Setting Up Service Purchase Configuration Rules

This topic provides an overview of service purchase configuration rules and discusses how to set up those rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_SP_CFG_ELIG |

Define which service purchase types a plan supports, and for each service purchase type, specify how to determine eligibility to purchase service and how to calculate purchasable service. |

|

|

PA_SP_CFG_PARAMS |

Enter general rules for service purchases, including minimums and maximums for the plan and for specific service purchase types, whether certain overrides are allowed, and tolerance and expiration rules. |

|

|

PA_SP_BFT_BASIS |

Define rules for calculating benefits with and without purchased service. |

|

|

PA_SP_COST_BASIS |

Define rules for determining the cost of a service purchase. |

|

|

PA_SP_PAYMENT_OPT |

Enter service purchase rules related to payments, including rules cancellations and refunds and rules for lump sums, installment payments, and payments through payroll deductions. |

|

|

PA_SP_AR_CFG |

Enter parameters to support integration with PeopleSoft Accounts Receivable. |

With service purchase configuration rules, you can control:

Which of your service purchase types are allowed by the plan, and who is allowed to purchase each type of service.

General rules such as maximum purchase amounts and whether manual overrides are allowed.

How to calculate benefit amounts with and without purchased service.

How to calculate the cost of a service purchase.

What payment options are available to an employee who wants to purchase service.

Service purchase integration with PeopleSoft Accounts Receivable (AR).

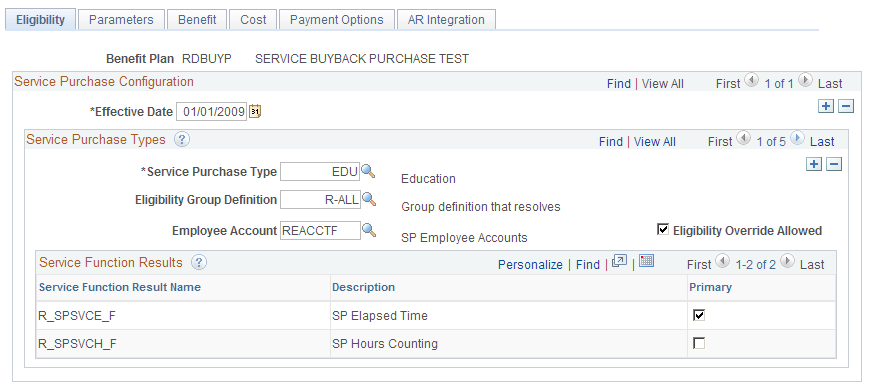

Use the Service Purchase Configuration - Eligibility page (PA_SP_CFG_ELIG) to define:

Which service purchase types a plan supports.

The group definition used to determine eligibility for each service purchase type.

The employee account and service function result used for each service purchase type.

Navigation:

This example illustrates the Service Purchase Configuration - Eligibility page.

Field or Control |

Description |

|---|---|

Benefit Plan |

When you access this component, you identify the benefit plan that you are configuring. |

Service Purchase Configuration

Field or Control |

Description |

|---|---|

Effective Date |

Enter the effective date of your configuration. Use the effective date scroll area to manage changes to your configuration over time. |

Service Purchase Types

Field or Control |

Description |

|---|---|

Service Purchase Type |

Create a row for every service purchase type that this plan offers. Service purchase types are configured on the Service Purchase Type Page. |

Eligibility Group Definition |

For each service purchase type, enter the Eligibility Group Definition that the system uses to determine whether an employee is eligible for a service purchase arrangement. |

Employee Account |

For service purchase types other than Withdrawn Contributions, use the Employee Account field to identify the service purchase account that the system will use to store the cost of the service purchase and to track service purchase payments. Note: The specified employee account can be used only once per employee. So when you set up your employee accounts for service purchase, the best practice is to create a set of identical accounts where the base account name (the one entered here) has at most eight characters, and the additional accounts have the same name with sequential two-digit suffixes, starting with 01. Then, if an employee enters into more than one service purchase arrangement that is configured to use the specified account, the system automatically looks for the next unused account in the set. |

Eligibility Override Allowed |

Select this check box if users can manually override the system’s determination of eligibility. |

Service Function Results

Field or Control |

Description |

|---|---|

Service Function Result Name and Description |

After you specify the employee account to be used for tracking the service purchase, the system populates the Service Function Result grid with all of the service function results that are associated with that account definition. |

Primary |

Select the Primary check box for the type of service that the system will use when performing the service purchase calculations. |

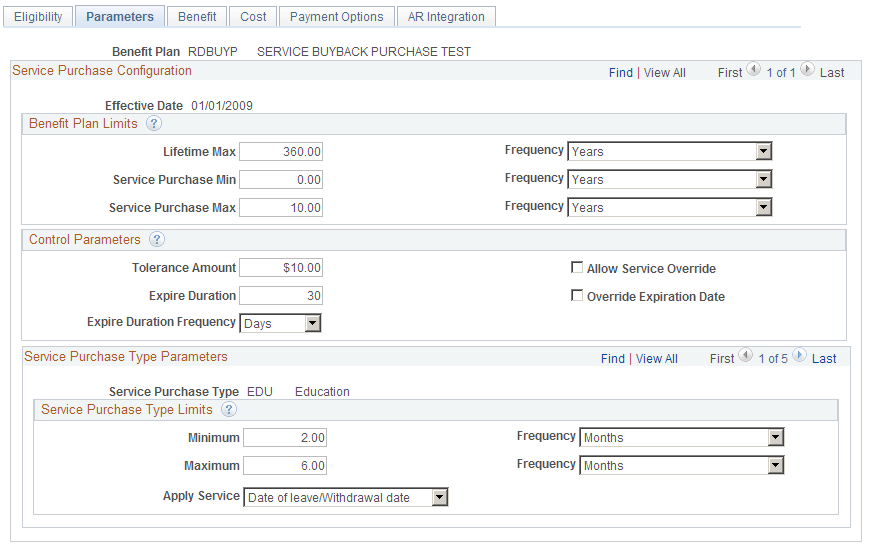

Use the Service Purchase Configuration - Parameters page (PA_SP_CFG_PARAMS) to enter general rules for service purchases, including minimums and maximums for the plan and for specific service purchase types, whether certain overrides are allowed, and tolerance and expiration rules.

Navigation:

This example illustrates the Service Purchase Configuration - Parameters page.

Enter general parameters for the selected benefit plan and effective date.

Benefit Plan Limits

Use the fields in the Benefit Plan Limits group box to specify overall plan limits that apply across the plan and are not limited to a specific service purchase type.

Field or Control |

Description |

|---|---|

Lifetime Max (lifetime maximum) and Frequency |

Enter the lifetime maximum amount of service that can be accumulated for the specified plan. Select Months or Years in the Frequency field, and enter the number of months or years in the Lifetime Max field. |

Service Purchase Min (service purchase minimum) and Frequency |

Enter the minimum amount of service that must be purchased. Select Months or Years in the Frequency field, and enter the number of months or years in the Service Purchase Min field. |

Service Purchase Max (service purchase maximum) and Frequency |

Enter the maximum amount of service that can be purchased. Select Months or Years in the Frequency field, and enter the number of months or years in the Service Purchase Max field. |

Control Parameters

Field or Control |

Description |

|---|---|

Tolerance Amount |

Due to rounding variances, payments applied to the employee Service Purchase account may not bring the account exactly to a zero balance. Use the Tolerance Amount field to indicate the threshold where a non-zero balance is considered to be fully paid. |

Allow Service Override |

Select this check box to allow users to manually modify the amount of service that the system has calculated for a specific service purchase. |

Expire Duration and Expire Duration Frequency |

Specify how long a service purchase agreement remains valid. Select Days or Months in the Expire Duration Frequency field, and enter the number of days or months in the Expire Duration field. |

Override Expiration Date |

Select this check box to allow users to manually modify the calculated expiration date. |

Service Purchase Type Parameters

This scroll area lists the service purchase types that you added on the Service Purchase Configuration - Eligibility Page. For each service purchase type, enter the following information.

Field or Control |

Description |

|---|---|

Minimum and Frequency |

Enter the minimum amount of service that can be purchased for the specified service purchase type. |

Maximum and Frequency |

Enter the maximum amount of service that can be purchased for the specified service purchase type. |

Apply Service |

Choose when the purchased service is added to the employee’s service account. Select Date of leave/Withdrawal date to add the purchased service to the period of the original leave or contribution withdrawal. Select Payment Period to add the purchased service to the periods when the purchase payments are made. |

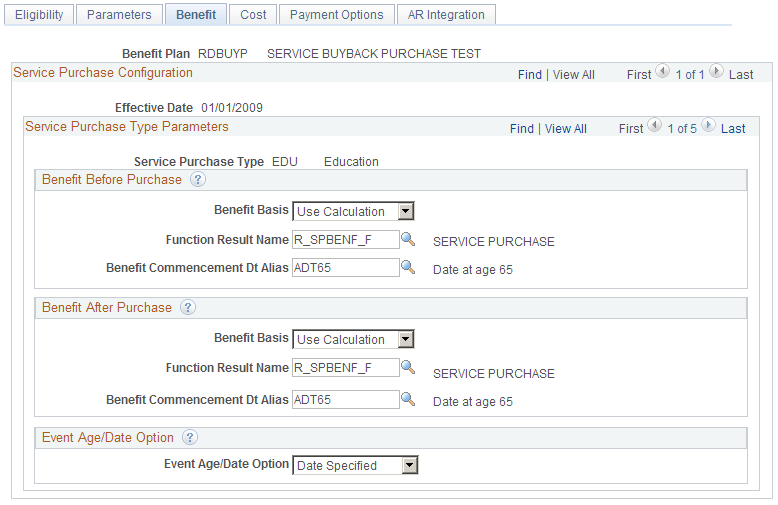

Use the Service Purchase Configuration - Benefit page (PA_SP_BFT_BASIS) to define rules for calculating benefits with and without purchased service.

Navigation:

This example illustrates the Service Purchase Configuration - Benefit page.

Enter benefit calculation options for the selected benefit plan, effective date, and service purchase type. The Service Purchase Type Parameters scroll area lists the service purchase types that you added on the Service Purchase Configuration - Eligibility Page.

Benefit Before Purchase and Benefit After Purchase

Service purchase estimates for employees show the projected benefit amount with and without the purchased service. Use the Benefit Before Purchase and Benefit After Purchase group boxes to enter parameters for these projected benefit amounts.

Field or Control |

Description |

|---|---|

Benefit Basis |

Select Use Calculation to have the system calculate the benefit amount, or select Enter Amount if the user will enter the benefit amount manually. |

Function Result Name |

If you selected Use Calculation as the benefit basis, enter the benefit formula function result to use when calculating the benefit. This field is not available if you selected Enter Amount in the Benefit Basis field. |

Benefit Commencement Dt Alias (benefit commencement date alias) |

If you selected Use Calculation as the benefit basis, enter an alias for the benefit commencement date to use when calculating the benefit. This field is not available if you selected Enter Amount in the Benefit Basis field. |

Event Age/Date Option

Field or Control |

Description |

|---|---|

Event Age/Date Option |

An employee's pension benefit depends on the event date when the employee ends employment. Service stops accruing as of the event date. Benefit eligibility might depend on the event date, and other calculation components might use this date, depending on your plan rules. Select Age Specified, Date Specified, or Alias Date to indicate what type of input will be used for the assumed event date for the benefit calculations for a service purchase estimate. |

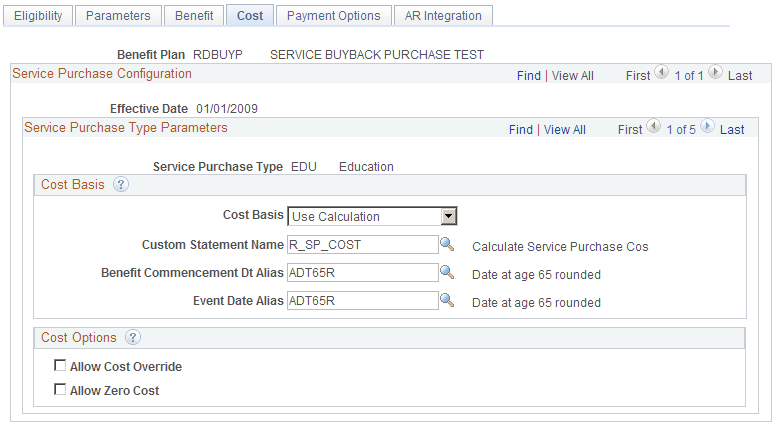

Use the Service Purchase Configuration - Cost page (PA_SP_COST_BASIS) to define rules for determining the cost of a service purchase.

Navigation:

This example illustrates the Service Purchase Configuration - Cost page.

Enter cost calculation options for the selected benefit plan, effective date, and service purchase type. The Service Purchase Type Parameters scroll area lists the service purchase types that you added on the Service Purchase Configuration - Eligibility Page.

Cost Basis

Field or Control |

Description |

|---|---|

Cost Basis |

Use the Cost Basis field to specify how the system will determine the cost of purchasable service.

|

Program Name |

If you selected App Engine Process in the Cost Basis field, enter the name of the Application Engine program. |

Custom Statement Name |

If you selected Use Calculation in the Cost Basis field, enter the name of the custom statement that performs the calculation. |

Benefit Commencement Dt Alias (benefit commencement date alias) |

If you selected Use Calculation in the Cost Basis field, enter the name of the date alias for the benefit commencement date to be used in the calculation. |

Event Date Alias |

If you selected Use Calculation in the Cost Basis field, enter the name of the date alias for the event date. |

Cost Options

Field or Control |

Description |

|---|---|

Allow Cost Override |

Select this check box to allow users to override the calculated cost on a service purchase agreement. |

Allow Zero Cost |

Select this check box to allow a zero cost option on service purchase agreements. |

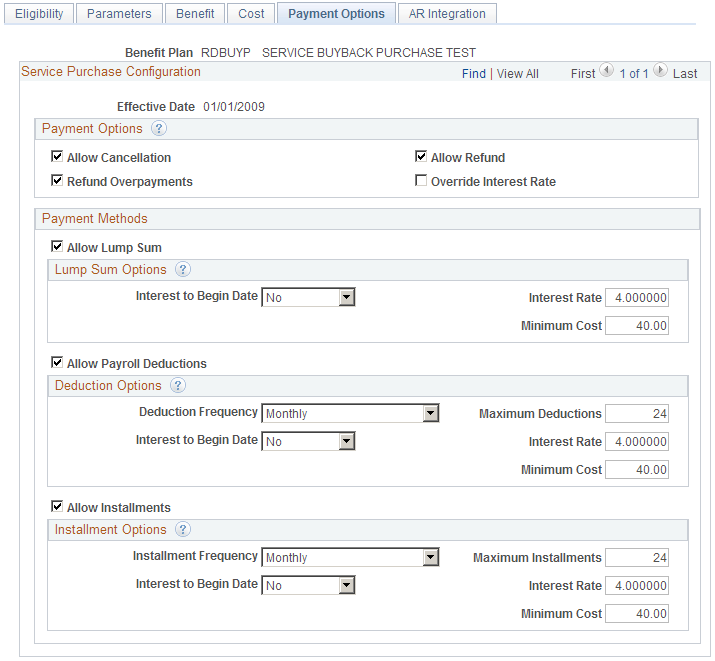

Use the Service Purchase Configuration - Payment Options (PA_SP_PAYMENT_OPT) page to enter service purchase rules related to payments, including rules cancellations and refunds and rules for lump sums, installment payments, and payments through payroll deductions.

Navigation:

This example illustrates the Service Purchase Configuration - Payment Options page.

Enter payment options for the selected benefit plan and effective date. Payment options are the same for all service purchase types.

Payment Options

Field or Control |

Description |

|---|---|

Allow Cancellation |

Select this check box to permit cancellation of purchase agreements after the agreement is in Elected status. |

Allow Refund |

If cancellations are allowed, select the Allow Refunds check box to give users the option of initiating a payment refund at the time the agreement is cancelled. |

Refund Overpayments |

Select this check box to use your accounts receivable system to refund payment in excess of the amount required to complete the purchase. If this check box is not selected, the overpayment is kept in the employee account. |

Override Interest Rate |

Select this check box to make the interest rate editable on a service purchase transaction. If this check box is not selected, the interest rate on the service purchase transaction is read-only, and users cannot override the default interest rate. |

Payment Methods

Field or Control |

Description |

|---|---|

Allow Lump Sum |

Select this check box to allow lump sum payments for service purchase. |

Allow Payroll Deductions |

Select this check box to allow employees to use payroll deductions to pay for service purchase. |

Allow Installments |

Select this check box to allow installment payments for service purchase. |

Lump Sum Options

Use the fields in this group box to specify parameters specific to receiving payments as a lump sum. These fields are editable only if the Allow Lump Sum check box is selected.

Field or Control |

Description |

|---|---|

Interest to Begin Date |

Select Yes if the system should begin calculating interest from the original purchase date. Select No if no interest is applied. Interest is calculated from the date of the cost estimate to the lump sum payment date. |

Interest Rate |

If you selected Yes in the Interest to Begin Date field, enter a default interest rate. |

Minimum Cost |

Enter any minimum amount below which lump sum payments are not allowed. |

Deduction Options

Use the fields in this group box to specify parameters specific to receiving payments through payroll deductions. These fields are editable only if the Allow Payroll Deductions check box is selected.

Field or Control |

Description |

|---|---|

Deduction Frequency |

Specify the frequency for payments made by payroll deduction: Weekly, Semi-Monthly, Monthly, Bi-Monthly, or Quarterly. |

Maximum Deductions |

Specify the maximum number of payroll deductions across which the cost can be spread. |

Interest to Begin Date |

Select Yes if the system should begin calculating interest from the original purchase date. Select No if no interest is applied. |

Interest Rate |

If you selected Yes in the Interest to Begin Date field, enter a default interest rate. |

Minimum Cost |

Enter any minimum amount below which payroll deduction payments are not allowed. |

Installment Options

Use the fields in this group box to specify parameters specific to receiving installment payments. These fields are editable only if the Allow Installments check box is selected.

Field or Control |

Description |

|---|---|

Installment Frequency |

Specify the frequency for installment payments: Weekly, Semi-Monthly, Monthly, Bi-Monthly, or Quarterly. |

Maximum Installments |

Specify the maximum number of installments across which the cost can be spread. |

Interest to Begin Date |

Select Yes if the system should begin calculating interest from the original purchase date. Select No if no interest is applied. |

Interest Rate |

If you selected Yes in the Interest to Begin Date field, enter a default interest rate. |

Minimum Cost |

Enter any minimum amount below which installment payments are not allowed. |

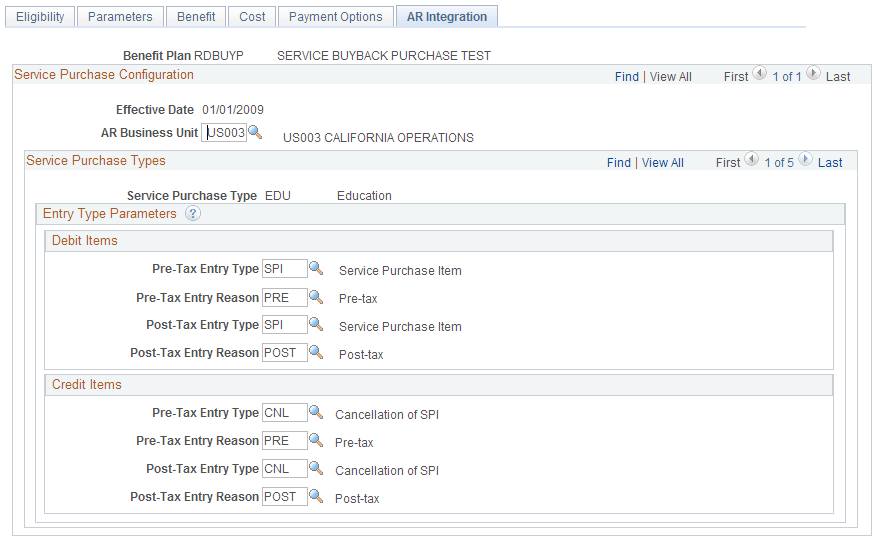

Use the Service Purchase Configuration - AR Integration page (PA_SP_AR_CFG) to enter parameters to support integration with PeopleSoft Accounts Receivable.

For more information about integration between PeopleSoft Pension Administration and PeopleSoft Receivables, refer to your PeopleSoft Receivables documentation.

Navigation:

This example illustrates the Service Purchase Configuration - AR Integration page when integration with PeopleSoft Receivables is active. Notice that you set up the integration using entry type parameters.

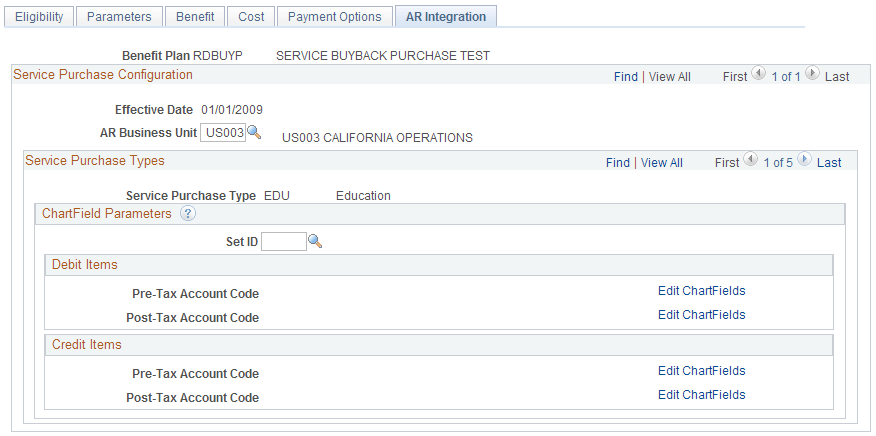

This example illustrates the Service Purchase Configuration - AR Integration page when integration with PeopleSoft Receivables is active. Notice that you set up the integration using ChartField parameters.

Enter accounts receivable integration options for the selected benefit plan, effective date, and service purchase type. The Service Purchase Types scroll area lists the service purchase types that you added on the Service Purchase Configuration - Eligibility Page.

Service Purchase Configuration

Field or Control |

Description |

|---|---|

AR Business Unit (accounts receivable business unit) |

Enter the accounts receivable business unit for integration with PeopleSoft Receivables or another accounts receivable system. To use different accounts receivable business units for different human resources business units, leave this field blank and instead use the Business Unit Reference Page to map your human resources business units to different accounts receivable business units. If you set up this mapping, then each employee’s human resources business unit is used to determine the appropriate accounts receivable business unit. |

Entry Type Parameters

This section of the page is visible only if the Use ChartFields check box on the Pension Installation Page is deselected, indicating that your accounts receivable integration is with PeopleSoft Receivables.

Use the Entry Type Parameters to specify pre-tax and post-tax entry types and reasons for both debit items and credit items. Debit entries are used to create open items in PeopleSoft Receivables. Credit entries are used to cancel open items in PeopleSoft Receivables.

Note: Entry Types in PeopleSoft Receivables are associated with a sign, positive or negative. If you accidentally choose a positive entry type for a credit memo, or a negative entry type for a debit memo, Receivables will send an error message reply to the message from the pension system.

ChartField Parameters

If you integrate with an accounts receivable system other than PeopleSoft Receivables, use the ChartField Parameters to specify pre-tax and post-tax ChartField codes for both debit items and credit items.

Debit entries are used to create open items in the receivables system. Credit entries are used to cancel open items in the receivables system.