Setting Up Pay Programs

This topic discusses how to create festive advance pay programs.

To set up festive advance pay programs, use the Pay Program (FA_PAY_PROGRAM) and Job Code Table (JOB_CODE_TBL) components.

After you set up the calculation rules by which you'll determine the amount of the festive advance payment, use these rules to set up one or more pay programs. Use these pay programs to pay festive advances to employees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FA_PAY_PROGRAM |

Create pay programs to use to pay festive advance for employees. |

|

|

JOBCODE_TBL1_GBL |

Set up one or more festive advance pay programs to cover each holiday type. Associate a default pay program with a specific job code. |

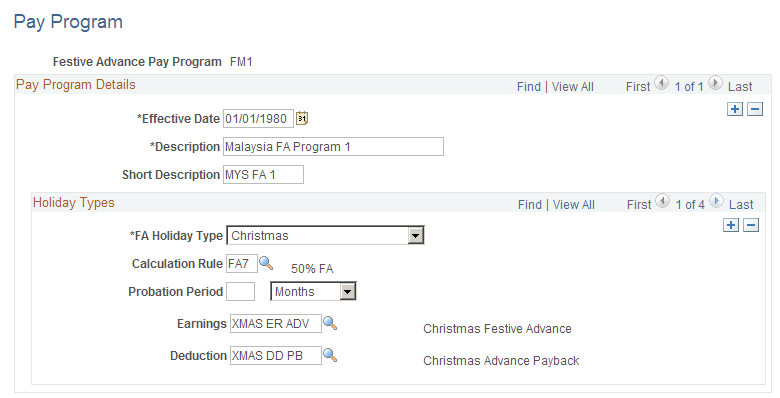

Use the Pay Program page (FA_PAY_PROGRAM) to create pay programs to use to pay festive advance for employees and to associate calculation rules with pay programs, holiday types, earnings and deductions elements, and any probationary period.

Navigation:

This example illustrates the Pay Program page.

Holiday Types

Field or Control |

Description |

|---|---|

FA Holiday Type (festive advance holiday type) |

Select the type of festive advance holiday: C New Year (Chinese New Year),Christmas, Deepavali, or Hari Raya. If you select N/A, the warning message FA Type can not be none in the FA Pay Program appears. Note: If you want to set up a pay program that includes more than one festive holiday type, insert a new row for each additional holiday type and its details. |

Calculation Rule |

Select the rule that applies to this festive advance. |

Probation Period |

Specify the probation period by entering the number and type of periods. For the type of period, select Days orMonths. |

Earnings andDeduction |

Select the earnings or deduction element that applies to this festive advance. If you have PeopleSoft Global Payroll installed, these fields hold the earnings and deductions elements that the system uses to pay and recover the festive advance. |