Setting Up Benefit Calculations

This topic provides an overview of calculation names and discusses how to set up a pension calculation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CALCULATION_2 |

Set up employee information and processing parameters:

|

|

|

PA_CALCULATION_3 |

Enter plan-specific information about ages, dates, and overrides. |

|

|

PA_CALCULATION_5 |

Enter override values for calculation components. The processes listed on this page are brought in when you identify a plan and an as of date on the Main Definition page. |

|

|

PA_CALCULATION_4 |

Isolate individual calculation components to calculate those results without running through an entire calculation. For example, if you enter an override for the benefit formula result, you can process only the optional forms function, bypassing service, final average earnings, and all other functions that you already ignore by entering the benefit amount override. You must first enter a plan and as of date on the Main Definition page. |

|

|

PA_CALCULATION_6 |

You must first identify a plan and as of date on the Main Definition page. |

Use the calculation name to access calculation-related information throughout the system to view and report on the calculation results, to offer optional forms to employees, and to pay employees based on the optional form. For this reason, assign meaningful calculation names. The Calculation Name field is 20 characters long. Your naming standards could incorporate employee names or IDs, the date or reason for the calculation, or sequential numbering when you have multiple calculations for a single employee. Develop a naming standard that gives you the information to distinguish one calculation from another at a glance.

Use the Main Definition page (PA_CALCULATION_2) to set up employee information and processing parameters. On this page, you:

Enter assumptions for employee hours, earnings, and beneficiaries.

Request that detailed values be stored with the results.

Run custom code to access employee data from another system.

Assume full service credit.

Establish when to delete results from the system.

Navigation:

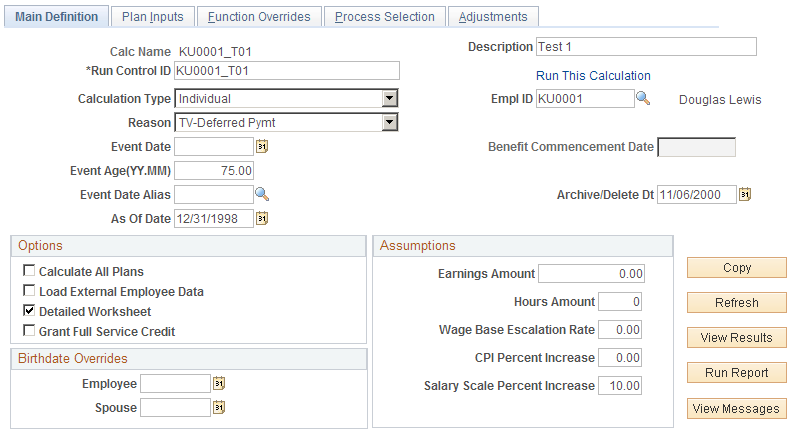

This example illustrates the fields and controls on the Main Definition page.

Field or Control |

Description |

|---|---|

Calculation Type |

You can run a calculation for an individual employee, a predefined list of employees, or a predefined group of employees. |

Empl ID, List Name, or Group Name |

The field that appears depends on the value you select in the Calculation Type field. When you select:

|

Reason |

Enter one of the following codes to indicate the reason for the event:

Your plan rules might reference this field when death and disability have different calculation rules from the rules used for regular termination and retirement. This field's significance depends on how your company sets up calculation rules. You can leave this field blank. |

Event Date, Event Age (YY.MM), and Event Date Alias |

An employee's pension benefit depends on when the employee ends employment. Service stops accruing as of the event date. Benefit eligibility might depend on the event date, and other calculation components might use this date, depending on how you configure your calculation rules. You can use one of these fields to set the event date:

Note: Enter a value in only one of these fields. |

As Of Date |

Because your plan rules are effective-dated, you must enter an as of date for the plan rules. If you are reproducing a past estimate, this date ensures that you use the rules that were in effect at the time. Typically, the as of date is the same as the event date. Note: The system brings the plan rules onto the calculation pages based on a combination of the plan and the as of date. If you're testing changes to your plan rules, you must reenter one of these values, usually the as of date, to pick up the changes. This reloads all of the data on the Function Overrides and Process Selection pages, so you also must reenter data on those pages. |

Benefit Commencement Date or Benefit Commencement Dt Alias |

The field that appears depends on the value you select in the Calculation Type field. When you select:

|

Archive/Delete Dt (archive or delete date) |

Enter an expiration date here to have periodic processing delete the calculation and its results as of that date. If you leave this field blank, the system uses the current date as the expiration date. If you do not want periodic processes to delete the calculation, do not run the Delete Calculations periodic process. Periodic processing deletes calculation results if both of the following conditions are met:

|

Copy |

To run calculations for several retirement scenarios (for example, different event dates or retirement dates for an employee's retirement counseling), you must run multiple calculations. Most of the data in these calculations is the same. Use this button to clone the current calculation parameters in a new calculation. After you clone an existing calculation, you can make minor modifications to set up the alternative retirement scenario. When you click this button, the system automatically saves changes to the current calculation. Note: This button is not available in Add mode. Warning! When you click this button, the system does not ask if you want to save changes; it just saves them. When using the Copy button, be careful not to save unwanted changes. After the system saves the current calculation, it prompts you for a new calculation name and description. Enter the information and click OK. The system displays the new calculation, but it has not yet been saved. Be sure to explicitly save the new calculation before leaving the page. |

Options

Field or Control |

Description |

|---|---|

Calculate All Plans |

If you select this option, the system runs the calculation on all plans associated with the employee, list, or group. If you select this check box, the system uses the plan normal retirement date (NRD) as the benefit commencement date and the lump sum date. You can override this default for individual plans by manually adding those plans to the scrolling area. If you set a different benefit commencement date without associating that date with a plan, you do not override the default. If you deselect this check box, the system displays a warning message reminding you that 415 limits apply to all qualified plans and that you should be sure to include all plans for which the employee is eligible. Note: If each plan has a plan eligibility function that filters out ineligible employees, All Plans really means all the plans for which an employee is eligible. You can also run a calculation for more than one plan at a time by adding a row on the Plan Inputs page. |

Load External Employee Data |

Pension Administration normally receives employee data from the PeopleSoft HCM tables. Users of a standalone system might not have this data available. If you select this check box, the system runs your own custom process to bring relevant employee data into the calculation linkage, where it is then available to all of the pension functions. This option does not populate non-pension tables. |

Detailed Worksheet |

A benefit calculation is based on several components, including service, vesting percentage, earnings, and contributory balances. When you run a calculation, the system captures the values of all the components. This enables you to view basic information used to determine the benefit. In calculating each component, the system also produces intermediate results. For example, to calculate total service, the system calculates service for each annual period during the participant's employment. If you select this check box, the system preserves these intermediate results for reporting purposes. The system already has fields to hold the results; selecting this option just captures the data. |

Grant Full Service Credit |

Contributory plans frequently associate contributions with service. Terminating employees who withdraw their contributions forfeit the corresponding service, and rehired employees who repay their contributions (with interest) can have that service credit restored. You might run calculations for a rehired employee who is considering buying back service or who is in the process of buying back the service. If you select this check box, the calculation gives the employee full credit for all of the service that was forfeited because of a withdrawal of contributions. This option does not affect the employee account balance, which still includes only money that was actually paid into the account. |

Birth date Overrides

Field or Control |

Description |

|---|---|

Employee and Spouse or Number of Years added to Age |

The field or fields that appear depend on the value you select in the Calculation Type field. When you select:

|

Assumptions

To estimate a benefit for a future event date, you must usually estimate future earnings, hours, and contributions. To calculate social security for a future retirement, you must make assumptions about annually published government tables, such as the taxable wage base table.

You can enter assumptions for each plan. If you select the Calculate All Plans check box, you can only enter assumptions for plans that you specifically add to the list of included plans.

Functions and utilities that use this information (social security, projections, and others) automatically have access to your parameters.

Field or Control |

Description |

|---|---|

Earnings Amount and Hours Amount |

When a calculation projects earnings or hours, these values determine the current period amounts, if the rules so specify. The plan rules can specify either that this amount replace the entire period or that it be prorated and used only for the incomplete portion of the current period. |

Wage Base Escalation Rate |

Indicates the assumed rate of increase in the taxable wage base. This is used for social security calculations and can also affect other calculation components, depending on plan rules. |

CPI Percent Increase (consumer price index percentage increase) |

Indicates the assumed rate of increase in the CPI-W table. This is used for social security benefit increases. |

Salary Scale Percent Increase |

Indicates the assumed rate of increase in periodic earnings. This is used when projecting earnings. Enter a rate that is consistent with the type of earnings period (annual, monthly, or other). |

Use the Plan Inputs page (PA_CALCULATION_3) to enter plan-specific information about ages, dates, and overrides.

Navigation:

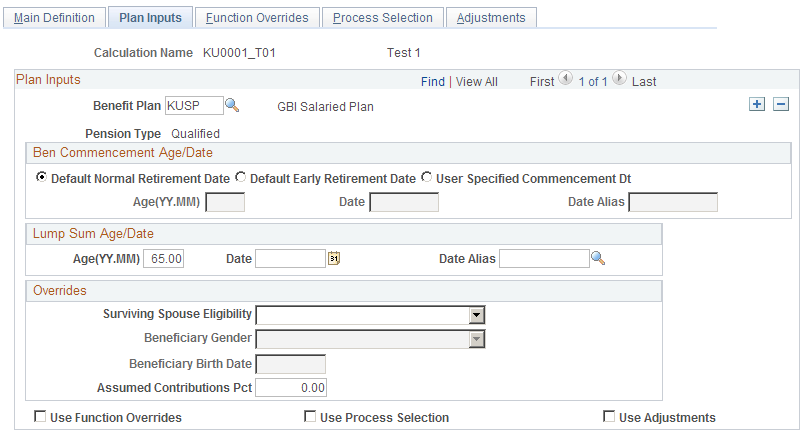

This example illustrates the fields and controls on the Plan Inputs page.

Plan Inputs

Field or Control |

Description |

|---|---|

Benefit Plan and Pension Type |

When you enter a plan name, the system displays the pension type: Qualified or Nonqualified. By inserting a new row in this section, you can calculate multiple plans at once. |

Ben Commencement Age/Date

Many aspects of a calculation depend on when benefits begin. You specify that information on this page.

Field or Control |

Description |

|---|---|

Default Normal Retirement Date, Default Early Retirement Date, or User Specified Commencement Date |

Select the plan normal retirement date, early retirement date, or other option, as defined in the plan rules. |

Age(YY.MM), Date, and Date Alias |

If you selected User Specified Commencement Date for the benefit commencement age or date, enter a benefit commencement age, date, or date alias for calculating benefits from a plan. |

Lump Sum Age/Date

If your plan rules reference a lump sum date that is different from the benefit commencement date, use this group box.

For a group calculation, you usually select the Plan NRD or Plan ERD option, because these are determined for each individual employee. If you enter an actual date, this causes different employees in the group to commence benefits at different ages, at which they might not be eligible to receive benefits. For a lump sum, enter an age instead of a date, for the same reason.

Overrides

Certain plans offer an automatic joint and survivor benefit to qualified spouses—that is, a joint and survivor benefit that does not require an actuarial adjustment to an employee's benefit. If you provide this benefit, you establish the eligibility criteria in your plan rules. For example, perhaps the employee and spouse must be married for a full year before being eligible for this benefit.

Field or Control |

Description |

|---|---|

Surviving Spouse Eligibility |

Override the eligibility criteria by selecting the appropriate option: N - Override to Ineligible. Y - Override to Eligible. |

Beneficiary Birth Date and Beneficiary Gender |

If the employee has a non-spouse beneficiary on record, you can override information about the beneficiary in these fields. Since this information depends on data for an individual, do not use these fields for group calculations. |

Assumed Contributions Pct (assumed contributions percentage) |

To calculate possible future contributions, enter a percentage. When the calculation projects contributions, the system applies this percentage to projected earnings to arrive at future contribution amounts. |

Use Function Overrides |

Select to enter overrides for a plan. Enter the actual overrides on the Function Overrides page. |

Use Process Selection |

Select to indicate processes to run on the Process Selection page. |

Use Adjustments |

Select to enter adjustments for a plan. Enter the actual overrides on the Adjustments page. |

Use the Function Overrides page (PA_CALCULATION_5) to enter override values for calculation components.

Navigation:

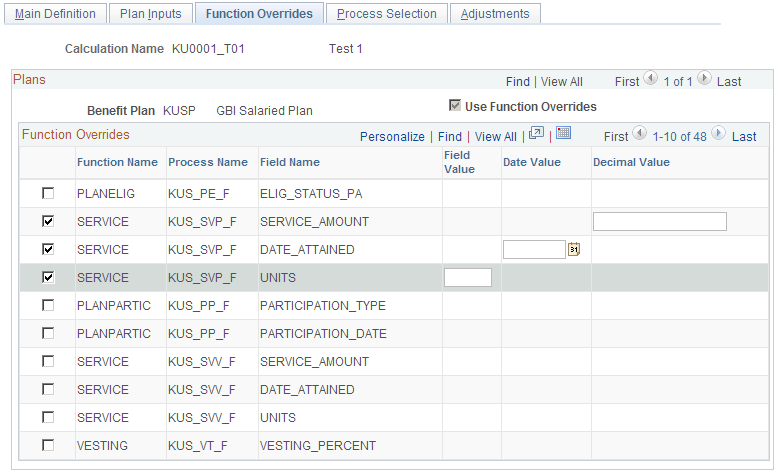

This example illustrates the fields and controls on the Function Overrides page.

Field or Control |

Description |

|---|---|

Use Function Overrides |

Displays a read-only mirror of the Use Function Overrides check box on the Plan Inputs page. |

Process Selection

Field or Control |

Description |

|---|---|

<Selection Check Box> |

Select the check box next to each process whose calculated value you want to override. |

Function Name |

Displays the pension function that controls the processing. |

Process Name and Description |

Displays the ID and description for the specific function result. |

Field Name |

Displays the result fields to override. Many functions have only a single result field. For example, the final average earnings and vesting functions both produce a single result. Conversely, some functions produce multiple (or compound) results. For example, the service function produces service amount, service units (years or months), and date attained. Although you do not have to enter overrides for all of the values, enter overrides for values that are necessary for the calculation. For example, there's no need to enter 10 fields of intermediate information for social security results, but enter the PIA_AMT_ADJ, which is the final adjusted social security benefit. If you enter overrides for the benefit amount (shown on the page as BENCALC), enter overrides for all four of the benefit amount fields:

The first three fields are required for optional forms conversions. The automatic spousal benefit override default is zero. Note: If you enter an override for one of a function result's values, that function result produces only the result that you enter. Therefore, there are no detailed results. |

Field Value, Date Value, and Decimal Value |

When you select a function result field to override, the system displays the appropriate column for entering the override value. Subsequent processes in the job flow use this override value instead of the calculated value. For example, if you override a final average earnings value, the benefit formula uses the earnings amount that you enter, rather than actual earnings data. |

Using Overrides

Pension Administration produces a benefit amount through a series of processes that build upon each other. Normally, each process produces a result according to rules that you set up. Instead, however, you can bypass the calculation process and enter override values for calculation components. Use the Function Overrides page to enter these override values.

As an example of when you might use overrides, suppose a terminated vested employee remarries before beginning to receive payments. Because the new spouse has a different birth date from the previous spouse, the joint and survivor factors must be recalculated. Instead of running a new calculation from the beginning, use the original benefit amount as an override. This way, you can recalculate optional forms factors while ensuring that the normal benefit amount is the same as the amount that you calculated at the time of termination.

Overrides also enable you to set up what-if scenarios by manipulating a portion of the calculation.

Consider the following when working with overrides:

Do not enter overrides for the plan eligibility function. This prevents the system from producing the timeline of eligible and ineligible periods that might be needed for other processes. If you know that your plan rules do not reference this timeline, you can skip eligibility processing.

Valid participation overrides are Y (yes) and N (no).

When you enter a vesting override, use a percentage rather than a factor. For example, if an employee is 60 percent vested, enter 60, not 0.6.

The social security function has 10 result fields, all of which appear in the overrides section. Enter just a final social security amount in the PIA_AMT_ADJ field.

Enter early and late retirement adjustments as adjustment factors—not adjustment amounts. For example, if an employee's benefit is to be reduced by 20 percent, the factor is 0.8. If an employee's benefit is to be increased by 5 percent, the factor is 1.05.

Enter death coverage factors as adjustment factors—not adjustment amounts. For example, if an employee's benefit is to be reduced by 2 percent, the factor is 0.98.

Reviewing Examples of Overrides

Use the following table to understand appropriate values for the override fields:

|

Function |

Field |

Description |

Example |

|---|---|---|---|

|

Plan eligibility (PLANELIG) |

ELIG_STATUS_PA |

Eligibility status. |

Do not enter overrides. |

|

Participation (PLANPARTIC) |

PARTICIPATION_TYPE |

Participation status. |

Y (participating) N (not participating) |

|

PARTICIPATION_DATE |

Participation date. |

01/31/1999 |

|

|

Service (SERVICE) |

SERVICE_AMOUNT |

Service amount. |

10.50 |

|

DATE_ATTAINED |

Date on which the service amount is attained. |

12/31/1999 |

|

|

UNITS |

Service units. |

Y (years) M (months) |

|

|

Vesting (VESTING) |

VESTING_PERCENT |

Vesting percentage. |

80 |

|

Plan eligibility (BENELIG) |

BEN_ELIG_STATUS |

Benefit eligibility status. |

Y |

|

Final average earnings (FAE) |

FAE_AMOUNT |

Final average earnings amount. |

54321.89 |

|

Cash balance accounts (CASHBAL) |

ACCUM_AMT |

Cash balance value as of event date. If you use an override, the system does not produce the secondary aliases that provide the value at other dates. |

158674.47 |

|

Employee accounts (EMPLACCTS) |

ACCUM_AMT |

Employee account value as of the beneficiary date. |

10543.89 |

|

Social security (SOCSEC) |

PIA_AMT |

Unadjusted primary insurance amount (PIA). |

861.40 |

|

PIA_AMT_ADJ |

Adjusted PIA—adjusted for early or late commencement. This is the final result for social security. |

861.40 |

|

|

SOC_SEC_AGE |

Social security normal retirement age. Enter partial ages as decimals. |

65.333333 |

|

|

SOC_SEC_BCD |

Social security benefit commencement date. |

65 |

|

|

INDEX_YR |

Social security indexing year (two years before the eligibility year). |

1999 |

|

|

ELIG_YR |

Social security eligibility year (the year an employee attains age 62 or the year of death or disability). |

2001 |

|

|

AIME |

Average indexed monthly earnings. |

1920.00 |

|

|

AVGWAGES_INDEX_YR |

National average wage for the index year. |

23132.67 |

|

|

BIRTHDATE |

Employee's birth date. |

12/01/1939 |

|

|

COMPUTATION_YRS |

Number of years of earnings history used in the social security computation. |

35 |

|

|

Covered compensation (COVRDCOMP) |

COMP_AMT |

Covered compensation amounts. |

3500 |

|

Early and late retirement factors (AGEADJUST) |

ADJ_FACTOR |

Adjustment factor. |

0.8 |

|

PRD_OF_ADJ |

Number of periods (months or years) used to arrive at the factor. |

4 |

|

|

Death coverage factors (DEATHCVRG) |

ADJ_FACTOR |

Final death coverage adjustment factor. |

0.98 |

|

NUM_PRD |

Number of periods (months or years) used to arrive at the factor. |

10 |

|

|

Benefit formula (BENCALC) |

BEN_AMT |

Dollar amount of the employee's benefit in the plan's normal form of payment. |

3404.32 |

|

PYMT_FREQ |

Payment frequency of the normal form of the benefit. (Valid values appear on the Benefit Formula - Normal Form of Payment page. |

M (monthly) |

|

|

FORM_CODE |

Optional form code. (Form codes appear on the Benefit Formula - Normal Form of Payment page). |

LIFE |

|

|

AUTO_AMT |

Dollar amount of the benefit automatically available to an eligible spouse, regardless of the employee's optional form selection. |

25 |

|

|

Employee-paid benefit (CONTSBEN) |

ACCT_BAL_EVENT |

Account balance as of the event date. |

10543.89 |

|

ACCT_BAL_DOD |

Account balance at the date of determination. |

13276.18 |

|

|

ACCT_BAL_NRD |

Account balance as of the normal retirement date. |

13276.18 |

|

|

EE_BEN_AMT |

Annuity value of the employee account at the normal retirement date. This is the final result for the employee-paid benefit function. |

55.317417 |

|

|

INT_RT_1 |

Interest rate used to project from the event date to the date of determination. |

5 |

|

|

INT_RT_2 |

Interest rate used to project from the date of determination to the normal retirement date. |

5 |

|

|

FACTOR |

Factor used to convert the balance as of the normal retirement date to annuity. |

0.004167 |

|

|

DT_OF_DET |

Date of the determination. |

12/31/1998 |

|

|

Optional forms of payment (OPTFORMS) |

No overrides available. |

N/A |

N/A |

|

415 limits (LIMIT415) |

No overrides available. |

N/A |

N/A |

Note: When you apply 401(a)(17) limits (or other limits) to final average earnings or cash balance accounts, a regular calculation also produces secondary values with the unlimited FAE and cash balance amounts. You normally access these values through function result aliases. When you use overrides, the system does not calculate these secondary values.

Use the Process Selection page (PA_CALCULATION_4) to isolate individual calculation components to calculate those results without running through an entire calculation.

For example, if you enter an override for the benefit formula result, you can process only the optional forms function, bypassing service, final average earnings, and all other functions that you already ignore by entering the benefit amount override. You must first enter a plan and as of date on the Main Definition page.

Navigation:

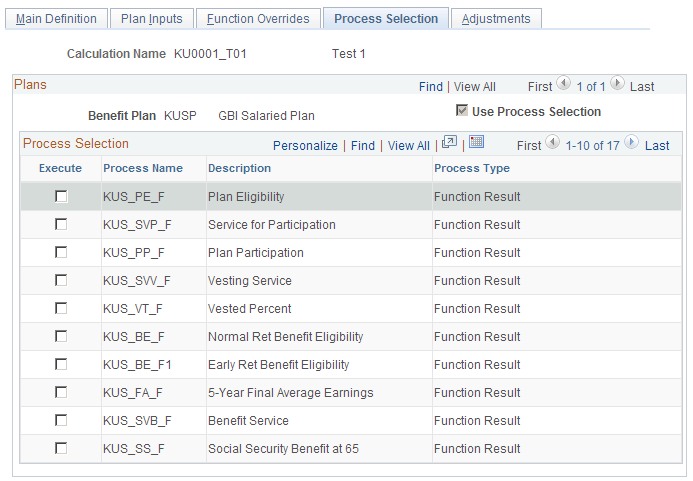

This example illustrates the fields and controls on the Process Selection page.

Note: The processes listed on this page are brought in when you identify a plan and an as of date on the Define Calculation - Main Definition page.

Field or Control |

Description |

|---|---|

Use Process Selection |

Displays a read-only mirror of the Use Process Selection check box on the Plan Inputs page. |

Process Selection

Field or Control |

Description |

|---|---|

Execute |

If you select the Use Process Selection check box on the Define Calculation - Plan Inputs page, select the Execute check box for each process to run. If you select a process that depends on values obtained from previous processes, either run those processes or enter overrides for them. |

Process Name and Description |

Displays the ID and description for the specific process. |

Process Type |

Indicates how your organization defines the processing rules; disregard this field. |

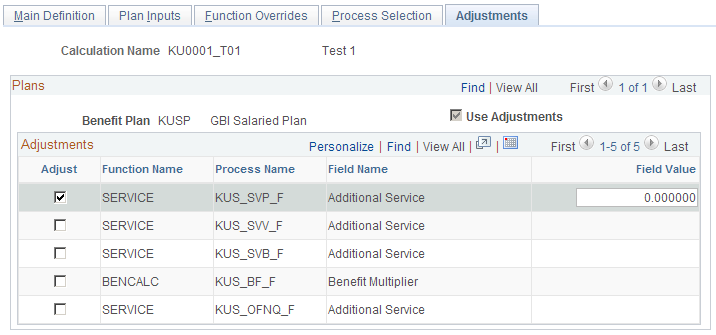

Use the Adjustments page (PA_CALCULATION_6) to you must first identify a plan and as of date on the Main Definition page.

Navigation:

This example illustrates the fields and controls on the Adjustments page.

Field or Control |

Description |

|---|---|

Use Adjustments |

Displays a read-only mirror of the Use Adjustments check box on the Plan Inputs page. |

Adjustments

Field or Control |

Description |

|---|---|

Adjust |

Select this check box for each function that you need to adjust. |

Function Name |

The name of a pension function—for example, BENCALC for the benefit formula function. |

Process Name |

The ID your organization has assigned to a process (the function result name). |

Field Name |

The name of a value that you can adjust. |

Field Value |

Enter the adjustment amount in the text box. |

Reviewing Examples of Adjustments

Use the following table to understand the appropriate values for the adjustment fields:

|

Function |

Field |

Description |

Example |

|---|---|---|---|

|

Service (SERVICE) |

SERVICE_AMOUNT |

Adjustment is added to the calculated service amount for the specified function result before the service minimum and maximum are applied. |

10.50 |

|

Benefit formula (BENCALC) |

BEN_AMT |

Multiplier is applied to the dollar amount of the employee's benefit in the plan's normal form of payment for the specified function result. |

2 |