Allocating Tips

This topic provides overviews of the tip allocation process and tip allocation calculation methods, and discusses how to allocate tips.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TIPS_EMPL_INPUT |

(USA) Specify the gross receipts to which an employee's tips apply in each tip establishment. |

|

|

TIPS_ALLOC_PD |

Select the end date for the tip allocation. Use the same pay end date as your allocation end date. |

|

|

RUNCTL_TIPS_ALLOC |

(USA) Run the Run Tip Allocation COBOL SQL process (PSPTARUN), and (after you are satisfied with the results) approve the allocated tips. |

|

|

TIPS_EMPL_PD |

(USA) View the record of an individual employee's allocations. |

|

|

RUNCTL_TIPS_ALLOC |

(USA) Run the Update Allocation Balances SQR Report process (PAY053) and produce the Update Allocations Balances audit report. . |

|

|

Tip Allocation by Establishment Report Page |

RUNCTL_TIPS_ALLOC |

(USA) View tip allocation data, by employee, for an establishment. Use the subtotals on this page for troubleshooting. |

|

Tip Allocation by Employee Report Page |

RUNCTL_TIPS_ALLOC |

(USA) Generate the PAY051 report, which lists tip employees, sorted by establishment. |

|

Employee Receipt Report Page |

RUNCTL_TIP_PAY055 |

(USA) Generate the PAY055 report, which lists gross receipts for each employee in a selected time period, sorted by input date. Also provides subtotals for each tip establishment and total receipts for the company. |

|

TIPS_ESTAB_PD |

(USA) Generate the PAY050 report, which lists tip allocation information for establishments. |

|

|

TIPS_ALLOC_ST |

(USA) Review the status of the tip allocation process for a company. |

|

|

Balance Verification Report Page |

RUNCTL_TIP_PAY |

(USA) Generate the PAY052 report, which lists directly tipped employees and their YTD and pending allocated tips. This is a point-in-time report of all employees with allocated tips, sorted by company. |

|

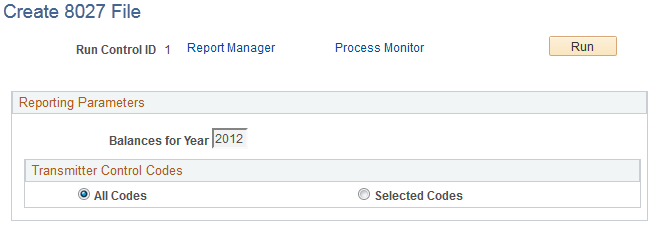

RUNCTL_TAX960TP |

(USA) Generate the file for electronic submission of IRS Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips. |

|

|

Form 8027 Audit Report Page |

RUNCTL_TAX962TP |

(USA) Generate the TAX962TP report, which provides audit data from the electronic IRS Form 8027 for large tip establishments. |

Most large hospitality industry employers must report additional information to the Internal Revenue Service (IRS) concerning the establishment's receipts and the employees' tip incomes, by establishment. A large establishment is one that employs more than 10 people on a typical business day.

Tip allocation is required when the amount of tips reported by tipped employees for a pay period is less than a specified percentage of the establishment's gross receipts for that period. The amount that you allocate is the difference between the total reported tips and the specified percent of the establishment's gross receipts. You can apply for a lower percentage, if you can show, in writing, that the tip rate at the establishment is less than the specified percent.

Each tip establishment allocates tips. An establishment is an individual restaurant, hotel, and so on, at a unique location. If a company has 15 restaurants, it allocates tips separately for each restaurant. In addition, allocated tips are not subject to withholding; therefore, the system does not withhold taxes. However, the system maintains the year-to-date allocated tips shortfall balance and reports it on the employee's Form W-2. Also, the system reports allocated tips on the paycheck stub as memo earnings because memo earnings do not add to the check gross and are not included in taxable grosses.

The tip allocation process consists of four steps:

Calculate the allocated tips.

Use the Structured Query Report (SQR) reports to check the results.

You can calculate allocated tips any number of times for an allocation date before approving the calculation.

Approve the tip allocation results.

After you approve the calculation for an allocation date, you cannot recalculate for that date.

Update the allocated tip balances.

Allocated tips must be approved before the balances can be updated.

Reporting on the Tip Allocation Process

The system provides the following tip allocation reports:

Allocation Earnings (PAY052)

Employee Gross Receipts (PAY055)

Allocation by Establishment (PAY050)

Allocation by Employee (PAY051)

Three acceptable tip allocation calculation methods exist:

Gross receipts

Hours worked

Good faith agreement

In each method, the company allocates tips once per month, quarterly, annually, or for each pay period.

Gross Receipts Method

This method calculates an allocation amount for each directly tipped employee, using the gross receipts that are attributable to directly tipped employees. These steps are based on Form 8027.

To use the gross receipts method:

Calculate the allocation base for an allocation period:

gross receipts in that period × specified percent

Calculate the tipped employee allocation base:

allocation base − total tips reported by indirectly tipped employees

For each directly tipped employee, calculate the employee's gross receipt ratio:

total gross receipts for all tipped employees / gross receipts attributable to the employee

Calculate the employee's share of the allocation base:

tipped employee allocation base × employee's gross receipt ratio

Calculate the employee's shortfall:

employee's share of the allocation base − employee's reported tips

If the amount is less than zero, it is considered zero.

Calculate the total shortfall by summing all employees' shortfall amounts.

Calculate the total tips by summing all the tips that are reported by directly and indirectly tipped employees.

Calculate the total allocation amount:

allocation base − total tips

Calculate the employee's shortfall ratio:

employee's shortfall / total shortfall

Calculate the employee's allocated amount:

total allocation × employee's shortfall ratio

Hours Worked Method

This method calculates an allocation amount for each directly tipped employee using the hours that are worked by the employee.

Note: Only establishments that employ fewer than 25 employees (tipped and nontipped) during a pay period can use this method.

To use the hours worked method:

Calculate the allocation base for an allocation period:

gross receipts in that period × specified percent

Calculate the tipped employee allocation base:

allocation base − total amount of tips reported by indirectly tipped employees

For each directly tipped employee, calculate the employee's hours worked ratio:

employee's total hours worked during this period / total hours worked by all tipped employees that worked during this period

Calculate the employee's share of the allocation base:

tipped employee allocation base × employee's hours worked ratio

Calculate the employee's shortfall:

employee's share of the allocation base − employee's reported tips

If the amount is less than zero, it is considered zero.

Calculate the total shortfall by summing all employees' shortfall amounts.

Calculate the total tips by summing all tips that are reported by both directly and indirectly tipped employees.

Calculate the total allocation amount:

allocation base − total tips

Calculate the employee's shortfall ratio:

employee's shortfall / total shortfall

Calculate the employee's allocated amount:

total allocation amount × employee's shortfall ratio

Good Faith Agreement Method

A good faith agreement is a written agreement between the employer and at least two-thirds of the employees in each occupational category that receives tips (for example, waiters, waitresses, and bus persons). The agreement must provide an allocation of the difference between total tips reported and the specified percent of the gross receipts among the tipped employees. The company decides how to configure the system to allocate tips; however, the formula the company creates must allocate tips based on the actual distribution of tip income among the employees.

Before you can allocate tips, you must set up the following information for tipped employees:

Company table.

Pay Group table.

Federal and state Tax table.

Tip Establishments table.

General earnings code information.

Earnings code tax information.

Earnings code tax calculation information.

Job Data record.

Form W-2.

(USA) Use the Update Employee Gross Receipts page (TIPS_EMPL_INPUT) to specify the gross receipts to which an employee's tips apply in each tip establishment.

Navigation:

This example illustrates the fields and controls on the Update Employee Gross Receipts page.

Field or Control |

Description |

|---|---|

Input Date |

Enter the input date, which should be between the start date and the end date (posted date) of the period for which you're calculating or approving the tip allocations. |

Employment Record (employment record number) |

Enter an employment record number for employees with multiple jobs. |

Receipts Amounts

Field or Control |

Description |

|---|---|

Gross Receipts |

Enter the gross receipts to which the employee's tips apply. |

Service Charge Receipts and Charge Tips |

Enter the service charge receipts and service charge tips that apply to employee tips. The system uses these values to calculate the amount to report for each Establishment Serial Number on Form 8027 under Service Charge Less than 10%. |

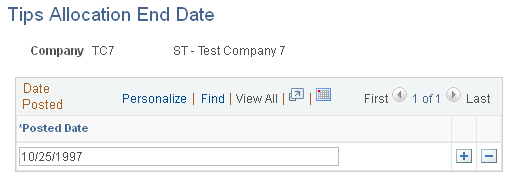

Use the Tips Allocation End Date page (TIPS_ALLOC_PD) to select the end date for the tip allocation. Use the same pay end date as your allocation end date.

Navigation:

This example illustrates the fields and controls on the Tips Allocation End Date page.

Field or Control |

Description |

|---|---|

Posted Date |

This date must match the date that is entered on the run controls for calculating allocated tips and for updating the balances. |

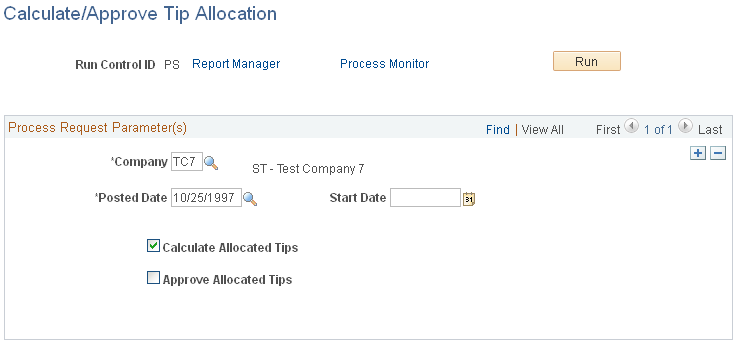

(USA) Use the Calculate/Approve Tip Allocation page (RUNCTL_TIPS_ALLOC) to run the Run Tip Allocation COBOL SQL process (PSPTARUN), and (after you are satisfied with the results) approve the allocated tips.

Navigation:

This example illustrates the fields and controls on the Calculate/Approve Tip Allocation page.

Field or Control |

Description |

|---|---|

Posted Date |

Select the end date of the period for which you're calculating or approving the tip allocations. |

Start Date |

Select the start date of the period for which you're calculating or approving the tip allocations. |

Calculate Allocated Tips |

Select to run or rerun the calculation process. You can run the calculation process as many times as you like until you run the approve process. After you run the approve process, you cannot run the calculation process again for that company and allocation date. |

Approve Allocated Tips |

After you check the results of the calculation process, and you are satisfied with the calculation, select this check box to run the approve process. |

(USA) Use the Review Tips Allocation by Employee page (TIPS_EMPL_PD) to view the record of an individual employee's allocations.

Navigation:

This example illustrates the fields and controls on the Review Tips Allocation by Employee page.

Note: You can view all the allocations of an individual employee even if that employee has allocations for more than one establishment. This page is display-only.

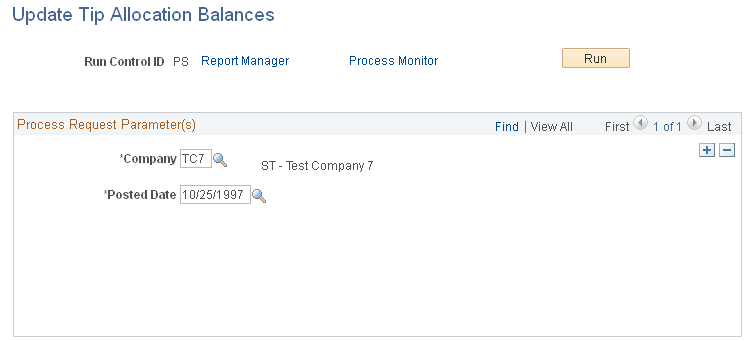

(USA) Use the Update Tip Allocation Balances page (RUNCTL_TIPS_ALLOC) to run the Update Allocation Balances SQR Report process (PAY053) and produce the Update Allocations Balances audit report.

Navigation:

This example illustrates the fields and controls on the Update Tip Allocation Balances page.

The report lists, by employee, the current allocation amount, the year-to-date (YTD) allocation amount after the current update, the YTD hours (if tip allocation method is hours), and the allocated tips earnings code that is updated. Before using this page, you must approve the allocated tips calculation.

Field or Control |

Description |

|---|---|

Company |

Enter the company which you are updating tip allocation balances. |

Posted Date |

Select the end date of the period for which you're updating tip allocation balances. The value comes from the Tip Allocation End Date page. |

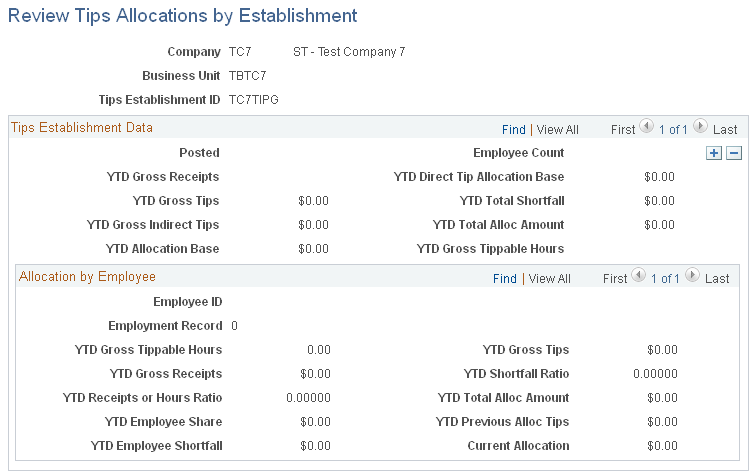

(USA) Use the Review Tips Allocations by Establishment page (TIPS_ESTAB_PD) to generate the PAY050 report, which lists tip allocation information for establishments.

Navigation:

This example illustrates the fields and controls on the Review Tips Allocations by Establishment page.

Note: Access the Review Tips Allocation by Employee page to view allocations for an individual employee.

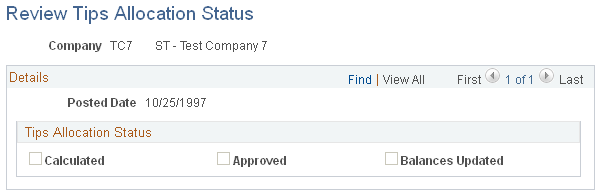

(USA) Use the Review Tips Allocation Status page (TIPS_ALLOC_ST) to review the status of the tip allocation process for a company.

Navigation:

This example illustrates the fields and controls on the Review Tips Allocation Status page.

Tips Allocation Status

This group box indicates the company's tip allocation status as of the allocation end date.

Note: At the end of the process, all boxes should be selected as complete for that cycle.

(USA) Use the Create 8027 File page (RUNCTL_TAX960TP) to generate the file for electronic submission of IRS Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips.

Navigation:

This example illustrates the fields and controls on the Create 8027 File page.