Defining Benefit Plans

To define benefit plans, use the Benefit Plan Table (BENEFIT_PLAN_TABLE) component.

This section provides an overview of benefit plans and discusses how to enter benefit plan information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BENEFIT_PLAN_TABLE |

Enter benefit plan information. |

Benefit plans are the benefits you want to offer to your employees. Benefit plans can be broken down into categories. A -character alphanumeric numbering scheme is used to identify the different categories. Nine categories are already set up in the Manage Base Benefits business process.

|

Category |

Numbering Sequence |

|---|---|

|

Simple Benefits |

A0 – A9, AA – AZ |

|

Health |

10 – 19, 1A – 1Z |

|

Life and Accidental Death |

20 – 29, 2A – 2Z |

|

Disability |

30 – 39, 3A – 3Z |

|

Savings |

40 – 49, 4A – 4Z |

|

Leave |

50 – 59, 5A – 5Z |

|

Flexible Spending Accounts |

60 – 69, 6A – 6Z |

|

Retirement |

70 – 79, 7A – 7Z |

|

Pension |

80 – 89, 8A– 8Z |

|

Vacation Buy/Sell |

90 – 99, 9A – 9Z |

Within each category, a set of predefined benefit plan types help the system identify the type of benefit plan. The following table lists the delivered benefit plan types.

|

Benefit Plan Type |

Description |

|---|---|

|

A0 |

Long-Term Care |

|

A1 |

Legal Services |

|

A2 |

Wellness Credit |

|

10 |

Medical (USF) FEHB (federal employees health benefits) |

|

11 |

Dental |

|

12 |

Medical and Dental |

|

13 |

Major Medical |

|

14 |

Vision |

|

15 |

Nonqualified Medical |

|

16 |

Nonqualified Dental |

|

17 |

Nonqualified Vision |

|

20 |

Basic Life (USF) FEGLI (federal employees' group life insurance) |

|

21 |

Supplemental Life Additional (USF) Option B – Additional |

|

22 |

AD/D (life and accidental death and dismemberment) |

|

23 |

Life and AD/D |

|

24 |

Dependent AD/D |

|

25 |

Dependent Life (USF) Option C – Family |

|

26 |

Survivor Income |

|

27 |

Supplemental AD/D |

|

2Y |

(USF) FEGLI Living Benefits |

|

2Z |

(USF) Option A – Standard |

|

30 |

Short Term Disability |

|

31 |

Long Term Disability |

|

40 |

401(k) |

|

41 |

Profit Sharing |

|

42 |

Thrift (including Roth 401(k)) |

|

43 |

IRA (individual retirement account) |

|

44 |

Capital Accumulation |

|

45 |

US Savings Bonds |

|

46 |

Elective 403(b) |

|

47 |

Non-Elective 403(b) |

|

48 |

Employer Only 403(b) |

|

49 |

457(b) |

|

4A |

Stock Purchase (Stock Purchase Administration only) |

|

50 |

Sick Leave |

|

51 |

Vacation Leave Annual Leave |

|

52 |

Personal Leave |

|

53 |

FMLA Leave (Obsolete) |

|

5A |

Company Car (global users only) |

|

60 |

Flexible Spending Health Care |

|

61 |

Flexible Spending Dependent Care |

|

65 |

Flexible Spending Canadian Health Care |

|

66 |

Flexible Spending Canadian Retirement Counseling |

|

67 |

Health Savings Account (health care for U.S. companies) |

|

70 |

PERS (public employees' retirement system) Retirement |

|

7Z |

(USF) TSP 1% Agency Contribution (thrift saving plan 1 percent agency contribution) |

|

80 |

(CAN) Standard Pension |

|

81 |

(CAN) Supplementary Pension |

|

82 |

(USA) Pension Plan 1 |

|

83 |

(USA) Pension Plan 2 |

|

84 |

(USA) Pension Plan 3 |

|

85 |

(USA) Pension Plan 4 |

|

86 |

(USA) Pension Plan 5 |

|

87 |

(USA) Pension Plan 6 |

|

90 |

Vacation Buy |

|

91 |

Vacation Sell |

You can add additional benefit plan types. However, you need to understand the numbering scheme behind benefit plan types. The system is designed to recognize specific sequences.

For example, anything with a 1 as the first character is recognized as a health plan. Anything with a 2 as the first character is recognized as a life and accidental death plan.

Because Oracle's PeopleSoft application adds plan types starting from the beginning of the alphabet, Oracle recommends that you start with Z and work backward to A. Oracle also recommends that you not delete a plan type; simply make it inactive.

Note: You should work within the PeopleSoft plan type series. If you add plan types that do not conform to the provided series, you'll have to add the new plan type to the Translate Table and update associated processing logic.

To set up a benefit plan:

Identify the benefit provider for the benefit plan and enter the benefit provider in the Provider/Vendor Table page.

Enter the detail information for the benefit plan on the Benefit Plan Table page.

Repeat this process for each benefit plan that you will offer to your employees.

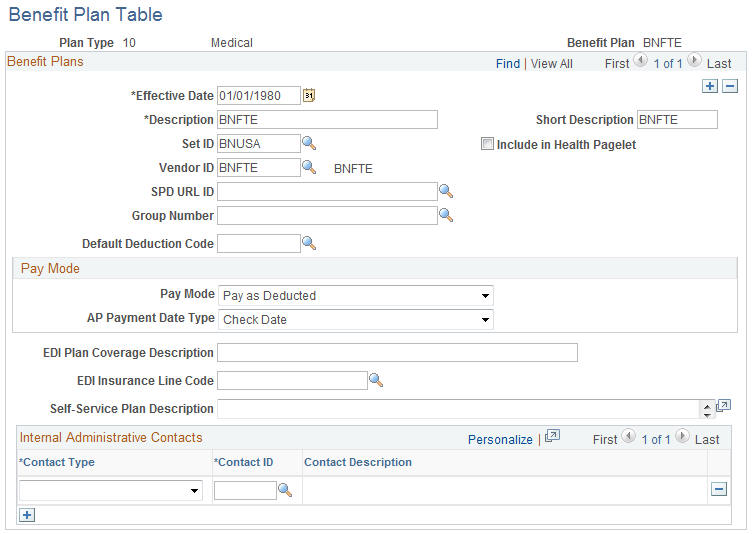

Use the Benefit Plan Table page (BENEFIT_PLAN_TABLE) to enter benefit plan information.

Navigation:

This example illustrates the fields and controls on the Benefit Plan Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Set ID |

Select a set ID for the vendor to be used. |

Include in Health Pagelet |

This check box is visible only for health plans (plan types 1x) Select this check box to include the plan in the Health Benefits Pagelet, which shows overall enrollment statistics for health plans. |

Vendor ID |

Enter the provider ID. Define vendor IDs on the Provider/Vendor Table page. |

SPD URL ID (summary plan description uniform resource locator identifier) |

Enter the URL ID for the provider. This URL is used with the PeopleSoft Benefits Self Service application to provide access to the summary plan description. |

Group Number |

Enter the group number. Group numbers are defined on the Provider Policy Table page. |

Default Deduction Code |

(Optional) Entering a default code saves you from typing the deduction code each time that you associate this benefit plan with a benefit program on the Benefit Program Table. Deduction codes are created on the Deduction Table. |

Minimum Spousal Allocation % (minimum spousal allocation percentage) |

Certain qualified plans in the life, savings, or pension category have mandated lower limits on the percentage amount that must be assigned to a spouse. Enter that amount here for the system to enforce or monitor compliance with this beneficiary right. |

Include in Nondiscrimination |

Check to include in nondiscrimination testing. Available only to plan types in the 40-series (savings plans). |

Pay Mode |

Complete if you are using PeopleSoft Payroll for North America with PeopleSoft Payables. Select when the vendor will be paid: Pay as Deducted: Pay the vendor each time payroll calculates this deduction. Pay at Specified Date: Specify the date in the AP Payment Date Type field. Pay when Collection Complete: Pay the vendor only when the goal amount or deduction end date has been reached. (This pay mode is valid for general deductions and garnishments.) |

AP Payment Date Type (accounts payable payment date type) |

Choose from Check Date or Pay Period End Date. |

EDI Plan Coverage Description (electronic data interchange coverage description) |

(Optional) Enter a value that is included in the HIPAA (Health Insurance Portability and Accountability Act of 1996) file. |

EDI Insurance Line Code (electronic data interchange insurance line code) |

Select a value from the drop-down menu. |

Self-Service Plan Description |

Enter text describing the benefit plan to appear on all fluid Benefits Self Service plan enrollment pages. In Classic Self Service, this field is used only for health (1x), disability (3x), leave (5x), and retirement (7x) plans. |

Contact Type |

Select the type of contact: COBRA Administrator (Consolidated Omnibus Budget Reconciliation Act), HIPAA Administrator (Health Insurance Portability and Accountability Act), or Plan Administrator. |

Contact ID |

Select the contact ID for the administrator. Contact IDs are defined on the Benef Administrative Contact (benefits administrative contact) page. |