Generating End of Year Returns

This topic discusses how to generate the End of Year Returns process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_RNCTL_EOYR |

Run the GP UK End of Year Returns process. |

At the end of every tax year, employers submit certain information to HMRC about their employees, including details of National Insurance Contributions, pay, and income tax.

This information is submitted in hard copy, using P14 and P35 schedules, or electronically. Global Payroll for the UK supports two options for generating year end returns:

P14 and P35 reports.

GP UK End of Year Returns process.

This process generates an output file that you copy to magnetic media (flexible diskette, open reel tape, or data cartridge) and submit to the HMRC.

Note: The GP UK End of Year Returns process produces an output file that conforms to the HMRC formatting requirements.

Before you run the GP UK End of Year Returns process, you must:

Finalize your payroll data for the tax year.

Do not create the year end returns until you have run and finalized the last payroll for the tax year.

Obtain a magnetic media permit number from HMRC for each pay entity.

Permit numbers are detailed in the HMRC guidelines.

Warning! You should understand the HMRC's technical requirements and process for year end submission before you run PeopleSoft's year end return process, or submit the output to HMRC.

See HM Revenue and Customs Technical Guide "Submitting Year End Returns on Magnetic Media" – Reference CA51/52

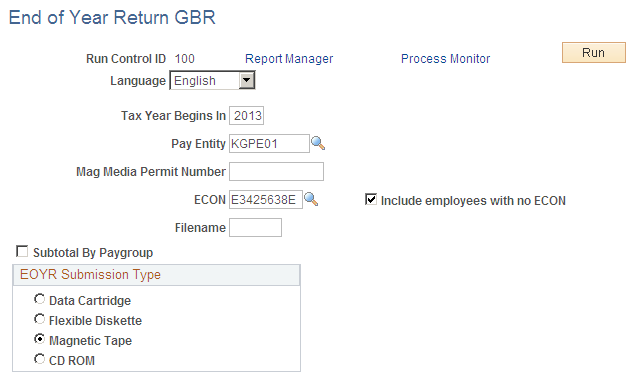

Use the End of Year Return GBR page (GPGB_RNCTL_EOYR) to run the GP UK End of Year Returns process.

Navigation:

This example illustrates the fields and controls on the End of Year Return GBR page.

Field or Control |

Description |

|---|---|

Tax Year Begins In |

Enter the year for the start of the tax year. |

Pay Entity |

Select the pay entity for which you want to create the year end return. Note: Pay entity tax details must exist for the pay entity before you can run the process. Use the Pay Entity Details page to define this information. |

Mag Media Permit Number (magnetic media permit number) |

Enter the permit number for the tax year you're processing. HMRC issues employers with a new permit number for each tax year. |

ECON (employer contracted out number) and Include employees with no ECON |

Select an ECON. The process selects employees in the pay entity with the ECON that you specify here. Select the Include employees with no ECON check box if you want the process to include any employees in the pay entity who do not have an ECON identified at employee level. |

Filename |

Enter the name of the output file. Refer to the HMRC guidelines for file naming conventions. |

Subtotal By Paygroup |

Select this check box if you want the output file to include a subtotal record for each pay group. |

EOYR Submission Type |

Select the media you're using to submit the end of year return. |

See HM Revenue and Customs Technical Guide "Submitting Year End Returns on Magnetic Media" – Reference CA51/52

Once you have successfully run the GP UK End of Year Returns process, you need to:

Prepare your magnetic media.

The HMRC guidelines specify the types of media accepted and the format of information for each media type.

Copy the file generated by the GP UK End of Year Returns process to the prepared media.

The process creates an output file in the %PS_SERVDIR%\files directory on the machine where your Process Scheduler runs.

Note: As of the tax year 2004/05, HMRC requires all medium and large employers to submit end of year returns using EDI or the internet. Employers who submit magnetic media submissions will be liable to fines imposed by HMRC.

See HM Revenue and Customs Technical Guide "Submitting Year End Returns on Magnetic Media" – Reference CA51/52