Defining Benefits and Other Deductions

To define benefit plans and other deductions, use the Deduction table (DEDUCTION_TABLE1), General Deduction Table (GENL_DEDUCTION_TBL), Company General Deduction Table (GDED_COM_TBL), Benefit Plan Table (BENEFIT_PLAN_TABLE), Coverage Code Table (COVRG_CD_TBL), and the Benefit Program Table (BEN_PROG_DEFN) components.

This topic provides an overview of benefit plans, benefit programs, and deductions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCT_TABLE1_NL |

Specify, for all benefits deductions and general deductions, whether a deduction is permanent or incidental and how the deduction affects taxes. |

|

|

GENL_DEDUCT_TBL_NL |

Set up general deduction data and define how nonbenefit deductions are calculated. These deductions include parking fees, union dues, or garnishments. (For benefit deductions, use one of the Benefits tables.) |

|

|

GDED_COM_TBL |

Set up general deductions for your organization. |

|

|

VNDR_ID1 |

Define the benefit providers for your benefit plans. |

|

|

BENEFIT_PLAN_TABLE |

Set up a benefit plan definition. Also define providers, provider codes, and default deduction codes for all plan types. |

|

|

COVRG_CD_TBL |

Create new coverage codes for your benefit programs. We recommend that you give the coverage code a numerical values of one through seven. Coverage codes should be ordered according to their complexity, with Employee being first. |

|

|

BEN_PROG_DEFN1 |

Set up basic benefit program information. |

|

|

BEN_PROG_DEFN2 |

Link plan types to the benefit program and add important information about plan types. |

|

|

BEN_PROG_DEFN3 |

Link a benefit program and plan type to rate and calculate rules. |

|

|

BN_CLONE |

Use the benefit program clone utility to identify a benefit program and have the system make an exact copy of that program with a different effective date. Give the duplicate program the same name as the original or rename it, which saves you time and effort when you create a new benefit program with a future effective date. |

Every benefit plan is distinguished by a unique combination of plan type and plan name. Plan type is important because our system uses it to distinguish insurance plans, for example, health insurance plans from life insurance plans.

Plan types are assigned a numerical value and are divided into categories based upon those values. For example, all health-related plan types begin with a 1. Therefore, the system recognizes all plan types in the range of 10−19 as health plans. After that come the life insurance plans, with plan type values of 20−29, and so on.

For each delivered category, you can add types that include a letter value, as long as you begin with the correct series identification. For example, all health plan types must start with a 1, so you can add plan types with values from 1A to 1Z. A value of 2Z wouldn't work as a health plan type but could be used for a new life insurance plan type.

Because you add plan types starting from the beginning of the alphabet, it is recommended that you start with Z and work backward to A. If you use a plan type in the range of 10−19 and 1A−1Z, the system recognizes it as a health plan type.

The plan type series delivered by HR are as follows:

|

Plan Type Numbers |

Plans |

|---|---|

|

10−19, 1A−1Z |

Health plans |

|

20−29, 2A−2Z |

Life insurance plans |

|

30−39, 3A−3Z |

Disability plans |

|

40−49, 4B−4Z |

Savings plans |

|

4A |

Employee stock purchase plans (ESPPs) |

|

50−59, 5B−5Z |

Leave plans |

|

5A |

Company car (European organizations only) |

|

60−69, 6A−6Z |

Flexible spending account plans (U.S. and Canada) |

|

70−79, 7A−7Z |

Retirement plans (U.S.) |

|

80−89, 8A−8Z |

Pension plans (U.S. and Canada) |

|

90−99, 9A−9Z |

Vacation buy/sell plans |

We recommend that you work within the delivered plan type series. If you add plan types that do not conform to the delivered series, update the associated processing logic.

The plan types delivered by HR are as follows:

|

Plan Type |

Description |

Plan Type |

Description |

|---|---|---|---|

|

10 |

Medical |

4A |

ESPP |

|

11 |

Dental |

50 |

Sick leave |

|

12 |

Medical/Dental |

51 |

Vacation leave |

|

13 |

Major medical |

52 |

Personal leave |

|

14 |

Vision/Hearing |

53 |

Family Medical Leave Act (FMLA) leave |

|

15 |

Nonqualified medical |

5A |

Company car (European organizations only) |

|

16 |

Nonqualified dental |

60 |

Health care - FSA (Flexible Spending) |

|

17 |

Nonqualified vision |

61 |

Dependent care - FSA |

|

20 |

Life |

62 |

Legal - FSA |

|

21 |

Supplemental life |

65 |

Canadian health care |

|

22 |

AD/D |

66 |

Canadian retirement counseling |

|

23 |

Life and AD/D |

70 |

PERS |

|

24 |

Dependent AD/D |

80 |

Standard pension (Canadian) |

|

25 |

Dependent life |

81 |

Supplementary pension (Canadian) |

|

26 |

Survivor income |

82 |

USDB Pension Plan 1 |

|

30 |

Short-term disability |

83 |

USDB Pension Plan 2 |

|

31 |

Long-term disability |

84 |

USDB Pension Plan 3 |

|

40 |

401(K) |

85 |

USDB Pension Plan 4 |

|

41 |

Profit sharing |

86 |

USDB Pension Plan 5 |

|

42 |

Thrift |

87 |

USDB Pension Plan 6 |

|

43 |

IRA |

90 |

Vacation buy |

|

44 |

Capital accumulation |

91 |

Vacation sell |

|

45 |

U.S. Savings Bonds |

The first step in defining a benefit plan is to name the plan and identify the plan type through the Benefit Plan table.

A benefit program is a set of benefits and deductions that is valid for an employee or group of employees. A single company may have any number of programs, and an employee with concurrent jobs may have multiple benefit programs. Therefore, when you set up a benefit program, you are defining which benefits and deductions are valid for the employees enrolled in the program.

To keep your benefit program accurate and consistent, the calculation rules and options must be individually effective-dated in a coherent, logical manner. If they aren't, your benefit program is open to a variety of errors as historical records get shuffled and benefits data lost. Plans associated with a benefit program cannot be in effect unless their effective dates are set on or after the effective date of the benefit program. Similarly, the rates and calculation rules that you associate with the plans cannot be in effect unless their effective dates are set on or after the dates of the plans to which they're linked. If a benefit program and benefit plan combination isn't effective when you think it should be, check the effective dates of the benefit program and the benefit plan. The effective date of the benefit plan must be less than or equal to the effective date of the benefit program.

Deductions comprise all payroll deductions for benefit plans and other general payments, not including taxes. There are two basic types of deductions: benefits deductions and general deductions. In Human Resources, a general deduction is a deduction (permanent or incidental) that isn't a benefit deduction. Charitable deductions, union dues, parking fees, garnishments, and bonds all fit into this category. Refer to deductions for taxes as taxes. When setting up deductions in Human Resources, remember that there are two parts to defining a deduction.

To define a deduction:

Use the Deduction Table page to specify, for all benefits deductions and general deductions, whether a deduction is permanent or incidental and how the deduction affects taxes.

Define the actual calculation of a deduction on the General Deduction Table page or on the Benefits tables, depending on the type of deduction that you specify.

Use the General Deduction Table page for non-benefit deductions, such as parking fees, union dues, or garnishments. This page contains the codes that classify all payroll deductions that do not fit into a category covered by one of the Benefits tables, such as loan payments, cash, advance settlements, union dues, and parking fees.

Use the Benefits tables for benefit deductions, such as those for medical and life insurance plans.

For each entry on the General Deduction Table page or in the Benefits table, there should be a corresponding entry on the Deduction Table page.

The HRsystem provides two Structured Query Reports (SQRs) for reviewing the deduction codes that are entered into the system:

The Deductions report (INT005NL) provides an overview of the different deductions defined in the system.

This SQR is sorted by plan type, deduction code, and effective date. It prints the classification codes that you set up for each plan type on the Deduction Table page.

The General Deduction/Frequency report (INT006NL) provides information about valid general deduction codes that you entered into the system.

The report shows the calculation type code for each deduction and, where applicable, the flat rate or percentage, the employee pay frequency, and any additional flat deduction amounts.

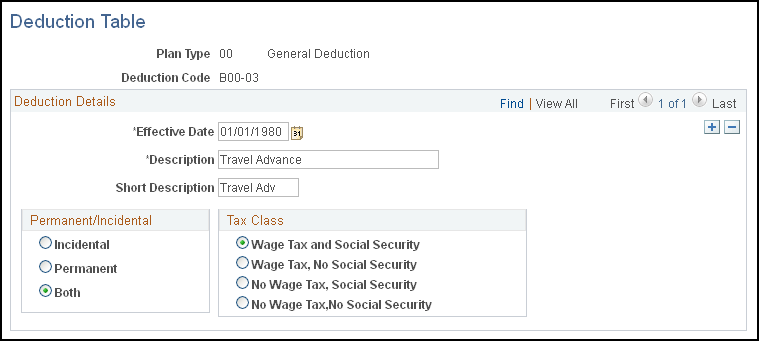

Use the Deduction Table page (DEDUCT_TABLE1_NL) to specify, for all benefits deductions and general deductions, whether a deduction is permanent or incidental and how the deduction affects taxes.

Navigation:

This example illustrates the fields and controls on the Deduction Table page. You can find definitions for the fields and controls later on this page.

Note: Deductions on the Deduction table are grouped by plan type. The plan type code for general deductions is always 00. Benefit deduction plan type codes vary depending on the nature of the benefit, but are already coded into the system as translate values. If you want to create plan types, use Z0 through ZZ. You must also ensure that the deduction codes you create are the same ones that you used in the General Deduction Table and the Benefits Table.

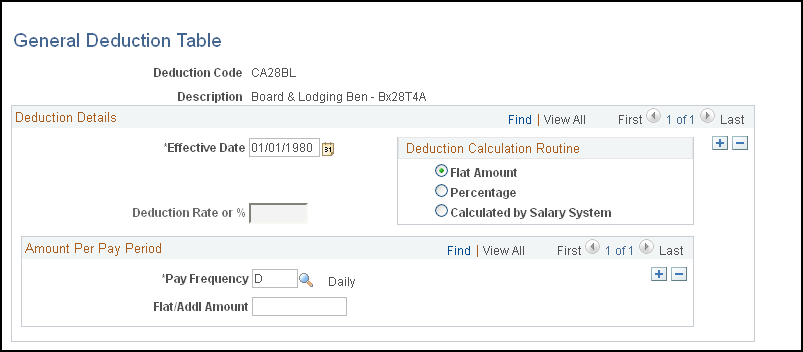

Use the General Deduction Table page (GENL_DEDUCT_TBL_NL) to set up general deduction data and define how nonbenefit deductions are calculated.

These deductions include parking fees, union dues, or garnishments. (For benefit deductions, use one of the Benefits tables.)

Navigation:

This example illustrates the fields and controls on the General Deduction Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Deduction Calculation Routine |

For each general deduction, indicate the type of deduction calculation routine that your payroll system uses to determine the amount of the deduction. If you select a deduction calculation routine that uses a deduction rate or percent, also enter a flat/additional amount per pay period to be deducted. However, you must indicate the amount here only if it's the same for all employees within a pay frequency. Flat Amount: Select if the deduction is a flat amount. Enter the amount in the Deduction Flat/Addl Amount (deduction flat/additional amount) field. Percentage: Select if the deduction is calculated as a percentage. Enter the percentage in the Deduction Rate or % (deduction rate or percent) field. Calculated by Salary System: Select if the deduction is calculated by the payroll system. |

Amount Per Pay Period

This group box displays the amount to be deducted from an employee's pay every pay period.

Field or Control |

Description |

|---|---|

Pay Frequency |

If you have a deduction that varies by pay frequency, indicate the amount deducted in each pay period for each pay frequency. For example, if there is a 50.00 EUR per month parking deduction for the company GBI, set up the deduction for the semimonthly pay group KN2 so that it applies only to the last pay period of the month. Rather than taking out 25.00 EUR each pay period, take the full 50.00 EUR at the end of the month. To set this up, indicate both the frequency and amount. |

Deduction Flat/Addl Amount (deduction flat /additional amount) |

If you select a deduction calculation routine that uses a flat amount, enter a flat amount or additional deduction amount. However, indicate the amount here only if it's the same for all employees within a pay frequency. |

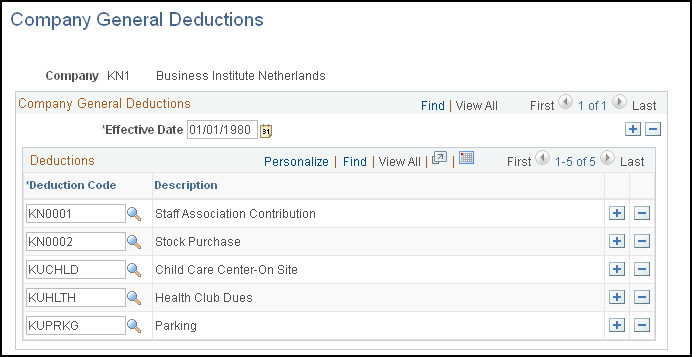

Use the Company General Deductions page (GDED_COM_TBL) to set up general deductions for your organization.

Navigation:

This example illustrates the fields and controls on the Company General Deductions page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Deduction Code |

Select deduction codes that are applicable for your company. Deduction codes are created on the Deduction Table page (DEDUCT_TABLE1_NL). |

Use the Vendor Information page (VNDR_ID1) to define the benefit providers for your benefit plans.

Navigation:

Benefit providers are defined as vendors. The Provider/Vendor Table component (PROVIDER_TABLE) is described in the PeopleSoft HCM Application Fundamentals product documentation.

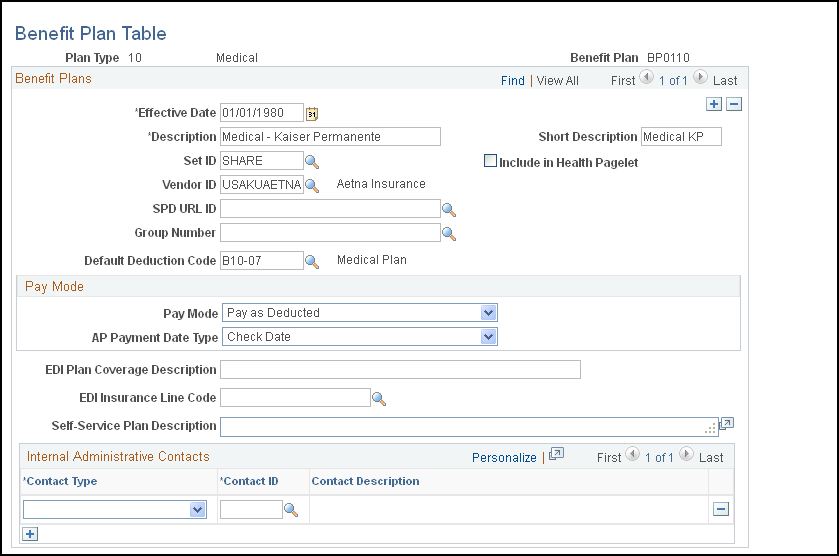

Use the Benefit Plan Table page (BENEFIT_PLAN_TABLE ) to set up a benefit plan definition.

Also define providers, provider codes, and default deduction codes for all plan types.

Navigation:

This example illustrates the fields and controls on the Benefit Plan Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Vendor ID |

Select the provider of the benefit plan. Use the Provider/Vendor Table component to set up providers. |

Group Number |

Select the group number. Define group numbers on the Provider/Vendor Table — Policy Information page. |

SPD URL ID (summary plan description uniform resource locator identification) |

PeopleSoft eBenefits provides access to the summary plan description on the Provider Policy Table. Select the URL ID to the location of the summary plan description. |

Default Deduction Code |

(Optional) Enter a default code here to save you from typing the deduction code each time that you associate this benefit plan with a benefit program on the Benefit/Deduction Program Table. (Deduction codes are created on the Deduction Table page.) |

Pay Mode |

Fields in this group box are for use with PeopleSoft Payroll for North America only. |

EDI Plan Coverage Description |

This field appears for health plans and is for use in North America only. |

EDI Insurance Line Code |

This field appears for health plans and is for use in North America only. |

Self-Service Plan Description |

Use only for health (1x), disability (3x), leave (5x), and retirement (7x) plans. Enter text describing the benefit plan that will also appear on eBenefits pages. |

Internal Administrative Contacts

Field or Control |

Description |

|---|---|

Contact Type |

Select the contact type: COBRA Administrator, HIPAA Administrator, or Plan Administrator. |

Contact ID |

Select the contact ID for the administrator. Contact IDs are defined on the Benef Administrative Contact (benefits administrative contact) page. |

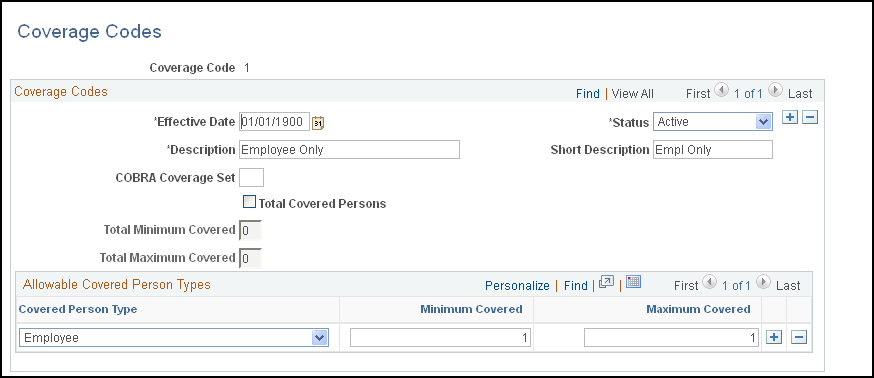

Use the Coverage Codes page (COVRG_CD_TBL) to create new coverage codes for your benefit programs.

We recommend that you give the coverage code a numerical values of one through seven. Coverage codes should be ordered according to their complexity, with Employee being first.

Navigation:

This example illustrates the fields and controls on the Coverage Codes page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

COBRA Coverage Set |

This field is not used by organizations in the Netherlands. |

Total Covered Persons |

Select this check box to activate the total covered person types functionality for this coverage code. |

Total Minimum Covered and Total Maximum Covered |

These fields are only visible when the Total Covered Persons check box is selected. Enter the allowable minimum and maximum covered persons. Include the employee in this count. |

Allowable Covered Person Types

Field or Control |

Description |

|---|---|

Covered Person Type |

Select the type of person for which you are setting parameters. Note: The coverage code controls for covered person type are used in PeopleSoft Benefits Administration. |

Minimum Number Covered |

Enter the minimum number of covered persons allowed. If you have selected the Total Covered Persons check box, this field is not editable. |

Maximum Number Covered |

Enter the maximum number of covered person allowed. If there is no limit to the number for this coverage code, enter 99. If you have selected the Total Covered Persons check box, this field is not editable. |

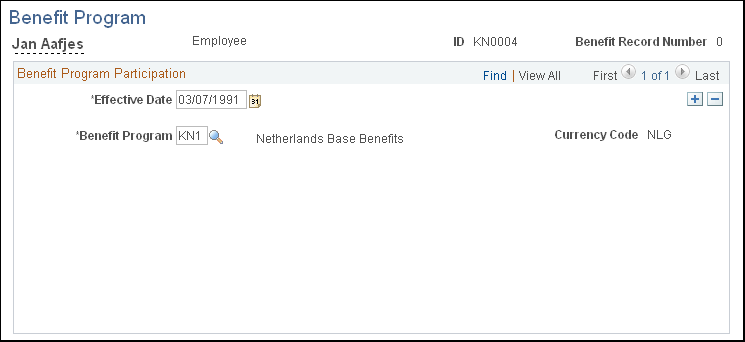

Use the Benefit Program page (BEN_PROG_DEFN1) to set up basic benefit program information.

Navigation:

This example illustrates the fields and controls on the Benefit Program page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Program Type |

The program type is set when you first build the benefit program. Set this field to Manual. When you create the benefit program, use PeopleSoft Benefits Administration in association with the Manage Base Benefits business process in HRand select the Benefits Administration check box in the Installation table, set the Program Type field to Automated. |

Currency Code |

The type of currency that the program uses for this program's benefit and deduction calculations. |

Dependent Age Limit |

Enables you to set a maximum age limit that, once reached, indicates that a dependent is no longer eligible for coverage. |

Student Age Limit |

Enables you to set a maximum age limit that, once reached, indicates that a dependent can no longer be covered by student status. |

Exclude Disabled from Age Lmt. (exclude disabled from age limit) |

Enables you to exclude disabled dependents from the maximum dependent limits. |

Dep Ineligible if Married (dependent ineligible if married) |

Indicates that dependents who are married aren't eligible for coverage under the benefits program. |

Important! All of the fields in the COBRA, Benefits Administration, FSA, and FMLA group boxes are for Canadian and U.S. functionality and are not for operations in the Netherlands.

Self-Service Configuration

Use this group box to define the rules for displaying and processing the PeopleSoft eBenefits application pages.

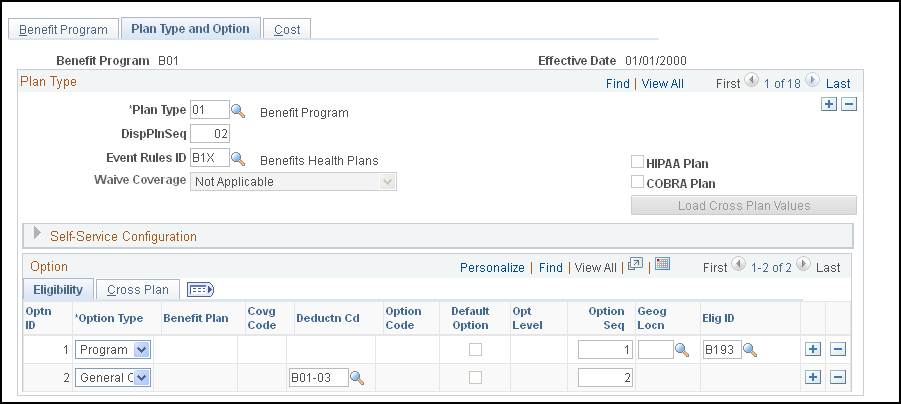

Use the Plan Type and Option page (BEN_PROG_DEFN2) to link plan types to the benefit program and add important information about plan types.

Navigation:

This example illustrates the fields and controls on the Plan Type and Option page. You can find definitions for the fields and controls later on this page.

Plan Type

Field or Control |

Description |

|---|---|

Plan Type |

Select a plan type from the predefined list of values. By adding rows, you can use this page to enter information for each plan type associated with a particular benefit program. Plan Type 01 also called the program level of the benefit program, is used only by benefit programs that run in association with Benefits Administration. |

Waive Coverage |

Select this check box if the plan type allows it. |

Important! The DispPlnSeq, Event Rules ID, COBRA Plan, HIPAA Plan, and Load Cross Plan Values elements are for Canadian and U.S. functionality and are not for operations in the Netherlands.

Self-Service Configuration

The fields in this group box are for Canadian and U.S. functionality and are not for operations in the Netherlands.

Option

Field or Control |

Description |

|---|---|

Optn ID (option ID) |

As you define options for each of the offered plan types, the system automatically enters the option ID. |

Optn Type (option type) |

Each row must have an option type designation. The option type that you select determines the remaining fields that you must complete on the Plan Type and Option (BEN_PROG_DEFN2) and the Cost (BEN_PROG_DEFN3) pages Gen Deduction (general deduction): Allowed only for plan type 00, which you use for general deductions. Option: At least one O is required for each plan type except 01. Gen Credit (general credit): Used only in benefit programs that run in association with Benefits Administration. Program: Used only in benefit programs that run in association with Benefits Administration. Waive Optn (waive option): Used only in benefit programs that run in association with Benefits Administration. |

Benefit Plan |

Enter the code for a benefit plan that was defined on the Benefit Plan Table page. |

Covrg Code (coverage code) |

Indicate the level of coverage for health plan types (1x). This is a required field for those plan types. |

Deductn Cd (deduction code) |

Indicate how to handle deductions. |

Important! The Option Seq (option sequence), Option Code, Opt Level (option level), Geog Locn (geographic location), and Elig ID (eligibility rules ID), fields are all used for Benefits Administration and are not for operations in the Netherlands.

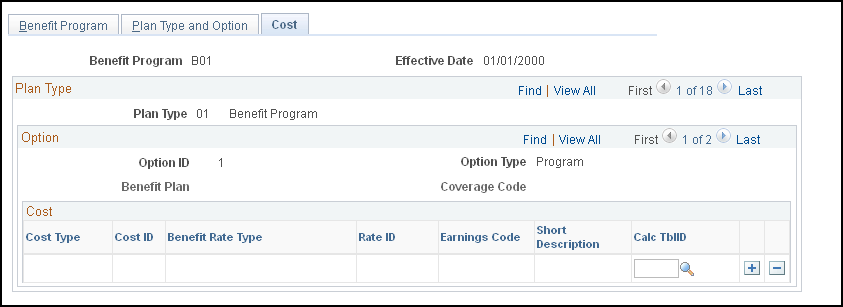

Use the Cost page (BEN_PROG_DEFN3) to link a benefit program and plan type to rate and calculate rules.

Navigation:

This example illustrates the fields and controls on the Cost page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Cost Type |

Select a cost type: Price, or Credit. |

Benefit Rate Type |

Select a rate type to specify which table should be used to determine rates for the plan type. |

Important! The Rate ID, Earn Code (earnings code), Cost ID, and Calc TblID (calculate table ID) fields are all used for Benefits Administration and are not for operations in the Netherlands.

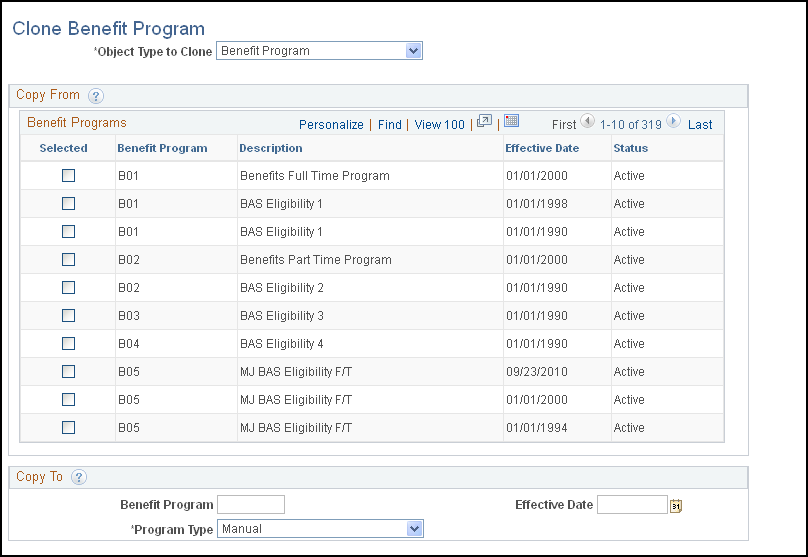

Use the Clone Benefit Program page (BN_CLONE) to use the benefit program clone utility to identify a benefit program and have the system make an exact copy of that program with a different effective date.

Give the duplicate program the same name as the original or rename it, which saves you time and effort when you create a new benefit program with a future effective date.

Navigation:

This example illustrates the fields and controls on the Clone Benefit Program page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Object Type to Clone |

Select the type of object you want to copy: Benefit Program, Coverage Formula, Eligibility Rule, or Event Rule. |

Selected |

Select the check box for the benefit program, coverage formula, eligibility rule, or event rule that you can to copy. |

Copy To

This group box defines the name of the new object that will be created. These fields vary, depending upon the type of object you're cloning.