Generating Payslips and General Reports

This topic provides an overview of payslips.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_RC_AL01_1 |

Run the Payslip report for Global Payroll Switzerland. |

|

|

Payslip Elem. View (payslip elements view) Page |

GPCH_RC_AL01_2 |

Specify additional currencies used to print special earnings. |

|

GPCH_RP_INQ_PYSLIP |

View the Swiss version of the online payslip. |

|

|

GP_SS_PSLP_OPTIONS |

Enable online payslip printing using the View Payslip self-service transaction, and enable mobile payslip access. |

|

|

GP_ELN_SET |

Define elements and components, and sort order. For more information, see Assigning and Viewing Print Classes. |

|

|

GPCH_RC_ST01 |

Run the BESTA Employment Statistics report (GPCHST01.SQR). The Federal Office for Statistics requires all enterprises that employ people in Switzerland to indicate quarterly the employment numbers and a business outlook. This report satisfies that requirement. The SQR generates both a printed report and a file for electronic transfer. |

|

|

GPCH_RC_AL02 |

Reconciliate values from Payroll, Bank Transfer and GL Interface |

|

|

GPCH_RC_AL08 |

Records the payroll process by defining all earnings and deductions for a specific month and the current year to date. |

Global Payroll for Switzerland enables you to generate and adapt payslips to meet your needs. You can also send a message (printed on the payslip) to an individual payee or to payees belonging to designated pay groups, locations, or departments.

The system generates an additional row per earning marked with an asterisk for the total of the retro results. Employee and pay summary data for the given month are printed in the header. This includes date of birth, starting date with the organization, location, department, religion, bank account details, currency in which the earnings are to be paid, and holiday entitlement for the remainder of the year. The run control for the payslip is a two-page component consisting of the Payslip Options page and the Payslip Element View page.

Global Payroll for Switzerland enables you to generate and adapt payslips to meet your needs. To support archiving and specific layout and printing needs, the design of the standard payslip supports the separation of data storage and data presentation.

In the first step the system creates an XML file and stores it in the GPCH_RP_AL10ONL record. A user can then view the XML file in their browser using the standard Stylesheet (XSL) GPCH_STYLE_KW1. Users can also create a PDF file from the XML and then print it.

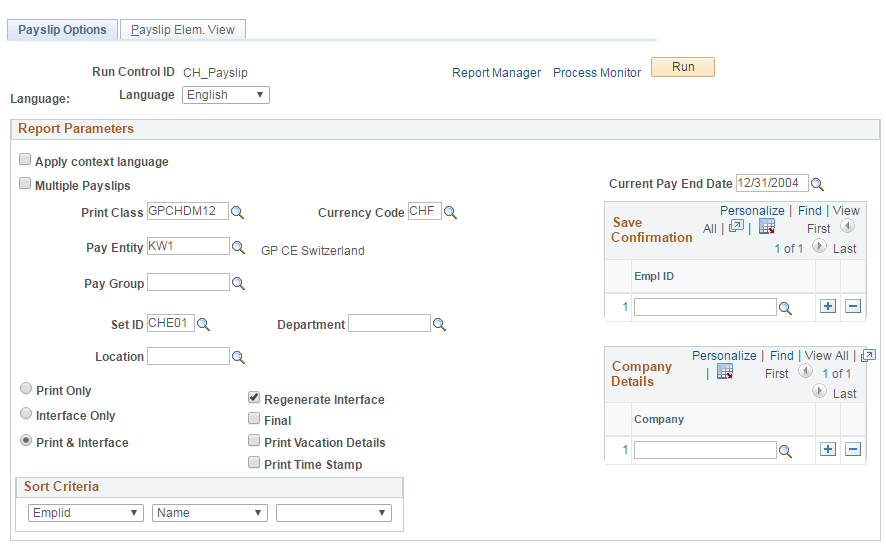

Use the Payslip Options page (GPCH_RC_AL01_1) to run the Payslip report for Global Payroll Switzerland.

Navigation:

Payslip Options page

Note: Define the elements that you want to display in multiple currencies on your payslip. You may want to see the values of some elements (gross and net, for example) in a different currency. This is especially useful for organizations in countries participating in the EMU—you can display key amounts in both the local currency and the Euro.

Field or Control |

Description |

|---|---|

Language |

Payslip supports these languages: English, French, German, and Italian. For languages that are not supported, the system automatically uses the base language. |

Apply Context Language |

The payslip is printed in the language of the employee. |

Multiple Payslips |

Select to print payslips for more than one month in a single request. When you select this option, all fields on the page except Print Class, Pay Entity, From Date, Current Pay End Date and EmplID are hidden. Enter the from date and the current pay end date and select the employees for whom you want to print the payslips. Note: When you select this option you cannot create new payslips. You can only print payslips that have been previously generated. |

Print Class |

Select a print class. The system includes two standard print classes, although you can create your own. |

Currency Code |

Select the currency in which to print the payslip. The system performs a currency conversion in case the processing currency isn't the specified currency. |

Sort Criteria |

Select sort criteria. Values include Canton, Company, Deptid (department ID), Empid (employee ID), Location, Name, and PayGroup. |

Print Only, Interface Only, and Print & Interface |

The Print Only option always uses the interface record as its source. Select the Print Only option if the report has already been run with either the Interface Only or the Interface & Print option selected. The Print Option creates PDF output. The Interface Only option creates only an interface record that stores the data as XML |

Regenerate Interface |

Select to regenerate the interface. When you run the payslip with the Interface Option selected, the process compares timestamps of the payroll (GP_PYE_SEG_STAT) and the Interface record. If the timestamps are identical, the system does not generate a new version. If you need a new version due to a change on the setup for earning description or message generation, you can force the regeneration, even if no payroll happened in between (as long as the period isn't finalized). |

Final |

Select to finalize the pay period. Once the period is finalized, you cannot change it any longer. The payslip is frozen. |

Print Vacation Details |

Select to print vacation details in the upper right corner of the payslip. |

Print Time Stamp |

Select to print the timestamp of the generation in the footer of the payslip. |

To create the Swiss version of the online payslip follow these steps:

Click Run.

The system displays the Process Scheduler Request page.

Select the Payslip Delta check box.

Click OK.

Note: Selecting the Online Payslip CHE job check box on the Process Scheduler Request page creates the same PDF as PDF Delta SQR. The system, however, uses a GP Core process to create the online payslip and the mobile payslip (if both were enabled during ePay setup) and then makes it available for self service and mobile access.

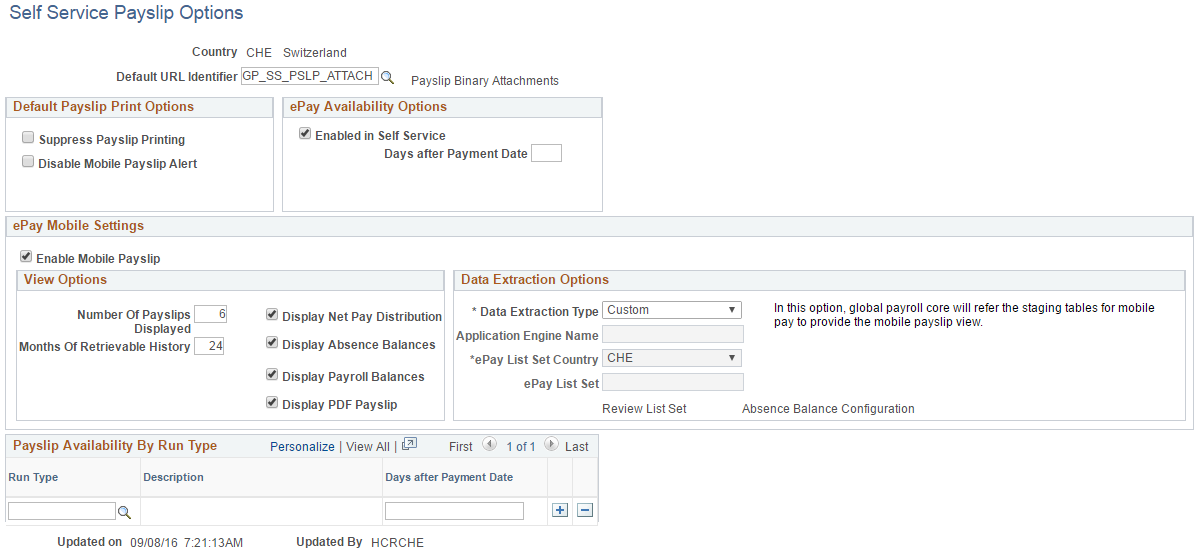

This is an example of how to set up the Self Service Payslip Options for Global Payroll for Switzerland

The default URL to determine the location of the PDF (FTP or attachment) is set to GP_SS_PSLP_ATTACH to store the generated PDF files as an attachment in the database.

For more information, see the product documentation for the Self Service Payslip Options Page.

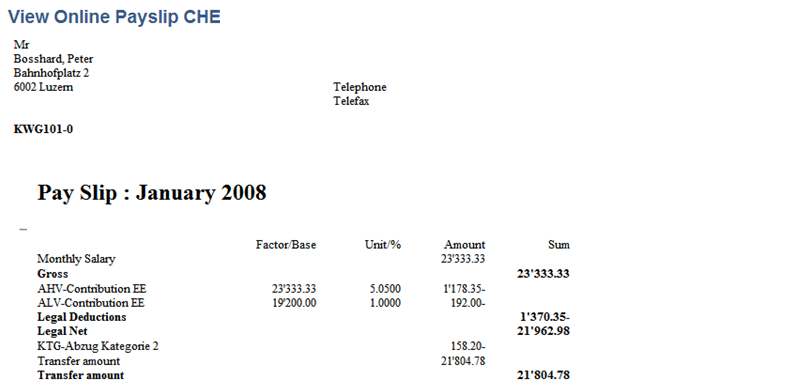

Use the View Online Payslip CHE page (GPCH_RP_INQ_PYSLIP) to view the Swiss version of the online payslip.

Navigation:

View Online Payslip CHE

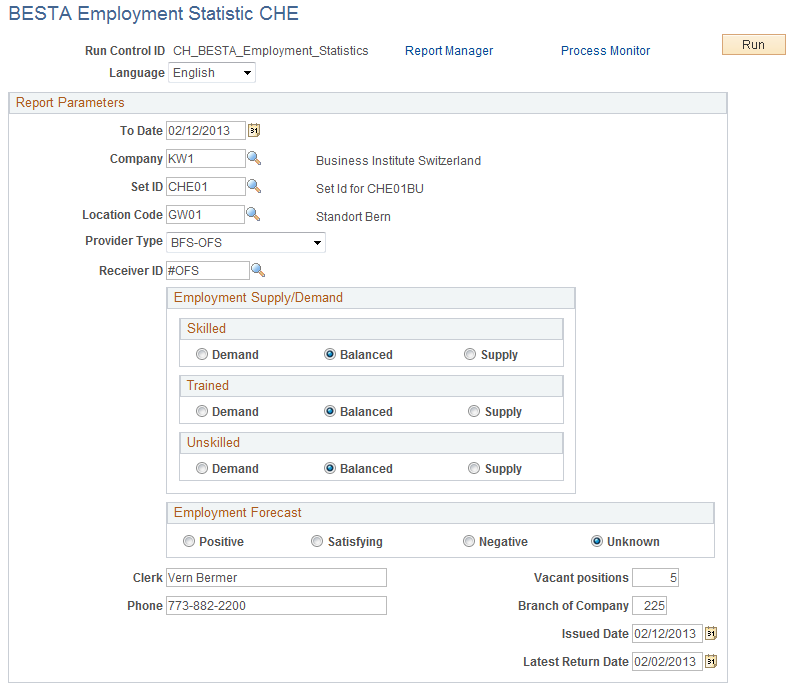

Use the BESTA Employment Statistic CHE page (GPCH_RC_ST01) to run the BESTA Employment Statistics report (GPCHST01).

SQR). The Federal Office for Statistics requires all enterprises that employ people in Switzerland to indicate quarterly the employment numbers and a business outlook. This report satisfies that requirement. The SQR generates both a printed report and a file for electronic transfer.

Navigation:

BESTA Employment Statistic CHE page

Field or Control |

Description |

|---|---|

Employment Supply/Demand |

For each category of labor (Skilled, Trained, Unskilled) select the best description of the forecast of availability of employees in the next quarter.

|

Employment Forecast |

Select the best description of the employment prospect for the next three months. |

Vacant positions |

Enter the number of vacant positions. |

Clerk |

Enter the name of the person to be contacted by the Federal Office for Statistic. |

Phone |

Enter the contact phone number of the person designated as clerk. |

Branch of Company |

Enter the branch that the contact person works in. |

Latest Return Date |

Enter the required return date as defined by the Federal Office for Statistic. |

Note: The report will also include the BUR number from the Company Location CHE page.

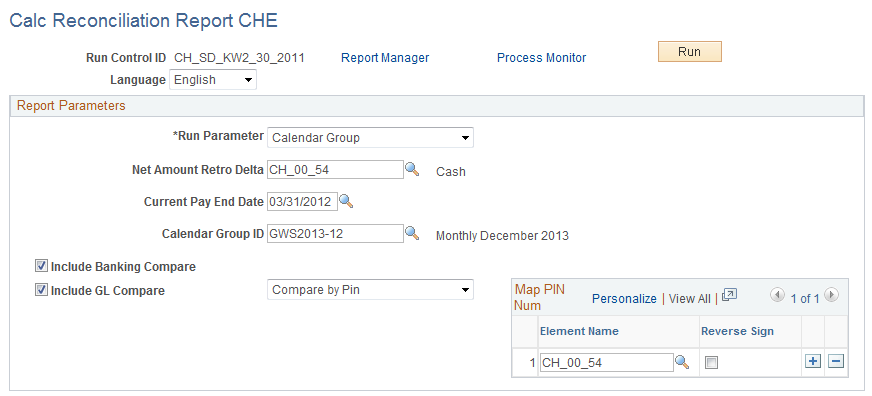

Use the Calc Reconciliation Report CHE page (GPCH_RC_AL02) to run the Calc Reconciliation Report.

Navigation:

Calc Reconciliation Report CHE page

Field or Control |

Description |

|---|---|

Run Parameter |

Select either Calendar Group or Pay Entity (if you want to run the report for a single pay entity). |

Net Amount Retro Delta |

Select the accumulator assigned in the process list as net payment. |

Current Pay End Date |

Enter the pay end date for reconciliation. |

Calendar Group ID and Pay Entity |

Depending on run parameter that you select, enter either the calendar group or the pay entity that you want to use to run the report. |

Include Banking Compare |

Select if you want to include the banking amounts. |

Include GL Compare |

Select if you want the GL amounts included. If you select this check box, select either Compare by Account or Compare by PIN. |

Map PIN Num and Map Account |

Depending on the mode you selected in the Include GL Compare field, the system displays either the Map PIN Num group box or the Map Account group box. Enter the PIN or the account that you want to use for the report. You can add multiple PINs or accounts by adding additional rows. |

Reverse Sign |

Select to compare amounts that need to be reversed. This process depends on the way the targeted interface handles credits and debits. |

Use the Pay El. Sum. Month (pay element summary month) page (GPCH_RC_AL08) to records the payroll process by defining all earnings and deductions for a specific month and the current year to date.

Navigation:

Pay El. Sum. Month (pay element summary month) page

Note: To provide more detailed information about the reporting unit, select the Address tab. If any address is displayed on this page, the system displays it in the header of the report.

Field or Control |

Description |

|---|---|

Print Class |

Select the print class that you want to use for your report |

Current Pay End Date |

Select the date to which you want to run the report within the year. |

Pay Entity |

Select the pay entity that you want to use for the report. |

Set ID |

if you want to select a department or location, you must first select a set ID. |

Department |

Select a department. If you use this field, you must also select a set ID. |

Print Detail Report |

Select this check box if you want the retro value displayed per retro month on the report. |

Company |

If you use pay entity as a legal entity, select the subset for the company |