Defining Employee Accounts

To set up an employee account, use the Employee Accounts (EMPLOYEE_ACCOUNTS) component.

This topic discusses how to set up an employee account.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CONTRIB_ACCT_C1 |

Set up employee accounts parameters. |

Use the Employee Accounts page (PA_CONTRIB_ACCT_C1) to set up employee accounts parameters.

Navigation:

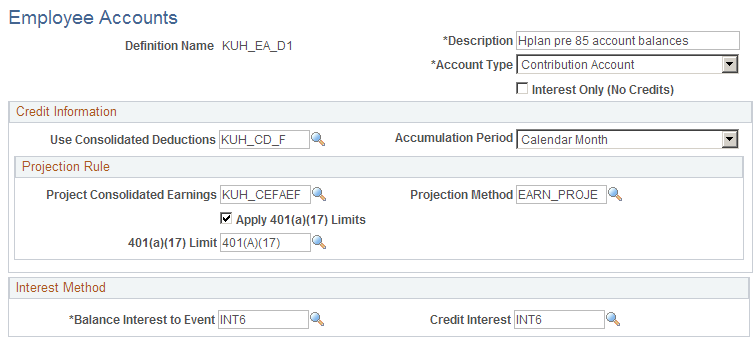

This example illustrates the fields and controls on the Employee Accounts page.

Field or Control |

Description |

|---|---|

Interest Only (No Credits) |

Select this option to create a definition that tracks interest only. |

Account Type |

Select an account type. Contribution Account: Every contributory plan has one contribution account to track the total contributions made to the plan. Withdrawal Account: These track amounts that employees withdraw and repay from the plan contributory account and track the effect of these transactions on service. When you create the function result for the withdrawal account, you associate it with a regular contributory account and with a service function result. If you need to track more that one repayment at a time, set up multiple withdrawal accounts. Service Purchase: The function result for this subaccount tracks amounts that employees pay into the main contribution account in order to buy service for specific time periods. Don't use purchase accounts to track repayment of withdrawn amounts. |

Credit Information

Field or Control |

Description |

|---|---|

Use Consolidated Deductions |

If you did not select Interest Only (No Credits), enter the name of the consolidated contributions function result that accumulates payroll deduction information. |

Note: If an employee changes employee accounts definitions in the middle of an accumulation period, the system normally uses the last definition in effect during the period for the entire period. If, however, an employee changes from a definition that uses consolidated deductions to a definition that uses interest only, the system uses the interest-only definition, but also picks up contributions made while the employee was covered under the previous definition.

Field or Control |

Description |

|---|---|

Accumulation Period |

Accounts grow over defined accumulation periods with interest credited at the end of the accumulation period. When you look at the results of your Employee Accounts calculations, you see the total for each period as well as the balance at the end of each period. Select from: Calendar Year, Calendar Month, and Plan Year. |

Note: When you administer withdrawals of contributions, the system looks up the present value of the contributions based on the most recent complete accumulation period created by periodic processing. For this reason, you probably want to use monthly accumulation periods rather than annual accumulation periods if you administer withdrawals.

Projection Rule

Field or Control |

Description |

|---|---|

Project Consolidated Earnings |

Entering a consolidated earnings function result to indicate the earnings basis, then enter the Projection Method you want to use. |

Apply 401(a)(17) Limits |

Select to apply limits to the earnings amounts and enter the 401(a)(17) method to use. |

Interest Method

Use Balance Interest to Event and Credit Interest the same way that you use them for cash balance accounts.