Managing Student Loans

This topic provides an overview of student loans and discusses how to enter student loan information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_EE_STLOAN |

Enter student loan data for a payee. |

Employers must deduct student loan repayments from the earnings of employees who took out one or more student loans after August 1998. They must then remit these student loan repayments, together with PAYE tax and NICs, to HM Revenue and Customs (HMRC). (This law has been in effect since November 1, 1999.)

Note: Student loan repayments are made on a per-pay-period basis; that is, they are non-cumulative.

HMRC sends you a start notice, informing you when to start deducting the repayments from an employee's earnings. Contributions are a fixed percentage of an employee's salary, provided that the employee earns more than the amount specified by HMRC. Once the loan has been repaid, HMRC sends you a stop notice informing you to stop making the deductions.

Global Payroll for the UK meets the HMRC's requirements for processing student loans, enabling you to record the amount of loan repayment deducted on these documents:

Employee's payslip

P11

P45 forms

For new employees who are already making student loan repayments, their P45 forms display a Y in the Student Loan check box. When you enter their details on the Maintain Tax Data GBR page and select the Student Loan Deductions check box, the system automatically creates a student loan for that employee.

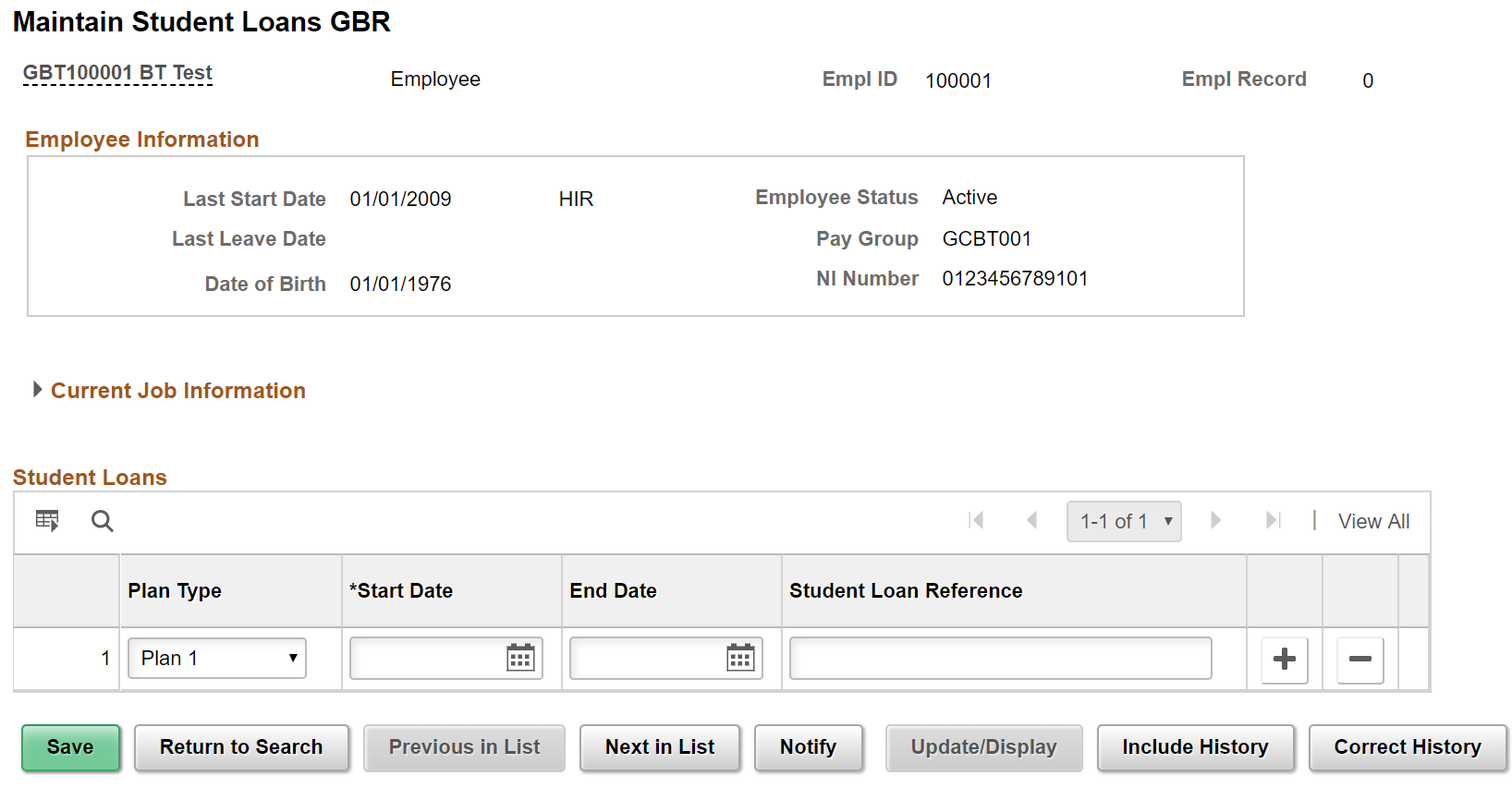

Use the Maintain Student Loans GBR page (GPGB_EE_STLOAN) to enter student loan data for a payee.

Navigation:

This example illustrates the fields and controls on the Maintain Student Loans GBR page.

Field or Control |

Description |

|---|---|

Plan Type |

Select the required plan type. If you want to enter post graduate loan details, select the Plan Type as ‘PG Loan’. The Plan Type field is displayed only when the Student Loan checkbox is selected in P46 Expat Details GBR page Note: If the user want to select plan type of the student loan, then you need to select the Student Loan checkbox in P46 Expat Details GBR page. |

Start Date |

Select the date when employers must start deducting student loan repayments from the employee's earnings. |

End Date |

Select the date when employers should stop deducting student loan repayments from the employee's earnings. |

Student Loan Reference |

Enter the student loan reference for an employee. Use this reference in all correspondence with HMRC. |