Establishing Employee General Deductions

This topic discusses how to enter data for general deductions.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

General Deduction |

GENL_DED_DATA_NL |

|

Enter data for general (not benefit-related) deductions for employees. Depending on how you choose to implement Administer Salaries for the Netherlands, you can also use this page to enter employee benefit deductions. |

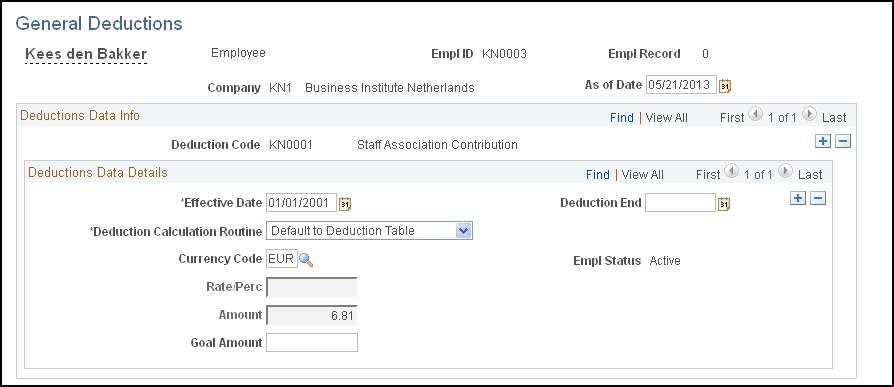

Use the General Deduction page (GENL_DED_DATA_NL) to enter data for general (not benefit-related) deductions for employees.

Depending on how you choose to implement Administer Salaries for the Netherlands, you can also use this page to enter employee benefit deductions.

Navigation:

This example illustrates the fields and controls on the General Deduction page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Deduction Code |

Select the deduction code. You can select from deductions that are on the General Deduction table only. |

Deduction End Date |

Enter the effective deduction end date. |

Currency Code |

Select the currency in which the funds are paid. |

Field or Control |

Description |

|---|---|

Deduction Calculation Routine |

Although you initially specify the calculation method for general deduction on the General Deduction table, you can override these settings for an individual employee by selecting new options in this field: Default to Deduction Table: Select to use the deduction calculation routine that is specified on the General Deduction table. Flat Amount: Select if the deduction is a flat amount. Percentage: Select if the deduction is calculated as a percentage. |

Deduction Rate or % (deduction rate or percentage) |

If you select Percentage in Deduction Calculation Routine, enter the percentage in this field. |

Flat/Addl Amount (flat/additional amount) |

If you select Flat Amount in Deduction Calculation Routine, enter the amount in this field. |

Goal Amount |

Enter a goal amount to indicate the total cumulative amount for this deduction at which you want the deduction to stop. |