SBI Numbering Options |

Select to define how the system groups SBIs. Options are: Group Vouchers (Auto-Num) (group [auto-number]): The system groups ERS vouchers in a single SBI voucher. Individual Vchr - Invoice Number (individual voucher - invoice number): The SBI contains information from only a single voucher. The system generates the SBI number by combining the invoice number with the ERS sequence number. Individual Voucher (Auto-Num) (individual voucher [auto-number]): The SBI contains information from only a single voucher. The system assigns the next available SBI number based on the invoicing location. |

ERS Tax Type |

Select to indicate the type of tax to which the vouchers are subject. Options are No Taxes, Sales Tax, Use Tax, and VAT. |

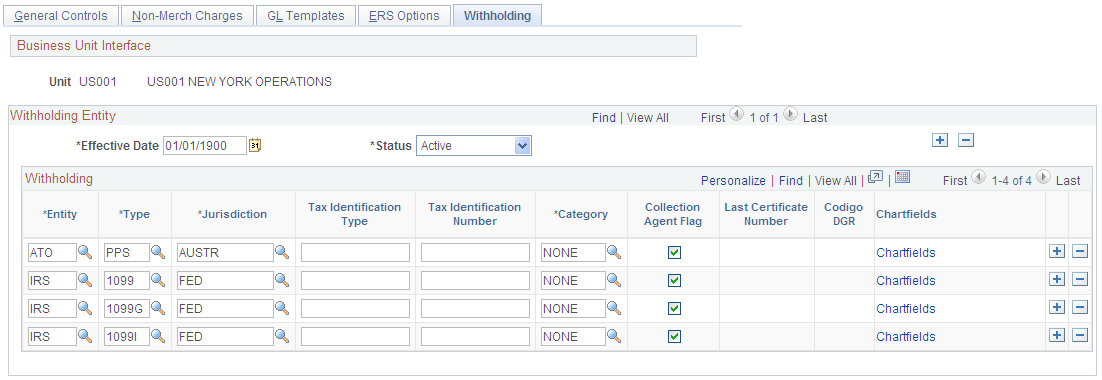

Use the Procurement Control - Withholding page (BU_WTHD_JUR) to specify general ledger business unit withholding setup options.

The withholding process uses this information to determine the withholding entities to which you report or for which you act as a collection agent.

Navigation:

This example illustrates the fields and controls on the Procurement Control - Withholding page. You can find definitions for the fields and controls later on this page.

Specify the general ledger business unit's relationship to the various withholding entities for whom you withhold. These tax authorities use this information to determine your relationship with them. Enter the applicable information for each combination of withholding entity, type, jurisdiction, and business unit category.

Note: The withholding entity and class information is related to the information defined on the Withholding Entity page. Therefore, the effective date used on this page must be greater than or equal to the effective date on the Withholding Entity page.

Field or Control |

Description |

|---|---|

Collection Agent Flag |

Select if you are a collection agent for the entity. |

Last Certificate Number |

Enter the last certificate number for the entity. |

(ARG) Codigo DGR |

Used exclusively in Argentina. This field is for information purposes only and does not trigger any action. |

ChartFields |

Click to access the Withholding ChartFields page to set up accounting parameters. |

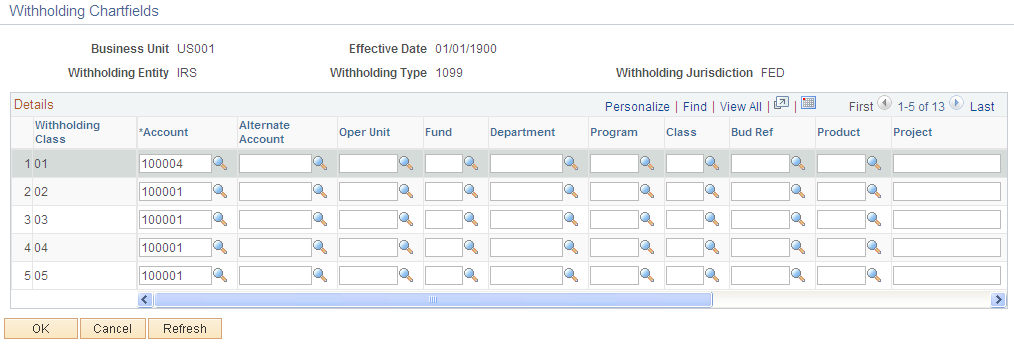

Use the Withholding ChartFields page (WTHD_BU_CF) to set up accounting ChartField parameters.

Specify general ledger information for each withholding class; indicate where the withholding amounts are going with respect to general ledger.

Navigation:

Click the ChartFields link on the Procurement Control - Withholding page.

This example illustrates the fields and controls on the Withholding ChartFields page. You can find definitions for the fields and controls later on this page.

Because withholding ChartFields are defined at the business unit level, you can specify ChartFields for every withholding entity, type, and jurisdiction.

Note: For each withholding class, you must specify the account ChartField. The system displays an error message upon saving if you have not populated the Account field.

Field or Control |

Description |

|---|---|

Withholding Class |

Displays the withholding classes defined for the withholding entity, type, and jurisdiction. The system automatically populates this field based on what you define on the Withholding Entity page. You can delete a withholding class if you have deleted the class on the Withholding Entity page. Otherwise, the delete button is not available. Note: When you add a new withholding class for an entity on the Withholding Entity page, the system populates this page with the new withholding class. The system populates the Account field with the account for the minimum withholding class of the entity. If the system is unable to determine a valid account, you must manually insert the account on this page. For example, you define account 230000 for withholding class 01 and account 235000 for withholding class 02. When you add a new withholding class 03 on the Withholding Entity page, the system populates the account with 230000 for the withholding class 03 on the Withholding ChartFields page (the account defined for the minimum withholding class, in this example, 01). When you delete a withholding class for an entity on the Withholding Entity page, the system displays a warning message stating that you must delete the withholding class from the Procurement Control - Withholding page as well. |

Account |

Select the account to be used as the withholding liability account in general ledger. This field is required. You can also select the ChartFields associated with the account you selected, as appropriate. Note: The account is based on the TableSet control of the business unit rather than the SetID of the withholding entity. |