Processing U.K. Withholding

To set up U.K. withholding, use the Withholding Codes component (WTHD_CODE).

This section provides an overview of the U.K. Construction Industry Scheme (CIS).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_ENTITY |

Define the withholding entities (tax authorities). |

|

|

WTHD_ENTITY_FIELDS |

Indicate which information the tax authority (entity) requires for your suppliers. |

|

|

BU_WTHD_JUR |

Specify General Ledger business unit withholding setup. |

|

|

WTHD_CODE |

Define withholding codes. |

|

|

WTHD_RULE |

Establish rules that determine the actions to be taken during withholding. |

|

|

WTHD_TYPE |

Define withholding types and associate them with withholding classes. |

|

|

VNDR_GBL_OPT_SEC |

Define withholding control information and reporting information for the supplier location. |

|

|

VNDR_ADDRESS |

Enter an alternate name to be used on withholding transactions. |

|

|

WTHD_CONTROL |

Enter payor data as defined by your tax authorities. |

|

|

CALENDAR_BUILDER |

Create and maintain tax calendars. |

|

|

WTHD_RPT_POST |

Define parameters for running the Withholding Reporting Application Engine process (AP_WTHDRPT) to populate the withholding report table with data from the withholding transaction table based on your report setup. |

|

|

Print CIS Payment Statement Page |

GBR_CIS_RPT_RUN |

Print CIS payment statement. |

This section describes how to implement the CIS using the Global Withholding features in PeopleSoft Payables.

In the U.K., payments to suppliers for construction operations fall within the scope of the CIS. This scheme states that suppliers (referred to in the scheme as subcontractors) who operate in the construction industry can be paid only if they are holders of either a Registration Card or a Subcontractors Tax Certificate. Registration Card holders have amounts deducted from their payments for labor based on their tax and National Insurance Contribution (NIC) liability. Certificate holders can be paid gross, but details of all the payments must be retained for reporting to the Inland Revenue.

With the legislative changes effective 04/2007, Contractors and sub-contractors will no longer use CIS Vouchers. Contractors must send a monthly return to HM Revenue & Customs including details of payments made within the scheme to all sub-contractors, details of any deductions they have made from payments to sub-contractors, a declaration confirming that employment status has been considered, and a declaration that the verification process has been applied correctly.

Note: Detailed Inland Revenue specifications are available at this web address: http://www.hmrc.gov.uk/new-cis

CIS Sample Data

The withholding setup for the U.K. should be configured as the sample data shown in this table:

|

Type |

Value |

|---|---|

|

Withhold Entity |

HMRC |

|

Withholding Rule |

CIS0 |

|

Withholding Rule |

CISS |

|

Withholding Rule |

CISI |

|

Withholding Type |

CIS07 |

|

Withholding Class |

CISI |

|

Withholding Class |

CISIM |

|

Withholding Class |

CISS |

|

Withholding Class |

CISSM |

|

Withholding Jurisdiction |

UKWTA |

|

Withholding Code |

CISS |

|

Withholding Code |

CISSSM |

|

Withholding Code |

CISI |

|

Withholding Code |

CISIM |

|

Withholding Code |

CIS0 |

Note: Jurisdiction is not needed for CIS processing, but it is a required object in the data structure. A dummy jurisdiction of UKWTA is delivered with the sample data.

Registration Cards

Registration cards, of which there are two types, are issued to those that do not qualify for a subcontractor tax certificate. For holders of these cards, a deduction must be made on payments at the prevailing rate that is specified by the government. The two types of registration cards are:

Term |

Definition |

|---|---|

CIS4(P) - Permanent Card |

This bears the National Insurance number of the card holder. It has no expiration date. |

CIS4(T) - Temporary Card |

This does not bear the National Insurance number and has an expiration date. |

In PeopleSoft Payables, no distinction is made between the two types of registration cards. This is because withholding is triggered by the withholding code and its associated rule, not by attributes that are assigned to the supplier. Oracle recommends that registration card holders use the delivered sample withholding codes (or their equivalents).

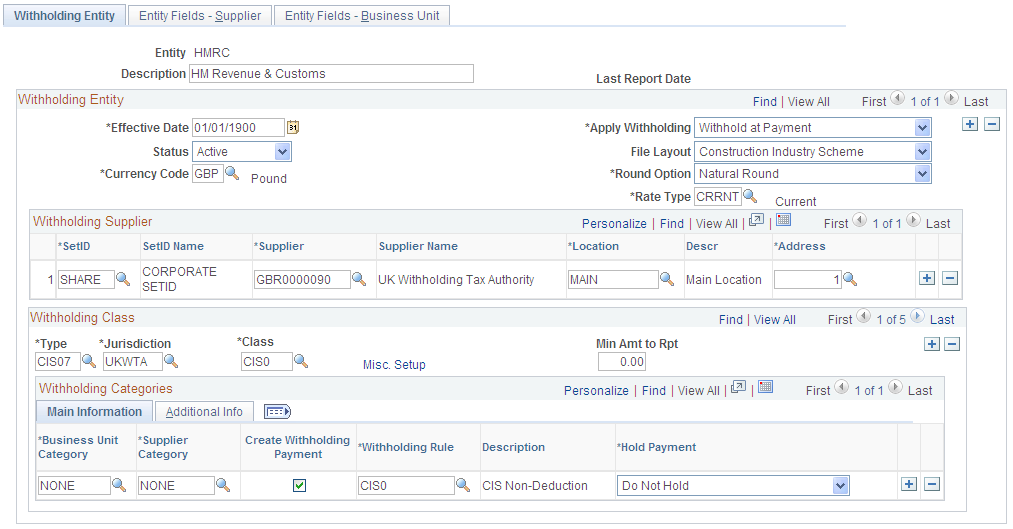

Use the Withholding Entity page (WTHD_ENTITY) to define the withholding entities (tax authorities).

Navigation:

This example illustrates the fields and controls on the Withholding Entity page.

The system creates scheduled payments for amounts that are deducted from payments to sub-contractors defined under the withholding entity. These payments must be made to the HM Revenue & Customs within 14 days after the end of the tax month. You must create a supplier that represents the Accounts Office of the HM Revenue & Customs to which these deducted amounts can be remitted. To ensure that scheduled payments are made to the HM Revenue & Customs supplier, you enter the supplier details on the Withholding Entity page.

To ensure that deductions from payments made to CIS Sub-contractors are kept as a separate payment that can be made at the end of the month to the HM Revenue & Customs, select the Create Withholding Payment check box for the CIS4 withholding class. Then, in the Round Option field, select Natural as the rounding option (you must not leave this field blank). Set the Hold Payment field to Wthd Only (withhold only) or No Hold.

Important. You must define at least one entity named HMRC as there is processing tied to the entity.

Use the Entity Fields - Supplier page (WTHD_ENTITY_FIELDS) to indicate which information the tax authority (entity) requires for your suppliers.

Navigation:

Mark the Registration Insurance Number, Business Type, Verification Complete, Verification Date, Verification Number, and Taxpayer Identification Number fields as optional.

Use the Procurement Control - Withholding page (BU_WTHD_JUR) to specify General Ledger business unit withholding setup.

Navigation:

To ensure that the supplier withholding defaults are passed to the voucher, select the Collection Agent Flag option for the withholding entities that apply to your business unit.

Use the Withhold Code page (WTHD_CODE) to define withholding codes.

Navigation:

There are several different classes you can use for CIS withholding:

Field or Control |

Description |

|---|---|

CIS0 |

Sub-Contractor non-deduction. |

CISI |

Incentive deduction |

CISIM |

Sub-contractor materials |

CISS |

Standard deduction |

CISSM |

Sub-contractor materials |

Use the Withhold Rule page (WTHD_RULE) to establish rules that determine the actions to be taken during withholding.

Navigation:

There are several different rules you can use for CIS withholding:

Field or Control |

Description |

|---|---|

CIS0 |

No Deduction |

CISS |

Verified supplier with a standard deduction of 20 percent. |

CISI |

Unverified or Incentive deduction of 30 percent. |

Use the Withhold Type page (WTHD_TYPE) to define withholding types and associate them with withholding classes.

Navigation:

PeopleSoft delivers the CIS07 withholding type that is associated with the CIS0, CISI, CISS, CISSM, and CISIM withholding classes.

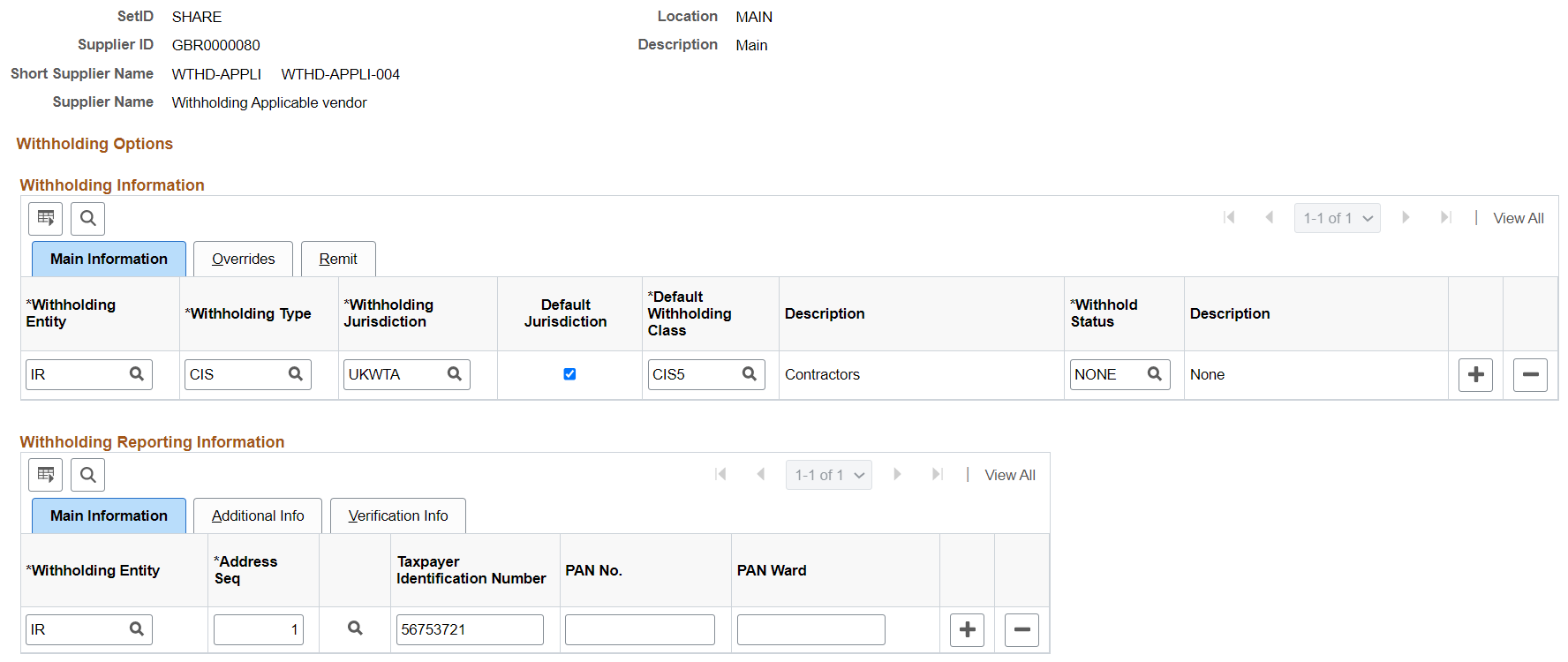

Use the Withholding Supplier Information page (VNDR_GBL_OPT_SEC) to define withholding control information and reporting information for the supplier location.

Navigation:

Click the Global Withholding link on the Supplier Location page.

This example illustrates the fields and controls on the Withholding Supplier Information page. You can find definitions for the fields and controls later on this page.

Withholding Information

The following fields in this grid have specific requirements for certificate withholding:

Field or Control |

Description |

|---|---|

Withholding Entity |

Select the entity to which the withholding amounts are reported. |

Withholding Type |

Select the type of withholding. For each withholding type, there may be classes and categories associated with the type. |

Withholding Jurisdiction |

Select the withholding jurisdiction for this type of withholding. |

Default Jurisdiction |

Select to ensure that the withholding defaults are copied to the invoice. |

Default Withholding Class |

Select a withholding class that will be used as a default for this supplier location. |

Withhold |

Select when setting up certificate information or registration card information for the supplier. |

Hold Pay Indicator |

Accept the default from the control hierarchy, or select Specify to override the default and activate the Hold Payment field. |

Hold Payment |

Select from these options:

|

Withhold Rule Indicator |

Accept the default from the control hierarchy, or select Specify to override the default and activate the Rule field. |

Withholding Rule |

Select a withholding rule. The withholding rule describes the actions to be taken during withholding. |

Remit Withhold to Flag |

Select withholding Entity or Supplier to indicate to whom you remit withholding payments for this supplier location. |

Remit Supplier |

For a remit to of Supplier, select the supplier to whom you want to remit withholding information. |

Withholding Reporting Information

Field or Control |

Description |

|---|---|

Withholding Entity |

Select the entity to which the withholding information is reported. The withholding entity is the body to which withholding is reported. You can define more than one entity for a supplier location. |

Address Seq (address sequence) |

Select the supplier's address from the addresses defined on the Supplier Information - Address page. The entity needs the supplier's address. |

Business Type |

Select Corporation or Individual. |

Registration/Insurance Number |

Enter the registration number if this is a corporation or the insurance number if this is an individual. |

Verified |

Select this check box if the number provided has been verified. |

Verification number |

Enter the verification number provided by the HMRC |

Verification Date |

The system automatically populates this field with the current date when the Verified check box is selected. |

Match TIN |

Select this check box if you have used the IRS online matching process. If the check box is selected, then the TIN Match Code is set to 0 and the TIN Match status set to Matched. |

TIN Match Status |

Displays the TIN match status. The various options displayed are New, Pending, Matched, or Error. |

TIN Match Code |

Displays the match code returned by the IRS (U.S. Internal Revenue Service).

|

Match Date |

Match date is the date the user enters when the file is uploaded. If the TIN was manually matched, the user can enter the match date from the Interactive TIN matching process. The Match date can be entered only if the Match TIN check box is selected. |

IRS Tracking Code |

The IRS assigns a tracking code to every file the user downloads. If the user enters the tracking code when the file is loaded into PeopleSoft, the supplier/location can be tracked enabling the user to tie the TIN to a bulk file. |

Manually Matched |

The check box will be selected as default if the matching was done through the online matching process. |

Use the Supplier Information - Address page (VNDR_ADDRESS) to enter an alternate name to be used on withholding transactions.

Navigation:

Make sure that you include the county. The program that extracts withholding data requires that the county field to be filled in.

Complete the Withholding Alternate name field with the name that appears on the withholding document.

Use the Report Control Information - Payor Data page (WTHD_CONTROL) to enter payor data as defined by your tax authorities.

Navigation:

Before you generate the monthly and annual returns, you must enter your own company's tax information (contractor details) on the Report Control Information - Payor Data page.

Payer Name 1 and Payer Name 2 are optional fields, but they are used on the EDI file that is submitted to the HM Revenue & Customs. Ideally, you should enter at least Payer Name 1. You should enter your Contractor tax reference in the Tax ID field. If you are using EDI to submit your returns, enter the EDI ID that is issued to you by the HM Revenue & Customs in the Transmitter Cntl Cd field.

It is also important that you enter your business address on the address page. Access this page by clicking the Envelope button.

Note: You must also make sure that you have listed the applicable business units and suppliers (or chose the All Suppliers option) on the Report Control Information - Suppliers and Business Units.

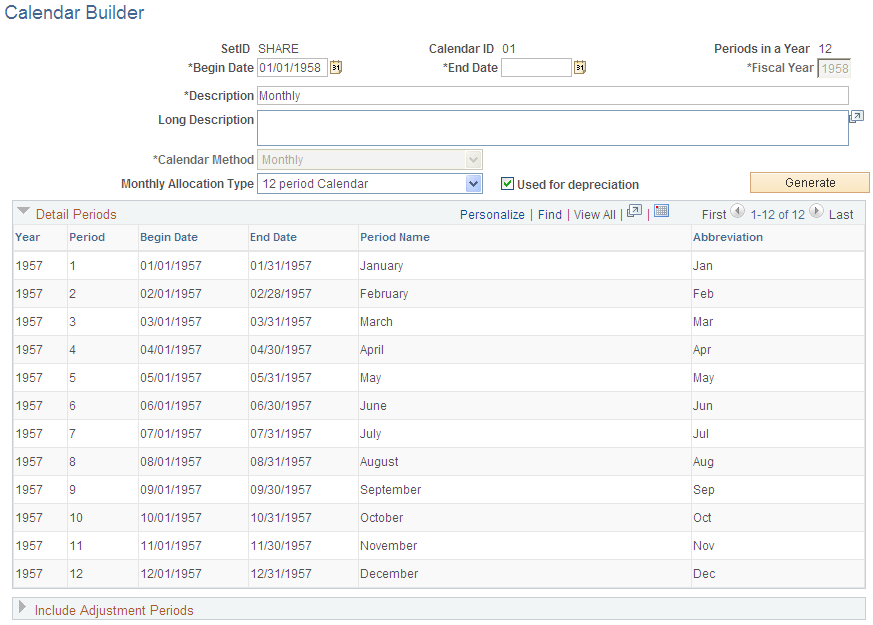

Use the Calendar Builder page (CALENDAR_BUILDER) to create and maintain tax calendars.

Navigation:

U.K. reporting consists of monthly and annual returns. You are obliged to report all payments that are made to subcontractors within 14 days of the end of the tax month.

In the U.K., the tax year runs from April 6 to April 5 of the following year. Each tax month starts on the sixth day of the month. To ensure that payments that are subject to withholding processing are reported in the correct tax month, create a monthly calendar for the U.K. tax year.

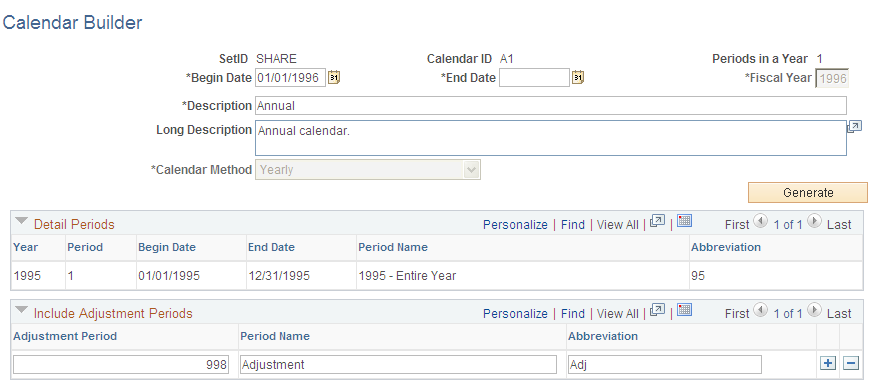

To produce the annual return, create an annual calendar.

Monthly Calendar

This is an example of a monthly calendar:

This example illustrates the fields and controls on the Calendar Builder page (monthly calendar).

Annual Calendar

This is an example of an annual calendar:

This example illustrates the fields and controls on the Calendar Builder page (annual calendar).

You generate two kinds of reports for CIS: monthly and annual.

Generating Monthly Reports

PeopleSoft provides a flat file conforming to the CIS scheme GFF(generic flat file format) data mapping standards as defined in the EB5/CIS300 message implementation guidelines published by the HMRC.

The U.K. CIS File SQR report (APY8032), which you run from the Withhold Report request page, produces both the flat file and the report output. The PeopleSoft system produces two files:

Field or Control |

Description |

|---|---|

Construction Gross Payment Vouchers |

This file contains details of payments that are made to contractors. The file that is produced is called APY8032.23E (or APCIS23E.DAT on IBM OS390 servers). |

Tax Payment Vouchers |

This file contains details of payments that are made to sub-contractors. The file produced is called APY8032.25E (or APCIS25E.DAT on IBM OS390 servers). In addition to producing the flat file, you must also print a copy of the Tax Payment Voucher (form CIS25E). This single-part document is sent to the subcontractor to provide a record of the amounts that have been deducted from the subcontractor's payments during the tax month. |

To create the files, you must first post the withholding details into the transaction table using the Withholding Posting Application Engine process (AP_WTHD), from the Withhold Transaction Post page. You then need to extract the data from the transaction table into the reporting tables, using the Withhold Report Post page to run the Withholding Reporting Application Engine process (AP_WTHDRPT). On the Withhold Report Post page, you enter your report ID and control ID for CIS reports (the delivered Report ID for monthly reports is CIS_NEW, UK Construction Industry Scheme; the delivered Control ID is GBR-REPORT, UK Withholding Report). For the monthly returns, you must select the U.K. monthly tax calendar.

After you extract the data to the report files, you create the output files and the CIS25E report by running the withholding reports using the Withhold Report page.

You must send the files that are produced into the EDI translation software of your choice. This software converts the flat file into EDI messages. A list of third-party EDI translation and submission software providers is available from the HMRC.

Generating Annual Reports

All payments that are made to subcontractors during the tax year must be reported to the HMRC. This can be done using preprinted, multi-part stationery or through EDI. PeopleSoft provides for the EDI solution. The system generates a flat file that conforms to the file that is specified in the HM Revenue & Customs Message Implementation Guide. A single file is produced:

End of Year Payments. The file that is produced is called APY8032.36E (or APCIS36E.DAT on IBM OS390 servers).

To create the files, all the withholding details for the year must have been posted to the transaction table using the Withhold Transaction Post page.

Then, extract the data from the transaction table into the reporting tables using the Withhold Report Post page. For the annual returns, select the U.K. annual tax calendar.

After you extract the data to the report table, you create the output file by running the Withholding Reports.

You must send the files that are produced to the EDI translation software of your choice. This software converts the flat file to EDI messages. A list of third-party EDI translation and submission software providers is available from the HM Revenue & Customs.

There are several ways in which you can set up the system to generate the payment to the HMRC. The method you select depends on the volume of CIS transactions and the way in which you run your pay cycle.

Method 1 - Placing HMRC Payments on Hold

With this method, you set up the system to place the HMRC scheduled payments on hold automatically. Within 14 days after the end of the tax month, you take the scheduled payments off hold. Set up a pay cycle that includes scheduled payment dates within the tax period range (for example, from the sixth of the previous month to the fifth of the current month). Then a single payment to the HMRC can be generated for all withheld amounts.

To place the withheld scheduled payments on hold:

Set the Hold option to Wthd Only (withhold only) on the Withholding Entity page for withholdingClasses CIS0, CISS, CISSM, CISI, and CISIM.

Set the Withholding Date option to Payment on the Payment Selection Criteria - Dates page.

This sets the scheduled due date on the payment so that it is equal to the payment date, making it easier to select only the withheld payments that were made during the tax month.

A variation of this method is to place the HM Revenue & Customs supplier on hold. With this approach, you leave the supplier on hold until just before running a pay cycle that selects HM Revenue & Customs scheduled payments. You take the supplier off hold before running the pay cycle and place the supplier back on hold immediately after the pay cycle completes. To do this, you select the Hold Payments check box on the Additional Payables Options collapsible region on the Supplier Information - Payables Options page.

Method 2 - Using Pay Groups

If the volume of withheld payment is too great to permit resetting the Hold option manually, then you can use Pay Groups. You define one set of pay groups for regular payments and another pay group exclusively for payments that are made to the HM Revenue & Customs. Then you assign the HM Revenue & Customs pay group to your HM Revenue & Customs supplier. When scheduled payments are created for the withheld amount, the system assigns the HM Revenue & Customs pay group to it. When payment to the HM Revenue & Customs is due, you either temporarily include the HM Revenue & Customs pay group in the Payment Selection Criteria component (PYCYCL_DEFN) or create a new pay cycle ID. To prevent the HM Revenue & Customs payments from being selected during the tax month, use different pay groups for all other voucher payments.

Method 3- Using Withholding Class Payment Terms

When defining your withholding entities, you can indicate for every combination of withholding class and withholding categories the payment terms you want to apply to the withheld payment. For example, knowing that you need to pay within 14 days after the end of the tax month, which ends on the 5th of the calendar month, you would create a payment term (Single Payment) that contains two split terms. The first term would say that for any payment falling between the 1st and the 5th of the calendar month, the payment ID would be Same month, on the 15th. The second term would indicate that between the 6th and the end of the calendar month, the scheduled date should be Next month, on the 15th. That way, all withheld amounts that need to be paid to the HM Revenue & Customs will be scheduled to be paid on the 15th, allowing you to run your pay cycle before the due date of the 19th of the calendar month.