Administering Contract Prepay

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CONTRACT_PREPAY |

(E&G) Enable a contract employee to prepay benefits over the course of the contract and pay period when the employee's benefits coverage extends past the term of the contract. |

The Contract Prepay Options page enables employees who are paid only during their contract term to prepay their deductions for benefits that extend past the term of their contract. For example, if benefits coverage is 12 months and an employee has a six-month contract and is paid only during the contract term, the employee can choose to prepay the remaining six months benefits deductions during the contract (and pay) period. This prepayment option is only available to employees who are paid over the contract term and who have Pay Over Contract selected as the payment term on the Contract Pay page.

The contract prepay option functionality does not allow for gross-up checks.

Note: The contract prepay option is not recommended for employees that have multiple contracts that, taken together, span the benefits period.

The balance that is accrued with the prepayment deductions covers benefits deductions after the contract term ends. The system doesn't take the prepay deductions to cover them if there are insufficient funds in the paycheck. The system takes all current deductions first. The following situations outline when the system takes deductions and when it uses the prepay balance to cover deductions:

If there are sufficient funds in the paycheck to take the prepay deductions, the system takes the prepay deductions, but only up to the prepay limit (a percentage of the net pay).

If there are funds in the paycheck for the prepay limit to cover some of the prepaid deduction, the system takes a partial deduction, if the prepay deduction is set up for partial deductions.

If there are insufficient funds in the paycheck to cover the prepaid deduction, the system does not take the deduction.

If there are insufficient funds to cover all of the current deduction, the system takes as much as possible of the deduction from the prepaid balance.

When the employee no longer receives a paycheck (the contract and payment term have ended), the system takes current deductions from the prepaid balance.

It is possible to prepay too much or too little in some circumstances, such as:

The deduction rates are based on age.

The deductions are based on current pay earnings, and there is a pay change.

The deduction rate changes after the contract is over.

The prepayment factor causes over payment.

If an employee prepays too much for benefits, use paysheets to make a one-time deduction refund. If an employee prepays too little, make a one-time benefits payment.

You must set up the Company General Deductions page to use PREPAY as a deduction code.

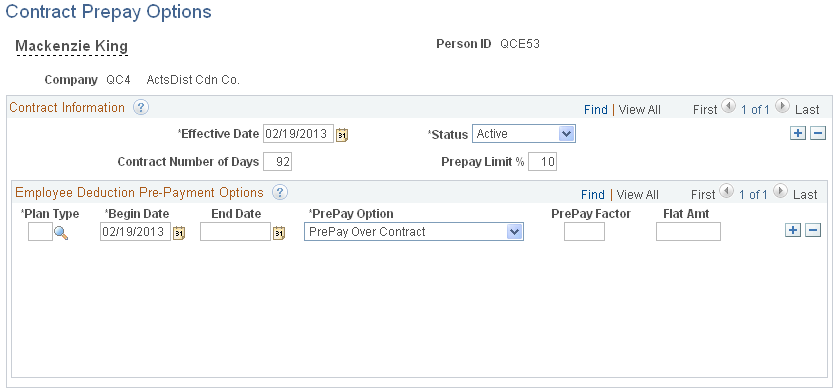

(E&G) Use the Contract Prepay Options page (CONTRACT_PREPAY) to enable a contract employee to prepay benefits over the course of the contract and pay period when the employee's benefits coverage extends past the term of the contract.

Navigation:

This example illustrates the fields and controls on the Contract Prepay Options page.

Field or Control |

Description |

|---|---|

Contract Number of Days |

The default value is the length of the contract term for the contract that is effective on the prepay options effective date. You can override this field. |

Prepay Limit % |

Enter the percentage of the net pay amount that you can use to prepay benefits. For example, if this value is 15, then you can use a maximum of 15 percent of the net pay amount to prepay benefits. If the prepay benefits amount exceeds 15 percent of the net pay amount, the system takes up to the 15 percent limit. |

Employee Deduction Pre-Payment Options

Use fields in this group box to indicate how to calculate the prepaid deductions for the specified benefits.

Field or Control |

Description |

|---|---|

PrePay Option |

Indicate how to calculate the prepaid deductions for this benefit: Contract: The system prorates the deductions that extend past the term of the contract across the contract pay period. Factor: The system adds a factor of the regular deduction to each pay period that falls in the time period in the Begin Date and End Date fields. The following are three possible prepay scenarios in the case of a 9-month contract with monthly payroll and 12-month benefits coverage. Assume the monthly benefits deductions are 60 USD:

|

Field or Control |

Description |

|---|---|

PrePay Factor |

Enter the prepay factor of the deductions that you are prepaying. For example, if you enter 2, the system deducts twice the pay-period deduction amount, in addition to the regular pay-period deduction, for each pay period between the begin and end dates. Use this field only when you select Factor in the PrePay Option field. Note: Using the PrePay Factor option might cause an overpayment of deductions. |