Defining Pay Entity Details

To define pay entity details, use the Pay Entity Details GBR component (GPGB_PYENT). This topic discusses how to set up pay entity details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_PYENT |

Define pay entity information required by HMRC. |

Use the Pay Entity Details GBR page (GPGB_PYENT) to define pay entity information required by HMRC.

Navigation:

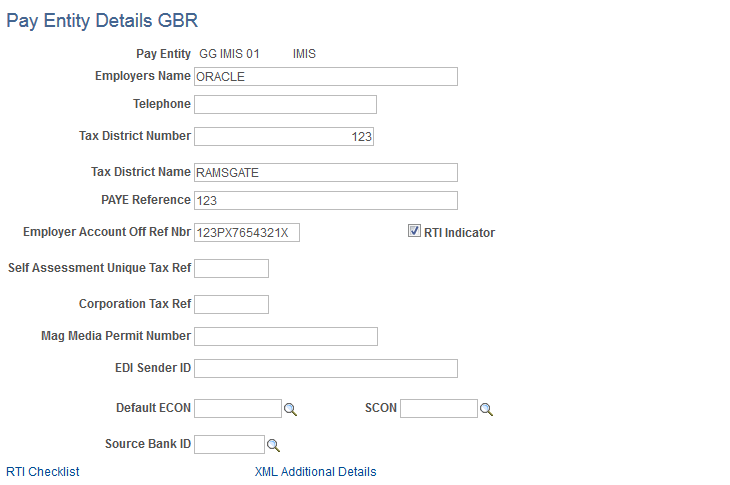

This example illustrates the fields and controls on the Pay Entity Details GBR page (1 of 3).

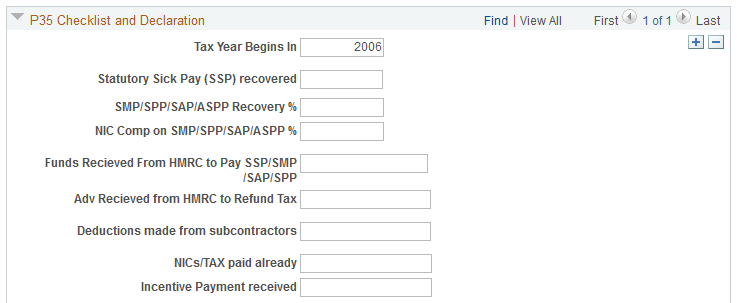

This example illustrates the fields and controls on the Pay Entity Details GBR page (2 of 3).

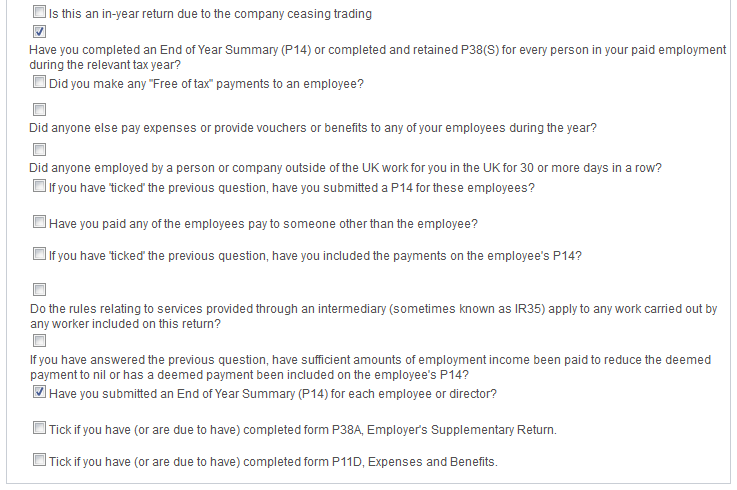

This example illustrates the fields and controls on the Pay Entity Details GBR page (3 of 3).

Field or Control |

Description |

|---|---|

Employers Name |

Enter the name of your organization. |

Tax District Number |

Enter the number of the tax district that deals with the pay entity's tax records. |

Tax District Name |

Enter the name of the tax district. |

PAYE Reference |

Enter the HMRC's reference number for your PAYE scheme. |

RTI Indicator |

Select this checkbox to set the RTI Indicator. |

Self Assessment Unique Tax Ref |

This field is optional and should only be used when the employer is a sole proprietor. Leave this field blank if a Corporation Tax Reference has been entered. |

Corporation Tax Ref |

This field is optional and should be used only when the employer is a limited company. Leave this field blank if a Self Assessment Unique Tax Reference has been entered. |

Mag Media Permit Number |

Enter your permit number for the tax year you're processing. HMRC issues employers with a new permit number for each tax year. |

EDI Sender ID |

Enter the pay entity's EDI sender ID. |

Default ECON (default employer contracted out number) |

Select an ECON for the pay entity. The system displays active ECONs only. |

RTI Checklist |

Click this link to open the Pay Entity Details for RTI page (GPGB_PYENT_RTI). |

XML Additional Details |

Click the XML Additional Details link to open the RTI XML Authentication Page. For more information, see Pay Entity Details GBR Page in RTI Set Up. |

P35 Checklist and Declaration

Update these fields for each reportable tax year. The information is used by the End of Year P35 reporting process and P14 if NIC holidays have been claimed.

Field or Control |

Description |

|---|---|

Tax Year Begins In |

Enter the year in which the tax year starts. |

Deductions made from subcontractors |

Enter the amount of deductions made from subcontractors during the tax year. |

SMP/SPP/SAP Recovery % |

Enter the rate at which statutory maternity pay (SMP), statutory paternity pay (SPP), and statutory adoption pay (SAP) can be recovered. This can be a partial or full recovery according to the employers annual liability for NI. Typically this is 92% for large employers and 100% for small employers. |

NIC Comp on SMP/SPP/SAP % (National Insurance compensation on SMP/SPP/SAP percentage) |

Enter the rate of NIC Compensation that applies to SMP, SPP and SAP payments. Typically this is 0% for large employers and 4.5% for small employers. |

Total NIC Holiday, Funding received from Inland Revenue to pay SSP/SMP/SPP/SAP, Advance received from Inland Revenue to refund tax, Deductions made from subcontractors, Funding received from Inland Revenue to pay tax credits, and NICs/TAX already paid |

Enter the amounts, including pounds and pence, that are applicable for the tax year. These fields relate to Part 2 (Summary) of the P35. |

Select the check boxes that apply for the tax year. These fields relate to Part 3 (Checklist) and Part 5 (Employer's Certificate and Declaration) of the P35.