Setting Up the Payroll System for Tip Allocation

Note: For each tip category, you can set up the general information as described in this section. However, this is only a recommendation. Depending on the company, you might need to change some selections.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_TIPS_TCC_TBL |

Enter the 5-digit IRS assigned TCC. Note: An establishment may have only one code, however you can associate multiple divisions or departments of that establishment to the code. |

|

|

Tips Processing Page |

COMP_TBL6USA_SEC |

Set up tips processing in the Company table, which is required for the system to account for tipped employees throughout the payroll process. |

|

Pay Group Table - Bank/Tip Info Page |

PAYGROUP_TABLE8 |

Specify the bank from which employees are to be paid. Establish tips processing for tipped employees within the pay group. Establish tips processing for tipped employees within the pay group. |

|

Tax Table - General Page |

STATE_TAX_TABLE1 |

View standard deductions, allowance amounts, and supplemental rates. |

|

Tax Table - Special Tax Amts Page (Tax table - special tax amounts) |

STATE_TAX_TABLE2 |

View information needed for tax calculations. The page for the Federal Tax table differs from the one for specific states. |

|

Tax Table - Rates Page |

STATE_TAX_TABLE3 |

View wage bracket information. |

|

Tax Table - Additional Rates Page |

STATE_TAX_TABLE4 |

View wage limits for unemployment and disability taxes. |

|

TIPS_ESTAB_TBL |

Set up tip establishment parameters for allocating employee tips. Before using this page, you must define the tip establishment field on the Tips Processing page in the Company table. |

|

|

Tip Establishment Report Page |

PRCSRUNCNTL |

Generate PAY750 that lists information from the Tip Establishment table, which contains the tip establishments and data related to allocating tips to tipped employees. |

|

EARNINGS_TABLE1 |

Define parameters and rules for calculating earnings for tip processing. |

|

|

EARNINGS_TABLE2 |

Set up earnings code tax information for tip processing. |

|

|

EARNINGS_TABLE3 |

Set up earnings code tax calculation information for tip processing. |

|

|

Payroll Page |

JOB_DATA2 |

Indicate whether this employee will receive tips, directly, indirectly or not tipped. The field for this appears only if the Company table Tip Processing check box is selected. See Payroll Page. |

Important Terms and Definitions

Before you set up earnings codes, you must understand how reported tips, tip credit, and minimum wage adjustments are related. The following definitions are provided to aid in the discussion:

Term |

Definition |

|---|---|

Allocated Tips |

The total amount of tips that the federal or state regulation believes that an establishment should make in a period. |

Tip Credit |

The special reduction in paid wages for a tipped employee allowed by the Department of Labor. It is the difference between statutory minimum wage and the minimum wage employers are allowed to pay to tipped employees. |

Statutory Minimum Wage |

The highest of the federal, state, or jurisdiction

(if the Minimum

Wage Jurisdiction option is enabled in the employee’s

pay group) minimum wage for states that accept tip credit as a component

of the statutory minimum wage.

|

Minimum Wage Adjustment |

The amount that the employer must contribute to make sure the employee makes at least the statutory minimum wage if the employee does not make enough in tips to cover the tip credit. |

Note: It is the employer's responsibility to know whether the state offers tip credit as an option; some states do not accept tip credit as a component of the statutory minimum wage.

Tip Credit and Minimum Wage Adjustment Calculations

The employer can select the minimum hourly rate to enter in an employee's Job Data record, provided that the rate does not fall below the regulation requirement. The system then determines what portion of the tips that are reported for an employee constitutes the tip credit for the pay period. The tip credit, in addition to the pay received from the employer, should bring the employee up to the statutory minimum wage pay.

The system calculates the tip credit as follows: tip credit = (statutory minimum wage pay) − (regular rate of pay from employer × hours worked).

If the employee does not make enough in tips to cover the remainder of the statutory minimum wage, a minimum wage adjustment is necessary. The system calculates the minimum wage adjustment as follows: minimum wage adjustment = (statutory minimum wage pay) − (employer paid wages + tips)

You must set up earnings codes for tips reported, allocated tips, tip credit, and minimum wage adjustment.

Tax Information

According to federal law, tips of more than 20 USD per month are subject to withholding for:

Federal income tax.

Old Age, Survivors and Disability Insurance (OASDI).

Medicare.

Federal Unemployment Tax Act.

Employers do not have to wait until the employee receives 20 USD in tips before withholding taxes. The system is flexible enough to withhold taxes before or after the employee receives the 20 USD.

Employers must pay their portions of OASDI and Medicare taxes even if the employee does not have enough earnings to cover the employee's share. If the employee cannot pay the OASDI and the Medicare taxes that are owed, the W-2 process calculates the uncollected amount and reports it in box 13 on the employee's Form W-2. The system reports the uncollected amount for each tax separately.

If the employee does not have sufficient net pay to withhold the total tax amounts, the system:

Withholds taxes on earnings.

If there is enough pay available, it withholds taxes on the tips.

Some states consider tips as earnings for state income tax and state unemployment insurance taxes. Some follow the federal 20 USD per month rule. Other state taxes, such as state disability insurance, Health Care Subsidy Fund (HCSF), Workforce Development Partnership Fund WFDP, and workers' compensation might not include tips in the gross that is used to calculate the tax. The taxation of tips for all states is in the federal and state Tax tables that are maintained by PeopleSoft.

For localities, tips are usually considered wages if the state considers tips as wages for income tax purposes.

Note: Most of the pages that are used to set up the payroll system for tipped employees are documented elsewhere in this product documentation. This topic discusses only those pages and fields that pertain to tipped employees and require additional explanation.

Annual Electronic Form 8027 (Employer’s Annual Information Return of Tip Income and Allocated Tips)

According to the IRS, Form 8027 is filed by large food or beverage establishment employers that are required to make annual reports to the IRS on receipts from food or beverage operations and tips reported by their employees. Employers filing 250 or more information returns must file the forms electronically. The filing requirements apply separately to both original and corrected returns.

The IRS requires a unique 5-digit numeric Transmitter Control Code (TCC) to file an electronic Form 8027 for a large tip establishment. Each location reported under the same EIN must be associated with the same TCC.

To obtain a Transmitter Control Code for submitting Form 8027 electronically, you must complete Form 4419, Application for Filing Information Returns Electronically (FIRE). Form 4419 can be submitted at any time during the year; however, it should be submitted at least 30 days before the due date of the return(s). Upon approval of the application, a five-character alphanumeric Transmitter Control Code (TCC) will be assigned and included in an approval letter.

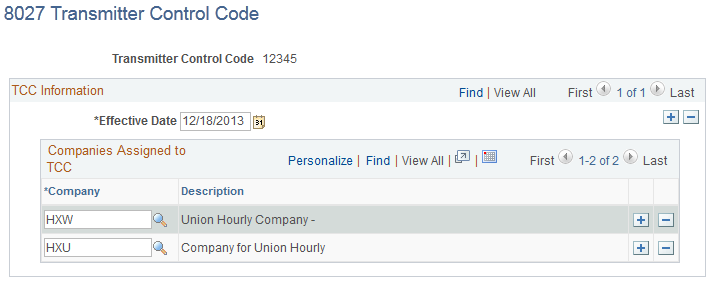

Use the 8027 Transmitter Control Code page (PY_TIPS_TCC_TBL) to enter the IRS assigned unique 5-digit transmitter code (TCC).

Navigation:

This example illustrates the fields and controls on the 8027 Transmitter Control Code page.

Field or Control |

Description |

|---|---|

Company |

Select each company (division or department) of a large tip establishment to associate with this Transmitter Control Code (TCC). Transmittal control codes are required by the IRS when filing the annual electronic Form 8027 for large tip establishments. Each location reported under the same EIN must be associated with the same TCC. A company can be associated with only one TCC. A company that is already associated with another TCC, cannot be associated with this one. |

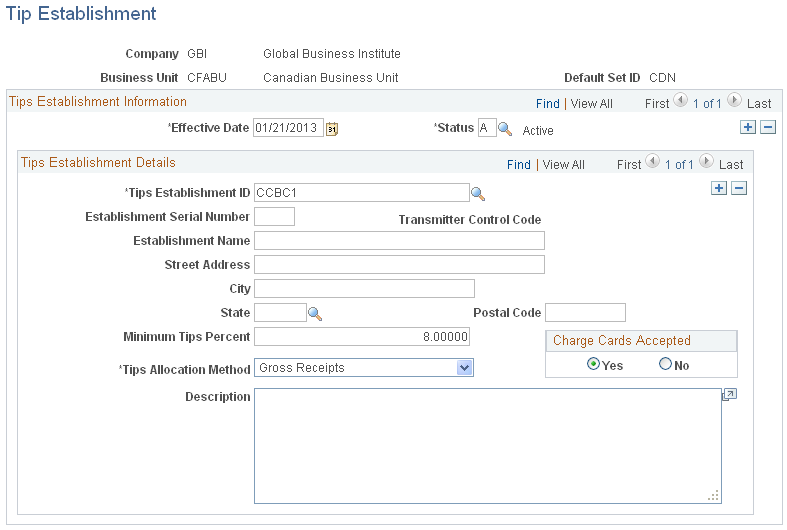

Use the Tip Establishment page (TIPS_ESTAB_TBL) to set up tip establishment parameters for allocating employee tips.

Note: Before using this page, you must define the Tip Establishment Field on the (USA) Tips Processing Page in the Company table.

Navigation:

This example illustrates the fields and controls on the Tip Establishment page.

Field or Control |

Description |

|---|---|

Tips Establishment ID |

Valid values for the Tips Establishment ID field depend on what is selected in the Tip Establishment Field on the Tips Processing page in the Company table. For example, if Job Location is selected as the tip establishment field on the Tips Processing page, a list of valid locations is available to choose from. If Job Dept ID (job department ID) is selected, a list of valid departments is available. See (USA) Tips Processing page (COMP_TBL6USA_SEC) in Entering Company Information in your PeopleSoft HCM Application Fundamentals documentation. |

Establishment Serial Number |

Enter the unique 5-digit numeric serial number that you have assigned to the tip establishment.. |

Transmitter Control Code |

If the tip establishment is associated with a Form 8027 Transmitter Control Code (TCC) on the 8027 Transmitter Control Code page, that code appears here. |

Establishment Name, Street Address, City, State, and Zip Code |

Enter the company name and address. If the Tips Establishment field for the company is set to Job Location on the Company table, the name and address associated with the serial number and TCC appear. You can modify the information here, but modifications here will not change the entry on the Company table or the information assigned by the IRS. |

Minimum Tips Percent |

Enter a minimum tips percent to allocate tips when employees report total tips that are less than a set minimum percent of total sales. The default comes from the Company table, but you can override it. |

Tips Allocation Method |

Valid values are: Gross Receipts, Hours Worked, and Good Faith (Custom). The default is Gross Receipts. The default comes from the Company table, but you can override it. |

Charge Cards Accepted |

Indicate whether credit cards are accepted at the tip establishment. The default value is Yes. |

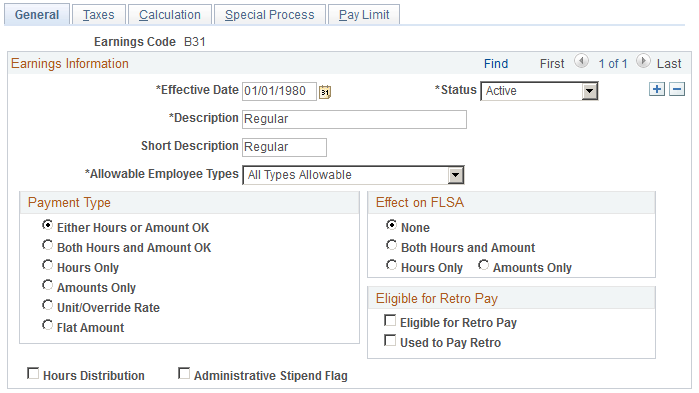

Use the Earnings Table - General page (EARNINGS_TABLE1) to define parameters and rules for calculating earnings for tip processing.

Navigation:

This example illustrates the fields and controls on the Earnings Table - General page.

The following table suggests values and options that you might select for each tip category:

|

Description Field |

Payment Type Group Box |

Effect on FLSA (effect on Fair Labor Standards Act) Group Box |

Eligible for Retro Pay (eligible for retroactive pay) Group Box |

|---|---|---|---|

|

Allocated Tips |

Amounts Only |

None |

Not applicable. |

|

Tip Credit |

Amounts Only |

None |

Not applicable. |

|

Minimum Wage Adjustment |

Amounts Only |

Amounts Only |

Selection depends on company policy. |

|

Reported Tips |

Amounts Only |

None |

Not applicable. |

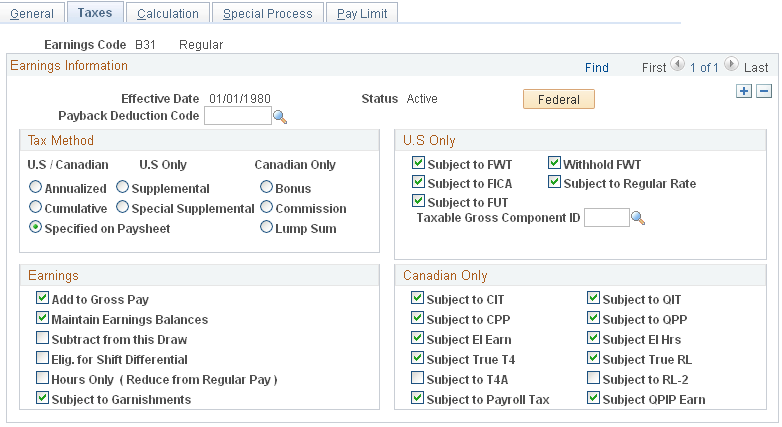

Use the Earnings Table - Taxes page (EARNINGS_TABLE2) to set up earnings code tax information for tip processing.

Navigation:

This example illustrates the fields and controls on the Earnings Table - Taxes page.

The following table suggests values and options that you might select for each tip category:

|

Earnings Code Field |

Tax Method Group Box |

Earnings Group Box |

U.S. Only Group Box |

|---|---|---|---|

|

Allocated Tips |

Specified on Paysheet |

Maintain Earnings Balances |

Not subject to withholding; therefore, leave everything blank. Companies do not have to withhold taxes on allocated tips; however, the employee eventually pays taxes on them. |

|

Tip Credit |

Specified on Paysheet |

Maintain Earnings Balances |

Not taxed; therefore, leave everything blank. |

|

Minimum Wage Adjustment |

Specified on Paysheet |

|

Subject to all taxes. |

|

Reported Tips |

Supplemental |

Maintain Earnings Balances |

|

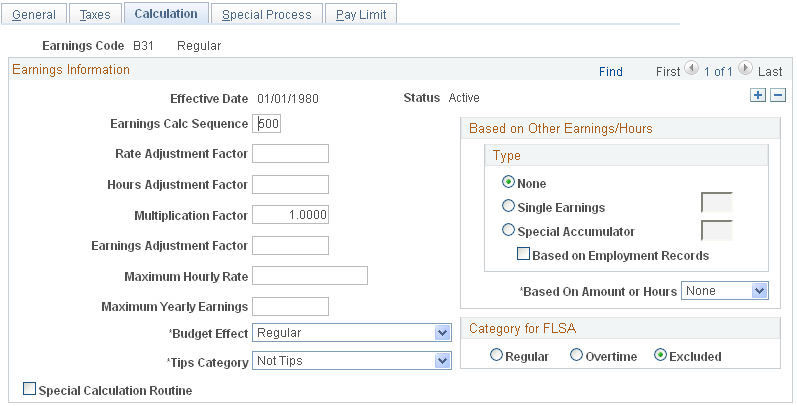

Use the Earnings Table - Calculation page (EARNINGS_TABLE3) to set up earnings code tax calculation information for tip processing.

Navigation:

This example illustrates the fields and controls on the Earnings Table- Calculation page.

The following table suggests values and options that you might select for each tip category:

|

Earnings Code Field |

Tips Category Field |

|---|---|

|

Allocated Tips |

Tip Allocation |

|

Tip Credit |

Tip Credit |

|

Minimum Wage Adjustment |

Not Tips |

|

Reported Tips |

Reported Tips |

Federal and state regulations require that you report tip information on the employee's Form W-2. PeopleSoft sets up all tax reporting information, except for the earnings code for allocated tips. For allocated tips, select the earnings code in the Earnings Code field.

For detailed information about this process, see the relevant year-end processing instructions posted on My Oracle Support.