Unposting Individual Vouchers

This section discusses how to unpost vouchers.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VCHR_UNPST1 |

Unpost vouchers. |

|

|

Document Sequence (Unpost) Page |

DOC_SEQ_UNPST_SEC |

Specify document sequencing information for the unposting transaction. |

|

Document Sequence (Repost) Page |

DOC_SEQ_REPST_SEC |

Specify document sequencing information for the voucher reposting transaction. |

|

Voucher Details Page |

VOUCHER_DETAILS |

Confirm that you have selected the correct voucher for unposting, closing, or deletion. View the voucher details, including payment terms, discount information, amount of voucher, and tax information. |

Use the UnPost Voucher page (VCHR_UNPST1) to unpost vouchers.

Navigation:

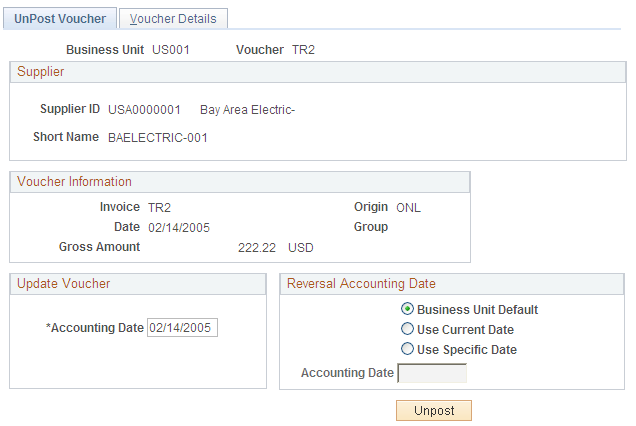

This example illustrates the fields and controls on the UnPost Voucher page. You can find definitions for the fields and controls later on this page.

After a voucher is posted using the Voucher Posting Application Engine process (AP_PSTVCHR), PeopleSoft Payables prevents you from changing distribution line fields by disabling those fields on the online Voucher component (VCHR_EXPRESS). If you must update distribution line information after posting, you must first unpost the voucher.

Unposting a voucher instructs the PeopleSoft Payables system to create reversing entries that undo the effects of the posting. Unposting happens immediately when you save the UnPost Voucher page.

Note: Any unpaid voucher can be unposted. Fully or partially paid vouchers can be unposted only if you select Allow Unpost Paid Vouchers on the Procurement Controls - General Controls page for the related general ledger business unit.

Update Voucher

Field or Control |

Description |

|---|---|

Accounting Date |

Override the accounting date, which defaults from the original voucher. This field is required. |

Reversal Accounting Date

Field or Control |

Description |

|---|---|

Business Unit Default |

Select this option to accept the business unit default as the date of the accounting reversal. The system checks the accounting date indicator on the Payables Options page and uses the specified accounting date. |

Use Current Date |

Select this option to make the current date the date of the accounting reversal. |

Use Specific Date |

Select this option if you want to enter the accounting date to which the reversals will post. |

Document Sequencing Links

The following links appear only if document sequencing is enabled for the business unit.

Field or Control |

Description |

|---|---|

Unpost Document Sequencing |

Click to access the Document Sequence page, where you can specify document sequencing information for the unposting transaction. |

Repost Document Sequencing |

Click to access the Document Sequence page, where you can specify document sequencing information for the reposting transaction. |

Unposting Action

Field or Control |

Description |

|---|---|

Unpost |

Click to start the unposting process. The system issues a message prompting you to confirm the unpost. If you want to continue with the unpost, click OK. Before you unpost the voucher, view voucher details on the Voucher Details page. |

Once you have unposted the voucher, you can update it using the Voucher component or the Voucher Maintenance component and repost it. If the voucher is unpaid, then all voucher fields are available for updating (unless it is a register voucher, in which case only voucher line and distribution lines fields can be updated). However, if the voucher has been paid or partially paid, all fields are completely unavailable for edit.

Note: The unposting process is not integrated with Vertex and Taxware tax functionality, and the process does not call the Vertex or Taxware functionality to recalculate sales and use tax amounts. This means if you have these third party tax applications installed and create a voucher with erroneous tax amounts, you cannot unpost the voucher, correct the tax amounts, and repost the voucher. Instead, you must create a reversal voucher to reverse all the accounting entries in the system, then recreate the voucher with the correct tax amounts.