Contract Pay Calculation Examples

This topic provides examples showing worked earnings, contract regular earnings, PNE earnings, and ENP earnings in various scenarios. All examples use a monthly pay frequency.

Note: In these examples, the contract regular (CRG) earnings shown have not yet been reduced by the amount of holiday pay.

In this example, the payment term begins before the contract term, and the payment term ends after the contract term.

Contract Settings

This table lists the parameters that determine the daily pay rate in this example:

|

Parameter |

Value |

|---|---|

|

Contract Salary |

60,000 |

|

Work Days |

147 |

|

Paid Holidays |

25 |

|

Total Paid Days (work days + paid holidays) |

172 |

|

Daily Pay Rate (contract salary / total paid days) |

348.83721 per day |

This table lists the parameters that determine the pay period rates in this example:

|

Parameter |

Contract Term |

Payment Term |

|---|---|---|

|

Dates |

September 1 to April 30 |

July 1 to June 30 |

|

Number of monthly pay periods |

8 |

12 |

|

Pay Period Rates |

Contract regular earnings (not adjusted for holidays) 60,000 over 8 months = 7,500 per month |

Amount paid: 60,000 over 12 months = 5,000 per month |

Prorate Method

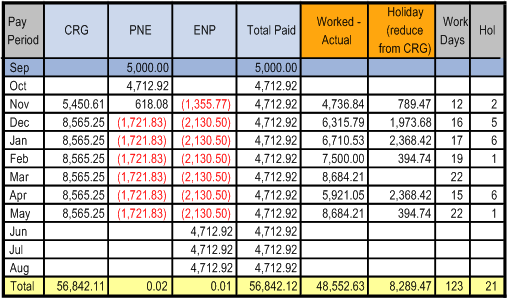

In the following table, worked earnings are calculated using the Prorate (pay period rate) method.

This diagram shows worked earnings calculations using the per period rate Prorate method.

Actual Method

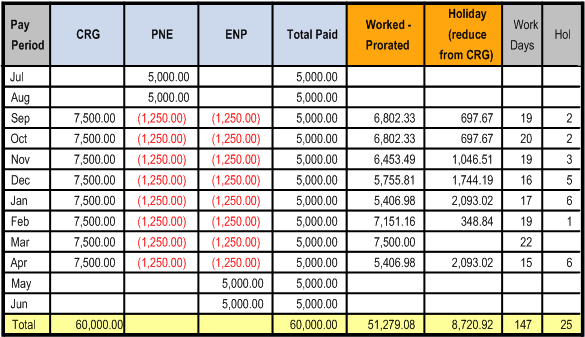

In the following table, worked earnings are calculated using the Actual (daily rate) method:

This diagram shows worked earnings calculations using the daily rate Actual method.

In this example, payments begin on September 1 for a contract term that starts on November 1. On October 1, the contract begin date changes to November 13.

Original Contract Settings

This table lists the parameters that determine the daily pay rate in this example:

|

Parameter |

Value |

|---|---|

|

Original Contract Salary |

60,000 |

|

Work Days |

130 |

|

Paid Holidays |

22 |

|

Total Paid Days (work days + paid holidays) |

152 |

|

Daily Pay Rate (contract salary / total paid days) |

394.73684 |

These are the parameters that determine the pay period rates in this example:

|

Original Settings |

Original Contract Term |

Original Payment Term |

|---|---|---|

|

Dates |

November 1 – May 31 |

September 1 – August 31 |

|

Number of monthly pay periods |

7 |

12 |

|

Pay Period Rates |

Contract regular earnings (not adjusted for holidays) 60,000 over 7 months = 8,571.42857 per month Note: This will be adjusted before the contract term begins. |

Amount paid: 60,000 over 12 months = 5,000 per month |

Prorate Method for Adjusting Contract and Calculating Worked Earnings

The system performs these recalculations because of the late start.

Term |

Definition |

|---|---|

New Value of Contract |

56,883.12 Starting November 13 instead of November 1 means that the employee is working only 14 of the 22 work days in November. (The two holidays are paid holidays and count as work days.) The original monthly value of the contract (60,000 / 7) is multiplied by the new number of months (6 + 14/22) for a new total contract value of 56,883.12. |

New Monthly Payments |

4,716.65 The contract change is entered on October 1, at which point there are 11 pay periods left in the contract. The new contract value is 56,883.12, but 5,000 was already paid in September, so 51,883.12 remains to be paid over the 11 remaining pay periods. The new level payment amount is 4,716.65. |

New Monthly CRG |

8571.43 The contract is now for 6 + 14/22 months. The new contract value of 56,883.12 is divided by (6 + 12/22), for a new monthly CRG of 8,571.43. Note: This is also the worked earnings per pay period. |

November CRG, PNE, and ENP |

|

December through May CRG, PNE, and ENP |

|

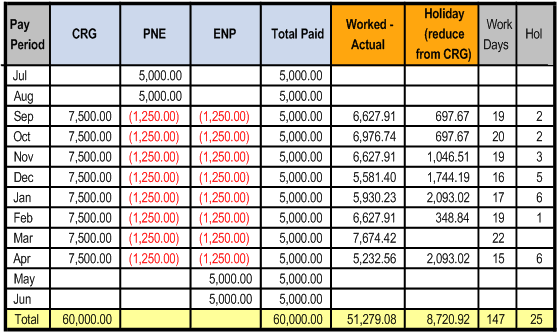

The following table shows the recalculated contract pay projections with worked earnings calculated using the Prorate method. The total worked earnings for each pay period is the sum of the Worked - Prorate earnings and the Holiday earnings. Because CRG shown in this table hasn't been reduced for holiday pay, the CRG also represents the worked earnings.

This diagram shows recalculated contract pay projections with worked earnings calculated using the daily rate Prorate method.

Actual Method for Adjusting Contract and Calculating Worked Earnings

The system performs these recalculations because of the last start.

Term |

Definition |

|---|---|

New Value of Contract |

56,842.11 From November 1 – 12, the there were eight work days. Therefore, the value of the contract worth is reduced by eight times the daily rate for the contract: 60,000 – (394.73684 * 8) = 56,842.11. |

New Monthly Payments |

4,712.92 The contract change is entered on October 1, at which point there are 11 pay periods left in the contract. The new contract value is 56,842.11, but 5,000 was already paid in September, so 51,842.11 remains to be paid over the 11 remaining pay periods. The new level payment amount is 4,712.92 |

New Monthly CRG |

8,565.24 The contract is now for 6 + 14/22 months. The new contract value of 56,842.11 is divided by (6 + 12/22), for a new monthly CRG of 8,565.24 |

November CRG, PNE, and ENP |

|

December through May CRG, PNE, and ENP |

|

Worked Earnings per Pay Period |

The daily rate for the contract is unchanged, so the worked earnings per pay period are reduced for November, when the employee worked fewer days than the original contract called for, but are the same for all other months. |

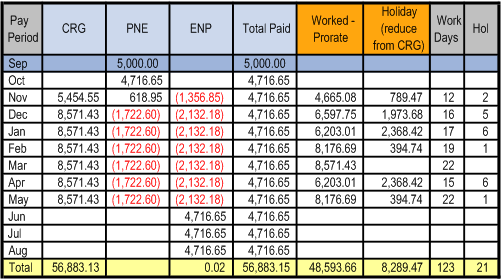

The following table shows the recalculated contract pay projections with worked earnings calculated using the Actual method. The total worked earnings for each pay period is the sum of the Worked - Actual earnings and the Holiday earnings.

This diagram shows recalculated contract pay projections with worked earnings calculated using the daily rate Actual method.