Running the EDI Processes

This topic discusses how to process EDI transactions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_RNCTL_EDI |

Process EDI transactions. |

|

|

Previous EDI Transactions Page |

GPGB_EDI_RNCTL_SEC |

Enter the EDI submission number for a previous P45 Leaver Notification transaction when you want to regenerate the transaction. |

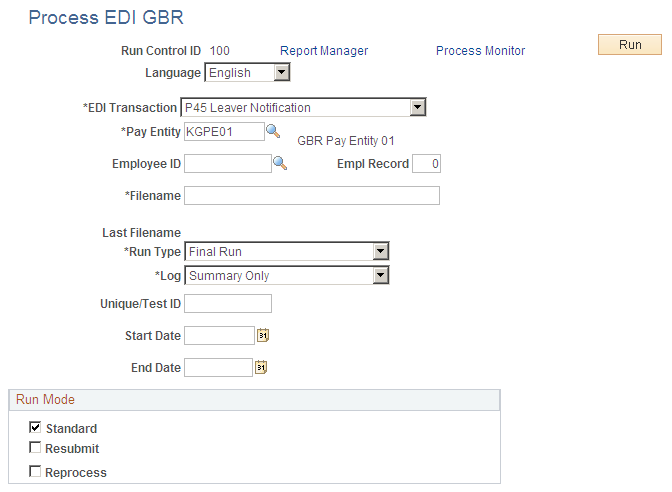

Use the Process EDI GBR page (GPGB_RNCTL_EDI) to process EDI transactions.

Navigation:

This example illustrates the fields and controls on the Process EDI GBR page.

Field or Control |

Description |

|---|---|

EDI Transaction |

Select the type of EDI transaction to process. Options are:

For more information see the transaction descriptions in this topic. Note: The fields that appear on this page depend on the type of EDI transaction you select. |

Pay Entity |

Select the pay entity for which to run the EDI transaction. |

Employee ID and Empl Rcd Nbr (employee record number) |

Select a specific employee ID and Empl Rcd Nbr to restrict the transaction to that employee's details. This field is only available for P45, P46, and P14 transactions. |

Filename |

For incoming transactions, enter the filename of the file to load. For outgoing transactions, enter the name of the file to be created. If you enter an asterisk (*) as part of the file name, the system automatically generates a unique filename by replacing the asterisk with an incrementing number. For example, if you enter EDIWNU*.TXT as the file name, the process names the first WNU file generated EDIWNU1.TXT, the second EDIWNU2.TXT, and so on. |

Last Filename |

Displays the last filename created or loaded. |

Run Type |

Select the mode to run the process in: Trial Run: Use this mode to review flat file information and identify any problems updating the database or creating flat files to send to HMRC. For outgoing transactions, running the process in this mode creates a flat file with the test flag set. For incoming transactions, running the process in this mode identifies the updates that would occur, without updating the database. Final Run: Use this mode to update the database or create flat files to send to HMRC. For outgoing transactions, final runs create flat files without the test flag and update the EDI audit tables (if you chose to generate EDI audit tables during setup). A unique transaction number is also allocated. For incoming transactions, final runs update the database and update the EDI audit tables (if you chose to generate EDI audit tables during setup). |

Log |

Select the level of information recorded about a transaction in the process log file. The options are: Summary Only, Detail - All, Detail – Warnings and Errors, and Detail – Errors Only. Note: If you select the Use EDI Audit check box on the EDI Setup GBR page, the audit tables contain all information regardless of the log type you select here. |

Unique/Test ID |

This field is available for P14, and P35 transactions only. For a P14 transaction, enter the unique ID required by HMRC. This identifier is chosen by the sender and is quoted when HMRC sends the P14 acknowledgement. The unique ID replaces the permit number previously issued for each PAYE scheme. For trial submissions (Run Type set to Trial), the system automatically prefixes the unique ID with TEST. For a P35 transaction, enter a test ID that is required for trial submissions. Leave this field blank for a final run. |

Tax Year Begins In |

Enter the year in which the tax year begins. This field is available for P14 and P35 transactions only. |

Num of P14 submissions sent |

Enter the number of P14 transactions submitted for the PAYE scheme for the tax year. This field is required for P35 transactions only. For example, if you submitted one P14 transaction for 40,000 employees, enter 1 in this field. |

Start Date and End Date |

Enter a start and end date for the EDI processing. The use and impact of these fields depends on the EDI transaction. See the individual transaction descriptions below for more information. |

Return Type

This group box appears if you select P14 or P35 in the EDI Transaction field.

Field or Control |

Description |

|---|---|

Original Return |

Select if you are submitting the P14 or P35 transaction for the first time. |

Amended Return |

Select if you are resubmitting a P14 or P35 transaction. |

Run Mode

This group box appears if you select the P45 Leaver Information in the EDI Transaction field. This field further defines the employees selected.

Field or Control |

Description |

|---|---|

Standard |

Select if you are submitting employees whose P45 details have not yet been submitted via an EDI P45 leaver transaction (the EDI Submission Reference field on the Maintain Tax Data GBR page is blank). |

Resubmit |

Select to regenerate an EDI submission based on the employees that have been previously selected in a submission. The Resubmission Details link appears when you select this check box. A previous submission number is required. Note: The employee population is the same but the detailed information reported in the submission may differ if any adjustments have been made to setup and/or result data in the interval between submissions. |

Reprocess |

Select to reselect all employees within the date range – regardless of the value in the EDI Submission Reference field on the Maintain Tax Data GBR page. |

Resubmission Details |

Click this link to enter the EDI submission number when you are re-submitting P45 Leaver Information transactions. |

EDI Transaction Description

P14

The P14 is an outgoing transaction that provides HMRC with your P14 End of Year Summary. It does not update any statutory information. It is an EDI-specific version of the paper P14 report and magnetic media (electronic P14) process.

If you have NIC holidays during the tax year, provide that information on the Pay Entity Details page in the P35 Checklist and Declaration group box for the relevant tax year.

If you specify an Original Return, the system uses the calculated results and adjusted accumulator values (if any) for the last processed calendar for each employee. If you specify an Amended Return, the system uses the adjusted accumulator values only. Accumulator adjustments are made using the core Adjust Accumulator Balance page.

For more information about P14 EDI returns refer to HMRC documentation on the EBU (Electronic Business Unit) web site.

Note: You may want to run the EOY Pre Validation report to validate your payee and pay entity data before running the P14 transaction. The report checks that payee and pay entity data conform to the HMRC validation standards and lists any payees and pay entity data that does not meet the standards. This enables you to identify invalid data that should be corrected before submitting a P14 to HMRC.

P35

The P35 is an outgoing transaction that provides HMRC with the P35 Employer's Annual Return. It does not update any statutory detail information. This is an EDI-specific version of the paper P35 report.

You must complete the P35 Checklist and Declaration group box on the Pay Entity Details page for the relevant tax year before you submit this transaction. This ensures that the correct summary values are included in the P35 submission.

If specifying an Original return then calculated results and adjusted accumulator values (if any) for the last processed calendar will be used for each employee. Specifying an Amended return will cause only adjusted accumulator values to be used.

For more information about P35 EDI returns, refer to HMRC documentation on the EBU (Electronic Business Unit) web site.

Note: You may want to run the EOY Pre Validation report to validate your payee and pay entity data before running the P35 transaction. The report checks that payee and pay entity data conform to the HMRC validation standards and lists any payees and pay entity data that does not meet the standards. This enables you to identify invalid data that should be corrected before submitting a P35 to HMRC.

Works Number Update (WNU)

The WNU is an outgoing transaction that provides HMRC with a list of employee names, Employee ID numbers, and NI numbers. It does not update any statutory detail information.

The key fields for this EDI transaction are Pay Entity, Start Date, and End Date. The EDI process selects employees who are members of the pay entity (by checking the maximum job effective-dated row that is before or on the end date for a pay group that is part of the pay entity) who are not terminated/transferred or who have a termination/transfer date on or after the start date.

P46

P46 (Notification of new starter) is an outgoing transaction that provides HMRC with new starter P46 information for those new starters who do not have a P45. The transaction adds a note to existing tax information on the Tax Notes page.

The key fields for this EDI transaction are Pay Entity, Employee ID, Start Date, and End Date. The EDI process selects employees who are members of the pay entity (by checking the maximum job effective-dated row that is on or before the end date for a pay group that is part of the pay entity) who have a P46 statutory detail notification on the Maintain Tax Data GBR page whose date is on or after the start date and on or before the end date.

P45 Part 3 (Starter)

P45 Part 3 (starter) is an outgoing transaction that provides HMRC with new starter P45 information for those new starters who have a P45. The transaction adds a note to existing tax information on the Tax Notes page.

The key fields for this EDI transaction are Pay Entity, Employee ID, Start Date, and End Date. The EDI process selects employees who are members of the pay entity (by checking the maximum job effective-dated row that is on or before the end date for a pay group that is part of the pay entity) who have a P45 statutory detail notification whose date is on or after the start date and on or before the end date.

P45 Part 1 (Leaver)

P45 Part 1 (leaver) is an outgoing transaction that provides HMRC with a set of P45 leaver notifications.

The key fields for this EDI transaction are Pay Entity, Employee ID, Start Date, End Date, and Run Mode. This EDI transaction is only transmitted for employees who have been issued with a finalized paper P45. When you run a final P45 paper report, the process updates the employee's P45 Leaver Information fields on the Maintain Tax Data GBR page with the Calendar Group (that was used to print the P45s) and a P45 leave date.

The EDI process searches the P45 leaver information for employees in the Pay Entity (or a specific employee) where there is a P45 calendar group and the P45 leave date is between the Start Date and End Date.

When the P45(1) EDI process is run in final mode it updates employees' P45 leaver information on the Maintain Tax Data GBR page with the EDI Submission Number.

P6, P6B, and P9

P6, P6B, and P9 are incoming transactions that apply employee tax code changes supplied by HMRC. The transaction inserts or updates rows of tax data on the Maintain Tax Data GBR page.

The key field for these EDI transactions is Pay Entity. The EDI process reads the employee information from the file sent by HMRC. The transaction inserts data into the tax data on the Maintain Tax Data GBR page, if possible.

Before loading information from the file, the EDI process performs the following validations:

Is the input file flagged as a test file?

If yes, then the run type mode (if specified as Final) is ignored and no updates are made.

Does the transaction type specified on the Process EDI GBR page match that provided in the input file?

P6 and P9 transactions are interchangeable and processing will continue as long as the transaction type specified on the Process EDI GBR page is P6, P6B, or P9

Does the pay entity specified on the Process EDI GBR page match the pay entity provided in the input file?

Does the tax office reference of the pay entity on the Process EDI GBR page match the tax office provided in the input file?

Can the process match the employee in the P6 file with an employee in the system based on works ID (emplid, empl_rcd), national ID (NI number), and surname?

If the process can match two out of three, then it updates the employee's information. NI matching is controlled by the EDI NI Number Match Length field on the EDI Setup GBR page; for example, an NI match length of 8 AA999999A format ignores the last character of NI numbers.

Does the employee have future dated tax row?

If so, the process does not update the employee's information, but the log contains all details that would have been applied to enable you to make manual adjustments if required.

Does the employee have a matching dated tax row?

If so, the process creates a new effective sequence tax row for the employee.

Does the employee have multiple jobs?

If so, then certain validation/defaulting occurs and the log contains the details.

SL1 and SL2

SL1 and SL2 XML files can be read using Process EDI GBR page and will be loaded into Maintain Student Loan page. SL1 is start notice of student loan which has start date and plan type as information, whereas SL2 is stop notice of Student loan from HMRC consisting of Stop date of student loan.

SL1 and SL2 transactions will read SL1 and SL2 files, validates employee information using National Insurance Number, Work ID and Last Name provided in the file. If it matches information with database then it inserts or updates the Maintain Student Loan component. It also logs all error/warning messages depending upon log parameter selected in run control similar to other transaction.

PGL1 Start Notice and PGL2 Stop Notice

PGL1 and PGL2 files can be read using Process EDI GBR page and will be loaded into Maintain Students Loan page. PGL1 is Start Notice of Post Graduate Loan which has start date as information, where as PGL2 is Stop notice of Post Graduate Loan from HMRC consisting of Stop Date of Post Graduate Loan.

PGL1 and PGL2 transactions will read PGL1 and PGL2 Files, validates employee information using National Insurance Number, Work ID and Last Name provided in the file. If it matches the information with database, then it inserts or updates the Maintain Student Loan component. It also logs all error/warning messages depending upon log parameter selected in run control similar to other transaction.