Implementing MPF Industry Schemes

This topic discusses:

Overview of MPF industry schemes.

Delivered supporting elements.

Delivered earnings.

Delivered deductions.

Identifying industry scheme participants.

Delivered element groups.

Payroll processing.

Note: The pages shown is these topics are documented in PeopleSoft HCM: Global Payroll.

Industry schemes are designed to make MPF participation more convenient for employers and casual employees in the construction and catering industries. Casual employees who work for an employer in the catering or the construction industries, and are employed on a day-to-day basis, or for a fixed period of less than 60 days, are eligible to join. Employers in the catering or construction industries are required to enroll casual employees in an MPF scheme regardless of the length of the employment period.

Global Payroll for Hong Kong provides these supporting elements to handle contribution calculations for MPF industry schemes:

Variables

MPF VR IND CALBGN

MPF VR IND CALEND

MPF VR IND EE CNTR

MPF VR IND ER CNTR

MPF VR IND NDLAVG

MPF VR IND NDLY EE

MPF VR IND PIVAL

MPF VR IND PRMENDT

MPF VR IND PRMSTDT

MPF VR IND REGDATE

MPF VR IND REGDAYS

MPF VR IND REGENDT

MPF VR IND REGSTDT

MPF VR IND EEUNIT

MPF VR IND ERUNIT

MPF VR IND WRKENDT

MPF VR IND WRKSTDT

MPF VR IND PERDAYS

MPF VR IND UNITS

MPF VR IND TEMPDT

MPF VR IND PYEOVRD

MPF VR IND BGNDT

MPF VR IND ENDDT

MPF VR IND TMPDAYS

Dates

MPF DT IND PRMEDT

MPF DT IND REGSTDT

MPF DT IND TEMPDT

Brackets

MPF BR IND CSL DLY

MPF BR IND CSLNDLY

Proration Rules

MPF PO IND ERNSLC

Arrays

MPF AR IND PIUNIT

Formula

MPF FM IND WRKINIT

MPF FM IND PRM DED

MPF FM IND INIT

MPF FM IND RLV INC

MPF FM IND PERDAYS

MPF FM IND REG PER

MPF FM IND REGDAYS

MPF FM IND NDLPMRT

MPF FM IND NDLRGRT

MPF FM IND NDLRERT

MPF FM IND PERTYP

MPF FM IND EEDLYPM

MPF FM IND EEDLYRG

MPF FM IND EENDLPM

MPF FM IND EENDLRG

MPF FM IND ERDLYPM

MPF FM IND ERDLYRG

MPF FM IND ERNDLPM

MPF FM IND ERNDLRG

MPF FM IND EEDLYVL

MPF FM IND ERDLYVL

MPF FM IND EENDLVL

MPF FM IND ERNDLVL

MPF FM IND RPT

MPF FM IND PIVAL

MPF FM IND WRKCNT

MPF FM IND RGLDAYS

MPF FM IND NDLRGUT

MPF FM IND NDLREUT

MPF FM IND NDLPMUT

MPF FM IND NDLPRUT

Generation Control

MPF GC EE-ER PRM

MPF GC EE-ER REG

Duration

MPF DR IND CALDAYS

MPF DR IND WRKDAYS

Accumulators

MPF AC IND TOTDED

MPF AC IND PIUNIT

MPF AC IND EEDAYS

MPF AC IND ERDAYS

Count

MPF CT IND WRKDAYS

The system delivers these earning elements for MPF industry schemes:

|

Earning Element |

Description |

||

|---|---|---|---|

|

DLYCSLERN |

PreProcessFM |

MPF FM IND WRKINIT |

This is the earning element for casual daily paid employees. The associated calculation rule is Rate x Unit. Hong Kong’s MPF industry scheme has been implemented to accept override for the unit value in the Defining Payee Overrides. |

|

Rate |

DAILY RT |

||

|

Proration Rule |

MPF PO IND ERNSLC |

||

|

Component |

DLYCSLERN_UNIT |

||

|

Component |

DLYCSLERN_RATE |

||

|

Auto Gen AC |

DLYCSLERN_CPTDA |

||

|

Auto Gen AC |

DLYCSLERN_CPTDU |

||

|

Auto Gen AC |

DLYCSLERN_CYTDA |

||

|

Auto Gen AC |

DLYCSLERN_CYTDU |

||

|

NDLYCSLERN |

PreProcessFM |

MPF FM IND WRKINIT |

This is the earning element for casual non-daily paid employees. The associated calculation rule is Rate x Unit. Hong Kong’s MPF industry scheme has been implemented to accept override for the unit value in the Defining Payee Overrides. |

|

Rate |

DAILY RT |

||

|

Proration Rule |

MPF PO IND ERNSLC |

||

|

Component |

NDLYSCLERN_UNIT |

||

|

Component |

NDLYCSLERN_RATE |

||

|

Auto Gen AC |

NDLYCSLERN_CPTDA |

||

|

Auto Gen AC |

NDLYCSLERN_CYTDA |

||

|

Auto Gen AC |

NDLYCSLERN_CYTDU |

||

The two system-delivered earning elements, DLYCSLERN and NDLYCSLERN, use the calculation rule Rate x Unit to compute MPF contributions. In this rule:

Rate is the system element DAILY RT.

Unit is the override value that is defined at the payee level (on the Element Assignment By Payee page). In case of period segmentation, the overrides are to be specified for each segment with the begin date the same as the segment begin date.

For retro calculations, rate changes should be done using the Job-Compensation component, whereas unit changes need to be made on the Defining Payee Overrides.

Note: MPF calculations are based on the daily rate (for daily-paid employees) or average daily rate (for non-daily-paid employees). Deduction rates are determined using brackets, which depend on their respective daily rates.

If positive input is to be used to override calculation rules, then it has to be selected as an override level for both earning and deduction elements.

The system delivers these deduction elements for MPF industry schemes:

|

Casual Daily Deduction Elements for MPF Contributions |

Description |

||

|---|---|---|---|

|

EEMPFDLYPRM |

Gen Control |

MPF GC EE-ER PRM |

Employee MPF contribution during permitted period. |

|

Rate |

MPF VR IND EE CNTR |

||

|

Unit |

MPF FM IND PERDAYS |

||

|

Component |

EEMPFDLYPRM_UNIT |

||

|

Component |

EEMPFDLYPRM_RATE |

||

|

Auto Gen AC |

EEMPFDLYPRM_CYTDA |

||

|

Auto Gen AC |

EEMPFDLYPRM_CPTDU |

||

|

EEMPFDLYREG |

Gen Control |

MPF GC EE-ER REG |

Employee MPF contribution during regular period. |

|

PreProcessFM |

MPF FM IND RLV INC |

||

|

Rate |

MPF VR IND EE CNTR |

||

|

Unit |

MPF FM IND REGDAYS |

||

|

Component |

EEMPFDLYREG_UNIT |

||

|

Component |

EEMPFDLYREG_RATE |

||

|

Auto Gen AC |

EEMPFDLYREG_CYTDA |

||

|

Auto Gen AC |

EEMPFDLYREG_CYTDU |

||

|

ERMPFDLYPRM |

Gen Control |

MPF GC EE-ER PRM |

Employer MPF contribution during permitted period. |

|

PreProcessFM |

MPF FM IND RLV INC |

||

|

Rate |

MPF VR IND ER CNTR |

||

|

Unit |

MPF FM IND PERDAYS |

||

|

Component |

ERMPFDLYPRM_UNIT |

||

|

Component |

ERMPFDLYPRM_RATE |

||

|

Auto Gen AC |

ERMPFDLYPRM_CYTDA |

||

|

Auto Gen AC |

ERMPFDLYPRM__CYTDU |

||

|

ERMPFDLYREG |

Gen Control |

MPF GC EE-ER REG |

Employer MPF contribution during regular period. |

|

PreProcessFM |

MPF FM IND RLV INC |

||

|

Rate |

MPF VR IND ER CNTR |

||

|

Unit |

MPF FM IND REGDAYS |

||

|

Component |

ERMPFDLYREG_UNIT |

||

|

Component |

ERMPFDLYREG_RATE |

||

|

Auto Gen AC |

ERMPFDLYREG_CYTDA |

||

|

Auto Gen AC |

ERMPFDLYREG_CYTDU |

||

|

EEMPFDLVOL |

Auto Gen AC |

EEMPFDLVOL_CPTDA |

Employee voluntary MPF contribution, if any, should be input using the Positive Input. |

|

Auto Gen AC |

EEMPFDLVOL_CYTDA |

||

|

ERMPFDLVOL |

Auto Gen AC |

EEMPFDLVOL_CPTDA |

Employer voluntary MPF contribution, if any, should be input using the Positive Input. |

|

Auto Gen AC |

EEMPFDLVOL_CYTDA |

||

Note: The system uses element DAILY RT to gather the contribution rate. MPF contribution is calculated using this formula:

MPF Contribution = Contribution Rate * (number of days in the relevant contribution period)

|

Casual Non-Daily Deduction Elements for MPF Contributions |

Description |

||

|---|---|---|---|

|

EEMPFNDLYPRM |

Gen Control |

MPF GC EE-ER PRM |

Employee MPF contribution during permitted period. |

|

Rate |

MPF FM IND NDLPMRT |

||

|

Unit |

MPF FM IND NDLPMUT |

||

|

Component |

EEMPFNDLPRM_UNIT |

||

|

Component |

EEMPFNDLPRM_RATE |

||

|

Auto Gen AC |

EEMPFNDLPRM_CYTDA |

||

|

EEMPFNDLREG |

Gen Control |

MPF GC EE-ER REG |

Employee MPF contribution during regular period. |

|

Rate |

MPF FM IND NDLRGRT |

||

|

Unit |

MPF FM IND NDLRGUT |

||

|

Component |

EEMPFNDLREG_UNIT |

||

|

Component |

EEMPFNDLREG_RATE |

||

|

Auto Gen AC |

EEMPFNDLREG_CYTDA |

||

|

ERMPFNDLPRM |

Gen Control |

MPF GC EE-ER PRM |

Employer MPF contribution during permitted period. |

|

Rate |

MPF FM IND NDLPMRT |

||

|

Unit |

MPF FM IND NDLPRUT |

||

|

Component |

ERMPFNDLPRM_UNIT |

||

|

Component |

ERMPFNDLPRM_RATE |

||

|

Auto Gen AC |

ERMPFNDLPRM_CYTDA |

||

|

ERMPFNDLREG |

Gen Control |

MPF GC EE-ER REG |

Employer MPF contribution during regular period. |

|

Rate |

MPF FM IND NDLRGRT |

||

|

Unit |

MPF FM IND NDLREUT |

||

|

Component |

ERMPFNDLREG_UNIT |

||

|

Component |

ERMPFNDLREG_RATE |

||

|

Auto Gen AC |

ERMPFNDLREG_CYTDA |

||

|

EEMPFNDLVOL |

Auto Gen AC |

EEMPFNDLVOL_CPTDA |

Employee voluntary MPF contribution amounts, if any, should be input using the positive input. |

|

Auto Gen AC |

EEMPFNDLVOL_CYTDA |

||

|

ERMPFNDLVOL |

Auto Gen AC |

ERMPFNDLVOL_CPTDA |

Employer voluntary MPF contribution amounts, if any, should be input using the positive input. |

|

Auto Gen AC |

ERMPFNDLVOL_CYTDA |

||

Note: Contribution rate is derived using the average daily income, in other words:

Contribution Rate = Total Earning / Period Days

Subsequently, the system uses element DAILY RT to calculate the relevant income and then MPF contribution using this formula:

Relevant Income = DAILY RT * (number of days in the relevant contribution period)

MPF Contribution = Relevant Income * Contribution Rate

PeopleSoft uses these variable elements to identify employees who participate in MPF industry schemes:

MPF VR CASUAL FLG

Setting the character value is set to Y indicates that employees participate in industry schemes.

If the value is set to N, employees are participants of master trust schemes.

MPF VR IND DLY EE

Setting the character value is set to Y indicates that employees are casual workers who are paid daily.

MPF VR IND NDLY EE

Setting the character value is set to Y indicates that employees are casual workers who are not paid daily. They can be paid weekly, biweekly or monthly.

As mentioned earlier, MPF contributions for casual employees are calculated differently based on their payment schedules (daily and non-daily). Use these variable elements to specify casual employees’ pay schedules at the pay group level on the Defining Payee Overrides.

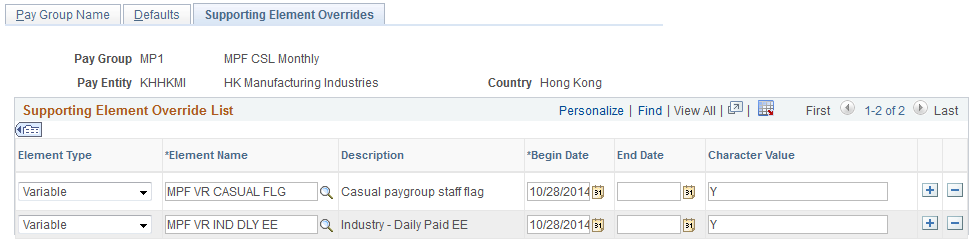

This example illustrates the fields and controls on the Supporting Element Overrides page showing MPF VR CASUAL FLG and MPF VR IND DLY EE elements.

Enter Y for both variables to indicate that employees are casual workers who are paid daily.

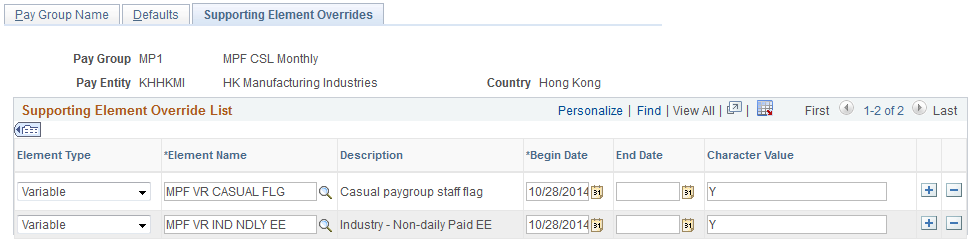

This example illustrates the fields and controls on the Supporting Element Overrides page showing MPF VR CASUAL FLG and MPF VR IND NDLY EE elements.

Enter Y for both variables to indicate that employees are casual workers who are not paid daily.

Note that the system does not deliver pay groups for industry schemes; you need to use existing or create new ones.

Note: It is not necessary to define and specify proration rules at the pay group level. The system delivers a proration rule (MPF PO IND ERNSLC) for industry schemes. This proration rule is based on the unit override value that is specified on the Defining Payee Overrides and the working days in the period. It is used at the MPF deduction element level, and prorates based on the unit override value (set at the payee level) and the working days instead of calendar days.

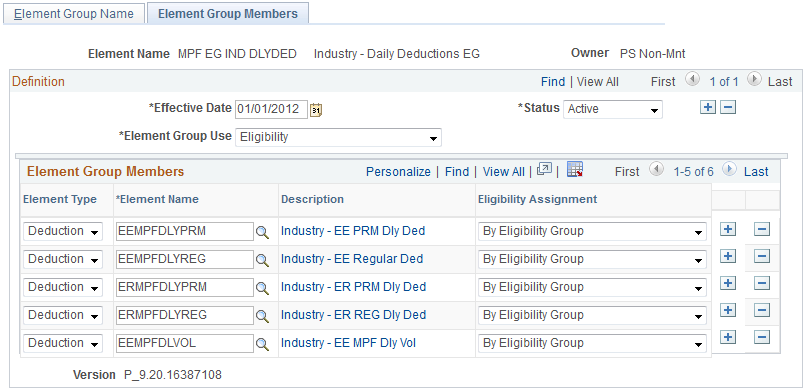

PeopleSoft delivers these element groups for use in MPF industry schemes:

MPF EG IND DLYDED

This element group is created for casual daily deduction elements.

MPF EG IND DLYERN

This element group is created for the casual daily earning element.

MPF EG IND NDLYDED

This element group is created for casual non-daily deduction elements.

MPF EG IND NDLYERN

This element group is created for the casual non-daily earning element.

Note that the system does not deliver eligibility groups for industry schemes; you need to use existing or create new ones.

This example illustrates the fields and controls on the Element Group Members page showing elements included in the MPF EG IND DLYDED group.

The payroll process identifies all employees who participate in industry schemes using three variable elements (or flags) that are specified at the pay group level. These elements are also used to resolve earnings and deductions for employees.

All deduction elements have a generation control to check the MPF VR IND DLY EE and MPF VR IND NDLY EE flags. Generation control results in true if the appropriate flag is set to Y. For example, all MPF deduction elements for daily paid casual employees have a generation control that checks for the MPF VR IND DLY EE flag. If the flag value is Y, then it resolves the deduction element. Similarly, for non-daily-paid casual employees, the corresponding generation control checks the MPF VR IND NDLY EE flag.

Permitted Period Date Variables

The permitted period date values are stored in these variables:

MPF VR IND PRMSTDT

MPF VR IND PRMENDT

The formula MPF FM IND INIT sets these variables with the permitted period start and end dates. If the employee does not qualify for the permitted period deductions, then these variables will be set to 01/01/1900.

Regular Period Date Variables

The regular period date values are stored in these variables:

MPF VR IND REGSTDT

MPF VR IND REGENDT

The formula MPF FM IND INIT populates values for these variables with the regular period start and end dates.

Working Period Date Variables

The working period date values are stored in these variables:

MPF VR IND WRKSTDT

MPF VR IND WRKENDT

The formula MPF FM IND WRKINIT sets these variables with the employees working period start and end dates. For employees hired in previous periods, these dates are the same as period begin and end dates. However, for employees hired in the current period, the work begin date is the hire date.

Permitted and Regular Period Days

These formulas are used to calculate permitted and regular period days:

The formula MPF FM IND PERDAYS calculates the days in permitted period.

The formula MPF FM IND REGDAYS calculates the days in regular period for employee contributions.

The formula MPF FM IND RGLDAYS calculates the days in regular period for employer contributions.

Daily and Non-Daily Paid Casual MPF Contribution Rates

The system delivers these brackets for MPF industry schemes:

The bracket MPF BR IND CSL DLY maintains the MPF contribution rates for employee and employer for daily-paid casual employees.

The bracket MPF BR IND CSLNDLY maintains the MPF contribution rates for employee and employer for non-daily-paid casual employees.