Adding Employee Incidental Deductions

This topic provides an overview of the incidental deductions and discusses how to add employee incidental deductions.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Incidental Deductions |

DEDUCTION_INC_NL |

|

Enter incidental deductions from an employee's pay. |

Incidental deductions are general deductions, other than benefits and taxes, which are applied to only one or two pay cycles. Incidental deductions apply to a time period that has definite start and end dates (the end date isn't left open indefinitely). A simple example of an incidental deduction is the settlement of a cash advance. Another type of incidental deduction is a one time benefit deduction, such as an additional payment for a savings plan. An example of another type of incidental deduction is a vacation deduction from an employee's regular salary (which is offset during payroll processing by the payment of an equivalent amount of vacation pay).

Use the Incidental Deductions page (DEDUCTION_INC_NL) to enter incidental deductions from an employee's pay.

Navigation:

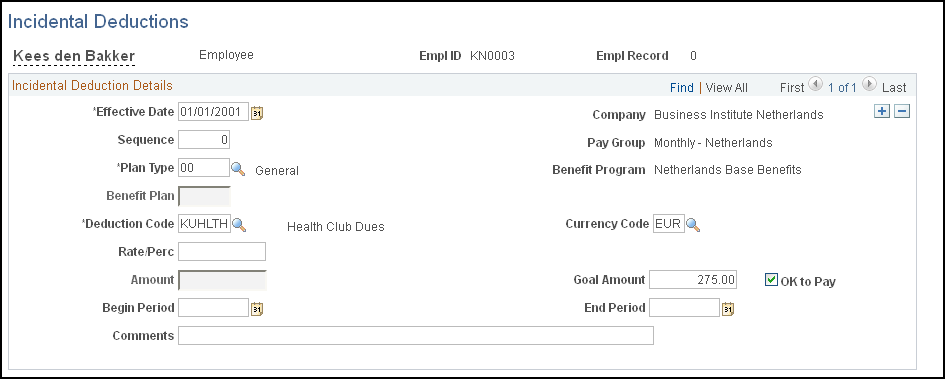

This example illustrates the fields and controls on the Incidental Deductions page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Sequence |

Enter a sequence number. This is required if you are entering multiple earnings information using the same effective date. |

Pay Group |

Displays the employee's pay group. |

Plan Type |

Select the plan type, which automatically uses a default of 00 (general) because most incidental deductions are general deductions rather than benefit deductions. Other one time benefit deductions can be associated with other plan type codes. |

Benefit Program |

Displays the benefit program in which the employee is enrolled. Use the Enroll in Benefits - Benefit Program page to verify or update the employee's enrollment. |

Benefit Plan |

Enter a benefit plan. |

Deduction Code |

Select a deduction code for the incidental deduction. Deduction codes are associated with plan types on the Deduction Table page, so the list shows only the deduction codes for the plan type that you just entered. See Deduction Table Page. |

Amount |

Enter the amount of the deduction, depending on the type of incidental deduction that is entered. |

Currency Code |

Select the currency code for the deductions. |

Rate/Pct (rate/percent) |

Enter the rate or percent of the deduction, depending on the type of incidental deduction that is entered. |

Goal Amount |

Enter the goal amount if you want to specify a total amount at which withholding of the deduction stops. |

OK to Pay |

Select to indicate approval if the organization has a procedure in place to first enter the incidental hours and then to obtain approval for payment of the incidental hours. |

Begin Period and End Period |

Enter the beginning and ending dates of the period for which the incidental deduction applies. |