Setting Up TDS Processing

To set up your TDS processing, use the following components:

Withhold Rule (WTHD_RULE).

Withhold Type (WTHD_TYPE).

Withhold Jurisdiction (WTHD_JURISDICTION).

Supplier Categories (WTHD_VNDR_CAT).

Withholding Entity (WTHD_ENTITY).

Procurement Control (BUS_UNIT_INTFC2).

Supplier Information (VNDR_ID).

Note: Setting up TDS processing is similar to setting up your global withholding environment.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_RULE |

Establish the rules that determine the actions to be taken during withholding. For example, you can create rules to define the amount of withholding and to determine different percentages based on the size of the transaction amount. |

|

|

WTHD_TYPE |

Specify a class and description for various withholding types. Select Contract Reference if the withhold class requires a contract reference on the voucher. |

|

|

WTHD_JURISDICTION |

Define withholding jurisdictions for the withholding type. |

|

|

WTHD_VNDR_CAT |

Define the relationship that exists between the withholding entity and your supplier. As jurisdiction and classification do, this relationship affects your withholding percentages. |

|

|

WTHD_ENTITY |

Define your withholding entities (tax authorities). The withholding entity component ties the withholding information together. |

|

|

WTHD_ENTITY_FIELDS |

Indicate which information the tax authority (entity) needs for your suppliers. |

|

|

BU_WTHD_ENT_FLDS |

Indicate which information the tax authority (entity) needs for your business unit. |

|

|

WTHD_BU_CF |

Define the accounting entries to record the TDS amounts. |

|

|

VNDR_LOC |

Enter one or more locations for the supplier. Supplier location is a default set of rules, or attributes, which define how you conduct business with a particular supplier. |

|

|

VNDR_GBL_OPT_SEC |

Define withholding information and reporting information for the supplier location. |

|

|

VNDR_PAY_OPT_SEC |

Enter the BSR code in the Branch ID field to use for TDS reporting. |

|

|

VCHR_EXPRESS1 |

Enter or view invoice information, including invoice header information, nonmerchandise charges, and voucher line and distribution information. |

|

|

VCHR_WTHD_EXP |

Override the withholding for the individual voucher lines, and specify a contract reference number if applicable. |

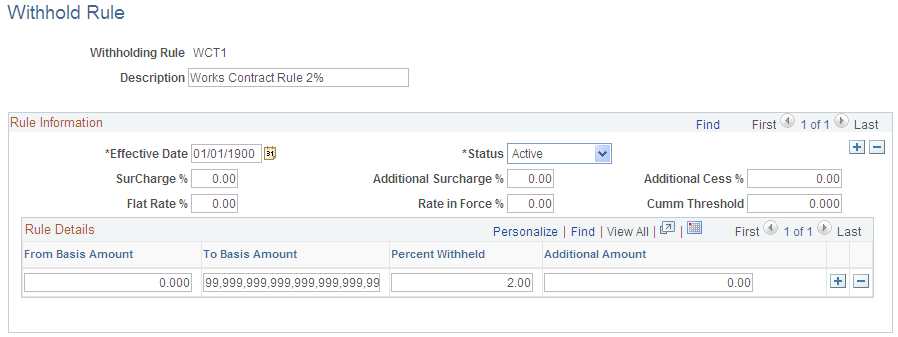

Use the Withhold Rule page (WTHD_RULE) to establish the rules that determine the actions to be taken during withholding.

For example, you can create rules to define the amount of withholding and to determine different percentages based on the size of the transaction amount.

Navigation:

This example illustrates the fields and controls on the Withhold Rule page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SurCharge % (surcharge percent) |

Enter a surcharge that is to be calculated on top of the tax amount, if required. |

Additional Surcharge % (additional surcharge percent) |

Enter an additional surcharge percent that is to be used for calculating the Education Cess tax levy, if required. |

Use the Withhold Type page (WTHD_TYPE) to specify a class and description for various withholding types.

Select Contract Reference if the withhold class requires a contract reference on the voucher.

Navigation:

This example illustrates the fields and controls on the Withhold Type page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Contract Reference |

Select whether the withhold class requires a contract reference on the voucher. |

Active |

Select to indicate that the withholding class is active. The withholding class is available immediately for you to use to define your withholding entity options. |

Note: The Contract Reference field is mandatory on the Voucher Withholding Information page, if you select Contract Reference.

Use the Withhold Jurisdiction page (WTHD_JURISDICTION) to define withholding jurisdictions for the withholding type.

Navigation:

Jurisdictions introduce an additional level of classification between the withholding type and withholding class. Jurisdiction also enables you to define different withholding percentages based on where the supplier is located, as well as on the classification (or activity) of a given transaction.

Field or Control |

Description |

|---|---|

Withholding Jurisdiction |

Specify any jurisdictions that belong to this withholding type. |

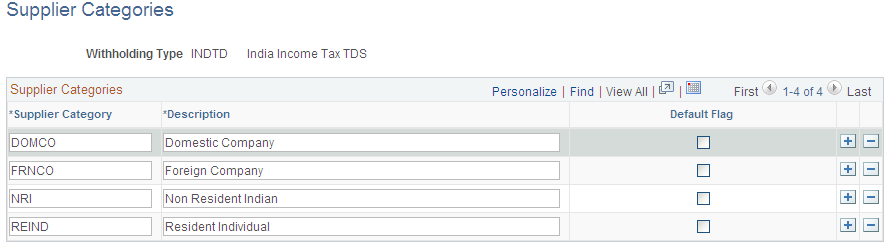

Use the Supplier Categories page (WTHD_VNDR_CAT) to define the relationship that exists between the withholding entity and your supplier.

As jurisdiction and classification do, this relationship affects your withholding percentages.

Navigation:

This example illustrates the fields and controls on the Supplier Categories page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Supplier Category |

Enter any category that belongs to this withholding type. |

Default Flag |

Select to have the supplier category or categories appear as defaults for the Withhold Status field on the Withholding Supplier Information page. |

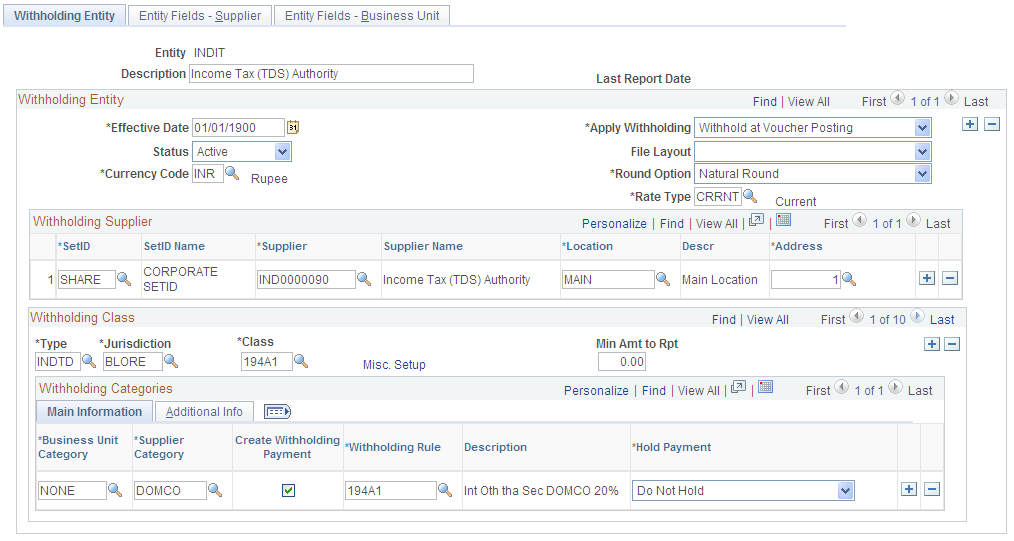

Use the Withholding Entity page (WTHD_ENTITY) to define your withholding entities (tax authorities).

The withholding entity component ties the withholding information together.

Navigation:

Define the withholding entity on three pages. Enter the supplier information for the entity, define the file layout, currency code and rate, and applicable withholding rules and types. You can also use the Withholding Entity page to determine whether to create a separate withholding payment, to set up accounting ChartField parameters and basis for withholding, as well as to tie business unit and supplier categories.

This example illustrates the fields and controls on the Withholding Entity page. You can find definitions for the fields and controls later on this page.

Withholding Entity

Field or Control |

Description |

|---|---|

Apply Withholding |

Select either Payment or Vchr Post (voucher post) to determine when withholding occurs. The default value is Payment. |

Round Option |

Select to indicate how the system should round to whole monetary amounts. Options are: Down: Select this value to round amounts down to the next whole number, regardless of actual decimal amount. Natural: Selecting this value rounds decimal amounts of less than 0.5 down to the next whole number, and rounds amounts of more than 0.5 up to the next whole number. Note that this option uses a function to determine the decimal precision to which to round the amount, depending on the installed currency configuration. (IND) NRR (Nearest Rupee Rounding): Select to round to the nearest Rupee. If an amount contains a part of a rupee consisting of paise then, if such part is fifty paise or more, it will be increased to one rupee and if such part is less than fifty paise, it will be ignored. If the transaction currency is different from the base currency, the transaction amounts will not be rounded. Only the base amounts will be rounded. TDS: Selecting this value rounds decimal amounts to the appropriate zero decimal, regardless of the installed currency configuration. Up: Select this value to round amounts up to the next whole number, regardless of actual decimal amount. |

Main Information Tab

Select the Main Information tab.

Field or Control |

Description |

|---|---|

Create Withholding Payment |

Select if you want to create separate payments for the withholding. Otherwise, withholding is not calculated, although basis amounts are reported. Note: Creating a zero percent withholding rule accomplishes the same result. |

Withholding Rule |

Select the withholding rule to which these categories apply. |

Hold Payment |

Select to hold these payments. The available options are: Hold All: Hold both the payment and the withholding amount. No Hold: Do not hold the payment or withholding amount. Wthd Only: Hold the withholding amount only. You can override the option you select here at the supplier level on the Withholding Supplier Information page. Note: If you wish to hold the supplier's payment, you can set the rule at zero percent and set the hold option to Hold All. |

Additional Information Tab

Select the Additional Information tab.

Field or Control |

Description |

|---|---|

Min Basis (minimum basis) and Min Withhold (minimum withhold) |

These fields are not used for TDS processing. Leave these fields blank. Note: The actual threshold amount is checked against the withholding rule. |

Payment Terms ID |

Enter a term to indicate when the withholding portion of the voucher will be paid to the withholding entity. |

Cumulative |

Select to indicate that the system should monitor voucher totals until it reaches the threshold amount that you specified on the withholding rules. Vouchers must have identical values for the withhold entity, type, jurisdiction, class, rule, supplier ID, and contract reference fields. Once it reaches that amount, the system calculates withholding on previous vouchers and on future vouchers as they are entered. Note: When the cumulative flag is not selected, the system calculates withholding on vouchers once the threshold limit is crossed but does not include previous vouchers. |

Use the Withholding Entity - Entity Fields - Supplier page (WTHD_ENTITY_FIELDS) to indicate which information the tax authority (entity) needs for your suppliers.

Navigation:

The Income Tax Department provides the permanent account number, which identifies you to the Income Tax Office.

Field or Control |

Description |

|---|---|

PAN No. (permanent account number) and PAN Ward |

Select Required to make it mandatory that users enter the permanent account number and the permanent account number ward when they enter withholding information and to make the fields available on the Withholding Supplier Information page. |

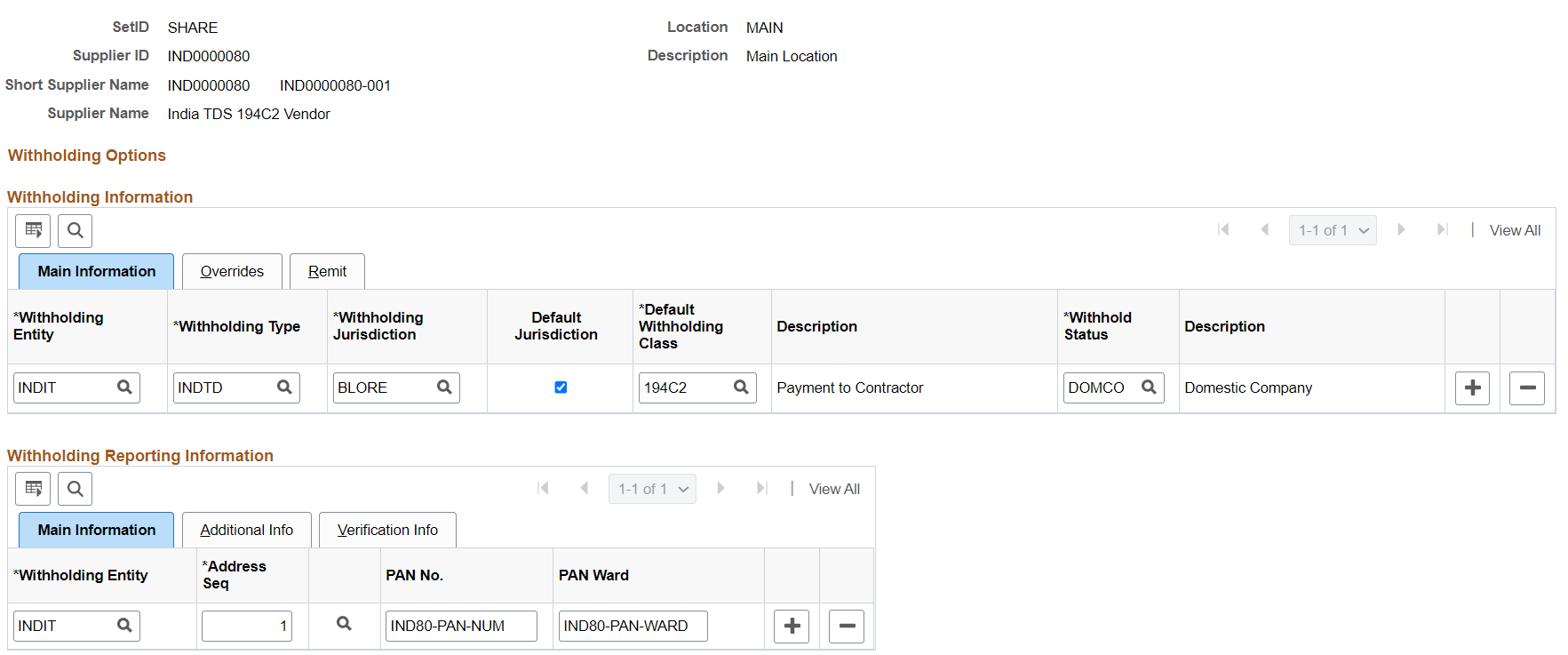

Use the Withholding Supplier Information page (VNDR_GBL_OPT_SEC) to define withholding information and reporting information for the supplier location.

Navigation:

Click the Global/1099 Withholding link on the Supplier Information - Location page.

This example illustrates the fields and controls on the Withholding Supplier Information page. You can find definitions for the fields and controls later on this page.

Note: Column order for grids may vary by implementation. All columns may not be visible.

Field or Control |

Description |

|---|---|

PAN No. |

Enter a permanent account number for this supplier. |

PAN Ward |

Enter a permanent account number ward. |

Use the Supplier Information - Payables Options page (VNDR_PAY_OPT_SEC) to enter the BSR code in the Branch ID field to use for TDS reporting.

Navigation:

Click the Payables link on the Supplier Information - Location page.

Expand the Supplier Bank Account Options collapsible region on the Supplier Information - Payables Options page.

Field or Control |

Description |

|---|---|

Branch ID |

If appropriate, enter a branch ID for the bank. This field may not be available, depending on the country that you selected. For India, enter the BSR code of the withholding entity's supplier's bank branch. This information is displayed on the TDS reports (APY8070 and APY8080). |