Setting Up Tax Rules

To set up tax rules, use the Stock Tax Types (ST_TAX_TYPE), Stock Country Tax (ST_COUNTRY_TAX), Stock State Tax (ST_STATE_TAX), and Stock Local Tax (ST_LOCAL_TAX) components.

This topic provides an overview of tax rule setup and discusses how to set up tax rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_TAX_TYPE |

Define the tax types and classes used by your payroll department. |

|

|

ST_COUNTRY_TAX |

Define default values for country taxes. You must first define tax types on the Stock Tax Types page. |

|

|

Stock State Tax Page |

ST_STATE_TAX |

Define default values for state taxes. You must first define Tax Types on the Stock Tax Types page. The data-entry fields on this page are identical to those on the Stock Country Tax page. |

|

Stock Local Tax Page |

ST_LOCAL_TAX |

Define default values for local taxes. You must first define Tax Types on the Stock Tax Types page. The data-entry fields on this page are identical to those on the Stock Country Tax page. |

By setting up default tax percentages and amounts you can limit the manual tax calculations that you need to perform when participants exercise options. You can override the defaults at the time of exercise depending on an individual employee's tax situation. However, by entering default tax information you get from your payroll administrator, you can help ensure that you don't take taxes above certain limits. If you use Payroll for North America, at a minimum, the tax types must be set up to integrate with the payroll system.

Important! The tax codes and data you enter here should be directly mapped from your payroll department. Contact your Payroll Administrator to get and maintain the information stored in these pages.

Warning! You are responsible for maintaining the default tax tables.

To set up tax rules:

Define tax types and classes.

Define default values for country taxes.

Define default values for state taxes.

Define default values for local taxes.

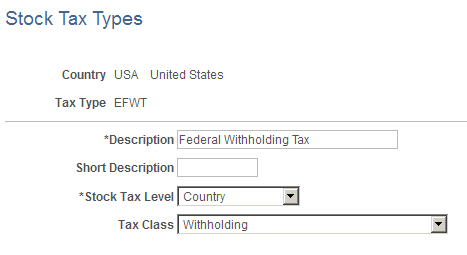

Use the Stock Tax Types page (ST_TAX_TYPE) to define the tax types and classes used by your payroll department.

Navigation:

This example illustrates the Stock Tax Types page.

Field or Control |

Description |

|---|---|

Stock Tax Level |

Select Country, Local, or State. |

Tax Class |

Select from available options. If your Stock Administration system is integrated with Payroll for North America, the Tax Class is set up in your payroll department. Work with your Payroll Administrator to find out the classes that are set up for payroll purposes to ensure the classes map correctly. |

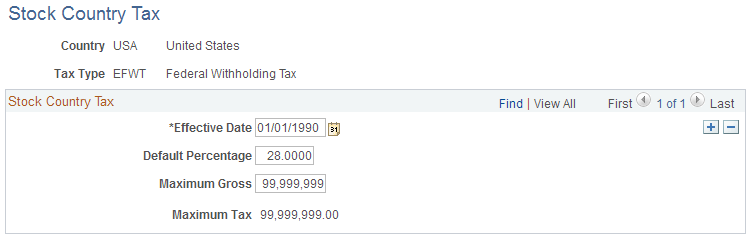

Use the Stock Country Tax page (ST_COUNTRY_TAX) to define default values for country taxes.

You must first define tax types on the Stock Tax Types page.

Navigation:

This example illustrates the Stock Country Tax page.

Field or Control |

Description |

|---|---|

Default Percentage |

Enter the percentage to use as default when calculating the tax due at the country level. You can override the percentage at the time of exercise or release. |

Maximum Gross |

Enter a maximum gross income. To indicate that there is no limit, enter 99,999,999. |

Maximum Tax |

The system displays the Maximum Tax based on data you entered in Default Percentage and Maximum Gross. |