Managing Invoices

Use the Manage Invoice page to create new invoices manually, review existing invoices, edit invoices, view statuses of invoices, cancel invoices, or submit selected invoices for approval. The Manage Invoice page is the central location and starting point for maintaining invoices. Use the search and sort features to streamline the search results. After you enter search criteria, access the roster area, where you can view invoice details, edit the invoice, submit invoices, or cancel invoices.

Note: This page displays invoices created by the sign-in user. Invoices generated by other users do not appear in this roster.

This topic discusses how to manage invoices.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SPF_INV_MANAGE |

Add invoices, search existing invoices, submit invoices, or cancel invoices. The values for the From Date and Date To fields are by default the last 30 days. You may need to change the date fields to see previous invoices. |

|

|

SPF_INV_HDR_ADD |

Create invoice header information. |

|

|

SPF_INV_TE_DTLS |

View all noninvoiced time sheets, progress logs, and expenses for the supplier or service provider. |

|

|

SPF_INV_LN_DTLS |

Modify the selected invoice. |

|

|

Invoice Process Detail Page |

SPF_INV_PROCES_DTL |

View invoice details. |

|

Invoice To Address Page |

SPF_ADDRESS |

View the invoice to address. |

|

Remit To Address Page |

SPF_ADDRESS |

View the remit to address. |

|

Currency Information Page |

EXCH_RT_DTL_INQ |

View multicurrency information. |

|

Work Order Details Page |

SPF_WORDER_DETAIL |

View details of the work order that is related to the invoice. |

|

SPF_INV_TIME_DTL |

View invoice line details, make adjustments, or both. |

|

|

Manage Invoices - Line Detail Page |

SPF_INV_PLOG_DTL |

View invoice line details, make adjustments, or both. |

|

Purchase Order Inquiry - Purchase Order Page |

PO_LINE_INQ |

View details of the purchase order that is related to the invoice. |

|

SPA_TIME_APPROVE |

View time reports. |

|

|

SPA_SHEET_LINES2 |

View expense reports. |

|

|

SPA_PLOG_LINES |

View progress log reports. |

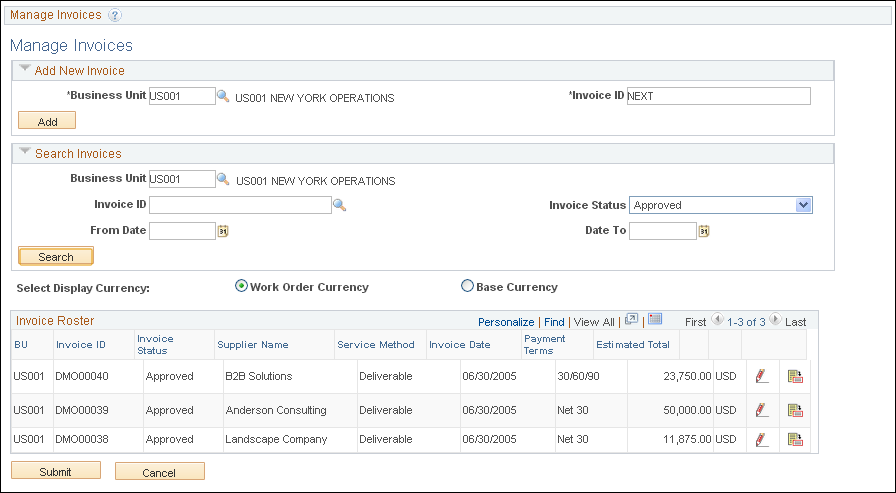

Use the Manage Invoices page (SPF_INV_MANAGE) to add invoices, search existing invoices, submit invoices, or cancel invoices.

Navigation:

This example illustrates the fields and controls on the Manage Invoices page. You can find definitions for the fields and controls later on this page.

You can access this page when you sign in as the PeopleSoft Services Procurement invoice manager.

Search Invoices

Enter search criteria to use to retrieve, edit, and view invoices.

Select Currency

Displays amounts in either base or work-order currency. The Select Currency field is available only if Allow Multicurrency is selected on the Services Procurement business unit page.

See Setting Up Business Unit Definitions.

Note: Invoices are generated in both base and work-order currency.

Invoice Roster

Field or Control |

Description |

|---|---|

Estimated Total |

Displays the estimated total, including expenses and estimated prorated tax. Note: The sales and use tax (SUT) included in the estimated total includes only the sales tax. The use tax is displayed as a separate line item on the Invoice Detail page. |

|

Click the Edit icon to access the Manage Invoice Line Summary page, where you can review and edit invoice lines. |

|

Click the View Entry icon to access the Invoice Process Detail page, where you can review invoice processing information. |

Submit |

Click to submit selected invoices for approval. |

Cancel |

Click to cancel selected invoices. Canceling invoices releases the time sheet, progress log, or expense associated with that invoice so that it can be invoiced again. |

Note: You can adjust invoices by adjusting the associated time sheets, progress logs, or expense amounts. If the adjusted time sheet, progress log, or expense is included in an invoice, the status of the invoice line associated with the adjustment is changed to Canceled and the invoice header status is changed to Adjusted. You can also adjust invoices after the invoice has been generated by adjusting the amounts on the Manage Invoice Line Detail page. Adjusting invoices in this manner does not change existing time sheets, progress logs, or expenses. Adjustments can be made prior to invoices being approved by either the supplier invoice approver or the enterprise invoice approver.

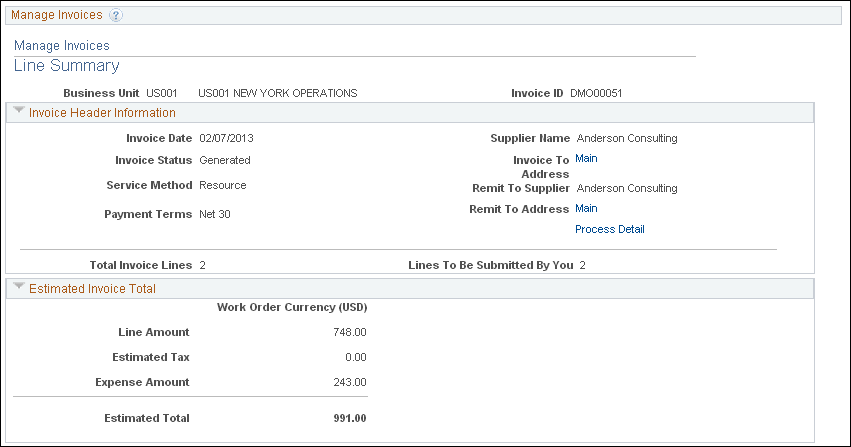

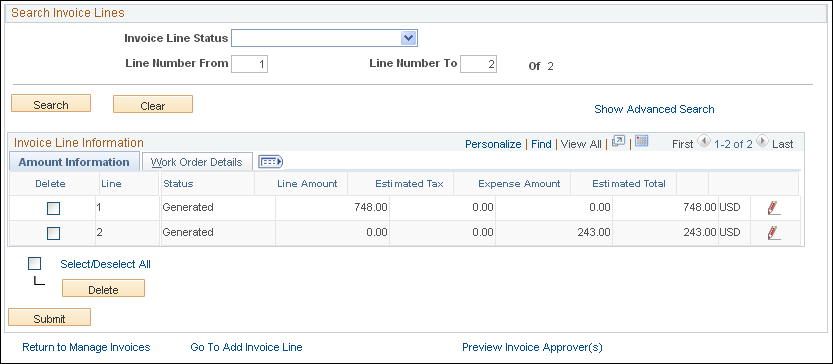

Use the Manage Invoices - Line Summary page (SPF_INV_LN_DTLS) to modify the selected invoice.

Navigation:

Click the Edit button for an invoice on the Manage Invoices page.

This example illustrates the fields and controls on the Manage Invoice - Line Summary page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Manage Invoice - Line Summary page (2 of 2). You can find definitions for the fields and controls later on this page.

The data appearing in the Invoice Header Information and Estimated Invoice Total sections depends on whether the invoice is for VMS services.

Field or Control |

Description |

|---|---|

Business Unit |

Displays the business unit associated with the invoice. |

Invoice ID |

Displays the number automatically or manually assigned to the invoice when it is created. |

Invoice Header Information

Field or Control |

Description |

|---|---|

Invoice Date |

Displays the creation date of the invoice. |

Invoice Status |

Displays the current status of the invoice. Values are:

|

Payment Terms |

Displays the payment terms assigned to the invoice. |

Supplier |

Displays the end supplier who performed the service. This option appears only in the Invoice Header Information section when invoices are not VMS-managed. The supplier appears at the line level when invoices are VMS-managed. |

VMS Suppler |

Displays the VMS supplier that manages the work orders for time and progress invoices. This option appears only in the Invoice Header Information section for VMS invoices. |

Estimated Invoice Total

Field or Control |

Description |

|---|---|

Line Amount |

Displays the total invoice amount in base or work-order currency. Any assignment pay based on time is included with the base pay in the line amount. Any assignment pay based on number of incidents is displayed in the Time/Expense Details group box, and is not included in the line amount. |

Estimated Tax |

Displays the total estimated tax for the invoice. |

Expense Amount |

Displays the total expense amount in base or work-order currency. |

Estimated Total |

Displays the estimated total for the invoice. |

VMS Fee |

Displays the amount paid to the VMS suppler for managing the service. The data appearing in the Invoice Line Information grid depends on the selected service method and whether the invoice is for VMS services. Select the Base Currency or Work Order Currency option to display amounts. View the estimated tax and estimated total amount for the invoice. Note: This option appears and is included only in the Estimated Invoice Total for VMS invoices. |

MSP Fee |

Displays the amount paid to the MSP supplier for managing the service. Note: This option appears and is included in the estimated invoice total only if MSP is installed and the supplier is an internal supplier. External suppliers can view MSP fees; however, the fee is not included in the estimated total. |

Invoice Line Information: Amount Information

Select the Amount Information tab.

Field or Control |

Description |

|---|---|

|

Click the Line Details icon to access the line details. |

Invoice Line Information: Work Order Details

Select the Work Order Details tab.

Field or Control |

Description |

|---|---|

Work Order |

Links to the related work order for viewing more details. If the work order is for a multi-resource service, the individual child work order is listed here. The related parent work order appears in the Parent Work Order field. |

Parent Work Order |

Links to the parent work order for multi-resource work orders. |

Supplier |

Displays the end supplier who performed the service. This option appears only for VMS invoices. |

Provider Contact |

Displays the provider contact for the work order. |

Time Sheet ID |

Displays the time sheet for the invoice line and has a value only for time sheet lines. |

Expense Sheet ID |

Displays the expense sheet for the invoice line and has a value for expense lines. |

Progress Log ID |

Displays the progress log for the invoice line. Appears only for deliverable invoices and has a value only for progress lines. |

Activity |

Displays the activity for the invoice line. This option appears only for deliverable invoices. Note: For deliverables-based requisitions, the rate-based activity is displayed in the Invoice Line Information region. |

Submit |

Click to submit the eligible invoice lines for approval. Note: Until all lines have been submitted for approval, the invoice header status remains Generated. |

Delete |

Click to remove the selected line from the invoice. Deleting the invoice line releases the time sheet, progress log, or expense associated with that invoice so that it can be invoiced again. |

Field or Control |

Description |

|---|---|

View Invoice Approver(s) |

Click to view a graphical map of the approval workflow. The link is available prior to submission of the invoice for approval, to preview the approvers to whom it will be routed. Invoice lines for approval are displayed in chunks depending on the value set in the Invoice Approval Monitor field in the Services Procurement Installation Options page. If the Enable Approval Chunking check box in the Services Procurement Installation Options page is selected and the Invoice Approval Monitor value is set to, for example 3, then the invoice lines are displayed in chunks of 3. Enter a value (as per the range set in Invoice Approval Monitor) and then click Retrieve to display the next chunk of invoice lines. |

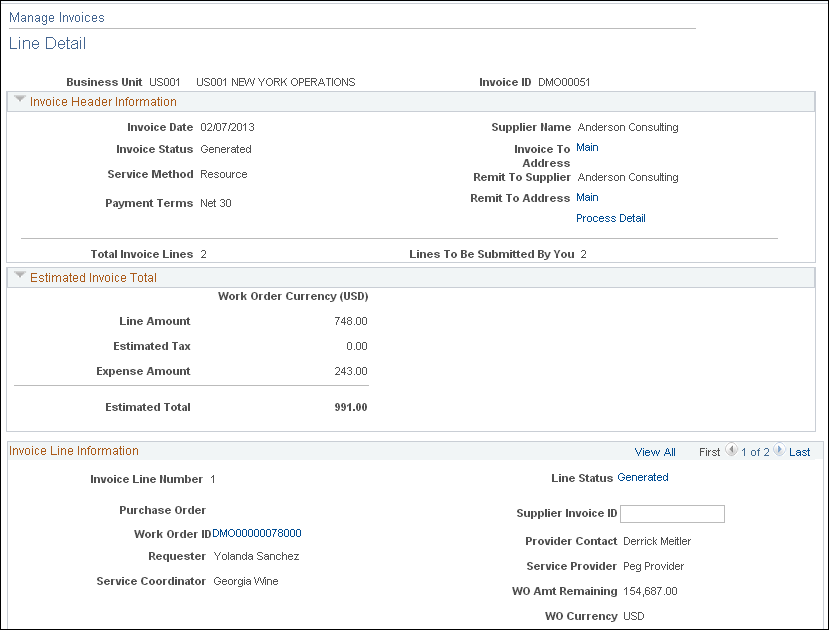

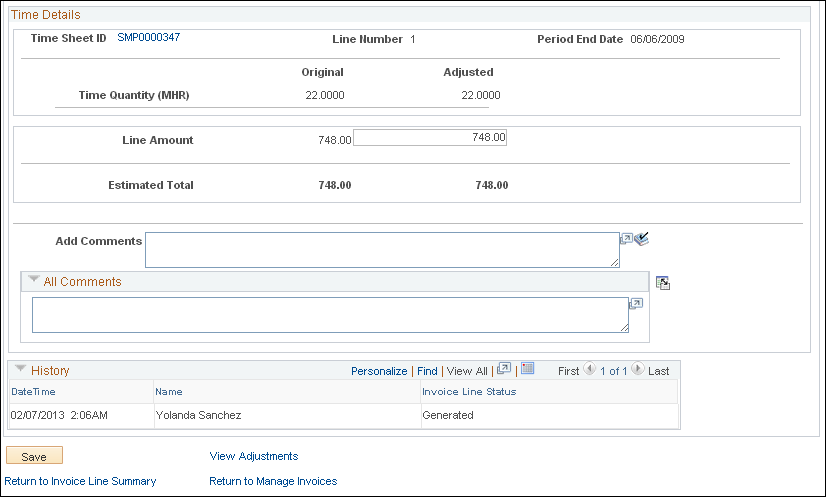

Use the Manage Invoices - Line Detail page (SPF_INV_TIME_DTL) to view invoice line details, make adjustments, or both.

Navigation:

For resource-based invoices, click the Edit button on the Manage Invoices - Line Summary page.

This example illustrates the fields and controls on the Manage Invoices - Line Detail page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Manage Invoices - Line Detail page (2 of 2). You can find definitions for the fields and controls later on this page.

The information appearing on this page depends on the selected service method. Click the View Adjustments link to access details about the adjustments that have been made to an invoice line.

For multi-resource work orders, this page displays only the header work order ID in the invoice line information section. You can click the Parent Work Order ID link to access the work order header page. Click the Work Order ID link to access the lower-level service associated to the work order for an invoice line.

Invoice Line Information

Field or Control |

Description |

|---|---|

Invoice Line Number |

Displays the number automatically assigned to the invoice line when it is created. Allows adjustments to the progress log line amount. |

Line Status |

Displays the current status of the invoice line. Values are:

|

Purchase Order |

Click to view the purchase order assigned to the work order associated with the services included on the invoice line. Note: The button is available only if the PO Work Order Integration (purchase order work order integration) check box is selected on the Services Procurement Installation Options page. |

Supplier Invoice ID |

Enter the supplier's invoice ID for each invoice line. This field is for reference only in the event that the supplier uses a different invoice ID. |

Work Order ID |

Click to view the work order associated with the services included on the invoice line. |

Provider Contact |

Displays the provider contact assigned to the work order associated with the services included on the invoice line. |

Requester |

Displays the requester assigned to the work order associated with the services included on the invoice line. |

WO Amount Remaining (work order amount remaining) |

Displays the amount still available for the work order. This amount is updated when invoices are approved. This field does not appear for multi-resource work orders. |

Service Provider |

Displays the name of the individual service provider associated with the services included on the invoice line. Note: This value displays for resource-based engagements only. |

Time/Expense Details - Resource-Based Invoices

Adjustments can be made after the invoice has been generated and not yet approved. Once approved, invoices cannot be adjusted.

Field or Control |

Description |

|---|---|

Timesheet ID or Expense Sheet ID |

Displays the time sheet or expense associated with the invoice line. Click to view the time sheet or expense details. |

Period End Date |

Displays the period end date of the time sheet associated with the invoice line. |

VAT Applicability (value-added tax applicability) |

Indicates whether value-added tax (VAT) applies to this invoice. If VAT Applicability is Taxable, the system displays the VAT percentage and VAT amount information. |

SUT Applicability (sales tax or use tax applicability) |

Indicates whether sales tax or use tax (SUT) applies to this invoice. If SUT Applicability is Sales Tax or Direct Pay/Sales Tax, then the Sale Tax % and Sales Tax Amount fields appear. If the value is Use Tax, then the system displays the use tax percentage and the use tax amounts. Note: Use tax is not included in the invoice total and is displayed for informational purposes only. Suppliers can view only the sales tax, not the use tax. |

Original/Adjusted Time Quantity |

Displays the original and adjusted time quantity for resource-based invoices. No manual adjustments are allowed for this field. |

Original/Adjusted Line Amount |

Displays the amounts based on the original and adjusted time quantity. You can adjust the line amount in the work order currency and the system automatically converts to base currency if the multicurrency option applies. |

Original/Adjusted MSP Fee (original/adjusted managed services provider fee) |

Displays the MSP fee. This option appears and is included in the estimated invoice total only if MSP is installed and the supplier is an internal supplier. External suppliers will have the MSP fee shown, but not included in the estimated invoice total. No manual adjustments are allowed for this field, but any adjustments made to the line amount recalculates the adjusted MSP fee. |

Original/Adjusted VMS Fee (original/adjusted supplier-managed service fee) |

Displays the VMS fee. This option appears only for VMS invoices. No manual adjustments are allowed for this field, but any adjustments made to the line amount recalculates the adjusted VMS fee. |

Original/Adjusted Expenses |

Displays the original and adjusted expenses from the expense sheet associated with the invoice line. You can enter adjustments prior to approval, but the adjustment must be made in the work order currency. The system automatically converts to base currency. |

Original/Adjusted Total |

Displays the total of the original and adjusted line amount, the original and adjusted expenses, and any associated fees and taxes. |

VAT Percent (value-added tax percent) |

Displays the actual VAT percentage. You can adjust the original VAT percentage for resource-based invoices. Note: The field is not available if VAT is not applicable. |

Estimated VAT (estimated value-added tax) |

Displays the estimated VAT amount. Adjusting the line amount or VAT percentage recalculates the estimated VAT amount. Note: The field is hidden if VAT is not applicable. |

Sales Tax Percent/Use Tax Percent |

Displays the estimated sales tax percentage if the tax applicability is sales tax or direct pay. If tax applicability is use tax, then the system displays the estimated use tax percent. You can adjust the tax percentage, which recalculates the estimated SUT amounts. Note: The field is not available if SUT Applicability value is not Sales Tax or Direct Pay/Sales Tax. |

Includes VAT (includes value-added tax) |

Indicates whether the estimated VAT amount is to be added to the line amount before SUT is calculated. If yes, the VAT amount is added to the line amount before SUT is calculated. Otherwise, the line amount is used for VAT calculations. Note: The field is not available if VAT and SUT are not applicable. |

Estimated Sales Tax |

Displays the estimated sales tax. Adjusting the line amount or SUT percentage recalculates the estimated sales tax amount. If the Includes VAT option is yes, then adjusting the VAT percentage also recalculates the estimated sales tax amount. Note: The field is not available if SUT Applicability value is not Sales Tax or Direct Pay/Sales Tax. |

Original/Adjusted Assignment Incidents |

Displays the number of assignments based on incidents associated with the invoice. |

Line Amount |

Displays the sum of all items associated with the invoice line. |

Estimated Total |

Displays the sum of the line amount, expense amount, VMS or MSP fees, and VAT or sales tax. |

Estimated Use Tax |

Displays the estimated sales tax. Adjusting the line amount or SUT percentage recalculates the estimated sales tax amount. If the Includes VAT option is yes, then adjusting the VAT percentage also recalculates the estimated sales tax amount. Note: The field is not available if SUT Applicability is not Use Tax. |

Progress Log Details - Deliverables Based Invoices

Field or Control |

Description |

|---|---|

Progress Log ID or Expense Sheet ID |

Displays the progress log or expense associated with the invoice line. Click to view the progress log or expense details. |

Activity |

Displays the activity associated with the invoice line. Note: This field is not visible if the settlement option on the work order associated with the invoice line is set to Percentage. |

% Complete (percent complete) |

Displays the total percent completed. Note: This field is visible only if the settlement option on the work order associated with the invoice line is set to Percentage. |

Rate |

Displays the rate from the work order associated with the invoice line. Note: This field is visible only if the settlement option on the work order associated with the invoice line is set to Rate Based. |

UOM (unit of measure) |

The unit of measure that is defined for the rate. Note: This field is visible only if the settlement option on the work order associated with the invoice line is set to Rate Based. |

Quantity |

Displays the number of units being billed on the invoice line. Note: This field is visible only if the settlement option on the work order associated with the invoice line is set to Rate Based. |

VAT Applicability (value-added tax applicability) |

Indicates whether VAT applies to this invoice. If VAT Applicability is Taxable, the system displays the VAT percentage and VAT amount information. |

SUT Applicability (sales and use tax applicability) |

Indicates whether SUT applies to this invoice. If SUT Applicability is Sales Tax or Direct Pay/Sales Tax, then the Sale Tax % and Sales Tax Amount fields appear. If the value is Use Tax, then the system displays the use tax percentage and the use tax amounts. Note: Use tax is not included in the invoice total and is displayed for informational purposes only. Suppliers can view the sales tax only, not the use tax. |

Original/Adjusted Line Amount |

Displays the amounts based on the original and adjusted progress log for this invoice line. You can adjust the line amount in the work order currency and the system automatically converts to base currency if the multicurrency option applies. |

Original/Adjusted MSP Fee (original/adjusted managed services provider fee) |

Displays the MSP fee. This option appears and is included in the estimated invoice total only if MSP is installed and the supplier is an internal supplier. External suppliers can view MSP fees; however, the fee is not included in the estimated invoice total. No manual adjustments are allowed for this field. Any adjustments made to the line amount recalculate the adjusted MSP fee. |

Original/Adjusted VMS Fee (original/adjusted supplier-managed service fee) |

Displays the VMS fee. This option appears only for VMS invoices. No manual adjustments are allowed for this field. Any adjustments made to the line amount recalculate the adjusted VMS fee. |

Original/Adjusted Expenses |

Displays the original and adjusted expenses from the expense sheet associated with the invoice line. You can enter adjustments prior to approval, but the adjustment must be made in the work order currency. The system automatically converts to base currency. |

Original/Adjusted Total |

Displays the total of the original and adjusted line amount, the original and adjusted expenses, and any associated fees and taxes. |

VAT Percent (value-added tax percent) |

Displays the actual VAT percentage. Enables you to adjust the actual VAT percentage for resource-based invoices. Note: The field is hidden if VAT is not applicable. |

Estimated VAT (estimated value-added tax) |

Displays the estimated VAT amount. Adjusting the line amount or VAT percentage recalculates the estimated VAT amount Note: The field is hidden if VAT is not applicable. |

Sales Tax Percent/Use Tax Percent |

Displays estimated sales tax percentage if tax applicability is sales tax or direct pay. If tax applicability is use tax, then the system displays the estimated use tax percent. You can adjust the tax percentage, which recalculates the estimated SUT amounts. Note: This field is visible only if SUT Applicability is not Sales Tax or Direct Pay/Sales Tax. |

Includes VAT (includes value-added tax) |

Indicates whether the estimated VAT amount is to be added to the line amount before SUT is calculated. If yes, the VAT amount is added to the line amount before SUT is calculated. Otherwise, the line amount is used for VAT calculations. Note: This field is not available if VAT and SUT are not applicable. |

Estimated Sales Tax |

Displays the estimated sales tax. Adjusting the line amount or SUT percentage recalculates the estimated sales tax amount. If the Includes VAT option is yes, then adjusting the VAT percentage also recalculates the estimated sales tax amount. |

Estimated Total |

Displays the sum of the line amount, expense amount, VMS or MSP fees, and VAT or sales tax. |

Estimated Use Tax |

Displays the estimated sales tax. Adjusting the line amount or SUT percentage recalculates the estimated sales tax amount. If the Includes VAT option is yes, then adjusting the VAT percentage also recalculates the estimated sales tax amount. Note: The field is not available if SUT Applicability is not Use Tax. |