Defining Company Social Insurance Contributions

This topic provides an overview on Company SI Contributions and Legal Daily Payment Calculations.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_SI_COMPANY1 |

Set up social insurance data for old age and survivors' insurance (AHV) and unemployment insurance (ALV). |

|

|

GPCH_SI_COMPANY2 |

Set up provider information for social insurance programs, including retirement and survivors' pension insurance, unemployment insurance, fund family benefits, and accident insurance. |

|

|

GPCH_SI_COMPANY8 |

Set up pension fund data that the company is providing to workers. |

|

|

GPCH_SI_COMPANY4 |

Set up tax data for social insurance programs that are being provided by the organization since the year 2006. Before 2006 the system provided a different tax statement. |

|

|

GPCH_SI_COMPANY5 |

Set up message information that will appear on the tax reports for workers from individual cantons or all cantons. |

|

|

GPCH_SI_COMPANY6 |

Enter the payslip style that you want to use to pay workers. |

|

|

GPCH_SI_COMPANY7 |

Enter details regarding the organization sending report information to different legal entities in different countries. You can use this page to enter different information according to the language that is being used by the organization to which you are sending the information. |

|

|

GPCH_SI_DATA |

Display and change social insurance data for individual employees. You can view and change retirement and survivors' pension insurance data (AHV) and unemployment insurance data (ALV). |

Use the Company SI Contributions CHE (GPCH_SI_COMPANY) component to define company social insurance contributions and data specific to your company. This component enables you to manage AHV and ALV data as well as accident insurance and daily accident benefits insurance.

Note: You must maintain both Company SI 1 and Company SI 2 tables.

PeopleSoft supports daily payments for unemployment insurance, accident insurance, child allowance, and source tax. To accommodate these payments, PeopleSoft added the Daily Limit and Avg Work Days fields to the Rates page within the Swiss Company SI Contribution component.

In addition to entering the appropriate information in the Daily Limit and Avg Work Days fields, you must change an employee's compensation frequency to (D) Daily on the Compensation page (select Workforce Administration, Job Information, Job Data, Compensation).

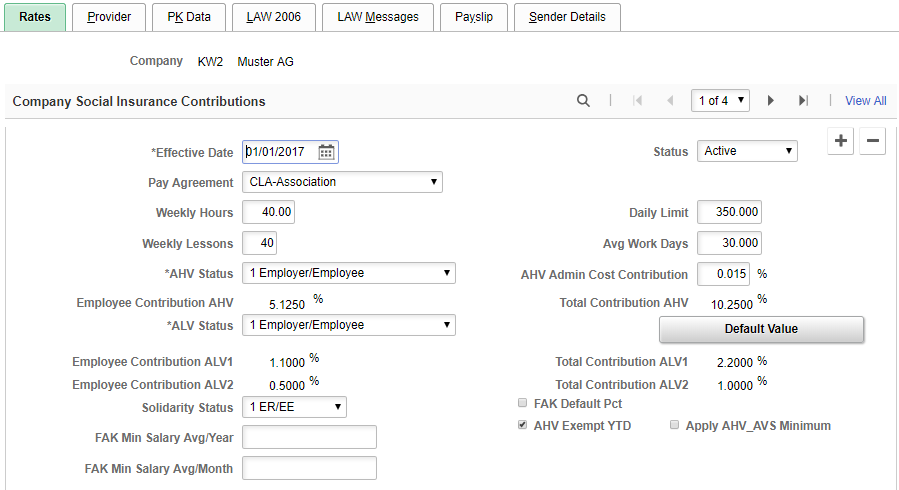

Use the Rates page (GPCH_SI_COMPANY1) to set up social insurance data for old age and survivors' insurance (AHV) and unemployment insurance (ALV).

Navigation:

Rates page

Field or Control |

Description |

|---|---|

Pay Agreement |

Select the Pay Agreement associated with the company social insurance contributions. Values are:

|

Weekly Hours |

Enter the number of hours employees generally work per week. |

Daily Limit |

Enter the ALV and UVG limit, which matches the number of average working days. For example, if the average working days for social insurance is 30, the daily limit should be 350; otherwise the amount needs to be agreed to by the provider. |

Weekly Lessons |

Enter the number of lessons. For some employees working time is counted in lessons (for example: teachers). In this case, enter the number of weekly lessons that employees usually work. Weekly lessons are entered as an integer (for example, .00). |

Avg Work Days |

Enter the average number of days an individual works in a week. |

AHV Status |

Select one of the these values to indicate the status of the retirement and survivors' pension insurance being offered by the organization:

|

AHV Admin Cost Contribution (AHV administration cost contribution) |

Enter the administrative clearing costs of the AHV agency, expressed as a percentage. |

Employee Contribution AHV |

Displays the percentage the employee contributes to retirement and survivors' pension insurance. |

Total Contribution AHV |

Displays the combined percentage the employee and employer contributes to retirement and survivors' pension insurance. |

ALV Status |

Select one of the these values to indicate the status of the unemployment insurance being offered by the organization:

|

Employee Contribution ALV1 |

Displays the percentage the employee contributes to (ALV) unemployment insurance. |

Total Contribution ALV1 |

Displays the combined percentage the employee and employers contributes to (ALV) unemployment insurance. |

Employee Contribution ALV2 |

Displays the percentage the employee contributes to (ALVZ) unemployment insurance. |

Total Contribution ALV2 |

Displays the combined percentage the employee and employers contributes to (ALVZ) unemployment insurance. |

Default Value |

Click to import the values defined at installation from the Social Insurance system tables. |

Solidarity Status |

Select the Solidarity tax distribution for the company. Values are: and

|

FAK Min Salary Avg/Year |

Minimum Salary per month to be eligible for Child Allowances |

FAK Min Salary Avg/Month |

Minimum Salary per year to be eligible for Child Allowances |

AHV_AVS Apply Minimum |

Check if in your company, AHV_AVS Salaries below minimum (defined in SI System data) are exempted from AHV_AVS. |

FAK Default PCT (Familienausgleichskasse default percentage) |

Select this check box if you want the system to use the default percentage for employer contribution to fund family benefits. |

AHV Exempt YTD (Alters-und Hinterlassenenversicherung exempt year-to-date) |

Select this check box if you want the system to exempt retirement and survivors' pension insurance for the year-to-date period. |

Note: You can override the ALV and AHV status on the Maintain Social Ins Data CHE page.

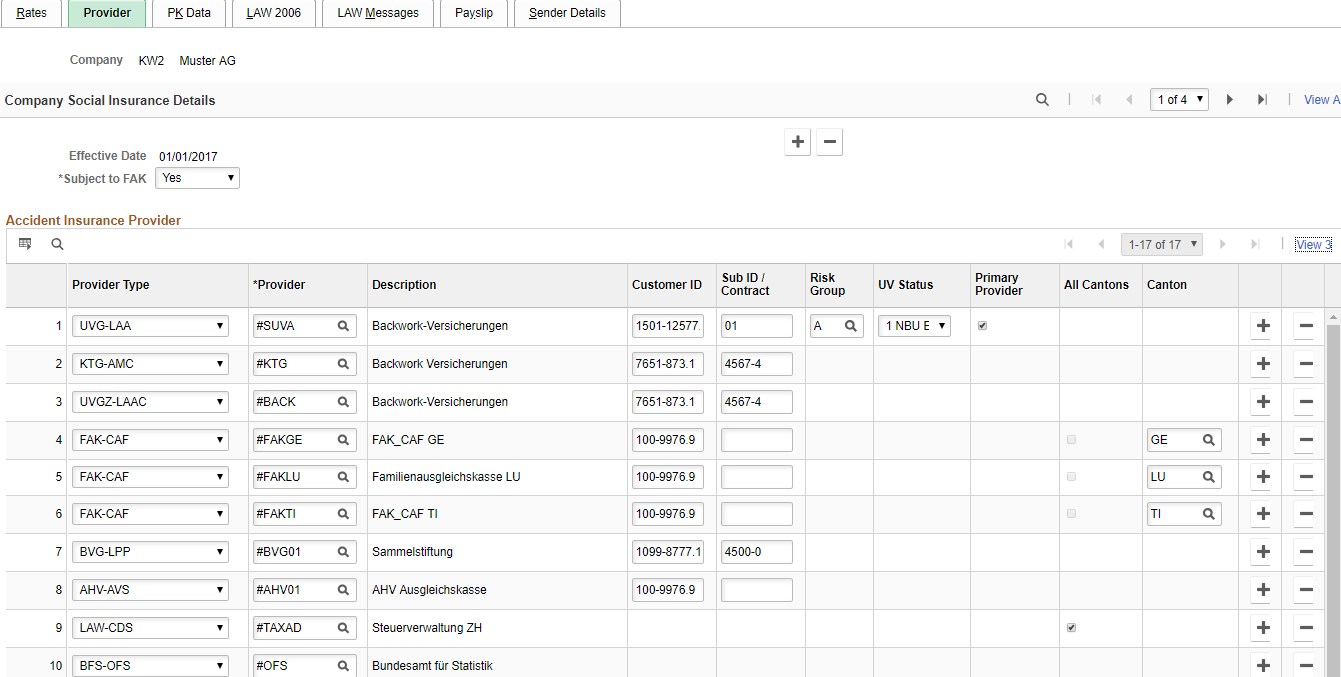

Use the Provider page (GPCH_SI_COMPANY2) to set up provider information for social insurance programs, including retirement and survivors' pension insurance, unemployment insurance, fund family benefits, and accident insurance.

Navigation:

Provider page

Field or Control |

Description |

|---|---|

Subject to FAK (subject to Familienausgleichskasse) |

Select either Yes or No to indicate if the provider is required to make contributions to fund family benefits. |

Provider Type |

Select the type of insurance being offered by provider you are entering (for example AHV-AVS, BFS-OFS, FAK-CAF, and so on). Abbreviations for Provider Types see Element Naming Conventions |

Provider and Description |

Select the name of the provider offering the insurance. The name of the provider appears in the Description field. Note: Depending on the provider type (and Run Mode), it is possible to display or hide fields Insurance ID, SubID/Contract, Risk Group, UV Status, Primary Provider, All Cantons, Canton. Only Customer ID for provider type AHV_AVS is declared mandatory. For others it’s customer’s responsibility to fill the editable fields. |

Customer ID |

Enter account assigned to you by your provider. |

Sub ID / Contract |

Enter the sub ID or contract number assigned to you by your provider.. |

Risk Group |

Default Risk Group (Betriebsteil) for UVG_LAA |

UV Status |

Default Status for UVG_LAA |

Primary Provider |

Select this check box if the provider is primary for the company. |

All Cantons |

Select this check box if all cantons are covered by the provider. |

Canton |

Select the specific canton that the provider is covering if they are not covering all cantons. |

Use the PK Data page (GPCH_SI_COMPANY8) to set up pension fund data that the company is providing to workers.

Navigation:

PK Data page

Provider Information

Field or Control |

Description |

|---|---|

PK Status |

Select either Calculate, Eligible, or Non Elig to indicate the provider's eligibility to provide pension fund data |

Provider Code and Description |

Select the code of the provider processing pension fund data. The name of the provider appears in the Description field. |

Lower Age, Upper Age for Man, and Upper Age for Woman |

Enter the correct ages in these fields. This information is required for both internal and external BVG (pension fund) calculations. |

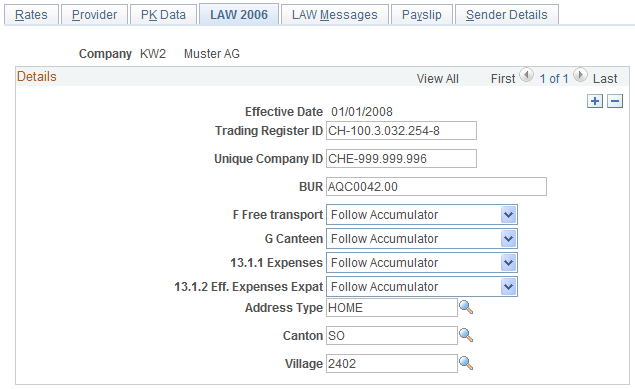

Use the LAW 2006 page (GPCH_SI_COMPANY4) to set up tax data for social insurance programs that are being provided by the organization since the year 2006.

Navigation:

LAW 2006 page

Field or Control |

Description |

|---|---|

Trading Register ID |

ID assigned by trading Register. |

UniqueCompanyID (UnternehmensIdentifikation) |

The unique company ID assigned by the statistics office |

BUR (Betriebs- und Unternehmensregisternumer) |

The location ID assigned by the statistics office. Here the BUR is just for information. For Swissdec reporting, the BUR from Company Location CHE is used instead. |

Free Transportation F |

In the tax statement form there is an F check box. This indicates if the person benefits for free transportation. On this page the system displays the default. |

Canteen G |

In the tax statement form there is a G check box. This indicates if the person receives canteen benefits, with a portion paid by the employer, or if the person receives a tax free meal allowance. On this page the system displays the default. |

Expenses 13.1.1 |

The system displays the default, whether that field on tax statement applies or not. |

Eff. expenses expat 13.1.2 |

The system displays the default, whether that field on tax statement applies or not. |

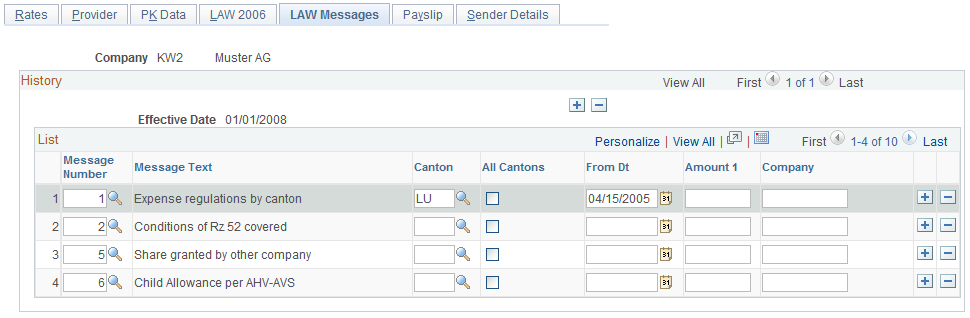

Use the LAW Messages page (GPCH_SI_COMPANY5) to set up message information that will appear on the tax reports for workers from individual cantons or all cantons.

Navigation:

LAW Messages page

Note: Use this page to define messages that are valid for the company in general or for specific cantons of the company. During message generation the system applies additional logic to decide whether this is a valid message for the dedicated employee. The system, however, only considers messages and cantons as declared here.

See Setting Up Tax Statements.

Field or Control |

Description |

|---|---|

Message Number and Message Text |

Select the message that you want to appear on the tax reports for an individual canton or all cantons. The text of the message appears in the Message Text field. |

Canton |

Select a canton. The system prints the message you selected on the tax reports for the particular canton indicated in the field. |

All Cantons |

Select this check box if you want the system to print the message you selected on the tax reports for the all cantons. |

From Dt (from date) |

Select the date from which you want the message to appear. |

Amount 1 and Company |

Some messages are reported with a fixed amount (for example, reallocation cost of CHF 2000.00). If the message in question is declared as generate always, then the amount from this page is reported. More see as well in chapter 19 Generating and reviewing |

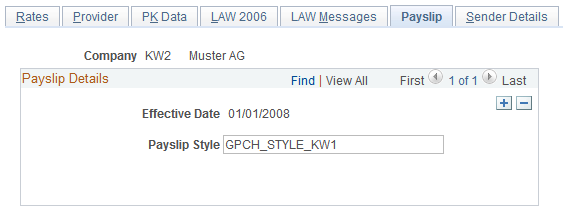

Use the Payslip page (GPCH_SI_COMPANY6) to enter the payslip style that you want to use to pay workers.

Navigation:

Payslip page

PeopleSoft enables you to print payslips for monthly salaries and bonuses. Because the format of payslips varies greatly from one organization to another, we provide one format as an example. We also provide a template that enables you to customize the format to accommodate the payslip style your organization uses. You can also print a message on the payslip to an individual payee or groups of payees.

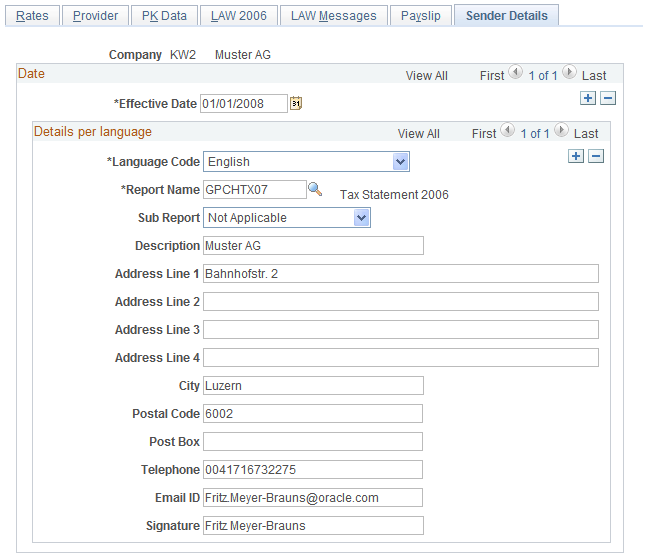

Use the Sender Details page (GPCH_SI_COMPANY7) to enter details regarding the organization sending report information to different legal entities in different countries.

You can use this page to enter different information according to the language that is being used by the organization to which you are sending the information.

Navigation:

Sender Details page

Field or Control |

Description |

|---|---|

Language Code |

Select the language in which you want the information sent. |

Report Name |

Select the report you are sending. |

Sub Report |

Select the name of the sub report you are sending. This field is optional. |

Description |

Enter a description for the report. |

Address Line 1, Address Line 2, Address Line 3, and Address Line 4 |

Use these fields to enter address information for the company that is sending the information. |

City, Postal Code, Post Box, Telephone, Email ID, and Signature |

Use these fields to enter identifying information for the company that is sending the information. |

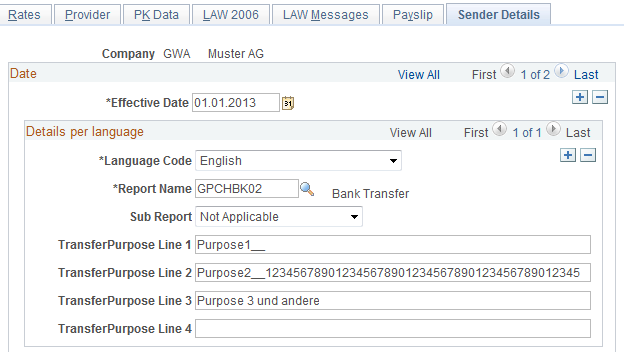

In case the user selects the setup for banking report (GPCHBK01), the layout will change as below:

Company SI Contributions CHE page - Sender Details

Field or Control |

Description |

|---|---|

Transfer Purpose Line 1 |

Fills the Transfer Purpose 1 in DTA file for Banking |

Transfer Purpose Line 2 |

Fills the Transfer Purpose 2 in DTA file for Banking |

Transfer Purpose Line 3 |

Fills the Transfer Purpose 3 in DTA file for Banking |

Transfer Purpose Line 4 |

Not supported. |

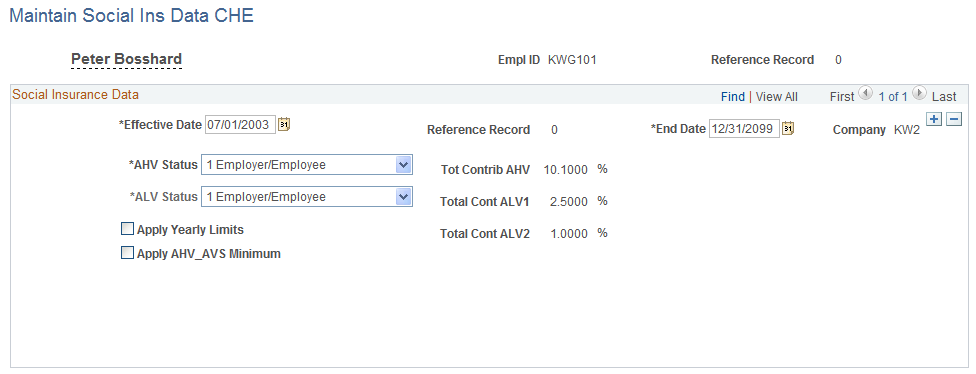

Use the Maintain Social Ins Data CHE page (GPCH_SI_DATA) to display and change social insurance data for individual employees.

You can view and change retirement and survivors' pension insurance data (AHV) and unemployment insurance data (ALV).

Navigation:

Maintain Social Ins Data CHE page

Field or Control |

Description |

|---|---|

End Date |

Enter an end date if you want to display data for a restricted period of time. |

AHV Status |

Stati are: 0 = not eligible, 1 = shared payment, 2 = paid by employer (2 triggers automatically a NetToGross calculation) |

ALV Status |

Stati are: 0 = not eligible, 1 = shared payment, 2 = paid by employer |

Apply Yearly limits |

Overrides Default value from Company |

Apply AHV_AVS Minimum |

Overrides Default value from Company |

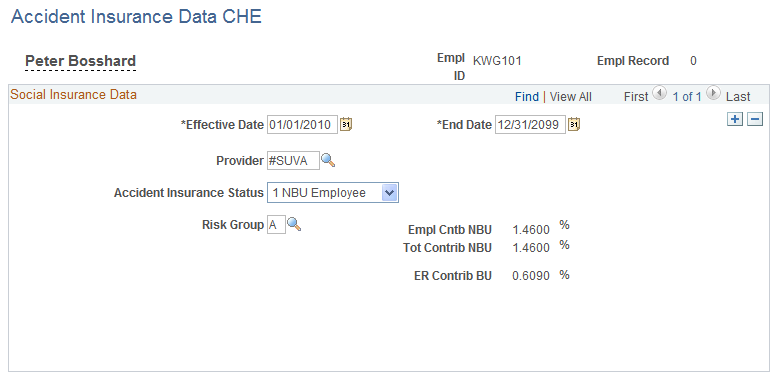

Use the Accident Insurance Data CHE page (GPCH_SI_ACC_INS) to enter accident insurance data.

Navigation:

Accident Insurance Data CHE page

Field or Control |

Description |

|---|---|

Provider |

Select the provider that is overriding the employee's accident insurance. |

Accident Insurance |

Select one of the these values to override the default company status of the accident insurance: Status

|

Risk Group |

Select the classification for your company. Insurance providers and employers decide which employees belong to which group. Possible entries are A, B, and Z. |

Total Contr EmployeeTotal Contr NBU (total contributions NBU) |

Displays the total contributions for accident insurance covered by employee Displays the total contributions for accident insurance liability (NBU) as a percentage. |

ER Contr BU (employer contributions BU) |

Displays the employer's contribution for employer liability insurance (BU). |