Running Statutory Reports

This topic discusses how to run statutory reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_GPSQR_PNL |

Run these reports:

|

|

|

GPGB_RC_P46C |

Run the P46(Car) report (GPGBP46C). This report is submitted to HM Revenue and Customs (HMRC) every quarter for employees with a company car. The report extracts information from both PeopleSoft HCM and Global Payroll for the UK tables:

|

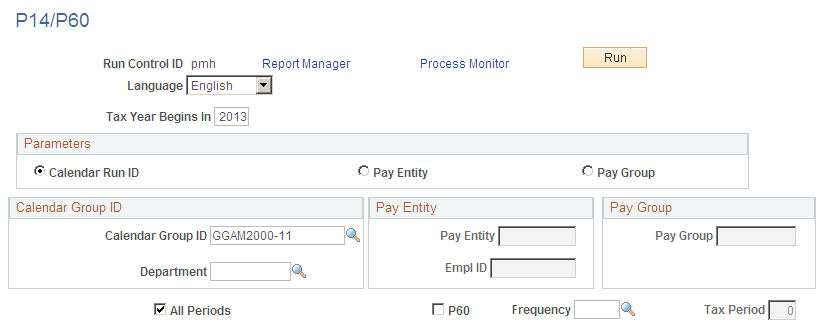

Use the P11A, P11B, P11C, P14/P60, P32, or P35 page (GPGB_GPSQR_PNL) to run the GBR P11, P14/P60, P32, and P35 reports respectively.

Navigation:

This example illustrates the fields and controls on the P14/P60 page, which is one example of P11A, P11B, P11C, P14/P60, P32, and P35 pages.

Note: The title of the page changes based on the GBR report — P11, P14/P60, P32, or P35—that you select from the Absence and Payroll Processing, Reports menu. The fields and controls are the same for each report except that the page for P14/P60 has an extra check box.

Field or Control |

Description |

|---|---|

P60 |

Select this check box to run the P60 report. |

Use the P46(Car) GBR page (GPGB_RC_P46C) to run the P46(Car) report (GPGBP46C).

This report is submitted to HM Revenue and Customs (HMRC) every quarter for employees with a company car. The report extracts information from both PeopleSoft HCM and Global Payroll for the UK tables:

Navigation:

This example illustrates the fields and controls on the P46(Car) GBR page.

Field or Control |

Description |

|---|---|

Pay Entity |

Select the pay entity for which you want to run the report. The system generates a report for each employee in the pay entity who has a company car or has withdrawn from the company car scheme during the quarter. Note: Make sure that you complete the Pay Entity Details page for the pay entity. The P46(Car) report uses the employer information from the Pay Entity Details page. |

Quarter Start/End Date |

Enter the start and end date for the quarter. |