Tax Reports

Tax Reports

This chapter provides an overview of tax reports and discusses how to generate tax reports.

See Also

Tax Reports

Tax Reports

PeopleSoft Global Payroll for China delivers two tax reports:

The Individual Income Tax Withholding Report is a summary monthly report of income, deductions, and taxes for all payees that must be submitted to the tax authorities within seven days after the end of the current month.

The Tax Withholding Detail Report is a detailed monthly report of income, deductions, and taxes for all payees. It is a supplement to the Individual Income Tax Withholding Report.

The reports are designed in accordance with Article 9 of the Individual Income Tax Law of the People's Republic of China. The State Administration of Taxation (SAT) issues general formats for these tax return reports, but each province or city directly under the central government can design their own format based on the regulations issued by the SAT. PeopleSoft Enterprise Global Payroll for China provides the general formats as issued by the SAT.

The system extracts data for both of these reports using the Report Data feature.

Process Flow

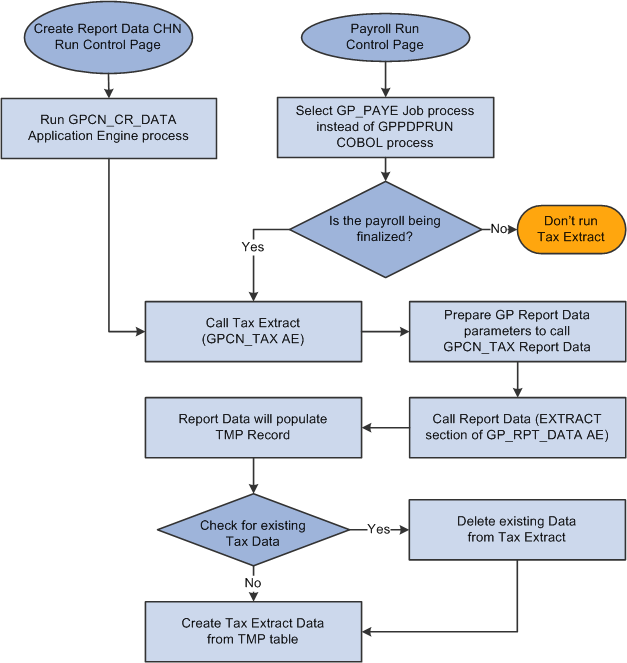

This diagram illustrates the flow of the tax report data extract process:

Tax Report data extract process flow

See Also

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Integrating with PeopleSoft Enterprise Performance Management," Reviewing Delivered Setup Data in the Global Payroll Database

Generating Tax Reports

Generating Tax Reports

This section discusses how to:

Create tax report data.

Create tax reports.

Pages Used to Generate Tax Reports

Pages Used to Generate Tax Reports|

Page Name |

Definition Name |

Navigation |

Usage |

|

Create Reporting Data CHN |

GPCN_CR_RPT_DTA_RC |

Global Payroll & Absence Mgmt, Authority Correspondence, Create Reporting Data CHN, Create Reporting Data CHN |

Generate report data for finalized payrolls. |

|

GPCN_TAX_DATA_RC |

Global Payroll & Absence Mgmt, Taxes, Tax Reports CHN, Tax Reports CHN |

Generate the Individual Income Tax Withholding and Tax Withholding Detail reports. |

Creating Tax Report Data

Creating Tax Report DataAccess the Create Reporting Data CHN page (Global Payroll & Absence Mgmt, Authority Correspondence, Create Reporting Data CHN, Create Reporting Data CHN).

|

Calendar Group ID |

Select the calendar group for which you want to generate report data. You can select only finalized calendar groups. |

The Create Reporting Data CHN (GPCN_CR_DATA) Application Engine process calls the GPCN_TAX Application Engine process, which generates tax report data for the selected calendar group.

The GPCN_CR_DATA process simultaneously calls the GPCN_PHFSI Application Engine process, which generates Public Housing Fund and Social Insurance (PHF/SI) report data for the selected calendar group.

Note. Instead of manually running the GPCN_CR_DATA process from this page to generate report data, you can select the GP_PAYE Job process instead of the GPPDPRUN COBOL process when you finalize a calendar group. This is similar to the way that GPCN_CR_DATA, GP_PAYE calls both GPCN_TAX and GPCN_PHFSI.

See Also

Public Housing Fund and Social Insurance Reports

Creating Tax Reports

Creating Tax ReportsAccess the Tax Reports CHN page (Global Payroll & Absence Mgmt, Taxes, Tax Reports CHN, Tax Reports CHN).

|

Year and Month |

Enter the year and month for which you are generating the report. |

|

Tax Area |

Enter the tax area for which you are generating the report. Values are:

|

|

Pay Entity |

Enter the pay entity for which you are generating the report. If you leave this field blank, the process creates a report for all pay entities in the selected tax area. |

|

Category of Income |

Select the category of the income for which you are generating the report. Values are:

|

|

Employee Type |

Select the type of employee for which you are generating the report. Values are:

|

|

Report Type |

Select which report to generate.

|

|

Filing Date |

Enter the date on which you file the report. |

|

Payment Date |

Enter the date when the company submits income tax to the local taxation administration. This is a required field for the Individual Income Tax Withholding report and is available only if you select Summary or Both in the Report Type field. |

|

Internal Sort Order |

Use the sort keys to sort your generated reports by Employee Name, Employee Number, and Pay Group. If you select Employee Name, the report is sorted by the payees' Han Yu Pin Yin names. |

Note. If the system calculates tax using the retro when earned override set, the taxable amount with retro does not appear on the tax reports. In this case, you must report the retro tax amount directly to the Tax Bureau.

See Also