Understanding the Administration of Mandatory Provident Fund Contributions

This section discusses the administrative and reporting requirements of MPF administration and maintenance to:

Support both employee and employer payments to a nominated fund in accordance with the calculation of eligibility rules for MPF legislation.

These deduction rules cover legislative MPF requirements such as permitted period processing, age eligibility, and the contribution holiday rule.

Provide reports to support MPF administrative requirements.

MPF reports such as the Remittance Statement and Terminated Employees Report enable you to manage MPF contributions.

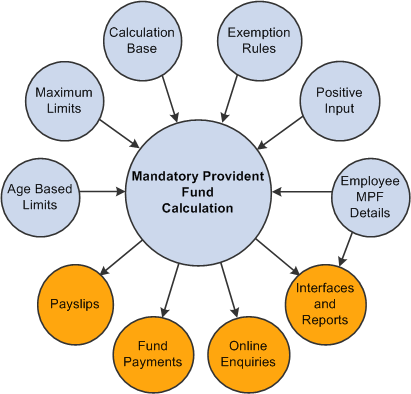

The following diagram displays the rules and options that you are required to set up or exercise to ensure correct MPF calculation and system outputs:

The Hong Kong Government provides three types of MPF schemes:

Master trust schemes.

This is the type that most employees, employers and self-employed persons in Hong Kong participate in.

Employer-sponsored schemes.

Schemes of this type are limited to the employees of individual employers and their associated companies.

Industry schemes.

These schemes are specially established for employees of the catering and construction industries, which are primarily casual employees (whose employment is on day-to-day basis or for a fixed period of less than 60 days).

Global Payroll for Hong Kong supports the master trust schemes and industry schemes.

Field or Control |

Description |

|---|---|

Casual Employee (as defined by MPF Ordinance) |

An employee engaged in the construction or catering industry, who is employed on a daily basis or for a fixed period of less than sixty days. |

Contribution Day |

For non-casual employees, the tenth day after the last day of the contribution period or the contribution period in which the permitted period ends—whichever is later. The employer must contribute to a scheme for their employees on or before the tenth day after the last day of the contribution period. For casual employees (who are not members of an industry scheme), this is the tenth day after the last day of the relevant contribution period, or the contribution period in which the permitted period ends—whichever is later. The employer and the approved trustee of the scheme concerned approve one of the following days:

|

Contribution Holiday |

An employee does not have to contribute to MPF for the first thirty days of employment. The first thirty days is referred to as the contribution holiday. An employee must start paying MPF from the thirty-first day of employment. |

Contribution Period (non-casual employee) |

Regarded as the payroll period. If an employee is paid on a calendar month basis and the payment pattern is specified in the employment contract, the contribution period should be one calendar month. |

Employee Reporting Period |

The pay period in which the holiday contribution period ends. Employee's can start contributing to MPF in this period. |

Employer Reporting Period |

The pay period subsequent to the period in which the contribution holiday ends. The remittance report and payslip are required to disclose the contribution amount and contribution dates within the permitted period. |

Mandatory Provident Fund (MPF) |

A compulsory retirement plan scheme for employees between the ages of 18 and 65, implemented by the government of Hong Kong to help ensure a financially sound retirement for the territory's workforce. Under MPF, both the employer and employee make regular mandatory contributions into an employee's account, with benefits payable at retirement. |

Permitted Period |

For casual employees, the period within which the employer must enroll the employee into a registered scheme—ten days for casual employees. |

Permitted Period MPF Deduction |

An MPF deduction (contribution amount) for the permitted period required for the MPF Remittance report. Used to report MPF contribution within the permitted period and does not contribute to balance accumulators. |

Regular MPF Deduction |

Regular MPF deductions are used for regular deduction processing in payroll and contribute to balance accumulators. There are two deduction elements. One element resolves the amount for payroll and the other resolves for reporting. |

The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Hong Kong. Instructions for running the query are provided in the PeopleSoft HCM: Global Payroll.