Defining and Tracking Reimbursable Tuition Expenses

These topics discuss how to define and track reimbursable expenses.

Note: The reimbursement information that you track here is for informational purposes only and does not affect payroll processing in Human Resources Management (HCM).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRN_EXPNS_TYP_GBL |

Define the types of training expenses that are reimbursable, define the percentage that is reimbursable, and set up a reimbursable limit. |

|

|

TRN_TUITION_REIMB |

Track reimbursable expenses. |

Use the Tuition Expense Type page (TRN_EXPNS_TYP_GBL) to define the types of training expenses that are reimbursable, define the percentage that is reimbursable, and set up a reimbursable limit.

Navigation:

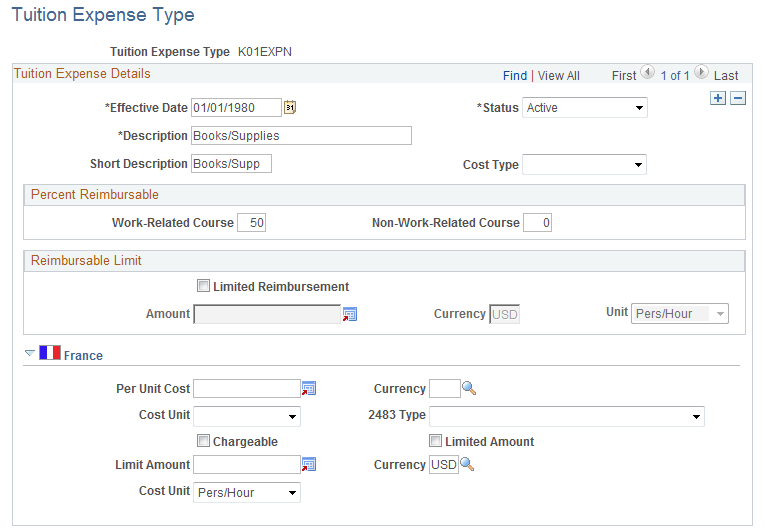

This example illustrates the fields and controls on the Tuition Expense Type page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Cost Type |

Select Direct or Indirect. |

Percent Reimbursable

Field or Control |

Description |

|---|---|

Work-Related Course and Non-Work-Related Course |

Enter the percentage of the expense that is reimbursable. You can have different percentages for work-related and non-work-related courses. |

Reimbursable Limit

Define reimbursable limits to help track tuition reimbursement costs.

Field or Control |

Description |

|---|---|

Limited Reimbursement |

Select to limit the amount that the students are reimbursed. The system makes the Amount and Cost Unit fields available. |

Amount and Cost Unit |

Enter the reimbursable limit and select the associated unit. For example, you can specify a flat cost, such as 100 USD, or limit the amount that is reimbursed for a period, such as 100 USD, per person per year. |

(FRA) France

Define additional expense data for 2483 report requirements.

Field or Control |

Description |

|---|---|

2483 Type |

Select an expense type. Options are Equipment, Furniture, Instructor Lodging & Transport, Instructor, Student Lodging & Transport, Non-Instructor (non-instructor-related expenses), and Student Restaurant. |

Chargeable |

Select to make the training course a chargeable item for the 2483 report. When selected, related costs that you entered are reported in the 2483 report. This is used to meet French legal reporting requirements. The default value derives from the chargeable flag set in the Course setup page and by the Compute Student Cost process. |

Limited Amount |

Select if the expense amount is restricted to a specific value. The system makes the Limit Amount and Cost Unit fields available. The limit amount is applied when computing the chargeable cost. |

Limit Amount, Currency, and Cost Unit |

Enter the limit amount and select the associated unit. For example, to limit hotel lodging to FRF 2000 per person per day, enter 2000 in the Limit Amount field and select Pers/Day in the Cost Unit field. Note: The quantity also applies to the limit. For example 2 meals that are paid by the same student costs 20 EUR pers/day, qty = 2. If the charge is only 15 EUR pers/day, the limit will be 15*2 = 30 EUR pers/day. |

Use the Maintain Tuition Reimbursement page (TRN_TUITION_REIMB) to track reimbursable expenses.

Navigation:

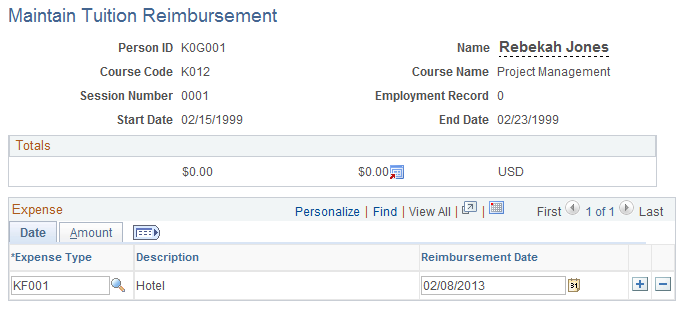

This example illustrates the fields and controls on the Maintain Tuition Reimbursement page. You can find definitions for the fields and controls later on this page.

You can track all expense types for which you usually reimburse students, including tuition, textbooks, and ancillary materials.

You can enter and update tuition reimbursements only for courses where students have a status of Enrolled, Currently Attending, or Completed. You update (or the system updates) the student status on the Enroll Individually and Student Training pages.

Totals

Displays the sum of the amounts in the Expense Amount field on the Date tab and the sum of the amounts in the Amount Reimbursed field and the currency code from the Amount tab.

Date Tab

Field or Control |

Description |

|---|---|

Expense Type |

Select an expense type from the types that you created on the Tuition Expense Type page. |

Amount Tab

Field or Control |

Description |

|---|---|

Work Rltd (work-related) and Amount Reimbursed |

Select if the course is work-related. The system calculates the amount that is to be reimbursed to the student based on the percentages that you entered on the Tuition Expense Type table. You can set up different percentages for work-related and non-work-related courses. If you have set a reimbursable limit on the Tuition Expense Type table, and you select this check box, the system calculates the amount that is to be reimbursed. If the limit is exceeded, the system displays a warning message and adjusts the Amount Reimbursed value. You can continue with the reduced amount or update the amount reimbursed. |