Setting Up Cash Balance Parameters

To set up cash balance parameters, use the Cash Balance Accounts (CASH_BALANCE_ACCOU) component.

To maintain a cash balance plan, you track the allocated credits to individual employee accounts. These credits are based on a percentage of earnings. The cash balance also includes interest on these credits. Use the Cash Balance Account pages to set up parameters for handling the credits and interest.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CSHBAL_ACCT_C1 |

Establish the earnings basis used to calculate cash balance credits and to set the cash balance accumulation period. |

|

|

PA_CSHBAL_ACCT_C2 |

Specify a method for taking a percentage of earnings. |

|

|

PA_CSHBAL_ACCT_C3 |

Specify the rate or rates to use, regardless of whether you use a level rate or different rates above and below a threshold. |

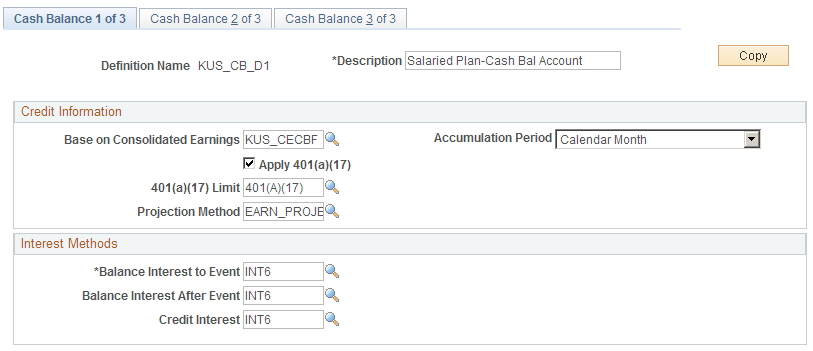

Use the Cash Balance 1 of 3 page (PA_CSHBAL_ACCT_C1) to establish the earnings basis used to calculate cash balance credits and to set the cash balance accumulation period.

Navigation:

This example illustrates the fields and controls on the Cash Balance 1 of 3 page.

Credit Information

Field or Control |

Description |

|---|---|

Base on Consolidated Earnings |

Indicate the consolidated earnings function result you use as the source of your earnings data. The cash balance accounts function determines credits as a percentage of earnings. The consolidated earnings function provides the earnings history. |

Accumulation Period |

Select the cash balance accumulation period: Plan Year, Calendar Year, or Calendar Month. Cash balance accounts grow over defined accumulation periods. For example, a plan may grant credits every calendar year or every plan year. Interest is credited at the end of the accumulation period. When you look at the results of your cash balance calculations, you see the total for each period, as well as the balance at the end of each period. Note: Your cash balance accumulation period must match the accumulation period for the consolidated earnings you specify. |

Apply 401(a)(17) |

Select this option to use the limits. If you use the limits, use the adjoining text field to indicate the 401(a)(17) method to use. Qualified plans must observe Section 401(a)(17) limits. |

Projection Method |

Enter a projection method. Because consolidated earnings data is not always available for all periods (it is not available for estimates with event dates in the future), every cash balance accounts definition requires a projection method. The projection establishes an annualized earnings amount for the current period and then applies the assumed salary escalation rate (entered on the calculation page) to estimate future periods. The final period earnings are prorated using rules from the projection method. |

Interest Methods

Employees receive interest at the end of each accumulation period.

You can use different interest methods for amounts credited during the current period and for prior balances. You can also use different prior balance methods before the event date and after the event date.

Field or Control |

Description |

|---|---|

Balance Interest to Event |

Enter a method to use for balances up to the event date. |

Balance Interest After Event |

Enter a method to use for balances after the event date. |

Credit Interest |

Enter a method to use for credits made for the current period. |

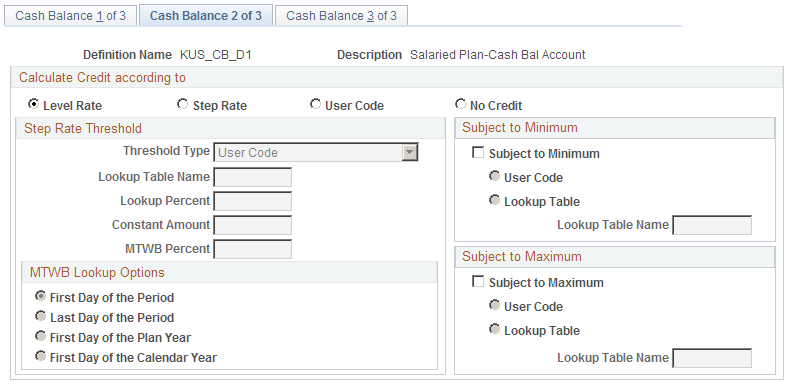

Use the Cash Balance 2 of 3 page (PA_CSHBAL_ACCT_C2) to specify a method for taking a percentage of earnings.

Navigation:

This example illustrates the fields and controls on the Cash Balance 2 of 3 page.

Calculate Credit according to

To accumulate credits based on earnings, you need to indicate the percentage of the earnings to use. Select one of the following options.

Field or Control |

Description |

|---|---|

Level Rate |

Uses the same percentage for all earnings. Set the rate used on the Cash Balance 3 of 3 page. |

Step Rate |

Uses one rate below a threshold amount and another rate above the threshold. Enter additional information in the Step Rate Threshold group box. Also, set the rate used on the Cash Balance 3 of 3 page. |

User Code |

Uses customized code. |

No Credit |

Use if there are no continuing credits to your cash balances—that is, the only increases are due to interest. You typically use this option for periods after the event date or for periods of ineligibility, such as those preceding a rehire or a return from leave. You use the system's grouping capabilities to apply the no credit definition to the appropriate period of time. |

Step Rate Threshold

Enter information in this group box if you select Step Rate under Calculate Credit according to.

Field or Control |

Description |

|---|---|

Threshold Type |

Select from these options:

Note: The system does not support table lookups that find different thresholds for different periods unless the threshold is based on the maximum taxable wage base. |

MTWB Lookup Options (maximum taxable wage base lookup options) |

Select one of the following to indicate the date on which to base the lookup: First Day of the Period, Last Day of the Period, First Day of the Plan Year, or First Day of the Calendar Year. When you use either the plan year or calendar year option, the system uses the plan year or calendar year that contains the first day of the accumulation period. |

Subject to Minimum and Subject to Maximum

Field or Control |

Description |

|---|---|

Subject to Minimum and Subject to Maximum |

Select these check boxes to set minimum and maximum credits per accumulation period. Your cash balance plan may give a fixed number of credits (for example, 500 per year), rather than basing the credits on earnings. In this case, you can use the minimum and maximum earnings limits to force the correct number of credits. If you do apply a limit, select Table Lookup or User Code to determine how to find the limit. Note: Remember, you can apply 401(a)(17) limits on the Cash Balance 1 of 3 page. Do not use Subject to Maximum for this purpose. |

Lookup Table Name |

If you use a lookup table to apply a minimum or maximum, select the lookup table to use. |

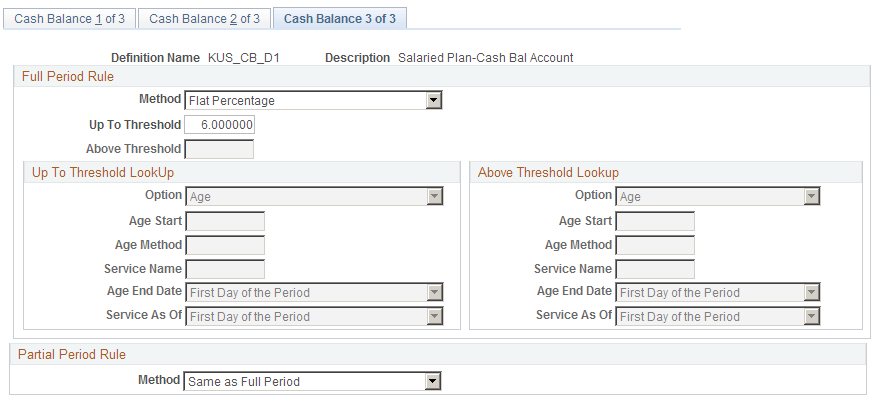

Use the Cash Balance 3 of 3 page (PA_CSHBAL_ACCT_C3) to specify the rate or rates to use, regardless of whether you use a level rate or different rates above and below a threshold.

Navigation:

This example illustrates the fields and controls on the Cash Balance 3 of 3 page.

Full Period Rule

The Full Period Rules options are the same for a flat rate and a step rate.

Field or Control |

Description |

|---|---|

Method |

Select a method, then enter supporting information in the Up to Threshold and Above Threshold fields.

|

Up To Threshold and Above Threshold |

If you use a level rate, complete the Up to Threshold field. If you use a step rate, complete both the Up to Threshold and Above Threshold fields. Enter information that supports your selected method. For example, if the method is Flat Percentage, enter a percentage. |

Up To Threshold LookUp and Above Threshold LookUp

There are two identical sets of parameters for configuring the age and service lookup bases. Up To Threshold LookUpapplies to level rates and step rates below the threshold. Above Threshold LookUpapplies to step rates above the threshold.

Field or Control |

Description |

|---|---|

Option |

Select one of the following to indicate what the program-generated lookup is based on:

|

Age Start |

If your lookup includes an age component, enter an alias for the date of birth (or any other starting date). |

Age Method |

Enter a duration option specifying the age calculation method. |

Service Name |

If your lookup includes a service component, enter a service function result. |

Age End Date |

For the age components, select either First Day of the Period or the Last Day of the Period. |

Service As of |

For the service component, select either First Day of the Period or the Last Day of the Period. |

Partial Period Rules

Partial period rules can occur when employees move in and out of plan eligibility or when they switch to another cash balance definition mid-period—for example, there is one definition before the event date and another with interest only after the event date. Select from Same As Full Period, No Credit, or User Code (your own custom code).