Reporting Pay/Pension Numbers

This topic discusses how to run the Pay/Pension Numbers process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_PPIN_FL |

Run the Pay/Pension Numbers process. |

As part of the process for updating employees' tax codes, HMRC requires employers to submit a list of their employees, including the following information:

Employee name

Employee NI number

Employee ID

This allows HMRC to update their systems with an up-to-date list of employees in preparation for the tax coding notification for the next tax year.

The MT3 - Pay/Pension Numbers process creates a file containing this information, formatted to the HMRC requirements.

See HM Revenue and Customs Submission Instructions and Technical Specifications "Updating of Pay/Pension Identity Numbers" – Reference MT3

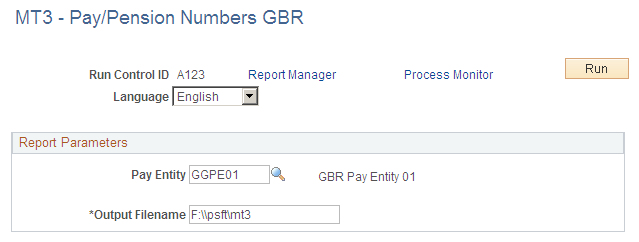

Use the MT3 - Pay/Pension Numbers GBR page (GPGB_PPIN_FL) to run the Pay/Pension Numbers process.

Navigation:

This example illustrates the fields and controls on the MT3 - Pay/Pension Numbers GBR page.

Field or Control |

Description |

|---|---|

Pay Entity |

Select the pay entity you want to process. Note: You must set up the tax district and HMRC reference numbers associated with this pay entity before you run this process. Use the Pay Entity Details page to define these tax details. |

Output Filename |

Enter the name for the output file. Refer to the HMRC guidelines for file naming conventions. |

See HM Revenue and Customs Submission Instructions and Technical Specifications "Updating of Pay/Pension Identity Numbers" – Reference MT3

Once you have successfully run the Pay/Pension Numbers process, you need to:

Prepare your magnetic media.

The HMRC guidelines specify the types of media accepted and the format of information for each media type.

Copy the file generated by the Pay/Pension Identity Numbers process to the prepared media.

The process creates an output file in the %PS_SERVDIR%\files directory on the machine where your Process Scheduler runs.