Entering Tax Credit Information

This topic discusses how to record employee tax credit information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_EE_TAXCRD |

Record tax credit information for an employee. |

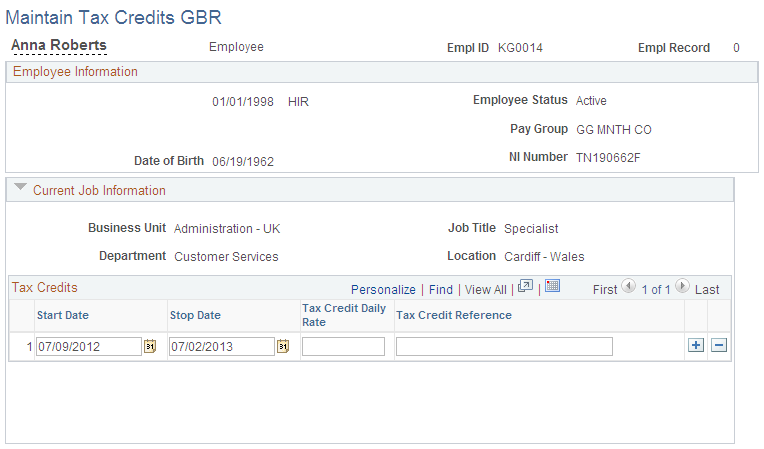

Use the Maintain Tax Credits GBR page (GPGB_EE_TAXCRD) to record tax credit information for an employee.

Navigation:

This example illustrates the fields and controls on the Maintain Tax Credits GBR page.

Tax Credits

Enter the tax credit data that applies to a payee.

Note: Only one tax credit can be running at any time. If an employee has more than one tax credit in a pay period (this is possible if a new tax credit is awarded for an employee with a change of daily rate, for example), make sure that the start dates and end dates do not overlap. In the unlikely event that an employee has more than three tax credits, you can enter more than three in the system, but the system processes and pays only three tax credits in any one pay period.

Field or Control |

Description |

|---|---|

Start Date |

Enter the date from which you must start paying tax credit to an employee. HMRC sends you a start notification by post, giving you either 14 (for weekly paid employees) or 42 days' notice (for all other employees). Note: The start date must not be after March 31, 2006. HMRC is responsible for payment of tax credits after this date. Global Payroll for the UK issues a warning message if the start date is April 1, 2006 or later, but it does not prevent you creating a tax credit. |

Stop Date |

Enter the date when your responsibility for paying tax credits to an employee ends. HMRC notifies you of the date when they want payment to end. |

Tax Credit Daily Rate |

Enter the daily amount that applies to each calendar day for which you must pay tax credit. HMRC notifies you of this amount. |

Tax Credit Reference |

Enter any reference that HMRC uses for the employee's tax credits. |

Stopping Tax Credit Payments

When you receive notification from HMRC to stop paying tax credits to an employee, you must stop paying tax credit as instructed. Also, if an employee leaves your organization, you do not have to pay tax credit from the last day of employment. Global Payroll for the UK automatically takes this change into consideration and stops paying tax credits accordingly.

Note: If you want to stop paying tax credit to an employee who is involved in a trade dispute, for example, or because an employee is leaving within three months, you must manually stop the payment in the system. Global Payroll for the UK does not calculate this automatically.

You must show the tax credit paid on the employee's payslip, as well as record the total tax credits paid in a tax year for an employee on the P14 and P60 reports.