Preparing Pay Period Reports

Note: Periodic payroll reports can be printed at any time. You may want to print many of these reports after running the payroll for each pay period.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Tax Submission Summary Report Page |

RUNCTL_PAYINIT |

(CAN) Generate TAX003CN that summarizes tax submission data, sorted by payroll account number. |

|

Deduction Register Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Deduction Register pay period report. |

|

Deduction Register Page |

RUNCTL_PAYINIT |

(CAN) Print Deduction Register pay period report. |

|

Payroll Register Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Payroll Register pay period report. |

|

Payroll Register Page |

RUNCTL_PAYINIT |

(CAN) Produces a report of pay cheque data by name, employee ID, and department ID for all employees who receive a pay cheque for a pay run and pay calendar. |

|

Cost Center Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Generate the PAY005 report that groups employee hours and earnings, sorted by cost center. You might have to modify the Structured Query Report (SQR) to meet your organization's requirements. |

|

Cost Center Report Page |

RUNCTL_PAYINIT |

(CAN) Generate the PAY005 report that groups employee hours and earnings, sorted by cost center. You might have to modify the SQR to meet your organization's requirements. |

|

Other Earnings Register Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Other Earnings Register pay period report. |

|

Other Earnings Register Page |

RUNCTL_PAYINIT |

(CAN) Print Other Earnings Register pay period report. |

|

Deductions in Arrears Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Deductions in Arrears pay period report. |

|

Deductions in Arrears Report Page |

RUNCTL_PAYINIT |

(CAN) Print Deductions in Arrears pay period report. |

|

Deductions Not Taken Report Page |

RUNCTL_PAYINIT |

Print Deductions Not Taken pay period report. |

|

Employees Not Processed Report Page |

RUNCTL_RPT_RUNID |

Print Employees Not Processed pay period report. |

|

RUNCTL_PAYINIT4 |

(USA, USF) Print Payroll Summary pay period report. |

|

|

Payroll Summary Report Page |

RUNCTL_PAY018CN |

(CAN) Print PAY018CN Payroll Summary pay period report. |

|

Employer Benefit Contributions Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Employer Benefit Contributions Report pay period report. |

|

Employer Benefit Contributions Report Page |

RUNCTL_PAYINIT |

(CAN) Print Employer Benefit Contributions pay period report. |

|

Statistics Canada Non-Educational Institutions Report Page |

RUNCTL_PAY100CN |

(CAN) Print PAY100CN Statistics Canada Non-Educational Institutions pay period report. |

|

Workers Comp Assessments Report Page (workers compensation assessments report) |

RUNCTL_PAY102CN |

(CAN) Print PAY102CN Workers Comp Assessments pay period report. |

|

Overtime Bank Report Page |

RUNCTL_PAY103CN |

(CAN) Print PAY103CN Overtime Bank pay period report. |

|

Statistics Canada Educational Institute Report Page |

RUNCTL_MO_YR_PAY |

(CAN) Statistics Canada Educational Institutional pay period report. |

|

Tax Deposit Summary Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Tax Deposit Summary pay period report. |

|

Local Tax Deposit Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Local Tax Deposit pay period report. |

|

RUNCTL_TAX010FD |

(USA) Print Federal Tax Summary pay period reports (TAX010FD, TAX010HA, and TAX010HB). |

|

|

State Tax Summary Report Page |

RUNCTL_TAX010ST |

(USA) Print TAX010ST State Tax Summary pay period report. |

|

Tax Summary Report-PA LST Page (tax summary report Pennsylvania - local services tax) |

RUNCTL_TAX010PA |

(USA, USF) Print TAX010PA Report-PA LST pay period report. |

|

Tax Summary-PA EIT Page (tax summary \Pennsylvania - earned income tax) |

RUNCTL_TAX011PA |

(USA, USF) Print TAX011PA Report-PA EIT pay period report. |

|

Reconciliation-Ohio Local Report Page |

RUNCTL_MO_QTR_YR |

(USA, USF) Print Reconciliation-Ohio Local pay period report. |

|

Federal Liability by State Report Page |

RUNCTL_PAYINIT2 |

(USA, USF) Print Federal Liability by State pay period report. |

|

Default Tax Data Report Page |

RUNCTL_FRMTHRU_PAY |

(USA, USF) Print FRMTHRU_PAY Default Tax Data pay period report. |

|

Default Tax Data Report Page |

RUNCTL_FRMTHRU_PAY |

CAN) Print FRMTHRU_PAY Default Tax Data pay period report. |

|

Employee Check Information Page Employee Cheque Information Page |

RUNCTL_TAX018 |

(USA, USF) Print TAX018 Employee Check Information pay period report. (Can) Print Employee Cheque Information pay period report. |

|

Employee Tax Information Report Page |

RUNCTL_TAX019 |

Print TAX019 Tax Information pay period report. |

|

Form 1042 Audit Page |

RUNCTL_TAX030 |

(USA) Print TAX030 Form 1042 Audit pay period report. |

|

EI Rebate Report Page (employment insurance rebate report) |

RUNCTL_TAX101CN |

(CAN) Print TAX101CN EI Rebate pay period report. |

|

RUNCTL_TAX102CN |

(CAN) Print TAX102CN Health Insurance Premium pay period report. |

|

|

RUNCTL_TAX103CN |

(CAN) Print TAX103CN Update Source Deductions pay period report. |

|

|

Employer Contribution to CNT Page (employer contribution to Commission des Normes du Travail) |

PRCSRUNCNTL |

(CAN) Print Employer Contribution to CNT pay period report. |

|

NW Territories Payroll Tax Report Page (Northwest Territories payroll tax report) |

RUNCTL_TAX905CN |

(CAN) Print TAX905CN NW Territories Payroll Tax Report pay period report. |

|

Nunavut Payroll Tax Report Page |

RUNCTL_TAX906CN |

(CAN) Print TAX906CN Nunavut Payroll Tax Report pay period report. |

|

RUNCTL_TAX907CN |

(CAN) Print TAX907CN British Columbia Annual Remuneration report for employer health tax. |

Following is a detailed summary of the output of the Payroll Summary report.

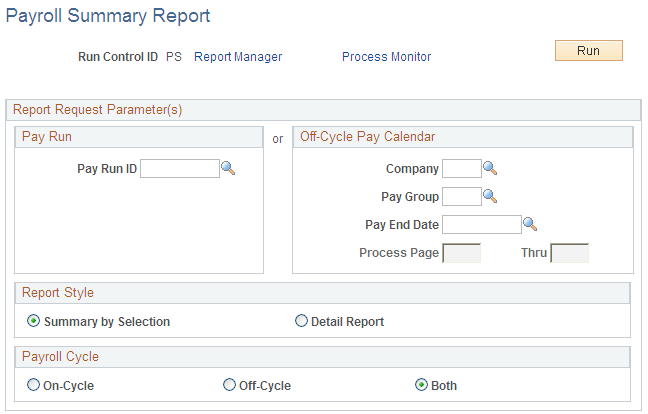

Select the Summary by Selection option and populate the Pay Run ID field to create an overall summary of companies and pay end dates in the RUNID. This report is identified as a Summary report in the heading.

If the pay run ID has only one company and only one pay end date, then the company, pay period end date, and pay run ID appear in the report.

If the same pay run ID is associated with multiple companies with the same pay end date, then the pay period end date and pay run ID appear in the report. The company does not appear in the report, and the field is blank.

If the same pay run ID is associated with multiple companies that do not share the same pay end date, then only the pay run ID appears in the report. The Company and Pay End Date fields are blank.

Select the Summary by Selection option and populate the Company, Pay Group, and Pay End Date fields to create an overall summary of companies and pay end dates for this selection. This report is identified as a Summary report in the heading.

The company and pay period end date appear in the report. The Pay Run ID field contains an asterisk (*).

Select the Detail Report option and populate the Pay Run ID field to create a detail report for each company and pay end date in the run ID. This report is identified as a Detail report in the heading.

If the pay run ID is for a single company, the company, pay period end date, and pay run ID appear in the report. A Summary report is not generated.

If the pay run ID is associated with multiple companies with the same pay period end date, the system creates a Detail report for each company and pay end date in the pay run ID. This report is identified as a Detail report in the heading. In the Detail report, the company, pay period end date, and pay run ID appear. A summary of all entries in the RUNID follows with the heading of Summary Report. In the Summary report, only the pay run ID appears.

If the pay run ID is associated with multiple companies with different pay period end dates, the system creates a Detail report for each company and pay end date in the pay run ID. This report is identified as a Detail report in the heading. In the Detail report, the company, pay period end date, and pay run ID are populated. A summary of all entries in the RUNID follows with the heading of Summary Report. In the Summary report, only the pay run ID appears.

Select Detail Report and populate the Company, Pay Group, and Pay End Date fields to create a Detail report for each company, pay group, and pay end date that you selected.

The system creates a Detail report for each company and pay end date in the pay run ID. This report is identified as a Detail report in the heading. In the Detail report, the company and pay period end date appear. The Pay Run ID field contains an asterisk (*) because the report does not know the pay run ID. In this case, a Summary report is not generated.

Payroll for North America delivers the B.C. (British Columbia) Employer Health Tax report (TAX907CN) to capture the total remuneration of B.C. employees for the previous year to assist employers in the estimation of their health tax obligations for the current year.

Prior to running this report, ensure that the final year-end process has been run for the specific company or companies to be reported. If the final year-end data is not available, the system generates an error message, and no report will be created.

See Also B.C. Employer Health Tax Report Page

Rerunning the Report for Prior Year Adjustments

If a B.C. employee’s original T4 slip from the prior year is amended or cancelled, the TAX907CN report can be rerun to reflect the revised total B.C. remuneration amount used to estimate the B.C. Employer Health Tax.

However, the status of the slips should be Closed before the report is run. If the status of the slips is Open, the report will not adjust the Total T4 Slips and Total Box 14 Total Remuneration values accordingly.

(USA, USF) Use the Payroll Summary Report page (RUNCTL_PAYINIT4) to print the Payroll Summary report.

Navigation:

This example illustrates the fields and controls on the Payroll Summary Report page.

Field or Control |

Description |

|---|---|

Summary by Selection |

Select this option to report only summary subtotals. |

Detail Report |

Select this option to include detail. |

Navigation:

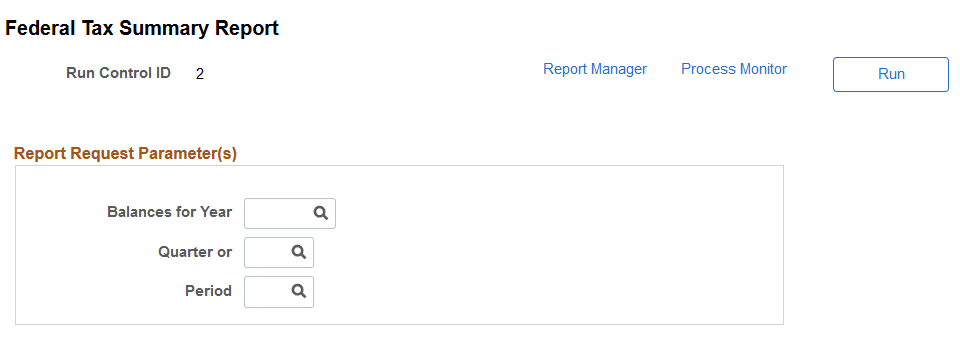

This example illustrates the fields and controls on the Federal Tax Summary Report page.

Field or Control |

Description |

|---|---|

Balances for Year |

Enter the calendar year for which you want to run this report. |

Quarter or Period |

Enter the quarter or period (month) for which you want to run this report. |

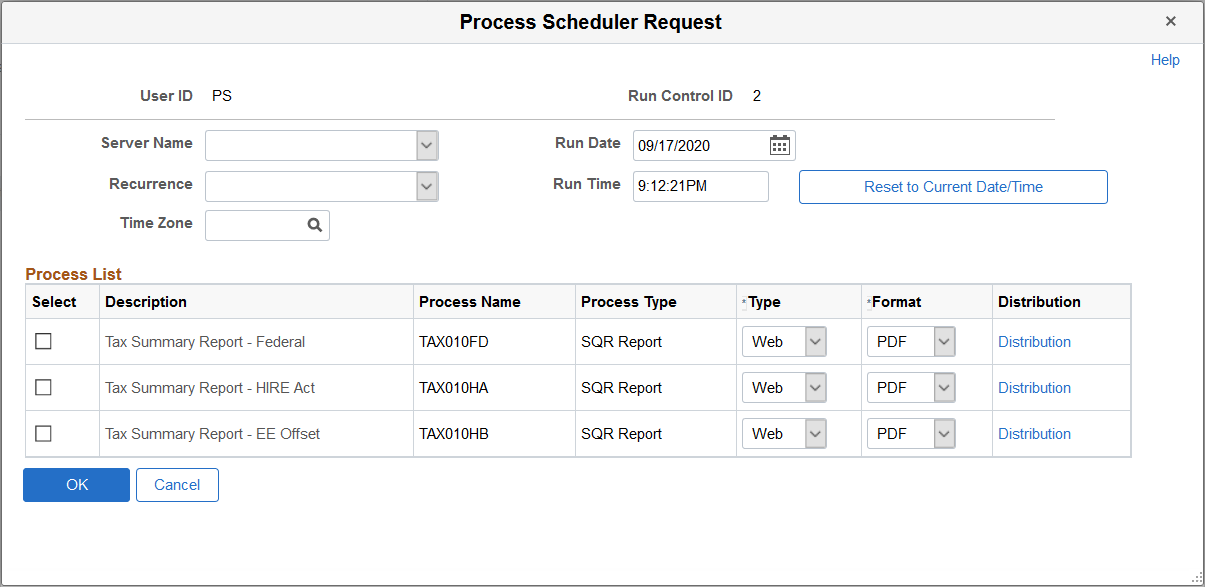

This example illustrates the fields and controls on the Federal Tax Summary Report - Process Scheduler Request page.

Select to run the TAX010FD, TAX010HA, TAX101HB, or a combination of these Federal Tax Summary reports.

TAX010FD.SQR produces a summary report of period-to-date federal income tax, Advance EIC payments, OASDI, OASDI tips, Medicare, Medicare tips, Additional Medicare, Federal Unemployment Insurance and Non Resident Alien Tax 1042.

TAX010HA and TAX010HB are a complement to the Federal Tax Summary Report (TAX010FD) and are modeled on the existing TAX010FD report.

TAX010HA.SQR reports negative dollar amounts for employer OASDI taxes on wages and tips. These negative dollar amounts are displayed in the Employer Taxable Wages and Employer Tax columns on the report for each of these two tax classes:

Tax Class 8 - FICA - ER Exempt

Tax Class 9 - FICA ER Tips Exempt

TAX010HB.SQR reports negative dollar amounts for employee OASDI taxes on wages and tips. These negative dollar amounts are displayed in the Employee Taxable Wages and Employee Tax columns on the report for each of these two tax classes:

Tax Class 8A - FICA - EE Exempt

Tax Class 9A - FICA EE Tips Exempt

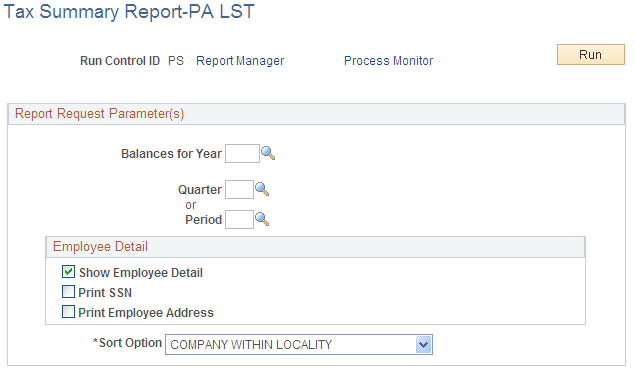

(USA, USF) Use the Tax Summary Report-PA LST (tax summary report Pennsylvania - local services tax) page (RUNCTL_TAX010PA) to print the Tax Summary report for Pennsylvania local services tax.

Navigation:

This example illustrates the fields and controls on the Tax Summary Report PA LST page.

Field or Control |

Description |

|---|---|

Balances for Year |

Enter the calendar year for which you want to run this report. |

Quarter or Period |

Enter the quarter or period for which you want to run this report. |

Show Employee Detail, Print SSN, and Print Employee Address |

Select the Show Employee Detail check box to include employee information in the report and to make the Print SSN and Print Employee Address check boxes appear on the page. Select these two additional check boxes to include the specified type of employee data in the report. If you choose to include employee addresses in the report, the system prints the employees' home addresses. |

Sort Option |

Select Company Within Locality or Locality Within Company. |

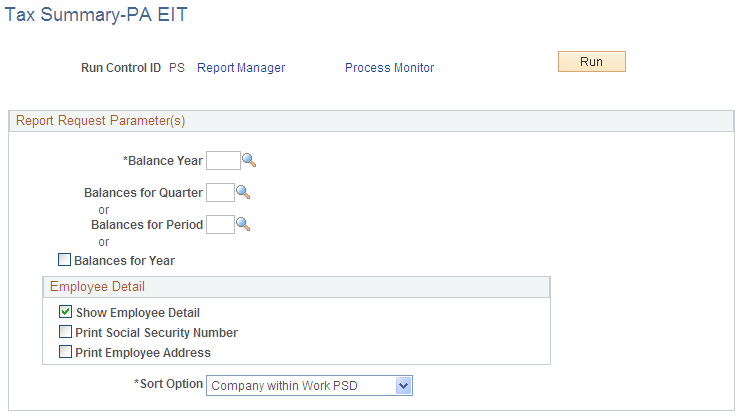

(USA, USF) Use the Tax Summary-PA EIT (tax summary report Pennsylvania - earned income tax) page (RUNCTL_TAX011PA) to print the Tax Summary report for Pennsylvania earned income tax.

Navigation:

This example illustrates the fields and controls on the Tax Summary Report PA EIT page.

The fields and controls here are the same as on the Use the Tax Summary Report-PA LST (tax summary report Pennsylvania - local services tax) page (RUNCTL_TAX010PA).

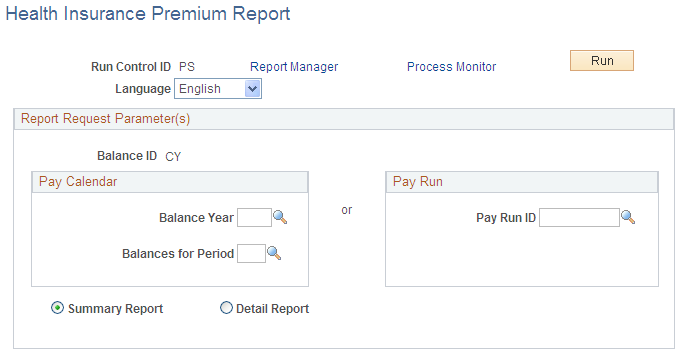

(CAN) Use the Health Insurance Premium Report page (RUNCTL_TAX102CN) to print the TAX102CN Health Insurance Premium report.

Navigation:

This example illustrates the fields and controls on the Health Insurance Premium Report page.

Field or Control |

Description |

|---|---|

Balance ID |

The default value is the balance ID for the calendar year. This field is unavailable for entry. |

Balance Year and Balances for Period |

Enter the year and month for which you want to run this report. |

Summary Report |

Select this option to report summary totals by company and province. |

Detail Report |

Select this option to include the employee detail listing. |

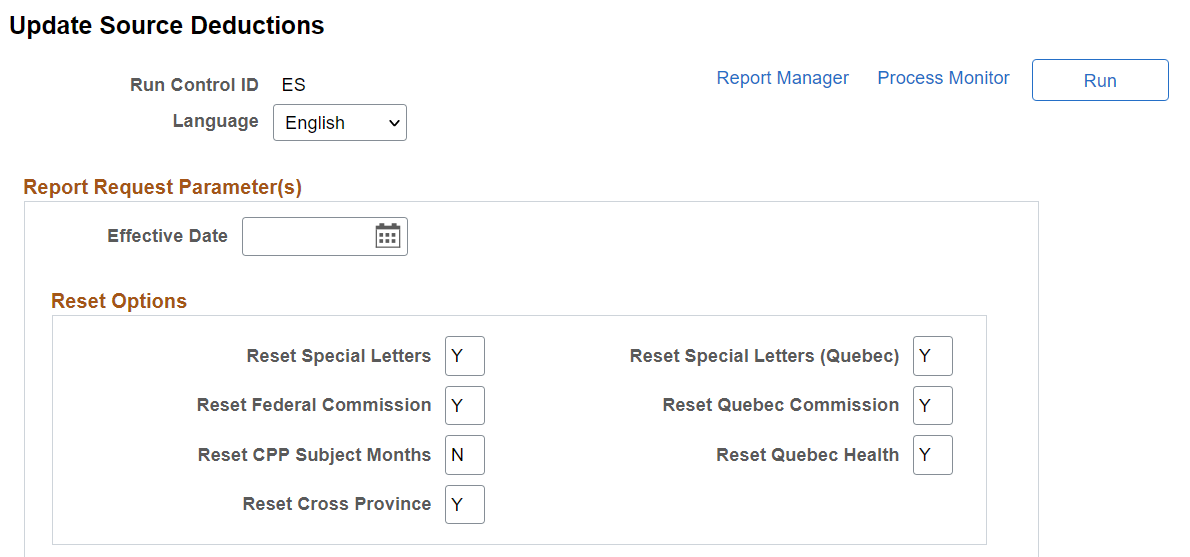

(CAN) Use the Update Source Deductions page (RUNCTL_TAX103CN) to print the TAX103CN Update Source Deductions report.

Navigation:

This example illustrates the fields and controls on the Update Source Deductions page (1 of 2).

This example illustrates the fields and controls on the Update Source Deductions page (2 of 2).

Reset Options

|

Field or Control |

Description |

|---|---|

|

Reset Special Letters |

Enter Y (yes) to reset the special letters amount to zero. |

|

Reset Federal Commission |

Enter Y to reset the federal commission amounts to zero. |

|

Reset CPP Subject Months (reset Canada Pension Plan subject months) |

Y (yes): Reset the employee's CPP subject months to 12. N (no): Reset the employee's CPP subject months to zero when the employee's original CPP subject months are fewer than 12 (for example, to reset CPP subject months to zero for employees who no longer contribute to CPP). If the employee's original CPP subject months are 12, they remain 12. |

|

Reset Cross Province |

Y (yes): The Cross Province check box on the Canadian Income Tax Data 2 page is deselected when the new record is created. N (no): The Reset Cross Province check box and associated field values are copied to the newly created record. |

|

Reset Special Letters (Quebec) |

Enter Y (yes) to reset the Quebec special letters amount to zero. |

|

Reset Quebec Commission |

Enter Y (yes) to reset the Quebec commission amounts to zero. |

|

Reset Quebec Health |

Enter Y (yes) to deselect the Exempt from Quebec Health check box on the Quebec Income Tax Data page for all employees for whom Exempt from Quebec Health is currently selected. Resetting in this way makes no employee exempt from Quebec Health. |

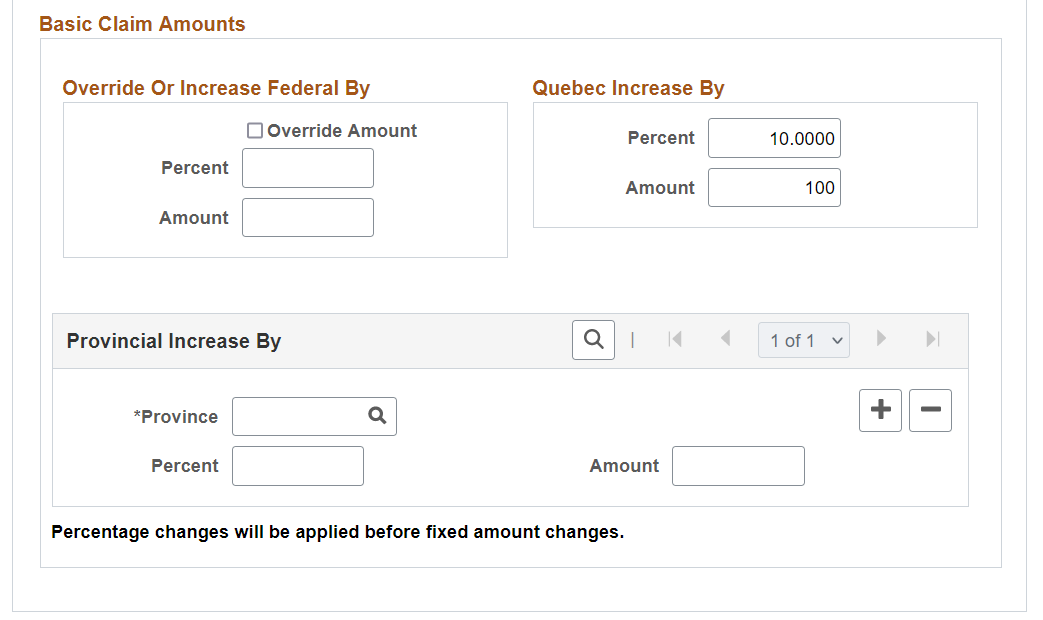

Basic Claim Amounts

|

Field or Control |

Description |

|---|---|

|

Override Or Increase Federal By |

Use this group box to perform updates to employees' federal basic claim amounts. Use percent, amount, or both to specify the value of the increase when the Override Amount check box is not selected. Use amount to specify the override amount when the Override Amount check box is selected. The amount will default to the Federal Basic Personal Amount from the Canadian Tax Table if amount is zero or blank. |

|

Quebec Increase By |

Use this group box to perform updates to employees' Quebec basic claim amounts. Use either percent or amount to specify the value of the increase. |

|

Provincial Increase By |

Use this group box to perform updates to employees' provincial basic personal amounts. Add rows to enter multiple provinces. Use either percent or amount to specify the value of the increase. |

Use the B.C. Employer Health Tax Report page (RUNCTL_TAX907CN) to print the TAX907CN British Columbia Annual Remuneration report for employer health tax.

Navigation:

This example illustrates the fields and controls on the B.C. Employer Health Tax Report page.

Field or Control |

Description |

|---|---|

Calendar Year |

Enter the previous calendar year. The B.C. Employer Health Tax (EHT) remittance requirement is based on the previous year’s total remuneration. The earliest calendar year is 2018. If an earlier year (or no value) is entered in this field, an error message is generated. |

Processing Option |

Select: All Companies (default) to include all companies in the health tax report for B.C. employers. Selected Companies to run the report a list of selected companies in the Companies field that appears. |

Company |

Select one or more companies to be included in the report. |