Processing Expense Amortization

Page Name | Definition Name |

Usage |

|---|---|---|

VCHR_EXPRESS1 |

Create an amortization voucher and enter detailed invoice information. | |

AMR_SCHED_ACT |

Validate the default values available from the newly created Payables Amortization voucher, create Stage journals, review and approve the schedule. | |

|

AMR_JOURNAL |

View the amortization stage journals. You can also update the ChartField values, if enabled on the User Preferences – General Ledger page. | |

AMR_ENTRY_E_IC |

Review the amortization stage journal header and line errors | |

AMR_ENTRY_T_IC |

Review the stage journal totals | |

|

AMR_JGEN_REQUEST | Run the Amortization Journal Creation process for a given amortization ID or for a range of amortization IDs. You can also create consolidated journals for a given BU and as of date. | |

AMR_RECON_REQ |

Generate the Amortization Reconciliation report. |

Amortization Voucher

The first step in processing an expense amortization is to create an amortization voucher using PeopleSoft Accounts Payable. After an accounts payable clerk creates and saves the voucher, a unique Amortization ID is generated for each GL business unit. The finance users can do further processing only after the voucher is posted.

For details on creating amortization vouchers see Entering Amortization Vouchers.

Amortization Schedule

The Amortization schedule and the accounting details of the voucher can be viewed in General Ledger on the Amortization Schedule component. Once the voucher is posted in Payables, the schedule becomes editable and amortization parameters can be modified at this point. You can review the stage journals and approve the schedule.

Amortization Stage Journal Creation Process (AMR_JGEN)

When you click the Stage button on the Amortization Schedule Page, the AMR_JGEN process generates the amortization stage journals based on the schedule type, From/To year/period, amount to amortize, amortization accounting template, and the journal date option. This process uses the Amortization source you have defined on the Source Definition page. The newly created amortization journals will have the debit to the expense picked from the amortization template, and a credit to the prepaid account, which was entered in the amortization voucher distribution line. All the stage journals created are edited at the end of the process.

A stage journal is not a regular journal but an intermediate-stage journal that is available for users to review before it gets converted into a regular journal. Once the actual journals are created, the stage journals will be removed.

Generate Amortization Journal Request Process

Amortization journals are created from stage journals using the Amortization Journal Creation process, which is run for a given amortization ID or for a range of amortization IDs.

You can also create consolidated journals for a given BU and the as of date, which is detailed in a section later in this documentation.

Amortization Reconciliation Report

Amortization Reconciliation reports are generated by specifying the run parameters – Amortization ID and the business unit. The AMR_RECON_REQ component is used to generate the Amortization Reconciliation GLX90001 report while the Process Scheduler manages the processes, tracks the status, and generates the report.

Use the Amortization Schedule page (AMR_SCHED_ACT) to validate the values passed from the amortization voucher, create stage journals, review and approve the schedule.

Navigation:

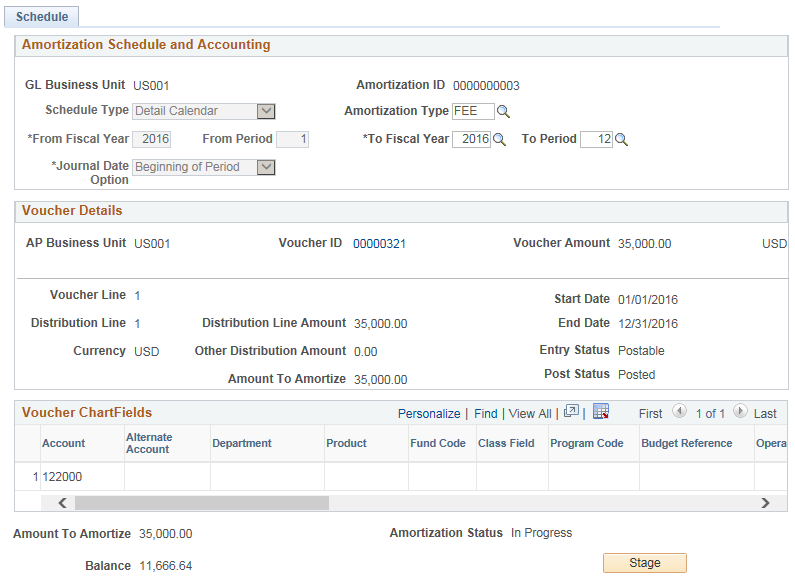

This example illustrates the fields and controls on the Amortization Schedule page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Amortization Schedule page. You can find definitions for the fields and controls later on this page.

This page appears as read-only until the voucher is posted. Once the voucher is posted, you can update the following fields:

Schedule Type

Amortization Type

From Fiscal Year

From Period

To Fiscal Year

To Period

Journal Date Option

Details that are passed from the payables amortization voucher cannot be modified on this page (GL business unit, Amortization ID, Voucher details and Voucher ChartFields)

Field or Control |

Description |

|---|---|

GL Business Unit | Displays the GL business unit in the amortization voucher distribution line |

Amortization ID | Displays the amortization ID that was generated by the system at the time of voucher save in AP. |

Schedule Type | Select the type to be used for the amortization schedule:

See Ledgers For A Unit - Definition Page This field is not editable after the first actual journal is created. Note: The Quarterly Calendar and Annual Calendar options are available only if these values are associated with the Journal Generator default ledger group on the Ledgers For A Unit page. |

From Fiscal Year | Enter the starting year to be used for creating the schedules. |

From Period | Enter the starting range of the period to be used for creating the schedules. This field is not available when the Schedule Type is Annual Calendar. |

To Fiscal Year | Enter the ending year to be used for creating the schedules. |

To Period |

Enter the ending range of the period to be used for creating the schedules. This field is not available when the Schedule Type is Annual Calendar. |

Journal Date Option | Displays the journal date option:

This option changes to display only once the first actual journal is created. |

AP Business Unit | Displays the AP business unit used in the amortization distribution line. |

Voucher ID |

Click the link to open the Voucher component — Voucher - Summary Page. |

Voucher Amount | Displays the total voucher amount. |

Voucher Line | Displays the voucher line number of the amortization voucher. |

Distribution Line | Displays the distribution line number the amortization voucher. |

Distribution Line Amount | Displays the merchandise amount for the specific distribution line. |

Start Date and End Date | Displays the default start and end date passed from the amortization voucher distribution line. The first time when the page is loaded, the From/To Fiscal Year/Period values are derived based on the start and end date. The finance user however can override and change the From/To Fiscal Year/Period. Note: The calculation of stage journals is based only on the From/To Fiscal Year/Period and NOT on the Start/End date. |

Other Distribution Amount | Displays the non-merchandise amount associated to the specific distribution line. |

Amount to Amortize | Displays the sum of the distribution line amount and the other distribution amount. |

Voucher ChartFields are displayed from the distribution line of the amortization voucher.

Field or Control |

Description |

|---|---|

Balance | Displays the balance amount yet to be amortized. This field gets updated as the actual journals are created. |

Amortization Status | Displays the amortization status values:

|

Stage | Initiate the stage journal creation process. See Amortization Journal – Stage Journal Page |

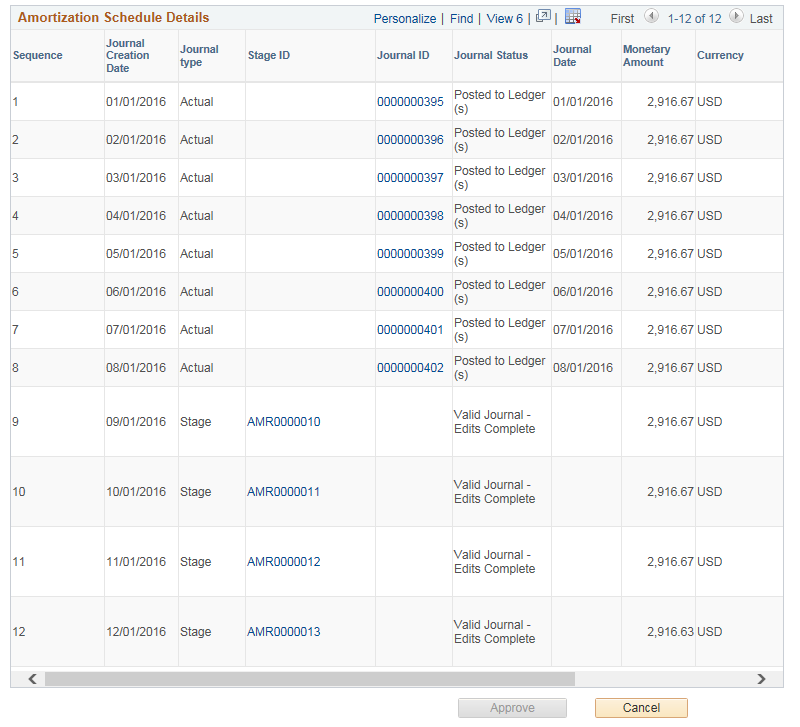

Amortization Schedule Details

Field or Control |

Description |

|---|---|

Sequence | Displays the sequence in which the journals are created. |

Journal Creation Date | Displays the expected date of the Actual journal creation. |

Journal Type | Displays the type of journal - Stage Journal or Actual Journal. |

Stage ID | Click the link to access the Stage Journal page and update ChartFields . Note: Only users with the Update Amortization Journal ChartField Values enabled on the User Preferences - General Ledger Page can update ChartFields. |

Journal ID |

Click the link to access the Journal Entry – Lines page. |

Journal Status | Displays the status of the journal based on the journal type - Stage or Actual. For a Stage journal:

For an Actual journal:

|

Journal Date | Displays the actual journal date. |

Monetary Amount | Displays the journal monetary amount calculated based on the number of journals created. |

Schedule Status | Displays the schedule status as:

|

Actions | Allows you to initiate related actions based on the type of the journal row. For a Stage journal, the only action available is Edit. For an Actual journal:

There will be no actions available if the journal is in Posted status. If an Actual journal is not posted and its status is Valid then only the Edit and Post actions will be available. In case if the user is not able to run the Post action from the Amortization Schedule page, it is recommended to use the Journal Entry page to run the Post process and correct any related errors. |

Approve | Review all the newly created stage journals and click this button to approve all the lines for the schedule. If one of the journals is in error or is in Edit Required status, the schedule approval is not allowed. |

Cancel | Click to cancel the amortization schedule. Status of all stage journals changes to Cancelled and are not selected for further processing. Any Actual journals created remain unchanged. |

Balance Amount Redistribution in Journals

You can regenerate the stage journals and redistribute the amounts by changing the available parameters, in two ways:

When no actual journals are created: Once the stage journals are created, you can re-generate them after changing the values for these fields - From Fiscal Year, From Period, To Fiscal Year, To Period, Schedule Type, and Journal Date Option.

When one or more actual journals are created: You can change only the following field values before running the Stage Journal Creation process again: From Fiscal Year, From Period, To Fiscal Year, and To Period. The Actual Journals, however, will not be changed or redistributed.

Note: From Period and To Period fields are available for Detail and Quarterly schedule types.

The old stage journals are deleted and the balance amount to amortize is redistributed in a new set of stage journals based on the new range of From Fiscal Year, From Period, To Fiscal Year, and To Period.

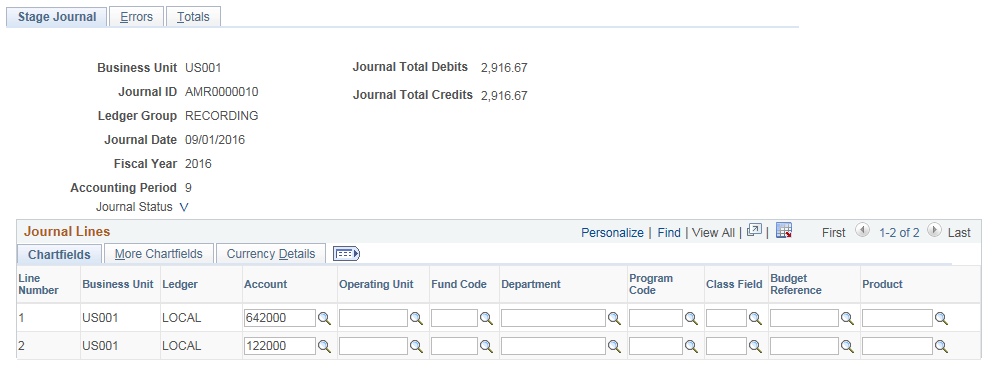

Use the Amortization Journal page (AMR_JOURNAL) to view the amortization stage journals.

Navigation:

This example illustrates the fields and controls on the Amortization Journal – Stage Journal page.

All the fields on this page are display only and unavailable for editing as the values reflecting here originates from the AP voucher. You can however edit the ChartFields if the Update Amortization Journal ChartField Values checkbox is selected on the User Preferences - General Ledger Page. In case the edit fails, you can modify these ChartField values so that the journal passes edit thereby enabling the journal to process to completion.

Enable the ChartField security for the Amortization Journal component AMR_JOURNAL by making it active on the Component Registry - Secured Components Page.

To restrict the access to update the ChartFields, disable the Update Amortization Journal ChartField values check box on the User Preferences - General Ledger Page.

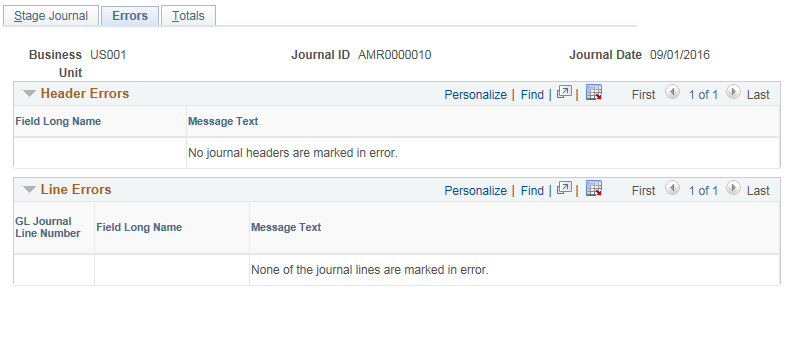

Use the Amortization Journal – Errors page (AMR_ENTRY_E_IC) to Review the amortization stage journal header and line errors.

Navigation:

. Click the Errors tab.

This example illustrates the fields and controls on the Amortization Journal – Errors page.

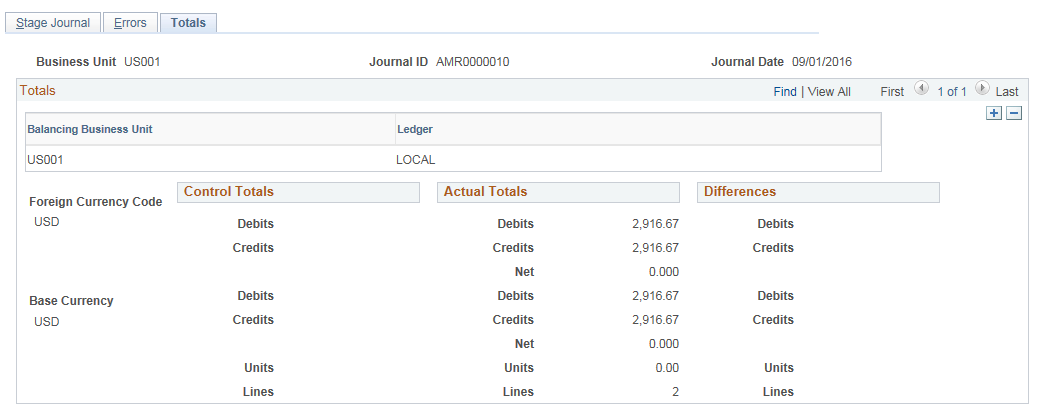

Use the Amortization Journal – Totals page (AMR_ENTRY_T_IC) to review the stage journal totals.

Navigation:

. Click the Totals tab

This example illustrates the fields and controls on the Amortization Journal – Totals page.

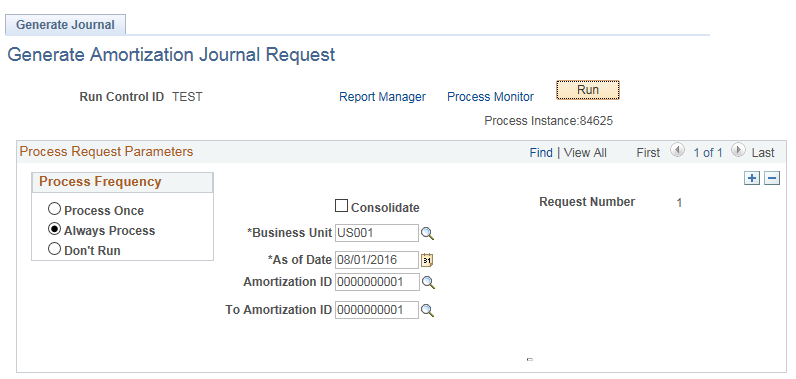

Use the Generate Amortization Journal Request page (AMR_JGEN_REQUEST) to run the Amortization Journal Creation process for a given amortization ID or for a range of amortization IDs. You can also create consolidated journals for a given BU and as of date.

Navigation:

.

This example illustrates the fields and controls on the Generate Amortization Journal Request page. You can find definitions for the fields and controls later on this page.

The AMR_JRNL_GEN processes only stage journals with schedule status Ready and journal creation date less than or equal to the As of Date.

Field or Control |

Description |

|---|---|

Consolidate | Select if you want to consolidate all the stage journals that share a common journal creation date into a single journal for a given GL Business Unit. Note: Due to the Consolidate option available while creating amortization journals, Unposting of amortization journals is not allowed. |

Consolidation of Stage Journals

Here is an example to show the consolidation of two stage journals into a single journal. Two amortization IDs that have two stage journals sharing the same journal creation date:

AMORTIZATION 1

Journal creation date | Stage journal |

Amount |

|---|---|---|

01/01/2016 | A1S1 | 100 |

02/01/2016 | A1S2 | 100 |

AMORTIZATION 2

Journal creation date | Stage journal |

Amount |

|---|---|---|

01/01/2016 | A2S1 | 200 |

02/01/2016 | A2S2 | 200 |

Upon selecting the Consolidate option, two journals are created as shown:

Journal 1 (01/01/2016)

Journal Line |

Description |

Amount |

|---|---|---|

1 | A1 | 100 |

2 | A1 | -100 |

3 | A2 | 200 |

4 | A2 | -200 |

Journal 2 (02/01/2016)

Journal Line |

Description |

Amount |

|---|---|---|

1 | A1 | 100 |

2 | A1 | -100 |

3 | A2 | 200 |

4 | A2 | -200 |

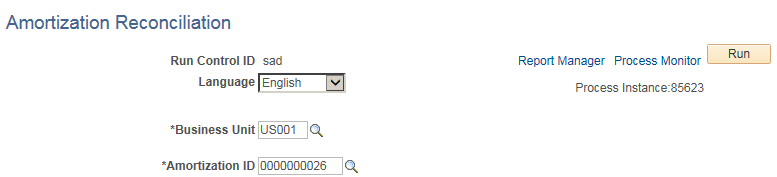

Use the Amortization Reconciliation page (AMR_RECON_REQ) to generate the Amortization Reconciliation report.

Navigation:

.

This example illustrates the fields and controls on the Amortization Reconciliation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Run | Click to generate the Amortization Reconciliation (GLX9001) containing the specified business unit and amortization ID. This report includes the details of the Amortization ID, Business Unit, Amortization Type, Amount, Voucher details, along with a detailed information of all the amortization schedules. Click the Process Monitor link to view the process status. Click the Report Manager link to access the completed report. |

Note: If Consolidate option is used to create the amortization journals then the report will contain details of the all consolidated amortization IDs. The description column can be used to identify the amortization ID.