Allocating Company Cars

To allocate company cars, use the Select Type of Benefits (CAR_PLAN) and Assign Type of Car/Dates (CAR_ALLOCATION) components.

This topic discusses how to allocate company cars.

Before allocating cars to employees, enroll them in the benefit plan.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CAR_PLAN |

Enroll workers in the car benefit plan. |

|

|

CAR_ALLOCATION |

Allocate company cars to workers. |

Use the Select Type of Benefits page (CAR_PLAN) to enroll workers in the car benefit plan.

Navigation:

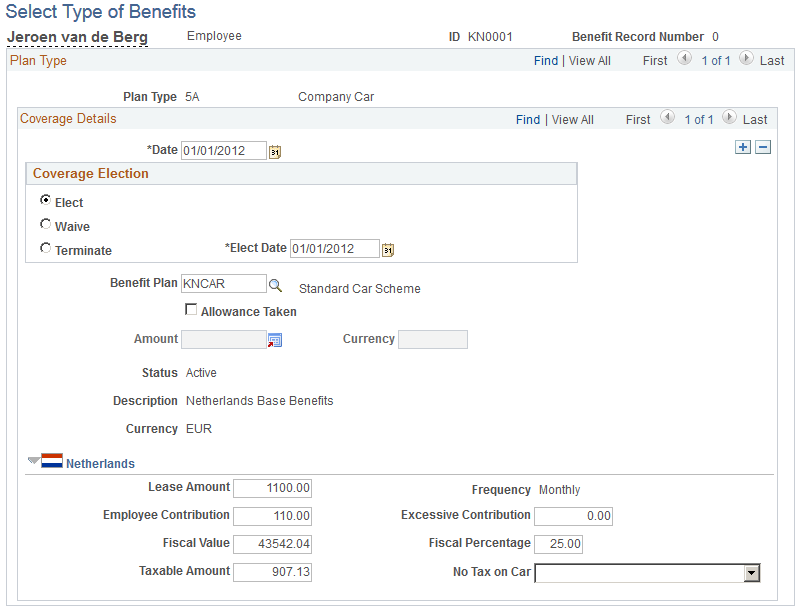

This example illustrates the fields and controls on the Select Type of Benefits page.

Field or Control |

Description |

|---|---|

Plan Type |

Displays the default value of Company Car. |

Coverage Begin Date |

Enter the start date for the worker's coverage under this plan. |

Coverage Election |

Indicate whether the worker chooses to Elect, Waive, or Terminate their coverage. |

Elect Date |

Enter the date on which the worker elected this coverage. |

Benefit Plan |

Enter a benefit plan from the plans that you set up in the Benefit Plan Table page. Only benefit plans that are in this worker's benefit program are available here. |

Allowance Taken |

Select if this worker chooses an allowance instead of a car. |

Amount |

Displays the allowance amount from the Company Car Plan page. You can override the amount, the currency, or both. Workers who choose the allowance can't have company cars allocated in the Assign Type of Car/Dates page. |

(NLD) Netherlands

Field or Control |

Description |

|---|---|

Lease Amount |

Enter the lease amount paid each period to the lease company. |

Frequency |

Displays the compensation frequency from the worker’s job data and applies to the lease amount. |

Employee Contribution |

Enter the contribution amount made by the employee. This can be a fixed amount or a percentage of the lease amount. |

Excessive Contribution |

Identify any excess above the employee’s lease budget. This amount will be considered an additional monthly contribution toward the employee’s private use. The budget is typically determine by the job family or position level. |

Fiscal Value |

Record the catalog price of a newly purchased car, including additional accessories. |

Fiscal Percentage |

Indicate the tax rate, which depends on the CO2 emission and the date of the registration of the vehicle. |

Taxable Amount |

Displays the taxable amount, which is derived from the amounts entered for Fiscal Value, the Fiscal Percentage, and the factor related to the Frequency (e.g. Monthly = 1/12). For example, if the fiscal value is equal to 20,000, the fiscal percentage is 25, and the frequency is monthly, then system would calculate the taxable amount accordingly: 20,000 * 25/100 * 1/12

= 416.67

When you change either the Fiscal Value or Fiscal Percentage values, the system re-calculates the Taxable Amount value. You can override the calculated amount, however, if you set the value to zero (0) include the reason for not having a tax on the company car in the No Tax on Car field.. |

No Tax on Car |

Select the reason for being exempt of paying tax for the use of a company car. For example, you might select No CO2 Emission for an electric car. Valid values include:

|

Use the Assign Type of Car/Dates page (CAR_ALLOCATION) to allocate company cars to workers.

Navigation:

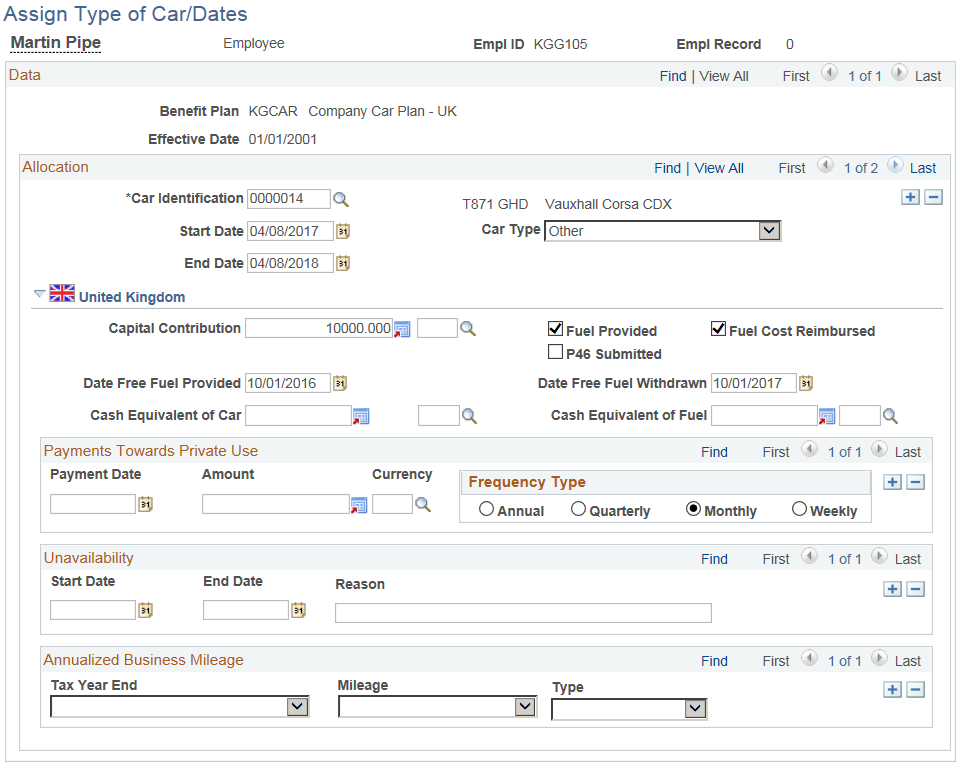

This example illustrates the fields and controls on the Assign Type of Car/Dates page.

Field or Control |

Description |

|---|---|

Car Identification |

Enter the code of the car that you want to allocate to the worker. Define values for this field in the Car Data table. Only cars that aren't already allocated or assigned to carpools as of the effective date are available. |

Start Date |

Enter the start date of the allocation. |

Car Type |

Select from these values: Primary Car, Replacement Car, Secondary Car, or Other. The car type is used in the P46 (Car) report that is provided with Global Payroll for the U.K. |

End Date |

Enter a date when the worker is scheduled to (or does) return the car. |

(GBR) United Kingdom

This information is required for the P46 (Car) report that is provided in PeopleSoft Global Payroll for the U.K.

Field or Control |

Description |

|---|---|

Capital Contribution |

Enter the amount and the currency code if the worker makes any capital contributions toward the car. |

Fuel Provided |

Select if you supply fuel to the worker for private use. |

Fuel Cost Reimbursed |

Select if the worker reimburses the total cost. |

P46 Submitted |

Select if you've submitted the P46 (Car) report to the Inland Revenue. If you have Global Payroll for the U.K., you can generate this report automatically. |

Date Free Fuel Provided |

Select the date from which free fuel was provided to the worker for private use. |

Date Free Fuel Withdrawn |

Select the date one which free fuel is withdrawn. |

Cash Equivalent of Car |

Enter the amount equivalent to the car. Click the Display In Other Currency button to access the Display In Other Currency page, where you change the currency. |

Cash Equivalent of Fuel |

Enter the amount equivalent to the fuel. Click the Display In Other Currency button to access the Display In Other Currency page, where you change the currency. |

Payments Towards Private Use

Complete this group box if the worker makes any payments for private use of the car.

Field or Control |

Description |

|---|---|

Payment Date andAmount |

Enter the date on which the worker started making payments and enter the amount of each payment. |

Frequency Type |

Select the frequency of the worker's payments. |

Unavailability

Indicate any period when the car is unavailable.

Annualized Business Mileage

Track the distance that the car is driven on business. Only mileage ranges are required for tax purposes.

Field or Control |

Description |

|---|---|

Tax Year End andMileage |

To identify the mileage for a particular tax year, select the Tax Year End value and the range of business mileage |

Type |

Values are: Actual: Select at the end of the tax year when a more accurate value is available. Expected: Select to enter an estimate for the current tax year. |