Adjusting Imputed Income for U.S. Group-Term Life Insurance

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_IMP_CALC |

(USA, USF) Calculate imputed income adjustments and update paysheets with the adjustment amounts. |

|

|

Imputed Income Adjustment Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Generate the PAY033 report, which contains the results of imputed income adjustments. |

Payroll for North America addresses imputed income every pay period. However, you might require adjustments at the end of the year as a result of changes in coverage, multiple plans subject to dependent life (DPL) imputed income, or an employee being terminated. To make adjustments, use the Imputed Income Adjustment process.

The Imputed Income process performs calculations and creates a file containing one-time adjustment records for all employees who require them.

Review the calculation results using the Imputed Income Adjustment report before loading the transactions into paysheets.

When you're ready to load the imputed income transactions into paysheets, run the Imputed Income process in Update Paysheets mode, and the system makes the adjustments as one-time deductions with a taxable benefit deduction classification. The system establishes these one-time deductions as off-cycle manual checks (paylines).

The manual checks that the Imputed Income process creates do not have an amount in the Total Gross and Net Pay fields. This is not necessary, because the imputed income adjustment that the process creates is a taxable benefit deduction class, and it does not affect gross or net pay.

When the Imputed Income process creates the adjustment paysheet, it changes the Deductions Taken field value on the By Paysheet - One-Time Deductions page to None. This prevents the system from taking normal taxable benefits and employer deductions on the adjustment check.

You cannot rerun the Imputed Income process. For example, suppose you run the process once and it produces an error after loading some paysheets. If you run it again using the same run control information (the same company, pay group, pay end date, date range, and so on), you receive another error, because the system attempts to insert duplicate rows into the database. Therefore, if you must rerun the process, delete the paysheets that the process added previously.

Attach your adjustment paysheets to a pay calendar that does not contain any other off-cycle paysheets. In other words, there should be no other off-cycle paysheets entered for the same calendar in which you create the imputed income adjustments.

Example

Joanne is a CCB employee in a monthly pay group. Her coverage changes in the middle of the year. From January 1 to June 30, she has basic and supplemental life. Her basic life is fully employer-paid; her supplemental life is fully employee-paid:

|

Plan Type |

Description |

Coverage |

Premium |

|---|---|---|---|

|

20 |

Life |

25,000 USD |

Employer-paid premium: 15 USD |

|

21 |

Supplemental Life |

25,000 USD |

Employee-paid premium: 1.25 USD |

Because the IRS does not consider the first 50,000 USD of coverage taxable, the system performs no imputed income calculations for Joanne during the first half of the year.

On July 1, however, Joanne suddenly gets a big increase in her basic life coverage:

Plan Type

Description

Coverage

Premium

20

Life

50,000 USD

Employer-paid premium: 30 USD

21

Supplemental Life

25,000 USD

Employee-paid premium: 1.25 USD

Because Joanne now has coverage totaling 75,000 USD, starting with the next payroll after July 1, 25,000 USD is considered taxable as imputed income.

Joanne is 37 years old. In this age bracket, the Uniform Premium table calls for a calculation of .11 USD per month per 1,000 USD of coverage:

25,000 USD / 1,000 USD x .11 USD = 2.75 USD

The system subtracts Joanne's employee-paid, after-tax contribution to the coverage:

2.75 USD – 1.25 USD = 1.50 USD taxable benefit.

These calculations are correct beginning with the end-of-July payroll. However, the IRS stipulates that any contributions that are made by the employee must be factored into the equation. In Joanne's case, you must include all her contributions from January 1 to June 30. The result is a reduction in her true tax liability for the year as a whole.

At the end of the year, Imputed Income processing:

Recalculates Joanne's imputed income (without subtracting her monthly contributions) for every month of the year.

Adds up the monthly figures to arrive at a total.

Adds up her monthly contributions.

This table shows the process:

|

Month |

Imputed Income |

Employee Contribution |

|---|---|---|

|

January |

0 USD |

1.25 USD |

|

February |

0 USD |

1.25 USD |

|

March |

0 USD |

1.25 USD |

|

April |

0 USD |

1.25 USD |

|

May |

0 USD |

1.25 USD |

|

June |

0 USD |

1.25 USD |

|

July |

2.75 USD |

1.25 USD |

|

August |

2.75 USD |

1.25 USD |

|

September |

2.75 USD |

1.25 USD |

|

October |

2.75 USD |

1.25 USD |

|

November |

2.75 USD |

1.25 USD |

|

December |

2.75 USD |

1.25 USD |

|

Totals: |

16.50 USD |

15 USD |

Joanne's total imputed income for the year is 16.50 USD; her contributions amount to 15 USD. On this basis, her taxable benefit for the year should be only 1.50 USD (16.50 − 15 USD). However, because the system calculates her taxable benefit on a month-by-month basis, her taxable benefit is 9 USD (6 months × 1.50 USD per month). Therefore, the system must reduce Joanne's taxable benefit for the year by 7.50 USD:

Total taxable benefit from month-by-month calculations (9.00 USD) – total taxable benefit from end-of-year calculation (1.50 USD) = end-of-year adjustment (1.50 USD).

Before running imputed income adjustment processing, you must establish the taxable benefit deduction that you plan to use for adjustments. You can use either an existing deduction code or establish a new deduction code only for adjusting imputed income. The deduction code should have plan type in the range 20–29, 2Y, or 2Z.

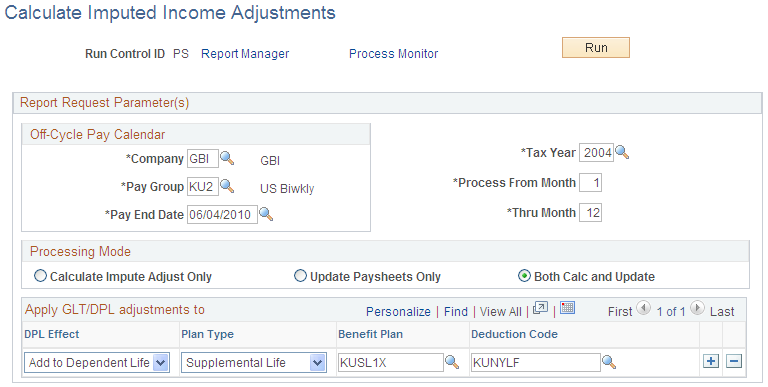

(USA, USF) Use the Calculate Imputed Income Adjustments page (RUNCTL_IMP_CALC) to calculate imputed income adjustments and update paysheets with the adjustment amounts.

Navigation:

This example illustrates the fields and controls on the Calculate Imputed Income Adjustments page.

Field or Control |

Description |

|---|---|

Process From Month and Thru Month |

Enter a numerical value for the first and last months in the date range. (Ordinarily, this is 1 through 12—January through December). |

Processing Mode

Field or Control |

Description |

|---|---|

Calculate Impute Adjust Only (calculate imputed adjustment only) |

Calculates imputed income for the selected period and creates transaction files, but does not load the transactions into paysheets. |

Update Paysheets Only |

Loads calculated imputed income transactions that are created in a previous run into paysheets as one-time deductions. |

Both Calc and Update |

Calculates imputed income and creates transaction files, then loads the transactions into paysheets as one-time deductions. Use these options as follows:

|

Apply GTL/DPL adjustments to

Use this group box to designate the deduction codes to which you want the system to apply the imputed income transactions when it loads the transactions into paysheets.

Field or Control |

Description |

|---|---|

DPL Effect (dependent life effect) |

Select the type of adjustment. You must have one row for Add to DPL (add to dependent life) and one row for Add to GTL (add to group-term life). Note: Under ordinary circumstances, the run control has only two rows in the Apply GTL/DPL adjustments to (apply group-term life/dependent life adjustments to) group box. Even if some employees have more than one GTL or DPL plan, the process applies their adjustments to a single plan—one for GTL and one for DPL. |

Deduction Code |

Deduction codes must be valid for all employees in the run. |

Important! This COBOL process takes one or two minutes to process each employee. If you have many employees, the process could take hours or even a full day.

(USA, USF) Use the Imputed Income Adjustment Report page (RUNCTL_PAYINIT2) to generate the PAY033 report, which contains the results of imputed income adjustments.

Navigation:

Note: If you used the process to load adjustment transactions into paysheets, use the Paysheet or Payline pages to view the one-time deductions.