Entering Employee Contract Pay Settings

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CONTRACT |

(E&G) Define contract pay for an employee. |

|

|

HP_CONTRACT_ACTUAL |

(E&G) Define pay annualization and funding options for contract pay. |

|

|

ChartField Detail Page |

HMCF_HRZNTL_CFLD |

(E&G) Identify the ChartField Combo Codes to use for Paid Not Earned and Earned Not Paid contract pay. |

|

JOB_CNT_CHG_SEC |

(E&G) Choose how to prorate contract pay when there is a change to the contract amount. |

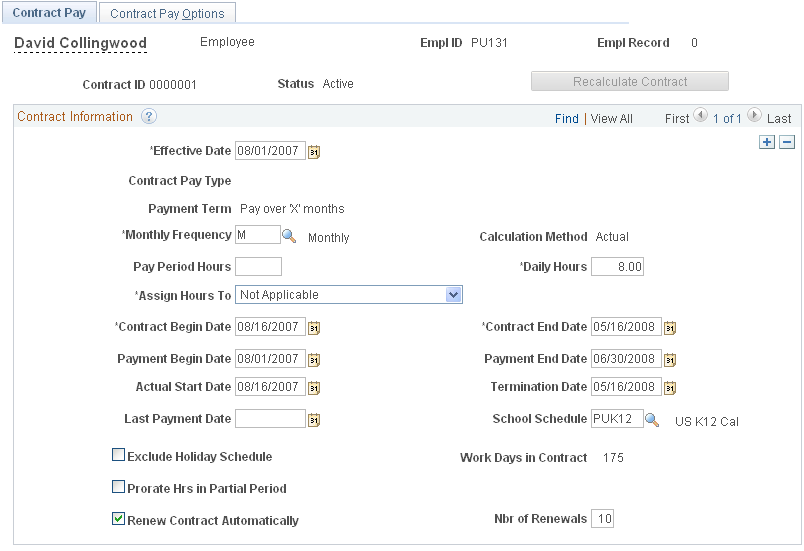

(E&G) Use the Contract Pay page (CONTRACT) to define contract pay for an employee.

Navigation:

This example illustrates the fields and controls on the Contract Pay page.

Field or Control |

Description |

|---|---|

Contract ID |

Displays an automatically-generated number that is unique for the employee and record number. This contract ID is not connected to a contract number from the Update Contracts component. When you renew a contract for another term, create a new contract ID. The system then creates a new set of projections for the new contract ID. When you change the terms of an existing contract (for example, by adjusting the contract begin date if the employee starts late), use a new effective dated row for the current contract ID. The resulting calculation then supersedes the existing calculation, and rolls up any actuals that are associated with the previous effective-date. |

Recalculate Contract |

Select this button to flag the contract for recalculation when you next run the Contract Projected Payment process. This button is unavailable if the system has already flagged the contract for recalculation. The system flags the contract for recalculation when you make certain contract pay changes or job data changes. |

Contract Information

Field or Control |

Description |

|---|---|

Effective Date |

The contract effective date must be within the contract payment term (between the Payment Begin Date and the Payment End Date). |

Contract Pay Type |

Select a contract type to populate the contract with default settings from the selected contract type. Using a contract type helps you enter data quickly and consistently, but it does not force you to accept any of the associated settings; you can override values that come from the contract type. Selecting a contract type overrides existing data on the Contract Pay page. |

Payment Term |

Choose the payment term for the contract. Contract pay is always levelled over the payment term you select. For example, consider a contract for 36,000 USD with a contract term of 9 months. If the payment frequency is monthly and the payment term is the same as the contract, you pay 4,000 USD per month for nine months. If you choose a 12 month payment term, you pay 3,000 USD per month for 12 months. Select from the these payment term options:

|

Monthly Frequency |

Select a monthly payment frequency to be used when calculating the monthly pay rate for the contract. Typically, you select the delivered frequency M (monthly), but you can choose any frequency definition with whose frequency type is Monthly. Note: This is not the employee's pay frequency. Pay frequency is established in the employee's pay group. |

Calculation Method |

Select a method for calculating worked earnings. This information is necessary so that you can properly calculate final pay if the person does not complete the contract. These are the available calculation methods:

See Understanding Contract Earnings, Contract Pay Calculation Examples. |

Pay Period Hours |

If you require hours data for other processes such as leave accruals, enter the number of hours per pay period. When the system loads contract pay to the paysheet, it loads the hours into the payline. |

Daily Hours |

Enter the number of hours worked per day. The system uses this to calculate an hourly pay rate for the contract. |

Assign Hours To |

If you enter pay period hours, use the Assign Hours To field to indicate how to assign hours to contract earnings codes:

|

Contract Begin Date and Contract End Date |

The maximum length for a contract is 12 months. |

Payment Begin Date and Payment End Date |

The payment term must begin on or before the contract begin date and must end on or after the contract end date. Follow these guidelines for defining the begin and end dates for the different types of payment terms:

Note: If an employee has more than one contract, the payment terms can not overlap. |

Actual Start Date |

Enter the date the employee actually starts work. The default is the contract begin date. The usual reason for changing this default is if the employee starts working later than originally contracted. |

Termination Date |

Enter the date the employee terminates the contract, if different from the contract end date. The usual reason for entering a date here is if the employee stops working earlier than originally contracted. |

Last Payment Date |

To set up a balloon payment, enter the date of the payment here. All payments after the last payment date are rolled up and paid on the last payment date. A common use of this option is if you pay contract employees as though they were paid over 12 months, except that the summer pay is paid as a balloon payment at the end of the school year. |

School Schedule |

Select the school schedule to use when calculating actual work days. The schedule lists the school break periods; break days are not counted as work days. |

Exclude Holiday Schedule |

Select this check box to exclude holidays from the count of actual work days in the contract term (that is, if holidays are considered unpaid leave rather than paid leave). |

Work Days in Contract |

Displays the number of work days in the contract term. The system calculates work days based on the employee's work schedule, the school schedule, and the holiday schedule. Holidays counts as work days unless the Exclude Holiday Schedule check box is selected. |

Prorate Hrs in Partial Period (prorate hours in partial period) |

If you enter pay period hours so that hours can be loaded to paysheets, you can select this check box to prorate the pay period hours during partial periods. If you allocate hours to contract earnings, partial periods occur when the contract term begins or ends in the middle of the pay period. If you allocate hours to all earnings (contract regular, paid not earned, and earned no paid), partial periods occur when the payment term begins or ends in the middle of the pay period. The proration calculation depends on the calculation method you are using:

|

Renew Contract Automatically |

Select to allow the Contracts Renewal process to renew this contract. |

Nbr of Renewals (number of renewals) |

Enter the maximum number of automatic renewals for the contract. If the contract can be renewed indefinitely, enter 99. |

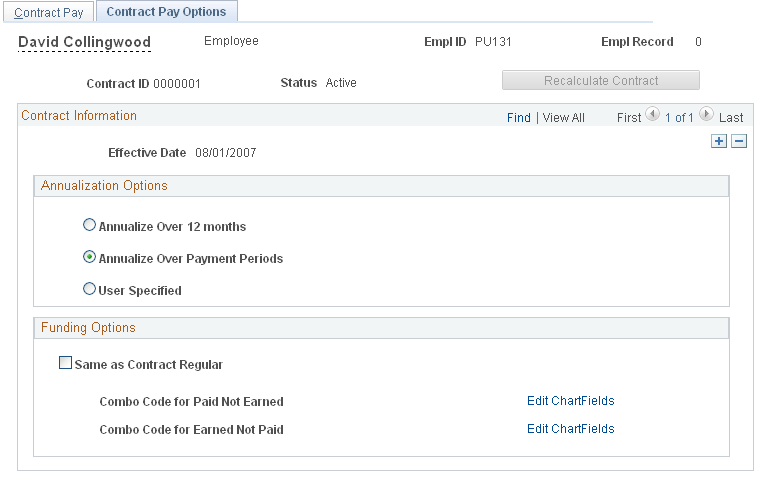

(E&G) Use the Contract Pay Options page (HP_CONTRACT_ACTUAL) to define pay annualization and funding options for contract pay.

Navigation:

This example illustrates the fields and controls on the Contract Pay Options page.

Annualization Options

Select an annualization option for taxable gross and for imputed income calculations for contract pay employees who are paid over less than a full year.

Field or Control |

Description |

|---|---|

Annualize Over 12 Months, |

The earnings are annualized over 12 months, regardless of the length of the payment term. |

Annualize Over Payment Periods |

The earnings are annualized over the number of pay periods in the payment term. |

User Specified and Annualization Factor |

The system uses the annualization factor that you enter. |

Funding Options

Field or Control |

Description |

|---|---|

Same as Contract Regular |

Select this check box to use the contract regular earnings funding source for the Paid Not Earned and Earned Not Paid earnings as well. When you select this check box, the system hides the other page elements in this group box. |

Combo Code for Paid Not Earned and Combo Code for Earned Not Paid |

If the Same as Contract Regular check box is not selected, these fields show the Combo Codes that you use for Paid Not Earned and Earned Not Paid earnings. |

Edit ChartFields |

Select to access the ChartField Detail page, where you select Combo Codes for Paid Not Earned and Earned Not Paid earnings. |

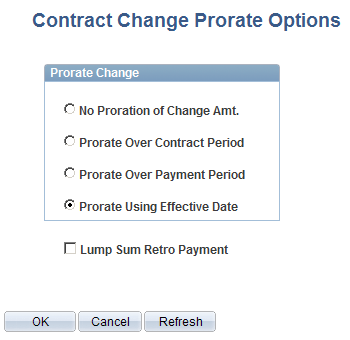

(E&G) Use the Contract Change Prorate Options page (JOB_CNT_CHG_SEC) to choose how to prorate contract pay when there is a change to the contract amount.

Navigation:

Select the Contract Change Prorate Option link on the Compensation page.

This example illustrates the fields and controls on the Contract Change Prorate Options page.

When an employee's contract pay changes, the settings on this page control how the new pay rate is to be applied.

Field or Control |

Description |

|---|---|

No Proration of Change Amt. (no proration of change amount) |

Select if you do not want to prorate the change; the person receives the entire amount of the increase. For example, if a contract amount increases by 4,000 USD, the employee receives all 4,000 USD, regardless of the effective date of the increase. |

Prorate Over Contract Period |

Select to prorate the change over the number of pay periods in the contract term (determined by the contract start and end dates). For example, if the contract term is ten months, and the contract amount increases by 4,000 USD after five months (with five months remaining in the contract term), the employee receives half of the increase, or 2,000 USD more than the original contract amount. |

Prorate Over Payment Period |

Select to prorate the change over the payment term (determined by the payment start and end dates). For example, if the contract term is ten months, the payment term is twelve months, and the contract and payment terms start at the same time, and the contract amount increases by 4,000 USD after five months (with seven months remaining in the payment term), the employee receives 7/12 of the increase, or 2,333.33 USD more than the original contract amount. |

Prorate Using Effective Date |

Note: This option is only applicable if the calculation method is Actual. Select to prorate the compensation change over the number of work days in the contract term. For example, if the contract term includes 150 work days, and the contract amount increases by 3,000 USD effective the 51st day (so the change is effective for 100 days), the employee receives two thirds of the increase, or 1,000 USD more than the original contract amount. |

Select Lump Sum Retro Payment (lump sum retroactive payment) |

Choose whether to issue a lump sum retro payment for salary increases. The amount of the increase is determined by the proration option that you choose; this check box controls only whether the increase is paid over the remainder of the payment term or whether it is allocated across all months in the payment term, with retro pay for completed months.

Regardless of whether the increase is allocated to the entire payment term or only the remaining pay periods, the exact amount allocated to each pay period depends whether your contract pay calculation method is Prorate, which in our example would mean that 1/12 of the increase is paid each month, or Actual, which allocates the amount based on the number of work days in each month. Note: This setting is relevant only for salary increases, not for reductions in salary. |