Setting Up Calculation Rules

This topic discusses how to define festive advance calculation rules.

To set up festive advance calculation rules, use the Calculation Rule (FA_CALC_RULE) component.

Before you allocate festive advances to employees, set up the rules by which you'll determine the amount of the festive advance paid. Then use these rules to set up one or more pay programs using the Pay Program page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FA_CALC_RULE |

Define rules for calculating the amount of the festive advance payment. |

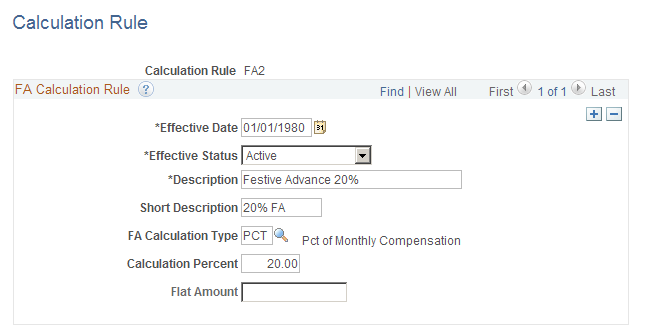

Use the Calculation Rule page (FA_CALC_RULE) to define rules for calculating the amount of the festive advance payment.

Navigation:

This example illustrates the Calculation Rule page.

FA Calculation Rule

You can have as many calculation rules as you need, depending on corporate policies. You might have a different rule for each of the festivals, or you might have different rules for shop floor staff and senior executives. Alternatively, you might have just one rule for all employees for all occasions.

Field or Control |

Description |

|---|---|

FA Calculation Type, Calculation Percent, andFlat Amount |

The FA Calculation Type field controls the display of theCalculation Percent andFlat Amount fields and defines what type of calculation to use to calculate the festive advance payment. Select: AMT − Flat amount: Enter the amount in theFlat Amount field. This amount is used in the calculation of the festive advance. TheCalculation Percent field is unavailable for entry. BTH − Flat Amount + Percentage of Monthly Compensation: Enter the calculation percent and the flat amount. PCT − Percentage of Monthly Compensation: Enter the percentage in theCalculation Percent field. The value stored here represents the percentage used in the calculation of the festive advance. TheFlat Amount field is unavailable for entry. Note: The percentage amount that you enter can be greater than 100 percent. The system issues a warning message, but you can still save the amount. |