Entering Exercise Information

This topic discusses how to enter exercise information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_GRANT_EXER |

Enter general exercise information, including the number of shares exercised and the methods for calculating the costs and taxes due. |

|

|

Exercise Comments Page |

ST_GRANT_EXER_SEC |

Enter comments for an exercise. |

|

ST_EXER_TAXES |

Calculate the taxes for an exercise |

|

|

ST_EXER_COST |

Calculate the total cost due to the company for the exercised shares and related taxes. Enter swap and trade information. |

|

|

ST_EXER_ISSUE |

Enter issuance instructions for the transfer agent. |

|

|

ST_EXER_CERT_SEC |

|

|

|

ST_EXER_BROKER_SEC |

Add brokerage information. |

|

|

ST_EXER_LEGEND_SEC |

Select the legends to display on the issuance instructions. |

|

|

ST_EXER_PAYMENT |

Record payments made to the company on the exercise and view outstanding balances. |

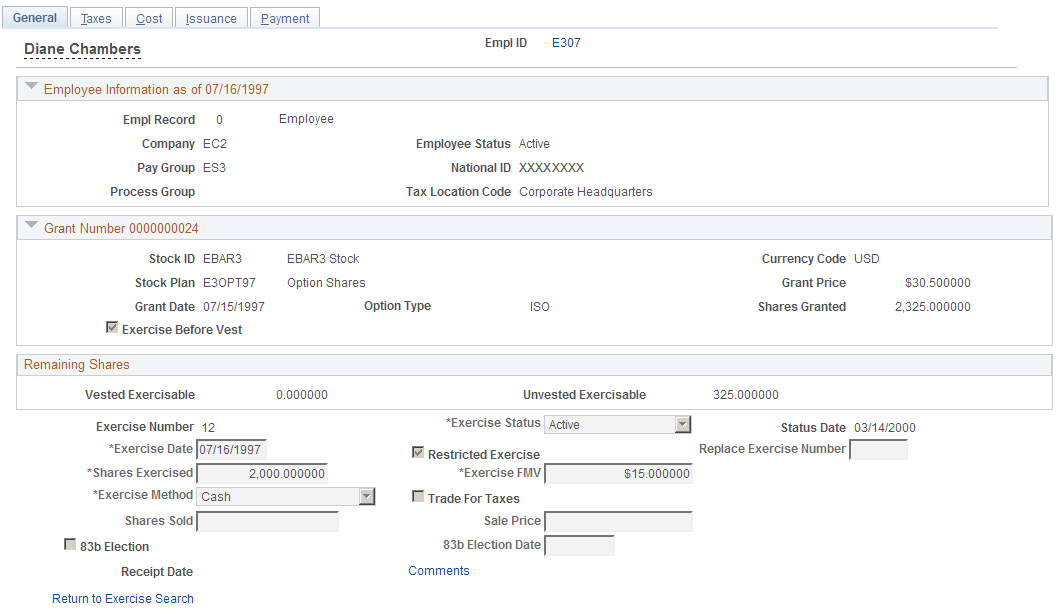

Use the Exercises - General page (ST_GRANT_EXER) to enter general exercise information, including the number of shares exercised and the methods for calculating the costs and taxes due.

Navigation:

Click a grant number on the Exercise Options page, then click the Add an Exercise button on the Exercise Transactions page.

This example illustrates the Exercises - General page.

Remaining Shares

Field or Control |

Description |

|---|---|

Vested Exercisable |

Displays the number of vested shares remaining that are exercisable as of the exercise date entered. |

Unvested Exercisable |

If the plan allows exercise before vesting, the system displays the number of unvested shares remaining that are exercisable as of the exercise date entered. |

Exercise Information

Field or Control |

Description |

|---|---|

Exercise Status |

Select the exercise status. Valid values are Pending, Void, and Active, which is the default. |

Status Date |

Displays the date that the status was last changed and saved. |

Exercise Date |

Enter the exercise date. |

Replace Exercise Number |

If this is a replacement exercise, select a replacement exercise number from the available choices. You must first void the original exercise before you can create a new, replacement exercise. You associate the two exercises with the Replace Exercise Number for audit purposes. |

Shares Exercised |

Enter the number of shares to be exercised. If exercise before vesting is allowed all vested shares must be exercised before unvested shares are exercised. The system will not allow shares exercised to include both vested and unvested amounts. |

Exercise FMV |

The default value is the exercise FMV calculated from the Daily Prices table as of the exercise date that you entered according to your Exercise FMV Rule. You can change this number. |

Exercise Method |

Select a method to pay for the exercise cost. If you select a value not defined on the Stock Option Plan Rules component, you get an error. Cash is the default. |

Trade For Taxes |

Select to enable shares to be traded for the amount of taxes to be withheld on the Exercises - Cost page. The check box is unavailable if:

When exercising unvested shares and 83b Election is not selected. |

Shares Sold |

If the exercise method is Sell to Cover, this field is available. Enter the number of shares sold. If the exercise method is Same Day Sale, the system displays the total shares exercised as shares sold. |

Sale Price |

If the exercise method is Same Day Sale or Sell to Cover, this field is available. The exercise FMV is the default, but you can enter a different number. |

83b Election Date |

If you select the 83b Election check box, this field becomes available. Enter the date that the optionee filed the 83b election. |

Receipt Date |

Displays the date that the exercise receipt was run. |

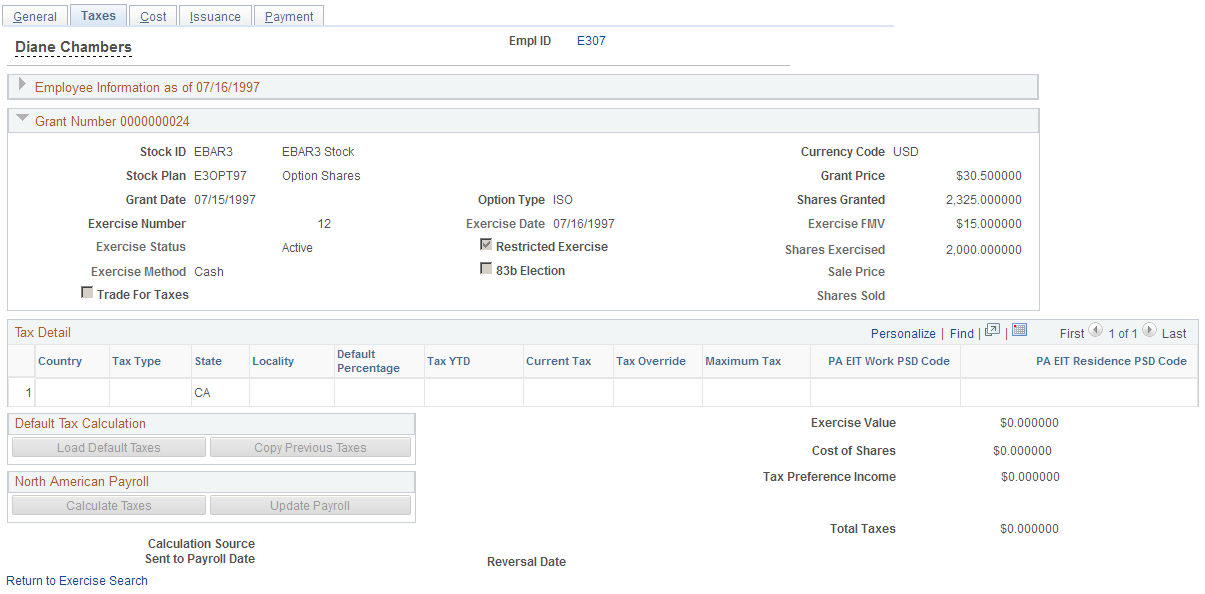

Use the Exercises - Taxes page (ST_EXER_TAXES) to calculate the taxes for an exercise.

Navigation:

Access the Exercises − General page and select the Taxes tab.

This example illustrates the Exercises - Taxes page.

Calculate the taxes by integrating with PeopleSoft Payroll for North America, using the stock tax tables, or entering taxes manually. If you use Payroll for North America, you can send the tax information to that system. To reverse a payroll transaction that you sent, void the exercise and send the information to payroll as a reversal.

Grant Information

Field or Control |

Description |

|---|---|

Exercise Number |

Displays NEW when you enter an exercise. When you save, the system generates a sequential exercise number from the last exercise number stored on the Stock table. |

Restricted Exercise |

If this is a restricted exercise, this check box is selected. |

Tax Detail

The system populates these fields when you click any of the Load Default Taxes, Copy Previous Taxes, or Calculate Taxes buttons. You can change the values until you send the transaction to payroll.

Field or Control |

Description |

|---|---|

Tax Type |

Select the type of tax to calculate. |

Default Percentage |

The system enters the default tax percentage based on the tax type. You can change the default percentage to modify the current tax amount. |

Tax YTD |

Enter the year to date tax amounts to have the system to use these values when calculating taxes with limits. |

Current Tax |

The system calculates the current tax based on the ordinary income amount displayed on the page and the default percentage. You can change the current tax amount and the default percentage changes accordingly. |

Tax Override |

If you overrode the default taxes or inserted the tax amounts the system displays Manual. The default is None, which means no tax override. |

Maximum Tax |

Displays the maximum tax limit if the tax type has a maximum tax limit. |

Default Tax Calculation

You can load the default tax information or copy the tax information from the previous exercise. Use these methods if you don't use Payroll for North America or for exception processing.

Field or Control |

Description |

|---|---|

Load Default Taxes |

Click to load the default tax rates based upon the country and state associated with the optionee's tax location and the tax rates that you entered on the tax setup pages. The taxes are calculated based upon the ordinary income from the exercise. |

Copy Previous Taxes |

Click to copy the tax percentages used in the last exercise within the last calendar year. If there are no exercises for the current year, the system copies the percentages from the previous year and gives a warning message. |

North American Payroll

If you use Payroll for North America, you can calculate the taxes owed and send them directly to payroll.

Field or Control |

Description |

|---|---|

Calculate Taxes |

Click to have Payroll for North America calculate the taxes due on the ordinary income from the exercise. The system determines the YTD taxes paid and monitors any limit that might be met. |

Update Payroll |

Click to send the tax and ordinary income data to payroll. Once the transaction is saved, you receive confirmation that the transaction was sent. If you don't save the exercise, Payroll is not updated. |

Sent to Payroll Date |

Displays the date the payroll taxes were sent to payroll either through Update Payroll or when the payroll report is run. Click the date to access the Exercise Payroll Data page to display how the transaction was sent to the payee (through Payroll for North America or a manual report) and the paycheck number, if applicable. |

Reversal Date |

Displays the date, if any, that the Payroll Reversal Report was run. |

Calculated Values

Field or Control |

Description |

|---|---|

Tax Preference Income |

Displays the alternative minimum tax value, if any, when the option type is ISO. Otherwise, it is ordinary income, which is the difference between the option price and the fair market value of the company's stock on the exercise date. |

Total Taxes |

Displays the sum of all taxes displayed. These are the taxes that are due on exercise. |

Net Due Optionee |

If this is a SAR exercise, the system displays the net due to the optionee. This amount is the difference between the ordinary income and the total taxes. |

Reversing Taxes Sent to Payroll

To reverse taxes that you've already sent to payroll, change the Exercise Status to Void on the Exercises - General page and save. If the transaction has not been processed by payroll the system deletes the transaction.

If the transaction has already been processed by payroll you receive a message that the transaction wasn't found. You can print the Options Income/Taxes Reversals report to notify your payroll administrator that the transaction should be reversed.

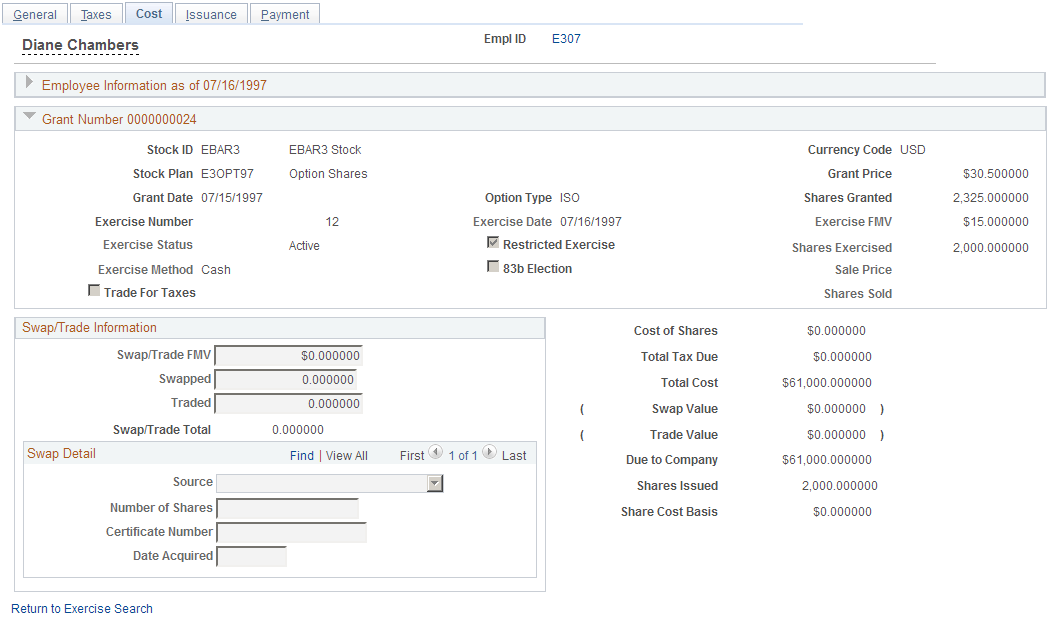

Use the Exercises - Cost page (ST_EXER_COST) to calculate the total cost due to the company for the exercised shares and related taxes.

Enter swap and trade information.

Navigation:

Access the Exercises − General page and select the Cost tab.

This example illustrates the Exercises - Cost page.

Swap/Trade Information

If a payment method is Swap for Shares or Trade for Taxes, these fields become available.

Field or Control |

Description |

|---|---|

Swap/Trade FMV |

The swap trade FMV as defined on the Stock Option Plan Rules - FMV Rules page. |

Swapped |

The number of shares required for the swap by dividing the total cost of shares by the swap/trade FMV. You can change the number, if necessary. |

Traded |

If the tax payment method is Trade and taxes were calculated, the system displays the number of shares required for the trade by dividing the Total Tax Due field by the Swap/Trade FMV field. You can change the number, if necessary. |

Swap/Trade Total |

The total number of shares required for the swap or trade. |

Swap Detail

If a payment method is Swap for Shares or Trade for Taxes, these fields become available. You can make multiple entries to record the various shares used for the swap or trade, and whether the shares are being surrendered or are to be netted from the exercise.

Field or Control |

Description |

|---|---|

Source |

Select Constructive Delivery if the shares surrendered for the swap/trade are to be netted from the exercise and a physical certificate is not delivered. Select Physical Delivery if a physical certificate is surrendered for cancellation. |

Number of Shares |

Enter the number of shares that were surrendered. Constructive delivery will reduce the number of shares to be issued by the number of shares that were swapped and/or traded. |

Certificate Number |

Enter the certificate number of the shares that were surrendered for the swap or trade, if any. |

Date Acquired |

Enter the date that the swapped or traded shares were acquired. |

Calculated Values

The system displays the following amounts.

Field or Control |

Description |

|---|---|

Cost of Shares |

Option price multiplied by number of shares exercised. |

Total Tax Due |

Total taxes due calculated on the Administer Exercises - Exercise Taxes page. |

Total Cost |

Cost of shares plus total taxes due. |

Swap Value |

Number of shares swapped multiplied by the swap/trade FMV. Displayed if the exercise method is swap. |

Trade Value |

Number of shares traded multiplied by the swap/trade FMV. Displayed if Trade for Taxes is selected. |

Due to Company |

Total Cost minus the Swap Value, or the Trade Value , if any. |

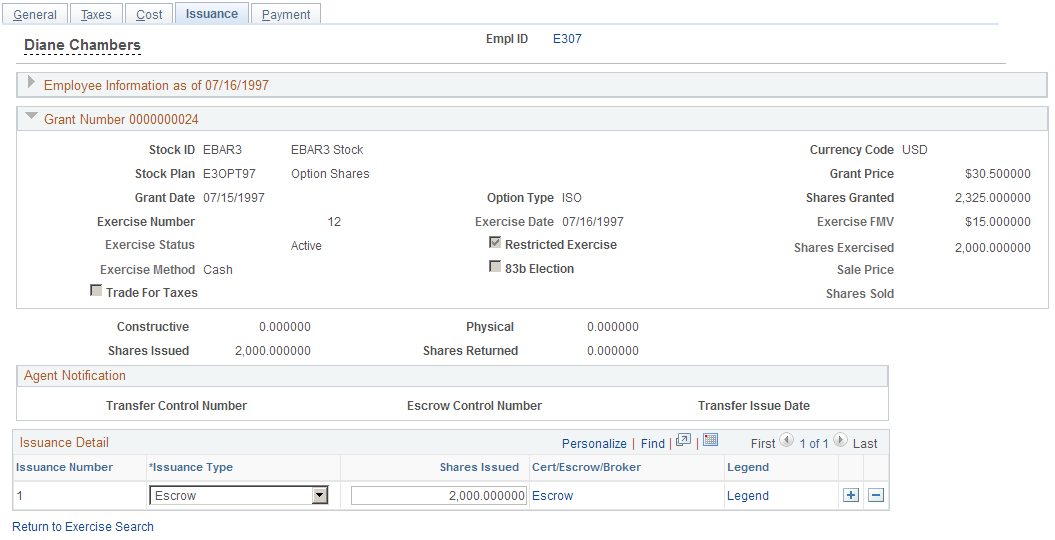

Use the Exercises - Issuance page (ST_EXER_ISSUE) to enter issuance instructions for the transfer agent.

Navigation:

Access the Exercises − General page and select the Issuance tab

This example illustrates the Exercises - Issuance page.

Shares Swapped/Traded

If shares are swapped or traded as part of the exercise, the system displays these amounts.

Field or Control |

Description |

|---|---|

Constructive |

The total number of constructively swapped/traded shares. |

Physical |

The total number of physically swapped/traded shares. |

Shares Issued |

The number of shares exercised less the total number of constructive shares swapped or traded. |

Shares Returned |

The total number of shares that were returned from the swap when a certificate is physically delivered for more shares than required for the swap or trade. |

Agent Notification

Field or Control |

Description |

|---|---|

Transfer Control Number |

Displays the transfer control number assigned by the Issuance Instructions report. |

Escrow Control Number |

Displays the control number assigned by the Issuance Instructions report. |

Transfer Issue Date |

Displays the date that the Issuance Instructions report was run. This field is populated after you run the Agent Issuance Instructions report. |

Issuance Detail

To enter multiple issuance instructions, enter the number of shares for each issuance requirement, select the issuance type, and select the brokerage information or the address where you want the certificate sent. After you save the release, you can generate the required transfer agent instructions, broker deposit instructions, and broker invoices.

Field or Control |

Description |

|---|---|

Issuance Number |

Displays 1 when you first add an exercise. For each subsequent issuance that you create, the system generates a sequential number. |

Issuance Type |

If the exercised shares are unvested, Escrow is the default. If the exercise is a same day sale or sell to cover, Broker is the default. If the exercise is any other type, the information on the optionee's Maintain Issuance Instructions page defaults. If issuance instructions are not set up for an optionee, Certificate is the default. You can change the default value. |

Shares Issued |

Enter the number of shares equal to the total number of shares being issued less any swapped or traded shares. The number of shares exercised defaults. |

Broker, Escrow, Certificate, and Legend |

Click to access the Broker page, Escrow Information page, or Certificate page, respectively. |

Legend |

Click to access the Legend page. |

Use the Exercise Issuance Certificate page (ST_EXER_CERT_SEC) to enter registration and address information for certificates.

Navigation:

Click the Certificate link on the Exercises - Issuance page.

The information from the Maintain Issuance Instructions page is the default.

Field or Control |

Description |

|---|---|

Registration Name |

Enter the name that is to appear on the stock certificate. |

Tax ID |

Enter the tax ID of the individual or organization to whom the stock is being issued, if not the optionee. |

Use the Exercise Issuance Certificate page (ST_EXER_CERT_SEC) to enter escrow and address information.

Navigation:

Click the Escrow link on the Exercises - Issuance page.

Field or Control |

Description |

|---|---|

Registration Name |

Enter the name that is to appear on the escrow account. |

Use the Exercise Issuance Broker page (ST_EXER_BROKER_SEC) to add brokerage information.

Navigation:

Click the Broker link on the Exercises - Issuance page.

Field or Control |

Description |

|---|---|

Registration Name |

Enter the name that is to appear on the brokerage account. |

Tax ID |

Enter the tax ID of the individual or organization to whom the stock is being issued, if not the optionee. |

Branch Control Number |

The system displays the branch control number after you run the Option Broker Deposits report. |

Branch Issue Date |

The system displays the branch issue date after you run the Option Broker Deposits report. |

Use the Legend page (ST_EXER_LEGEND_SEC) to select the legends to display on the issuance instructions.

Navigation:

Click the Legend link on the Exercises - Issuance page.

Field or Control |

Description |

|---|---|

Legend ID |

By selecting a legend ID, you can communicate further instructions to a transfer or escrow agent. The details of the legend ID print on the issuance instructions. You can use it, for example, to notify the transfer agent how to cancel swapped shares or place a specific legend on the back of a certificate. You can select multiple legends. |

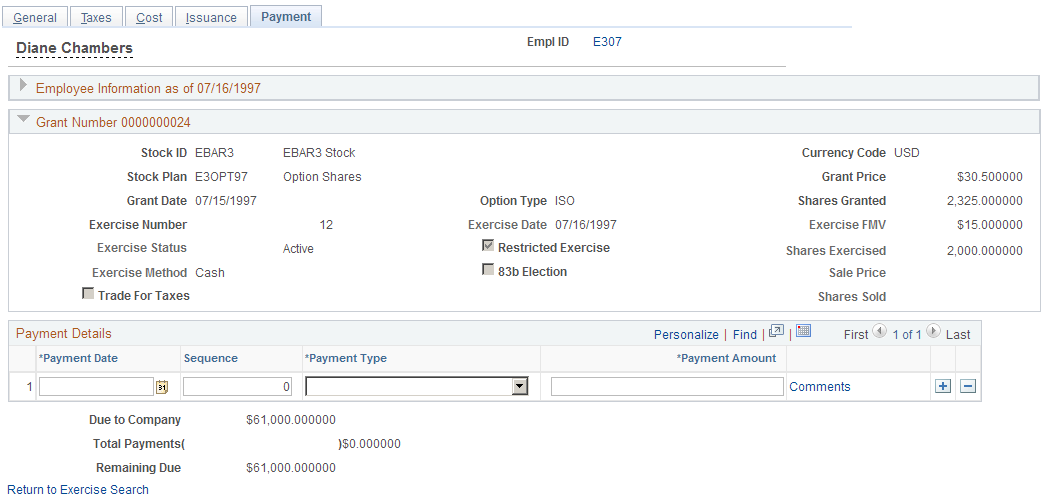

Use the Exercises - Payment page (ST_EXER_PAYMENT) to record payments made to the company on the exercise and view outstanding balances.

Navigation:

Access the Exercises - General page and select the Payment tab.

This example illustrates the Exercises - Payment page.

Record each payment on a separate line.

Field or Control |

Description |

|---|---|

Payment Date |

Enter the date that you received the payment. The payment date must be greater than or equal to the exercise date. |

Sequence |

If more than one payment is made in a single day, the system enters a sequence number. |

Payment Type |

Select Adjustment, Cash, Check, Loan, Pay Ded, or Wire. |

Payment Amount |

You can enter a negative amount to reflect an overpayment. |

Payment Totals

Field or Control |

Description |

|---|---|

Due to Company |

Displays the amount due to the company as calculated on the Administer Exercises - Cost page. |

Total Payments |

Displays the sum of payment amounts. |

Remaining Due |

This field is calculated by subtracting the Total Payments field from the Due to Company field. |