Setting Up the PeopleSoft Payables Withholding Environment

To set up your withholding environment, use the following components:

Rules (WTHD_RULE).

Types and Classes (WTHD_TYPE).

Jurisdictions (WTHD_JURISDICTION).

Business Unit Categories (WTHD_BU_CAT).

Supplier Categories (WTHD_VNDR_CAT).

Withholding Entities (WTHD_ENTITY).

Procurement Control (BUS_UNIT_INTFC2).

Wthd Code (withholding code) (WTHD_CODE).

This section provides an overview of setting up withholding entities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_RULE |

Establish rules that determine the actions to be taken during withholding. For example, you can create rules to define the amount of withholding and to determine different percentages based on the size of the transaction amount. You can also create tiered-based withholding on this page. |

|

|

Withhold Rule request Page |

RUN_APY7010 |

Define run parameters for the Withholding Rules Report (APY7010). Use this report to review withholding rules by as of date. |

|

WTHD_TYPE |

Define withholding at the highest level. For example, in the U.S. 1099 is a withholding type. For each withholding type, you can define subdivisions or classes, such as rent or royalties. |

|

|

Withhold Type request Page |

RUN_APY7020 |

Define run parameters for the Withholding Types report (APY7020). Use this report to review withholding types and classes. |

|

WTHD_JURISDICTION |

Define withholding jurisdictions for a withholding type. Jurisdictions introduce an additional level of classification between the withholding type and class. Jurisdiction also enables you to define different withholding percentages based on where the supplier is located as well as on the classification (or activity) of a given transaction. |

|

|

WTHD_BU_CAT |

Define the relationship that exists between you (your business unit) and your withholding entity. As with jurisdiction and classification, this relationship affects your withholding percentages. |

|

|

WTHD_VNDR_CAT |

Define the relationship that exists between the withholding entity and your supplier. As with jurisdiction and classification, this relationship affects your withholding percentages. |

|

|

WTHD_ENTITY |

Define your withholding entities (tax authorities). Enter the withholding entity information including supplier, class, and category information for the entity. The withholding entity component ties the withholding information together. |

|

|

WTHD_FLAGS |

Determine what constitutes the basis for your withholding, and specify how to apply the withholding balance. |

|

|

WTHD_ENTITY_FIELDS |

Indicate which information the tax authority (entity) requires for your suppliers. |

|

|

BU_WTHD_ENT_FLDS |

Indicate which information the tax authority (entity) wants to know about your business units. |

|

|

Withholding Entity request Page |

RUN_APY7030 |

Define run parameters for the Withholding Entity report (APY7030). Use this report to review withholding entities you have set up. |

|

BU_WTHD_JUR |

Set up withholding options at the general ledger business unit level. |

|

|

Withholding ChartFields Page |

WTHD_BU_CF |

Set up accounting ChartField parameters. Specify general ledger information for each withholding class; indicate where the withholding amounts are going with respect to general ledger. |

|

WTHD_CODE |

Create withholding codes. A withholding code represents a set of withholding entity types, jurisdictions, and classes that you want to apply to a voucher at the same time. For example, you may want to apply both a federal and local withholding. In this case, you can define a withholding code to combine the two withholding entities and use this code when you override withholding information at the voucher line level. |

|

|

Withhold Code request Page |

RUN_APY7040 |

Define run parameters for the Withholding Codes report (APY7040). Use this report to review withholding codes. |

This section discusses:

Withholding suppliers for withholding entity setup.

Withholding classes for withholding entity setup.

Withholding categories for withholding entity setup.

Withholding Suppliers for Withholding Entity Setup

Based on your withholding environment, you can define a single withholding remit supplier or multiple withholding remit suppliers to submit withholding payments. This enables you to associate multiple SetIDs and suppliers with any given withholding entity.

The Withhold Calculation Application Engine process (AP_WTHDCALC) retrieves the correct supplier ID for the given SetID based on the TableSet control value for the PeopleSoft Payables business unit. For example:

Create multiple withholding remit suppliers for a withholding entity.

Withholding supplier 1 SetID and supplier ID = SHARE and IRS.

Withholding supplier 2 SetID and supplier ID = SHR03 and WTHD000002.

Create a voucher in the FED01 PeopleSoft Payables business unit for a supplier who is set up for withholding with this withholding entity.

The TableSet control for this PeopleSoft Payables business unit is SHR03.

Run the Withhold Calculation process.

The system looks at the TableSet control for the PeopleSoft Payables business unit (SHR03) and retrieves the withholding remit supplier defined for SHR03 for this withholding entity. The system selects supplier 2 (WTHD000002).

Note: This example is intended to illustrate how the system determines the withholding remit supplier and does not represent the entire set up and process flow for withholding.

Withholding Classes for Withholding Entity Setup

Setting up withholding entities require you to define the withholding types, jurisdictions, and classes (or activities) associated with your entity. The withholding entity defined on the Withholding Entity page works closely with the information you define at the business unit level on the Procurement Control - Withholding and Withholding ChartFields pages.

Because of the close association between the withholding entity and business unit, any additions, deletions, and changes you make at the withholding entity level need to be made at the business unit level as well. For example:

When you add a new withholding class for an entity on the Withholding Entity page, the system automatically adds the class to the Withholding ChartFields page.

The system populates the Account field on the Withholding ChartFields page with the account for the minimum withholding class of the entity. The system displays a warning stating that you should verify the information on the procurement control (Procurement Control - Withholding and Withholding ChartFields pages).

When you delete a withholding class for an entity on the Withholding Entity page, the system displays a warning message indicating that you must delete the withholding class from the procurement control (Withholding ChartFields page) as well.

Withholding Categories for Withholding Entity Setup

The withholding percentage depends on the withholding entity, type, jurisdiction, and class for a given transaction. Furthermore, the withholding percentage depends on the relationship that exists between you (your business unit) and your supplier. In some countries, whether or not your supplier is registered through the proper authorities may influence the withholding percentage for a given transaction. Also, the way you operate your business (from your tax authority's point of view) further influences what percentage you use for withholding purposes.

Taking Ganancias (an Argentine withholding type) as an example, there are several different possible withholding percentages that you may use for an activity, depending on the relationship you have with your supplier:

Business unit centralized and supplier registered.

Business unit centralized and supplier not registered.

Business unit decentralized and supplier registered.

Business unit decentralized and supplier not registered.

For Ganancias, those four different possibilities need to be accounted for and each may have different withholding rules associated with them.

To accommodate these possibilities, two tables are provided (WTHD_BU_CAT and WTHD_VNDR_CAT). The first one represents the possible business unit categories for withholding taxes, and the second one represents the possible supplier categories for those same withholding taxes.

For each business unit, you can define the possible categories that would yield different withholding calculation. Here are some example categories that could be set up for Ganancias:

|

Withholding Entity |

BU Category |

|---|---|

|

Ganancias |

Centralized |

|

Ganancias |

Decentralized |

For each supplier, you can define the possible categories that would yield different withholding calculations. Here are some categories that could be set up for Ganancias:

|

Withholding Entity |

Supplier Category |

|---|---|

|

Ganancias |

Registered |

|

Ganancias |

Not Registered |

You can define these categories at the business unit and supplier level, and can set up withholding entities with different withholding rules for each permutation of those categories.

A child table has been created to the current WTHD_ENTITY_DTL record called WTHD_CATEGORY for this purpose. Here is a depiction of this record:

|

Entity |

Type |

Jurisdiction |

Class |

BU Category |

Supplier Category |

Wthd Rule |

|---|---|---|---|---|---|---|

|

Arg. Govt |

Ganancias |

Buenos Aires |

Lawyer fees |

Centralized |

Registered |

10%Rule |

|

N/A |

N/A |

N/A |

N/A |

Centralized |

Not Registered |

12%Rule |

|

N/A |

N/A |

N/A |

N/A |

Decentralized |

Registered |

5%Rule |

|

N/A |

N/A |

N/A |

N/A |

Decentralized |

Not Registered |

7%Rule |

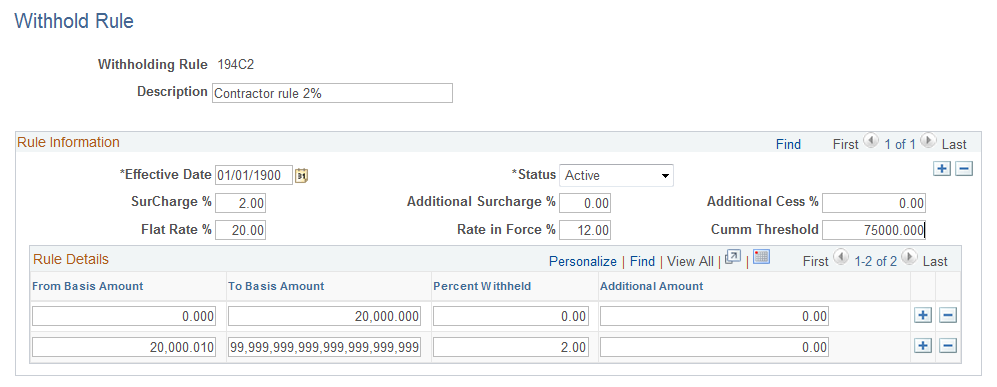

Use the Withhold Rule page (WTHD_RULE) to establish rules that determine the actions to be taken during withholding.

For example, you can create rules to define the amount of withholding and to determine different percentages based on the size of the transaction amount. You can also create tiered-based withholding on this page.

Navigation:

This example illustrates the fields and controls on the Withhold Rule page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

(IND) SurCharge % (surcharge percent) |

Enter any surcharge percentage as applicable. Surcharges are for Indian withholding and represent a percentage of the calculated tax amount which is added to the calculated tax amount for withholding. Note: According to India Income Tax Rules, in case the supplier’s PAN Number is not available, then the transaction is subject to Withholding at a flat rate of 20%. In this case Surcharge and Cess do not apply. |

(IND) Additional SurCharge % (additional surcharge percent) |

Enter an additional surcharge percent that is to be used for calculating the Education Cess tax levy, if required. |

(IND)Additional Cess % |

Enter any additional Cess charge to be used for calculating the Higher Education Cess tax levy, if required. |

(IND) Flat Rate % |

Enter a flat rate percentage value. This percentage value is applied in calculating TDS Withholding only if there is no PAN number associated with the supplier. If a PAN number exists for the supplier, this value is not considered for TDS Withholding Calculation. Note: A flat rate of 20 percent is charged if there is no PAN number for the supplier. |

(IND) Rate in Force % |

Enter a rate in force percent value if there is a change in rate within the fiscal year. |

(IND) Cumm Threshold |

Enter a cumulative threshold amount. This amount is used as a reference to accumulate the withholding amounts. Withholding begins calculation only if the total voucher amounts exceed the value entered (75000, in this example). Also, in order to calculate Withholding, the individual voucher amounts should be greater than the amount entered in the row corresponding to the To Basis Amount, requiring that the Percent Withheld value is greater than zero. |

You can use the Rule Details group box to define the withholding percentage within specific amount ranges, enabling you to specify tiered withholding.

Field or Control |

Description |

|---|---|

From Basis Amount |

Enter the lower amount of a range for which you want to define a percentage to be withheld. |

To Basis Amount |

Enter the upper amount of a range for which you want to define a percentage to be withheld. |

Percent Withheld |

Enter the percentage to be withheld for the range you defined. |

Additional Amount |

Enter any additional amount to be added to the withholding calculation, as appropriate. This field is used for tier-based withholding. |

To access the Withhold Rule request page, use the navigation:

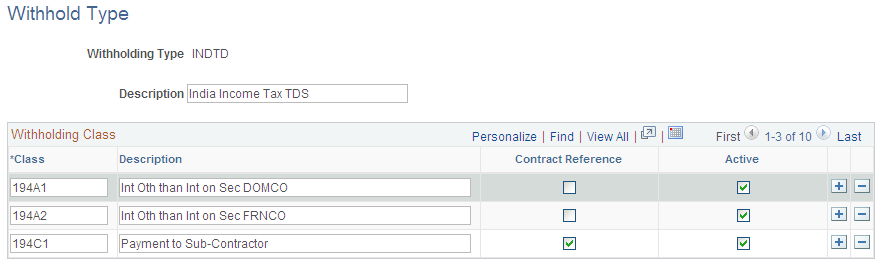

Use the Withhold Type page (WTHD_TYPE) to define withholding at the highest level.

For example, in the U.S. 1099 is a withholding type. For each withholding type, you can define subdivisions or classes, such as rent or royalties.

Navigation:

This example illustrates the fields and controls on the Withhold Type page. You can find definitions for the fields and controls later on this page.

Use the Withholding Class grid to specify the withholding classes.

Field or Control |

Description |

|---|---|

Class and Description |

Specify any classes that belong to this withholding type, and enter a description for each class that you add. |

(IND) Contract Reference |

Select to require a contract reference when creating a voucher with this withholding class. This feature is for Indian withholding only. |

Active |

Select to indicate withholding class is active. The withholding class is available immediately for you to use to define your withholding entity options. |

To access the Withhold Type request page, use the navigation:

Use the Withhold Jurisdiction page (WTHD_JURISDICTION) to define withholding jurisdictions for a withholding type.

Jurisdictions introduce an additional level of classification between the withholding type and class. Jurisdiction also enables you to define different withholding percentages based on where the supplier is located as well as on the classification (or activity) of a given transaction.

Navigation:

When you access the page, select the withholding type for which you are defining the jurisdiction.

Field or Control |

Description |

|---|---|

Withholding Jurisdiction and Description |

Specify any withholding jurisdictions that belong to this withholding type, and enter a description for each jurisdiction that you add. |

Use the Business Unit Categories page (WTHD_BU_CAT) to define the relationship that exists between you (your business unit) and your withholding entity.

As with jurisdiction and classification, this relationship affects your withholding percentages.

Navigation:

When you access the page, select the withholding type for which you want to define business unit categories.

Field or Control |

Description |

|---|---|

Category |

Specify any category that belong to this withholding type, and enter a description for each category you add. |

Use the Supplier Categories page (WTHD_VNDR_CAT) to define the relationship that exists between the withholding entity and your supplier.

As with jurisdiction and classification, this relationship affects your withholding percentages.

Navigation:

When you access the page, select the withholding type for which you want to define supplier categories.

Field or Control |

Description |

|---|---|

Supplier Category |

Specify any supplier categories that belong to this withholding type, and enter a description for each supplier category that you add. |

Default Flag |

Select to have the supplier category or categories appear as defaults for the Withhold Status field on the Withholding Supplier Information page. |

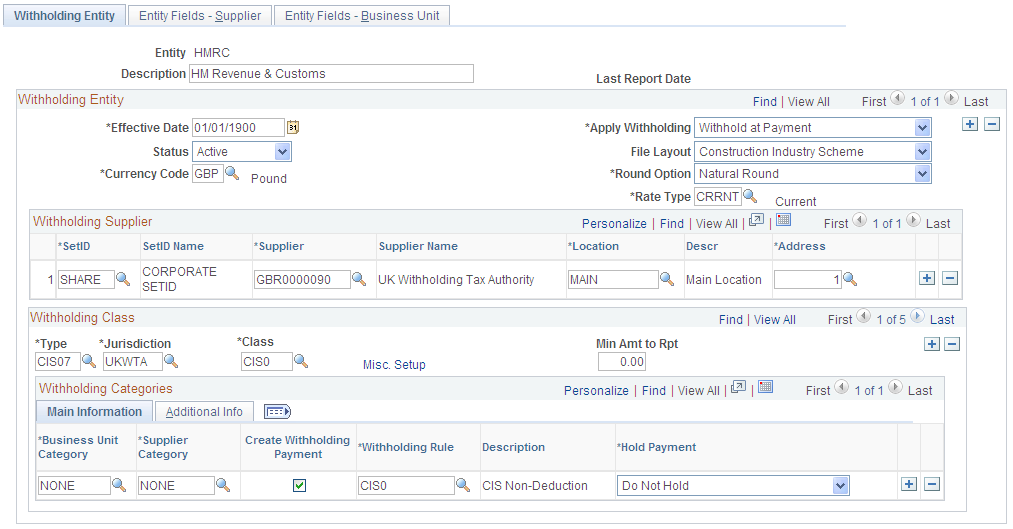

Use the Withholding Entity page (WTHD_ENTITY) to define your withholding entities (tax authorities).

Enter the withholding entity information including supplier, class, and category information for the entity. The withholding entity component ties the withholding information together.

Navigation:

This example illustrates the fields and controls on the Withholding Entity page. You can find definitions for the fields and controls later on this page.

Note: You must define the supplier information for the withholding supplier or suppliers in the Supplier Information component before you can complete the Withholding Entity page.

Withholding Entity

Field or Control |

Description |

|---|---|

Apply Withholding |

Use this field to determine whether the withholding calculation for any withholding belonging to this entity should occur at Payment or at Vchr Post (voucher post). If you select Payment as the withholding calculation setting, this setting can be overridden by users with the appropriate authority on the voucher Withholding Information page provided the voucher has not been posted and a payment has not been made. Note: You set up the security for overriding withholding calculation using the User Preferences component. |

Currency Code and Rate Type |

Specify the reporting currency code and exchange rate type for the entity. |

File Layout |

Select the appropriate reporting file layout. |

Round Option |

Select the appropriate rounding option: Down: Round all decimals down to the next whole number. Natural: Round normally. If the calculated withholding amount is less than five, round down; if it is five or above, round up. (IND) NRR (Nearest Rupee Rounding): Select to round to the nearest Rupee. If an amount contains a part of a rupee consisting of paise then, if such part is fifty paise or more, it will be increased to one rupee and if such part is less than fifty paise, it will be ignored. TDS: Selecting this value rounds decimal amounts to the appropriate zero decimal, regardless of the installed currency configuration. Up: Round all decimals up to the next whole number. |

Withholding Supplier

Use this group box to define all applicable withholding remit suppliers for this entity. You can associate one or multiple SetID and supplier combinations with the withholding entity.

Field or Control |

Description |

|---|---|

SetID, Supplier, and Location |

Select the SetID, supplier, and location associated with the withholding entity. The Withhold Calculation process retrieves the withholding supplier ID for the corresponding SetID based on the TableSet control value for the PeopleSoft Payables business unit of the supplier used during voucher entry. For example, for a PeopleSoft Payables business unit that uses SHARE as the SetID for suppliers, the Withhold Calculation process selects the withholding supplier ID defined for the SHARE SetID on the Withholding Entity page. |

Withholding Class

Use this group box to specify all the possible combinations of withholding types, jurisdictions, and classes for this entity.

Note: For the sake of brevity, sometimes the combination of withholding entity, type, class, and jurisdiction are referred as a withholding class combination.

Field or Control |

Description |

|---|---|

Misc. Setup (miscellaneous setup) |

Click to access the Withholding Options page, where you can select options that determine what constitutes the basis for your withholding. |

Min Amt to Rpt (minimum amount to report) |

Enter a minimum withheld amount above which you create reporting information for a supplier. |

Note: When you add a new withholding class for an entity, the system automatically adds the class and account ChartField on the Withholding ChartFields page. The system displays a warning stating that you should verify the information on the procurement control (Procurement Control - Withholding and Withholding ChartFields pages).

When you delete a withholding class for an entity on the Withholding Entity page, the system displays a warning message stating that you must delete the withholding class from the procurement control (Withholding ChartFields page) as well.

Withholding Categories

Use this group box to tie any business unit and supplier categories to your withholding rules. Different combinations of business unit and supplier categories may require different withholding rules.

Entities may categorize your business units differently. For example, in Argentina, one business unit may be considered centralized while another is considered decentralized. Different withholding parameters may be offered for each based on the type of business unit. Likewise, your suppliers may also be categorized differently, depending on whether the suppliers are registered or non-registered. Again, their withholding parameters may vary depending on the type of supplier with which you conduct transactions. The fields in the Withholding Categories group box enable you to capture all of the different possible relationships you may have with your entities and your suppliers, and the resultant withholding percentages, or rules which apply when you transact with them.

Main Information Tab

Field or Control |

Description |

|---|---|

Business Unit Category |

Select the business unit category for this entity, as applicable. |

Supplier Category |

Select the supplier category for this entity, as applicable. |

Create Withholding Payment |

Select if you want to create separate payments for the withholding. Otherwise, withholding is not calculated, although basis amounts are reported. Note: Creating a zero percent withholding rule accomplishes the same result. |

Withholding Rule |

Select the withholding rule to which these categories apply. |

Hold Payment |

Select to hold these payments. The available options are: Hold All: Hold both the payment and the withholding amount. No Hold: Do not hold the payment or withholding amount. Wthd Only (withhold only): Hold the withholding amount only. You can override the option you select here at the supplier level on the Withholding Supplier Information page. Note: If you wish to hold the supplier's payment, you can set the rule at zero percent and set the hold option to Hold All. |

Additional Info Tab

Field or Control |

Description |

|---|---|

Min Basis (minimum basis) |

Indicate the minimum accumulated withholding basis amount below which no withholding will be processed. If the accumulated withholding basis amount during a withholding period (identified by the calendar ID you enter) is less than this amount, the system does not create withholding. Let's say, for example, that you have withholding at 10% and have your minimum basis amount set at 1000 USD. The first voucher you enter is for 700 USD, so no withholding is calculated. The second voucher is for 400 USD. The accumulated total is now 1100 USD, so backup withholding is now calculated at 110 (10% of the accumulated amount) for the second voucher. Note: If you do not specify a calendar ID (or you do not use period based withholding), the current withholding basis amount is used instead of the accumulated total. For example, if the minimum basis is 1000 USD and period based withholding is not used, every voucher whose calculated withhold basis amount is less than 1000 USD will have no withholding. The same rules apply to the minimum withhold amount explained below. Note: The amount you enter here is assumed to be in the currency of the entity to which you report withholding. |

Min Withhold (minimum withhold) |

Indicate the minimum accumulated withholding amount below which no withholding will be processed. If the accumulated withholding amount during a certain period is less than this amount, the system does not create withholding. Let's say, for example, that you have withholding at 10% and your minimum withhold amount set at 1000 USD. The first voucher you enter is for 9000 USD and the system calculates 900 USD for the withholding. 900 is less than 1000, so no withholding is applied to this voucher. The second voucher you enter is for 2000 USD and the system calculates 200 USD for the withholding. Now, the accumulated withholding is 1100 USD (900 + 200). Therefore, withholding will be applied to the second voucher at 1100. Note: With period-based withholdings, it is possible that the withholding can exceed the payment amount. Note: The amount you enter here is assumed to be in the currency of the entity to which you report withholding. |

Appl. 1st Pmnt (apply first payment) |

Select if you want to apply the entire withholding amount to the first payment when the payments are split up into multiple installments. If you do not select this check box, the system treats each payment separately and splits the withholding across the payments. Here's an example of applying the entire withholding amount to the first payment: Withholding is at 10%. Voucher #1 is scheduled to be paid in two equal installments of 500.00 USD each. In this case, the payment of both installments would be as follows:

Note: Whenever you apply this method, you run the risk that the withholding will be greater than the payment amount, in which case the system rejects the transaction by throwing an exception. You then have to increase the size of the first payment manually so that the transaction can be processed. Note: Some tax types specify that the full amount of the withholding (for a given voucher) be paid entirely on the first installment paid to the supplier. |

Calendar SetID and Calendar ID |

Select the SetID and ID of the calendar you want to use if you are using period-based withholding. |

Payment Terms ID |

Specify the payment terms for creating the withholding payment schedule. |

(IND) Cumulative |

For Indian withholding only. |

Use the Withholding Options page (WTHD_FLAGS) to determine what constitutes the basis for your withholding, and specify how to apply the withholding balance.

Navigation:

Click the Misc. Setup (miscellaneous setup) link on the Withholding Entity page.

Wthd Basis Amt Determination (Withholding Basis Amount Determination)

Select the appropriate amount check boxes to apply these amounts to the withholding basis amount.

Field or Control |

Description |

|---|---|

Apply Net |

Applies the merchandise amount to the withholding basis amount. |

Apply Sales Tax |

Applies the sales tax amount to the withholding basis amount. |

Apply Freight |

Applies the freight amount to the withholding basis amount. |

Apply Excise Tax |

Applies excise tax to the withholding basis amount for the TDS withholding amount calculation. |

Apply Misc Chg (apply miscellaneous charges) |

Applies the miscellaneous charge amount to the withholding basis amount. |

Apply Discount |

Applies the discount amount to the withholding basis amount. Note: Withholding is calculated as the payment occurs (or when the voucher is posted, depending on the Apply Withholding option on the Withholding Entity page) and the system calculates withholding when discounts are taken, if the Apply Discount check box is selected. |

Apply VAT |

Applies the VAT amount to the withholding basis amount. |

Apply Withholding Balance To

Field or Control |

Description |

|---|---|

Remit to supplier or Invoicing Supplier |

Select to determine the proper supplier during reporting and also to determine the supplier for whom you accumulate basis amounts and withholdings on period-based withholding. |

Note: Some countries report withholding according to their remit-to suppliers, while other countries report withholding according to the invoicing supplier. On a voucher, the withholding information is always defaulted from the invoice supplier setup; using the remit supplier options is not recommended because you will have to remember to modify the withholding information on a voucher if the remit supplier has a different withholding treatment than the invoice supplier. Also, the invoice supplier determines the withholding applicability of a voucher. This means that both suppliers must be defined as withholding suppliers and have the same classes set up on the Withholding Information page.

Note: Do not use the remit supplier option if you are calculating withholding at voucher posting. Using this option will create unexpected results if you try to change remit suppliers on a voucher after posting.

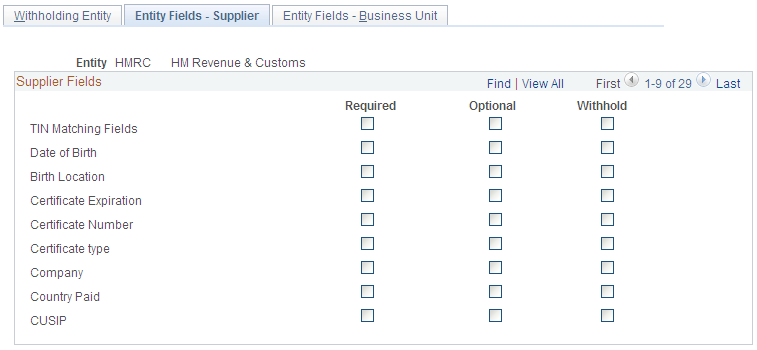

Use the Entity Fields - Supplier page (WTHD_ENTITY_FIELDS) to indicate which information the tax authority (entity) requires for your suppliers.

Navigation:

This example illustrates the fields and controls on the Entity Fields - Supplier page.

For each of the supplier fields listed you can select whether it is Required or Optional when users enter supplier information.

The Withhold field is delivered as a non functional field. You may want to configure it to your particular withholding requirements.

Use the Entity Fields - Business Unit page (BU_WTHD_ENT_FLDS) to indicate which information the tax authority (entity) wants to know about your business units.

Navigation:

There is only one field delivered on this page (for Argentine purposes), but you can add your own fields here if you find information which tax authorities in the countries you do business with may want to know about your business units. Adding new fields requires that you add the field to the BU_WTHD_FLD_SBR and BU_WTHD_JUR page as well as building the WTHD_BU_JUR table.

Note: This information appears on the Procurement Control − Withholding Page for the general ledger business unit.

To access the Withholding Entity request page, use the navigation:

Use the Procurement Control - Withholding page (BU_WTHD_JUR) to set up withholding options at the general ledger business unit level.

Navigation:

Here you define the information for the tax authorities on behalf of whom you withhold. For each combination of withholding entity, type, jurisdiction, and business unit category, you provide a tax ID number and specify whether or not you are a collecting agent for them.

You also define ChartFields for each withholding class for the withholding combination by using the Withholding ChartFields page. This page is accessible from the Procurement Control - Withholding page. For each withholding class, you must specify at least the account ChartField.

When you enter a voucher in PeopleSoft Payables, the system determines for which charges the supplier is withholdable, and also checks to see for whom (which tax authorities/entities) the general ledger business unit is a collection agent. When you post the voucher, the system creates the withholding liability entry using the procurement control ChartField definition for the general ledger business unit.

Use the Withhold Code page (WTHD_CODE) to create withholding codes.

A withholding code represents a set of withholding entity types, jurisdictions, and classes that you want to apply to a voucher at the same time. For example, you may want to apply both a federal and local withholding. In this case, you can define a withholding code to combine the two withholding entities and use this code when you override withholding information at the voucher line level.

Navigation:

The withholding code represents combinations of withholding entities, types, jurisdictions, and classes that you want to apply to a voucher to override the withholding information that defaults from the supplier. You can include multiple withholding class combinations.

You can select the withholding codes that you create here on the Withholding Information page for a voucher. Withholding codes are not used to specify withholding information for suppliers.

To access the Withhold Code request page, use the navigation: