Viewing Detailed Plan Results

This topic provides an overview of detailed plan results and discusses how to view the detailed results for individual plan functions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CLC_INPT_SUM |

View information that you entered when processing a calculation. |

|

|

PA_CLC_CLC_SUM |

View results from the benefit formula function, which produces the normal form of a benefit. |

|

|

PA_CLC_OFRM_SUM |

View results from the optional forms of payment function, which converts the normal form of a benefit into all the optional forms that the plan offers. |

|

|

PA_CLC_SVC_SUM |

View results from the service function, which provides a final service amount. |

|

|

PA_CLC_FAE_SUM |

View results from the final average earnings function, which provides an amount calculated according to the plan's averaging rules. |

|

|

PA_CLC_VST_SUM |

View results from the vesting function, which provides a participant's vesting percentage. |

|

|

PA_CLC_AGE_SUM |

View results from the early and late retirement factors function, which produces a factor used to adjust a benefit when a participant retires before or after the normal retirement date. |

|

|

PA_CLC_DTH_SUM |

View results from the Death Coverage function, which produces a factor used to reduce a benefit when a participant elects optional death coverage. |

|

|

PA_CLC_CMP_SUM |

View results from the covered compensation function, which calculates covered compensation for a participant by averaging the taxable wage base for the 35 years up to and including the year in which the participant reaches social security retirement age. |

|

|

PA_CLC_SOC_SUM |

View results from the social security function, which estimates a participant's social security primary insurance amount (PIA). |

|

|

PA_CLC_CASH_SUM |

View results from the cash balance accounts function, which provides a participant's periodic accumulation and final balance under a cash balance plan. |

|

|

PA_CLC_ACCT_SUM |

View results from the employee accounts function, which tracks the accumulation of contributions and interest for a participant in a contributory plan. |

|

|

PA_CLC_ACCT_SP |

View service purchase details associated with an employee account. |

|

|

PA_CLC_CONT_SUM |

View results from the employee-paid benefit function, which determines what portion of a total benefit, expressed in its normal form, is attributable to participant contributions. |

|

|

PA_CLC_PEL_SUM |

View results from the plan eligibility function, which determines whether a participant is eligible to participate in a plan. |

|

|

PA_CLC_PRT_SUM |

View results from the participation function, which determines whether a participant meets plan participation requirements. |

|

|

PA_CLC_BEL_SUM |

View results from the retirement eligibility function, which identifies whether a participant is eligible for a retirement type. |

|

|

PA_CLC_BENEF_SUM |

View beneficiary data used in calculating a participant's benefit. |

The detailed plan results display both the final benefit and the components used to determine the final benefit.

Note: The final benefit is not adjusted for 415 limits across multiple plans.

You can access all the detailed plan results in the Review Calculation Results component, or access individual results in the Individual Results component.

Note: Depending on which navigation path you use, the page name may appear different, although the Object Name will be the same. The examples in this topic show the pages as they appear when accessed through the Review Calculation Results component.

Although the detailed plan results pages display results from all of the calculation functions (except 415 limits), your plan might not use all the functions. Therefore, you may not see results on every page.

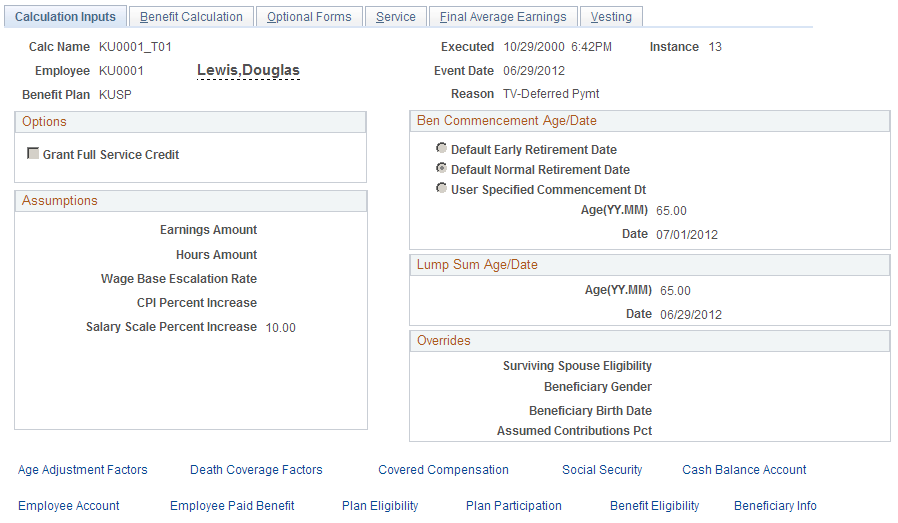

Use the Calculation Inputs page (PA_CLC_INPT_SUM) to view information that you entered when processing a calculation.

Navigation:

This example illustrates the fields and controls on the Calculation Inputs page.

Ben Commencement Age/Date

Field or Control |

Description |

|---|---|

Plan NRD (plan normal retirement date), Plan ERD (plan early retirement date) and Other |

The system selects one of these options to show the date used as the benefit commencement date in the calculation. |

Age (YY:MM) and Date |

Displays the participant's benefit commencement age (in years and months) and the benefit commencement date. |

Lump Sum Age/Date

Field or Control |

Description |

|---|---|

Age (YY:MM) and Date |

Displays both the participant's age (in years and months) and the date when the calculated lump sum amount applies. |

Options

Field or Control |

Description |

|---|---|

Grant Full Service Credit |

Indicates whether you assumed that service forfeited due to a withdrawal of contributions would be fully restored. If the check box is selected, then service is restored. If the check box is not selected, service is not restored. |

Assumptions

Field or Control |

Description |

|---|---|

Earnings Amount and Hours Amount |

Displays the amounts used to determine the current period earnings and hours amounts for certain types of projection methods. The plan rules specify either that this amount replaces the entire period, or that it is prorated and used only for the incomplete portion of the current period. |

Wage Base Escalation Rate |

Displays the assumed rate of increase in the taxable wage base. |

CPI Percent Increase (consumer price index percent increase) |

Displays the assumed rate of increase in the CPI-W, the consumer price index (CPI) for urban wage earners and clerical workers. This table is used for social security general benefit increases. |

Salary Scale Percent Increase |

Displays the assumed rate of salary increase. |

Overrides

Field or Control |

Description |

|---|---|

Surviving Spouse Eligibility |

Indicates overrides to your plan's determination of whether a participant's spouse is eligible for an automatic joint and survivor benefit, paid for by the plan with no actuarial reduction to the participant's benefit. Typical eligibility criteria might be that a participant and spouse be married for a year. |

Beneficiary Birthdate and Beneficiary Gender |

Display overrides for non-spouse beneficiary data. |

Assumed Contributions Pct |

Displays the percentage of projected earnings used to estimate future contributions. |

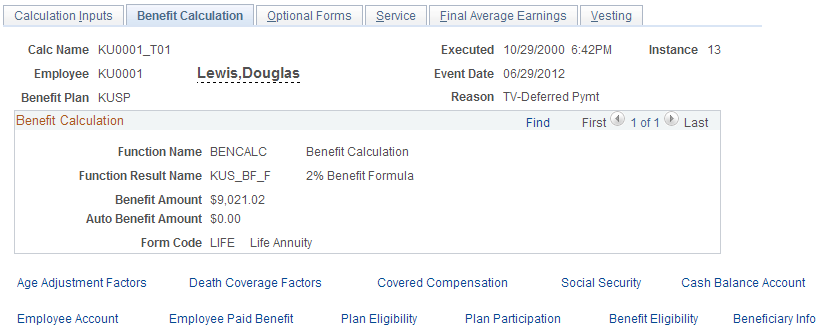

Use the Benefit Calculation page (PA_CLC_CLC_SUM) to view results from the benefit formula function, which produces the normal form of a benefit.

Navigation:

This example illustrates the fields and controls on the Benefit Calculation page.

Field or Control |

Description |

|---|---|

Function Result Name |

Identifies the specific benefit calculation whose results are displayed. Note: Typically a plan has multiple benefit formulas, such as the normal retirement benefit, the normal retirement benefit offset by any Qualified Domestic Relations Order (QDRO) amount, and the early retirement benefit. |

Benefit Amount |

Displays the amount of a participant's benefit in the plan's normal form of payment. |

Auto Benefit Amount (automatic benefit amount) |

Displays the amount of any benefit automatically available to an eligible spouse, regardless of the participant's optional form selection, and available without any actuarial reduction to the participant's benefit. |

Form Code |

Displays the normal form of the benefit. |

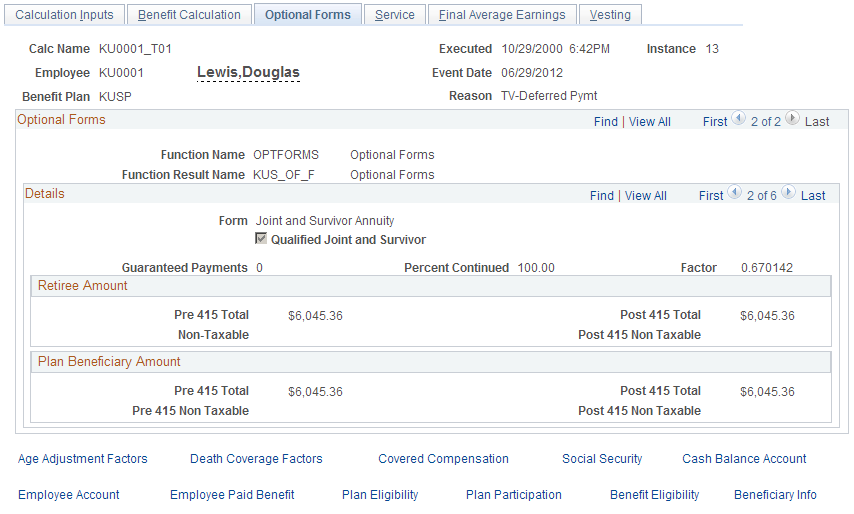

Use the Optional Forms page (PA_CLC_OFRM_SUM) to view results from the optional forms of payment function, which converts the normal form of a benefit into all the optional forms that the plan offers.

Navigation:

This example illustrates the fields and controls on the Optional Forms page.

Field or Control |

Description |

|---|---|

Form |

Displays each allowable payment form offered by the plan. Single participants are ineligible for joint and survivor, last to survive, pop-up, and reversionary annuities. Participants older than the level income age are ineligible for level income options. Participants with benefits above a specified amount are ineligible for lump sums that you define as small benefit cashouts. |

Guaranteed Payments |

Displays the number of years of guaranteed payments (for example, 5 means five years—not five monthly payments). |

Percent Continued |

Displays the percentage of the benefit that is continued to the designated spouse beneficiary when a retiree dies. |

Factor |

Displays the factor used to convert a benefit from its normal form to this form. |

<Payment Type>

A form can have multiple payment types. Certain payment types are payable to a retiree, and others are payable to a beneficiary. The optional forms results include a group box for each payment type that the form requires. For example, a joint and survivor form includes both a Retiree Amount group box and a Plan Beneficiary Amount group box. A level income option form includes both a Retiree Amount - Pre SSRA group box and a Retiree Amount Post SSRA group box.

Within each group box the system displays these amounts:

Field or Control |

Description |

|---|---|

Pre 415 Total and Post 415 Total |

For each payment type, there is an amount before the 415 limits are applied and an amount after 415 limits are applied. For all but your most highly compensated workers, the pre-415 and post-415 amounts are the same. The real amounts that are used for payments are the post-415 amounts; the pre-415 amounts are for your information only. |

Non Taxable and Post 415 Non-Taxable |

The system calculates the total pension benefit for the specified optional form without regard to taxability. If a benefit includes amounts attributable to participant after-tax contributions, that portion of the benefit is not taxable until the participant has completely recovered his or her contributions. That amount appears in the Non Taxable and Post 415 Non-Taxable fields. |

Retiree Payment Types

These are the available retiree payment types

|

Retiree Payment Type |

Description |

|---|---|

|

Retiree Amount |

Amount due to a retiree. Except in the case of lump sums, this is normally a monthly amount payable until death. |

|

Retiree Amount - Pre-SSRA (retiree amount pre-social security retirement age) Retiree Amount Post-SSRA (retiree amount post-social security retirement age) |

For a level income option (LIO), a retiree's benefit is higher before the retiree reaches social security retirement age (SSRA) and lower afterwards, when the retiree has presumably started receiving a social security benefit. Therefore, LIO forms produce two separate retiree amounts, the pre-SSRA and post-SSRA amounts. |

|

Pop Up Amount |

For a pop-up form of payment, the retiree amount increases if a beneficiary predeceases a retiree. The pop-up amount is the increased retiree amount. |

Plan Beneficiary Payment Types

These are the available beneficiary payment types:

|

Payment Type |

Description |

|---|---|

|

Plan Beneficiary Amount |

Amount payable to a spouse beneficiary at a retiree's death. This can come from two different sources: a joint and survivor form (or any form that includes a percent continued) elected by the retiree, and an automatic plan benefit for which there is no actuarial reduction. |

|

Nonspouse Beneficiary Amount |

Amount payable to a non-spouse beneficiary after a retiree's death under a joint and survivor form of payment. |

|

Spouse Demonstration J&S (spouse demonstration joint and survivor) |

If a married retiree selects a non-spouse beneficiary, the retiree's spouse is entitled to know the amount that would have been payable to the spouse if the retiree had named the spouse as the beneficiary instead of naming a non-spouse beneficiary. This is different from the non-spouse beneficiary amount because the actuarial adjustment is based on the spouse's age, rather than the non-spouse beneficiary's age. |

|

Survivor Amount |

For a last to survive form, this is the amount due to the retiree or spouse after the other one has died. |

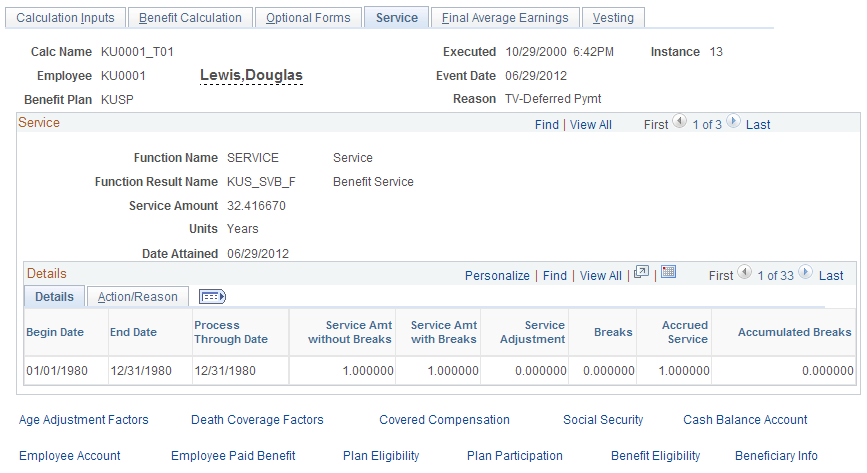

Use the Service page (PA_CLC_SVC_SUM) to view results from the service function, which provides a final service amount.

Navigation:

This example illustrates the fields and controls on the Service page.

Field or Control |

Description |

|---|---|

Function Result Name |

Identifies the specific service calculation whose results appear. You might have several service calculations, including service credit, vesting service and participation service. |

Service Amount, Units, and Date Attained |

Displays the final service accrued as of a specified date—typically, the event date. |

Details: Details Tab

If you produced detailed results for the calculation, this grid displays the periodic service history used to produce the final amount.

Field or Control |

Description |

|---|---|

Process Through Date |

For past periods, the process through date is the period end date. For the final period, the process through date is the event date. |

Service Amt without Breaks (service amount without breaks) |

Indicates how much service a participant earned during the period, based only on the service definition. |

Service Amt with Breaks (service amount with breaks) |

Indicates how much of the original service for the period is used after considering break rules and other reasons for forfeiture. |

Service Adjustment |

Indicates adjustments on the Service Adjustments page for the period. You can manually enter adjustments, or the system can automatically generate adjustments, based on a withdrawal of contributions, service buyback activity (repayment of contributions), or service purchase activity. |

Hours |

For service definitions that use hours, this column indicates how many hours a participant accrued during the period. |

Breaks |

Indicates whether the period counted toward a break in service. |

Accrued Service |

Indicates how much service a participant accumulated as of the end of the period, based on the previous accrued service amount and the activity for the current period. |

Accumulated Breaks (accumulated breaks) |

Indicates how many consecutive breaks a participant has up to and including the period. |

Details: Action/Reason Tab

Field or Control |

Description |

|---|---|

Action and Reason |

For elapsed time definitions, which base service accrual on a participant's action and reason history from the job record, these fields display the participant's action and reason history. |

Use the Final Average Earnings page (PA_CLC_FAE_SUM) to view results from the final average earnings function, which provides an amount calculated according to the plan's averaging rules.

Navigation:

This example illustrates the fields and controls on the Final Average Earnings page.

Field or Control |

Description |

|---|---|

Function Result Name |

Identifies the FAE calculation whose results appear. |

Average Earnings Amount |

Displays the participant's final average earnings. |

Period Dates

If you produced detailed results for a calculation, this grid displays the earnings history used to produce the amount.

Field or Control |

Description |

|---|---|

Through Date |

Displays the latest date that was included in the calculations for the period, which is the end date for past periods. |

Projected |

Indicates whether the earnings are projected. This applies only to future-dated calculations. |

Generated Earnings |

Displays the earnings after applying the plan's generation rules. |

Adjusted Earnings |

Displays the final earnings used in a calculation, which reflect minimums and maximums specified in the plan rules. Adjusted earnings that appear black on this page are included in the averaging period; gray amounts are disregarded. |

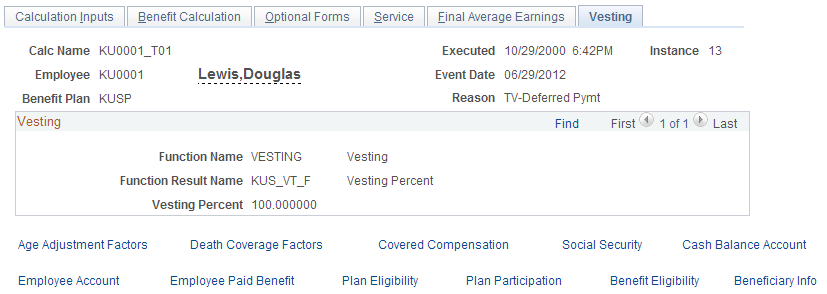

Use the Vesting page (PA_CLC_VST_SUM) to view results from the vesting function, which provides a participant's vesting percentage.

Navigation:

This example illustrates the fields and controls on the Vesting page.

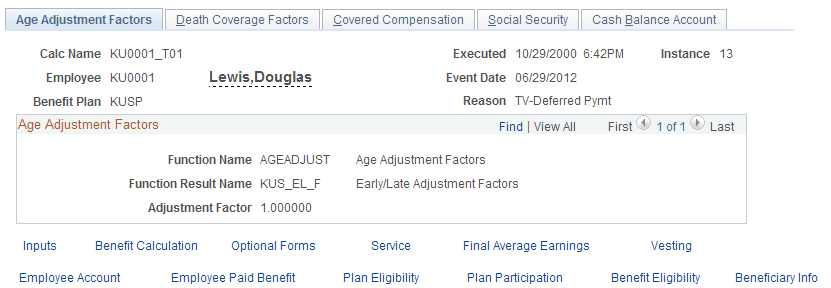

Use the Age Adjustment Factors page (PA_CLC_AGE_SUM) to view results from the early and late retirement factors function, which produces a factor used to adjust a benefit when a participant retires before or after the normal retirement date.

Navigation:

This example illustrates the fields and controls on the Age Adjustment Factors page.

Field or Control |

Description |

|---|---|

Adjustment Factor |

Displays the factor used to reduce or increase a benefit due to early or late benefit commencement. If there is no adjustment, the factor is 1.000000. |

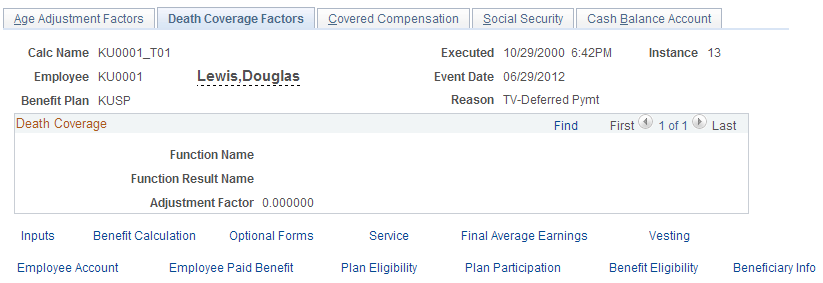

Use the Death Coverage Factors page (PA_CLC_DTH_SUM) to view results from the Death Coverage function, which produces a factor used to reduce a benefit when a participant elects optional death coverage.

Navigation:

This example illustrates the fields and controls on the Death Coverage Factors page.

Field or Control |

Description |

|---|---|

Adjustment Factor |

Displays the factor used to reduce a benefit due to a participant's preretirement survivor annuity (PRSA) coverage. |

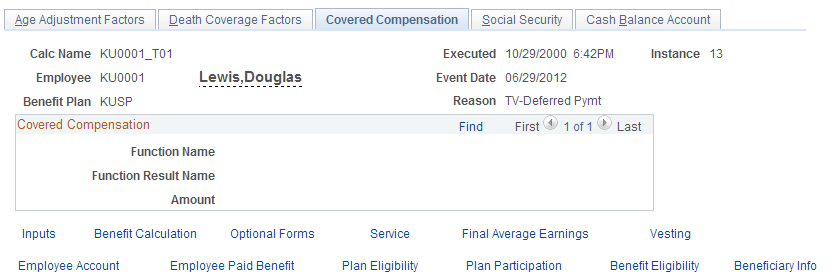

Use the Covered Compensation page (PA_CLC_CMP_SUM) to view results from the covered compensation function, which calculates covered compensation for a participant by averaging the taxable wage base for the 35 years up to and including the year in which the participant reaches social security retirement age.

Navigation:

This example illustrates the fields and controls on the Covered Compensation page.

Field or Control |

Description |

|---|---|

Amount |

Displays the result of a covered compensation calculation. This might be a monthly or annual amount, depending on how you set up your covered compensation calculation. |

Use the Social Security page (PA_CLC_SOC_SUM) to view results from the social security function, which estimates a participant's social security primary insurance amount (PIA).

Navigation:

This example illustrates the fields and controls on the Social Security page.

Field or Control |

Description |

|---|---|

Primary Insurance Amount |

Displays the initial social security PIA. |

Primary Insurance Adjusted |

Displays the final PIA after both general increases and increases or reductions, based on the commencement date. |

Eligibility Year |

Displays the year in which a participant reaches age 62 or the year of death or disability. |

NAW Indexing Year (national average wage indexing year) |

This is two years before the year of eligibility. |

NAW Index Year Amount (national average wage indexing index year amount) |

Displays the national average wage (NAW) for the indexing year. |

Number of Computation Years (number of computation years) |

Indicates how many years of a participant's earnings history are used in social security determination. Some years might be estimates based on your projection and regression rules. |

AIME (average indexed monthly earnings) |

To produce the average indexed monthly earnings, the system:

|

Birth Date and Social Security Age |

The birth date determines the social security age. |

Social Security BCD (social security benefit commencement date) |

This is the assumed benefit commencement date for social security benefits. This is important because benefits are reduced or increased for early or late commencement. |

Details

This group box displays the detailed earnings history that was used in the Social Security calculation. The earnings can come from one of two sources:

The system's consolidated earnings history, regressed and projected according to your plan assumptions.

The Yearly Soc Sec Earnings page, where you can override a participant's earnings history.

Field or Control |

Description |

|---|---|

Taxable Earnings |

Displays the lesser of the taxable wage base amount and the actual participant earnings. |

Natl Average Earnings (national average earnings) |

Indexing is based on NAW growth. This field displays the national average earnings for the NAW indexing year. |

Indexed Amount |

The indexed amount is determined by multiplying the taxable earnings by a factor in which the numerator is the NAW for the indexing year and the denominator is the NAW for the year being indexed. |

Indexed Amount Used in Calc (indexed amount used in calculation) |

Displays the final indexed amount used to determine the AIME. |

Use the Cash Balance Account page (PA_CLC_CASH_SUM) to view results from the cash balance accounts function, which provides a participant's periodic accumulation and final balance under a cash balance plan.

Navigation:

This example illustrates the fields and controls on the Cash Balance Account page.

Note: If you produced detailed results for the calculation, this page displays the periodic accumulations.

Field or Control |

Description |

|---|---|

Start Date and End Date |

If a participant had a startup balance from the time that you loaded data into Pension Administration, the first period begins and ends on the startup as of date. This startup period has an ending balance, but no other supporting detail. |

Contribution Rate |

The contribution rate displays the percentage of earnings for the period that was credited to the account. |

Beginning Balance |

Displays the accumulation amount at the beginning of the period. |

Earnings |

Displays the total earnings for the period. |

Credit |

Displays the non-interest amount credited to the account during the period. The credit is a percentage of earnings, based on the contribution rate and earnings amounts. |

Credit Adjustments |

If there were manual adjustments to the credit during a period, this column displays the adjustment amount. |

Interest |

Displays the amount of interest credited to the account during the period. |

Interest Rate |

Displays the interest rate used on the beginning balance. |

Interest Adjustments |

If there were manual adjustments to the interest amount during a period, this column displays the adjustment amount. |

Ending Balance |

Displays the accumulation as of the end of the period. |

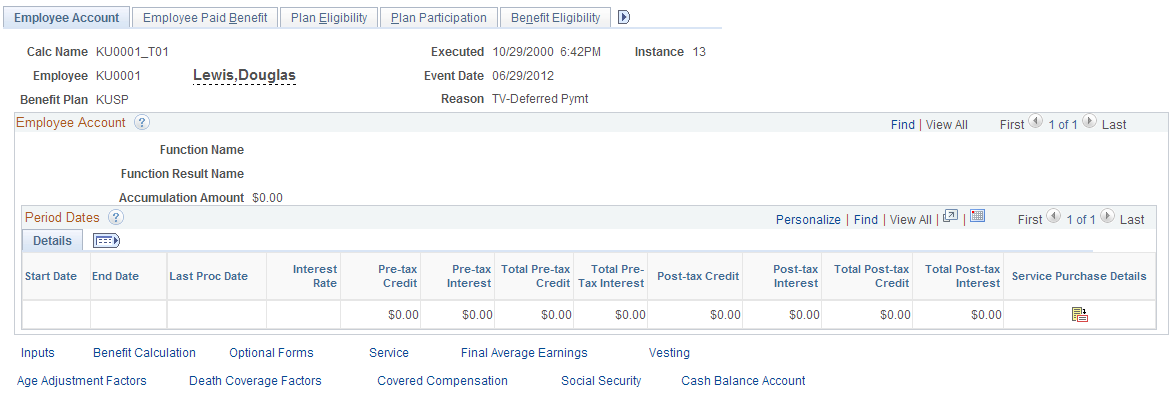

Use the Employee Account page (PA_CLC_ACCT_SUM) to view results from the employee accounts function, which tracks the accumulation of contributions and interest for a participant in a contributory plan.

Navigation:

This example illustrates the fields and controls on the Employee Account page.

Employee Account

Field or Control |

Description |

|---|---|

Accumulation Amount |

Displays the final value for the account as of the event date. |

Period Dates

If you produced detailed results for a calculation, this grid displays the periodic accumulations.

Field or Control |

Description |

|---|---|

Start Date and End Date |

If the participant had a startup balance at the time that you loaded data into Pension Administration, the first period begins and ends on the startup as of date. This period has no current period data, only ending balances in the total columns. |

Last Proc Date (last processed date) |

Displays the last processed date for the employee account. |

Interest Rate |

Displays the interest rate applied to the prior period balance. |

Pre-tax Credit, Pre-tax Interest, Post-tax Credit and Post-tax Interest |

These fields display the pretax and posttax credits applied to the account during the current period and the interest earned by each. Posttax interest is just the interest on posttax contributions; the interest itself has not yet been taxed. If there were manual adjustments during a period, the current period data displayed reflects those adjustments. |

Total Pre-tax Credit, Total Pre-tax Interest, Total Post-tax Credit, and Total Post-tax Interest |

Displays the running balances for pretax and posttax credits and interest. |

Service Purchase Details |

Click to access the Review: Employee Account page where you can see details related to adjustments for service purchase. |

Note: The service fields on this page apply only to withdrawal and service purchase subaccounts. Although the dollar activity in these accounts rolls up to the plan's main contributory account, the service information does not.

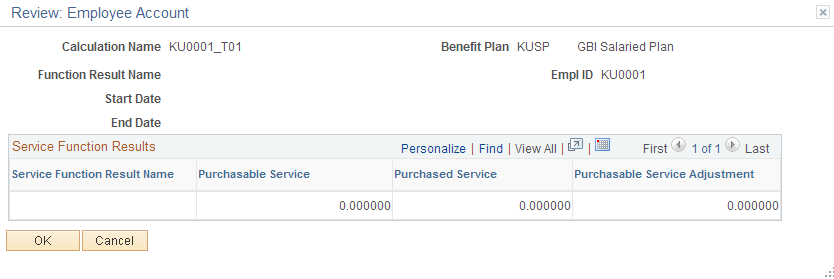

Use the Review: Employee Account page (PA_CLC_ACCT_SP) to view service purchase details associated with an employee account.

Navigation:

Click the Service Purchase Details icon on the Employee Account page.

This example illustrates the Review: Employee Account page.

Understanding Service Buyback and Purchase Activity

Sometimes activity in a participant account affects service. This happens in one of three ways:

Participants withdraw contributions and forfeit the corresponding service. This typically occurs at termination.

Participants repay the withdrawn contributions and buy back the service originally forfeited. This typically occurs after a rehire.

Participants make contributions for times when they were not accruing service and thus purchase service credit for that time. The purchased service period is typically a time when a person was employed but not eligible for the plan. Plans might also allow service purchase for time spent on military leave or other qualified leaves.

Service Function Results

This grid lists the service function results that are associated with an employee account.

Field or Control |

Description |

|---|---|

Purchasable Service |

Displays the service that a participant can receive if the participant repays previously withdrawn contributions or sets up a service purchase arrangement. The value is zero until either a contribution withdrawal or service purchase arrangement establishes an initial amount of purchasable service. As the service is restored, which can be all at once or gradually, the purchasable service amount is reduced. For example, if Lucia withdraws 2,000 USD of contributions and thus forfeits three years of service, the withdrawal account has an ending balance of -2,000 USD and a purchasable service amount of 3.0. The adjustment to the account balance rolls up to the plan's main contributory account, but the purchasable service does not. Therefore, the main contributory account still displays zero purchasable service. For a service purchase arrangement, a plan administrator must establish the initial amount of purchasable service and enter it (and the dollar amount necessary to purchase the service) on the Account Adjustments page. |

Purchased Service |

Displays service that was restored during the period, as defined by the Begin/End Date field. |

Purchasable Service Adjustment |

Displays manual adjustments to purchasable service during the period. For example, if you set up a service purchase process incorrectly and have to change the amount of purchasable service, you enter a manual adjustment on the Account Adjustments page. During the next periodic processing, the purchasable service is adjusted by that amount, and the results for the period include both the adjustment amount in this field and the adjusted amount in the Purchasable Service field. |

Use the Employee Paid Benefit page (PA_CLC_CONT_SUM) to view results from the employee-paid benefit function, which determines what portion of a total benefit, expressed in its normal form, is attributable to participant contributions.

Navigation:

This example illustrates the fields and controls on the Employee Paid Benefit page.

Field or Control |

Description |

|---|---|

Balance at Event Date |

Displays the value of the contributions, plus interest, as of the event date. |

Balance at Determination Date and Interest Rate for Projection |

Displays the value as of the date for refunding contributions (typically, the benefit commencement date or the lump sum date from the calculation inputs) and the interest rate used to project the participant contributory balance from the event date to the determination date. |

Balance at NRD and Interest Rate for Projection |

Displays the value as of the normal retirement date and the interest rate used to project the participant contributory balance from the date of determination to normal retirement date. |

Factor to Convert to Annuity |

Displays the factor used to convert from a lump sum to the plan's normal form. This enables you to eventually compare this amount to the total benefit. |

Employee Benefit Amount |

Displays the value of the account in the plan's normal form of payment as of the later of either the normal retirement date or the date of determination. |

Use the Plan Eligibility page (PA_CLC_PEL_SUM) to view results from the plan eligibility function, which determines whether a participant is eligible to participate in a plan.

Navigation:

This example illustrates the fields and controls on the Plan Eligibility page.

Field or Control |

Description |

|---|---|

Eligibility Status |

Indicates whether the employee is eligible to participate in a plan. |

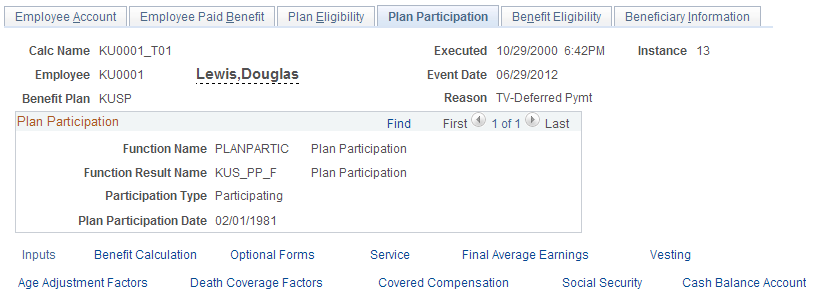

Use the Plan Participation page (PA_CLC_PRT_SUM) to view results from the participation function, which determines whether a participant meets plan participation requirements.

Navigation:

This example illustrates the fields and controls on the Plan Participation page.

Note: If a participant is not participating in a plan, the calculation stops after running the participation calculation.

Field or Control |

Description |

|---|---|

Plan Participation Date |

Indicates when a worker became a participant or, for calculations with projections, when the worker is expected to become a participant. When participation is based on age, the participation date is the same day that the worker attains the specified age, subject to date adjustments that you specify (either date rounding or plan entry dates). When participation is based on service, however, the system does not necessarily determine the exact day the worker attains the specified amount of service. Instead, the system checks the service history, finds the period when the worker attained the specified service amount, then uses the first day of the next period. The accuracy of this date depends on how you set up your service requirement. |

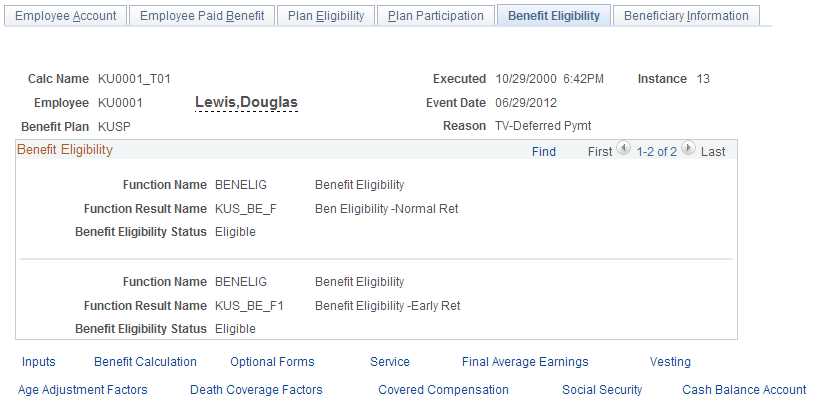

Use the Benefit Eligibility page (PA_CLC_BEL_SUM) to view results from the retirement eligibility function, which identifies whether a participant is eligible for a retirement type.

Navigation:

This example illustrates the fields and controls on the Benefit Eligibility page.

Field or Control |

Description |

|---|---|

Benefit Eligibility Status |

Indicates whether a participant is eligible or ineligible for a retirement type. Depending on how you set up your calculation rules, this can be the eligibility status as of the event date or the benefit commencement date. Typically, a plan has one retirement eligibility function result for each allowable retirement type, such as early retirement and normal retirement. You also use this function to determine eligibility for ancillary benefits, such as death and disability. |

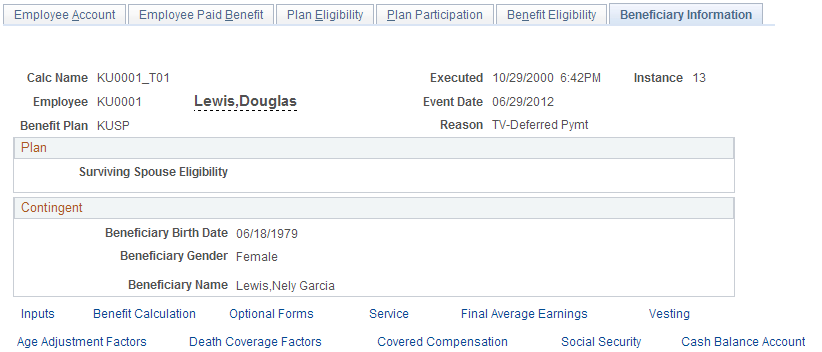

Use the Beneficiary Information page (PA_CLC_BENEF_SUM) to view beneficiary data used in calculating a participant's benefit.

Navigation:

This example illustrates the fields and controls on the Beneficiary Information page.

Field or Control |

Description |

|---|---|

Surviving Spouse Eligibility |

If a plan offers an automatic spouse benefit, this field indicates whether a participant and spouse met the plan's criteria to be eligible for the automatic benefit. |

Beneficiary Birth Date, Beneficiary Gender, and Beneficiary Name |

If a participant has a non-spouse beneficiary, these fields display information about that beneficiary. |

The calculation parameters include override fields for all of these fields except for the beneficiary's name. The values on this page display the information that the calculation used, regardless of the data source.