Setting Up the Final Average Earnings Function

To set up the final average earnings function, use the Final Average Earnings (AVERAGE_EARNINGS) component.

This topic provides an overview of the Final Average Earnings pages and discusses how to set up the final average earnings function.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_AVG_EARNS_PARMS |

Establish which consolidated earnings to use and which periods from the earnings history to use. |

|

|

PA_AVG_EARNS_PARM2 |

|

The consolidated earnings process produces periodic earnings totals—for example, an earnings total for each calendar year or anniversary year worked. If the benefit formula includes an average earnings component, use the Final Average Earnings pages to specify parameters for averaging those periodic earnings amounts.

All earnings consolidation periods that you reference from within a single Final Average Earnings function result must use the same consolidation period. This means that you cannot, for example, set up time segments to change over from a Final Average Earnings definition that uses calendar year consolidations to one that uses plan year consolidations.

Note: The final average earnings function calculates the average earnings element even when it's based on career pay rather than final pay.

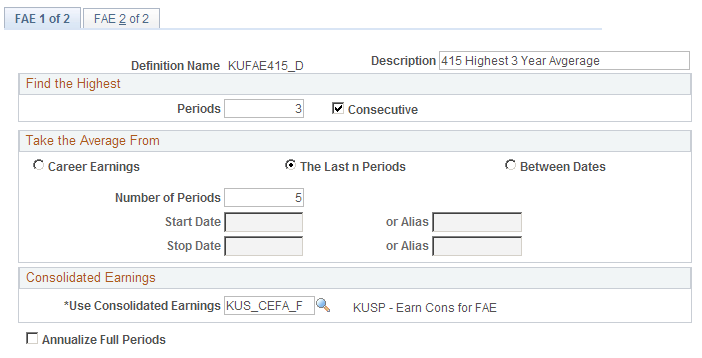

Use the FAE 1 of 2 page (PA_AVG_EARNS_PARMS) to establish which consolidated earnings to use and which periods from the earnings history to use.

Navigation:

This example illustrates the fields and controls on the FAE 1 of 2 page.

You can average earnings from every period in your averaging domain or pull out the highest earnings and average those. For example, you can average the earnings for an employee's highest-earning ten years in an employee's career, or the highest five of the last ten years.

Find the Highest

Field or Control |

Description |

|---|---|

Periods |

Specify the number of highest-earning periods to use. |

Consecutive |

Select to use the highest consecutive earning periods. |

Take the Average from

Whether you use all earnings periods or highest-earning periods, you can limit your averaging to periods within a defined time period. To do this, select one of the following options.

Field or Control |

Description |

|---|---|

Career Earnings |

This option looks at all available earnings. |

The Last n Periods |

This option looks back the number of periods you specify in the Number of Periods field. For example, to find the average earnings during an employee's final five years, specify five periods. On the FAE 2 of 2 page, you can direct the system to ignore final periods or periods with zero earnings. Ignored periods don't count when selecting the last periods. If you ignore the final period, the last five periods are the five periods before the final period. |

Between Dates |

Enter the start date and stop date for the time period. You can enter either a constant date or an alias. For example, you might use all periods between the plan participation date (date of plan entry) and the event date, excluding earnings from the periods before an employee meets the participation criteria. |

Consolidated Earnings

Field or Control |

Description |

|---|---|

Use Consolidated Earnings |

Indicate the source of the earnings data by entering a consolidated earnings function result. Earnings data is maintained by the earnings consolidation process. You define rules on the consolidated earnings pages. Periodic processing creates the earnings data by applying those rules to data in PeopleSoft payroll tables. |

Annualize Full Periods |

Select this option to annualize earnings for a period in which an employee worked the entire period, but accrued less than full service. Earnings are annualized based on the service function result for periods that have a partial period indicator of N (not a partial period). For example, if actual earnings are 18,000 USD, accrued service for the period is 0.75, and the partial period indicator for the period is N, then the annualized amount is 18,000 USD/0.75 or 24,000 USD. Note: The final average earnings and service function results must have the same computation period. |

Service Function Result |

Select the name of the service function result to be used for annualized earnings. |

Annualize Partial Periods |

Earnings are annualized for partial service periods (partial period indicator is Y). This is based on the service function result indicated. |

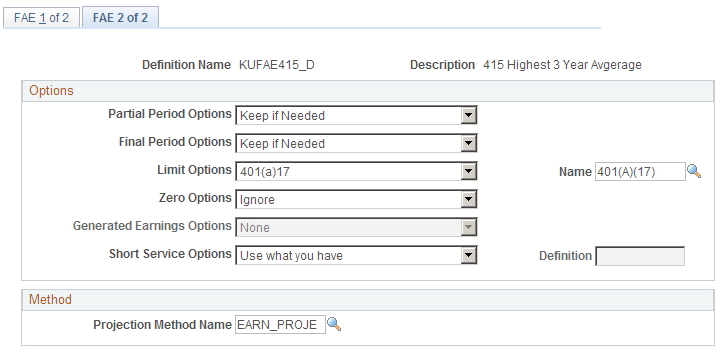

Use the FAE 2 of 2 page (PA_AVG_EARNS_PARM2) to:

Define adjustments to partial periods, final periods, and zero earnings periods.

Generate earnings.

Adjust earnings according to 401(a)(17) limits or other earnings limits.

Navigation:

This example illustrates the fields and controls on the FAE 2 of 2 page.

Options

Field or Control |

Description |

|---|---|

Partial Period Options |

The consolidated earnings history can include partial periods for any number of reasons. The consolidation process marks partial periods according to the criteria you set up in the consolidated earnings definition. Typically, they are based on the occurrence of specified human resources (HR) actions, such as leaves of absence, but they may be based on other criteria that you define. Select one of the following values to indicate how to process partial periods: Always Ignore: Never include partial periods, regardless of their effect on the average. Always Use: Use the partial period, but take the period length into account in the averaging process. Keep if Needed: Include the period only if the averaging definition specifies a certain number of periods to be averaged and an employee doesn't have enough periods unless the partial period is included. Treat as Full: Treat partial period earnings the same as full period earnings. Include them in the average without taking into account the shorter length of the period. User Code: Select this option to use customized code for including partial periods. |

With Always Use, you need to know the length of the short period. The consolidated earnings function calculates a partial period fraction for each partial period, and this fraction tells the system how much of the period counts.

Compare how Always Use and Treat as Full average the following five earnings periods: four full calendar year periods with earnings of 30,000 USD, 31,000 USD, 32,000 USD, and 33,000 USD; one partial period with earnings of 17,000 USD and a partial period fraction of ½ (meaning that the employee worked for half of the period).

In both cases, the averaging numerator is the sum of all the amounts: 143,000 USD. With Always Use, the averaging denominator is the sum of all the period lengths: 4.5. The average, therefore, is 31,777.78 USD. Using Treat as Full, the numerator is the same, but the denominator is five because the system does not take into account the shorter length of the partial period. This yields a significantly lower average: 28,600 USD.

Keep if Needed also ignores the partial period length.

Field or Control |

Description |

|---|---|

Final Period Options |

Final period values include all the partial period options plus two more: Use if Higher Average: If the final period is one of the highest periods or is part of the consecutive group with the highest average, include it. Otherwise, ignore the period. Use Only Full: Use the final period if it is a full period. |

Limit Options |

Use this field to limit the periodic earnings that the consolidated earnings process provides. Select one of these values: Maximum Taxable Wage Base: Limit annual earnings to the maximum taxable wage base (TWB). If the period is a calendar year, the system uses the TWB for that year as the limit. Otherwise, the system uses the TWB from the year that has the most days in the period. For example, if the period is 11/01/2003 to 10/31/2004, the limit is the TWB for 2004. None: There are no earnings limits. User Code Before Averaging: Use a custom limit that is applied to each period before averaging. User Code While Averaging: Use a custom limit that is applied to the average. 401(a)17: Earnings to be averaged are limited according to the 401(a)(17) parameters you specify in the adjoining Name field. Also, the final average earnings result is limited to the 401(a)(17) limit in effect at the event date. |

Note: Both 401(a)17 and Maximum Taxable Wage Base limit the earnings before determining the high periods or the high consecutive periods. If your plan uses limits that can't be determined until the high periods or high consecutive periods have been identified, you must select User Code While Averaging.

Field or Control |

Description |

|---|---|

Zero Options |

Includes User Code. Ignore: Never include any periods with zero earnings. Replace with Look Back: Replace the zeros with the prior non-zero value. Use: Treat zero earnings the same as any earnings. Include them in the average, allowing them to reduce the result. |

When you set Zero Options, be sure you understand when and why the consolidated earnings process produces zero earnings periods. Because consolidated earnings periods must be consecutive, you never have an interrupted earnings history; instead, you have zero earnings periods.

Consider Howard, who participated in the plan for five years, then changed jobs and wasn't eligible for the plan for ten years, then changed jobs again to become eligible once more. If the consolidated earnings definition is set up not to count any earnings for the period of ineligibility, Howard has ten earnings rows with zero earnings. On the other hand, if your consolidated earnings definition continues to count earnings or generate earnings for the ten years of ineligibility, there are no zero rows.

Margie, on the other hand, actually left the company for ten years. She has ten periods with zero earnings unless the consolidated earnings definition generates earnings for these periods.

Note: Consolidated earnings history consists of uninterrupted consecutive rows. Employees with interrupted earnings histories have zero earnings periods unless the consolidated earnings definition generates earnings for those periods.

Field or Control |

Description |

|---|---|

Generated Earnings Options |

Enables you to generate earnings by looking back to previous periods included in the high average. Because the generation does take place until the high periods are identified, the consolidation process cannot generate this final amount. Note: This functionality is not currently available. |

Short Service Options |

Some of the average earnings parameters on the FAE 1 of 2 page imply a need for a minimum number of periods. For example, a plan may use the highest five consecutive years in the last fifteen years. An employee hired at age 62 becomes 100 percent vested and entitled to a normal retirement benefit at age 65, but doesn't have enough years of earnings to use the plan's regular final average earnings rules. Includes User Code. Different FAE Definition: Use another set of final average earnings parameters. Enter the name of the alternate parameter set in the Definition field. Use what you have: Average as many periods as an employee has. Periods that are ignored because of other parameters (zero earnings periods or partial periods) are still ignored with this option. |

Projection Method Name |

Because consolidated earnings data is not always available for all periods up to the event date (specifically, for estimates with event dates in the future), every final average earnings definition requires a projection method. The projection method establishes an annualized amount for the current period. It then applies the assumed salary escalation rate (entered on the calculation page) to estimate future periods. The final period earnings are prorated using rules from the projection method. |