Calculating Tripartite Foundation Training Credit

To calculate training credit, use the FT Training Plans & Credit ESP (TRN_T_SIMU_CRD_ESP) component.

This topic discusses how to calculate training credit for companies.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Training Plan |

TRN_T_ACT_PLAN_ESP |

|

Plan the annual training plan for the company. |

|

Credit Calculation |

TRN_T_SIMU_CRD_ESP |

|

Calculate training credits for companies for the current training year. |

|

Credit Management |

TRN_T_CREDT_ESP |

|

Manage the annual training credit for the company. |

|

Bonus Distribution |

TRN_T_REDCTN_SEC |

Select the Bonus Distribution link on the Credit Management page. |

Distribute the cost to reduce, by months, to be reported to Tripartite Foundation (using the XML End of Groups files) and to Social Security (using the FAN File). |

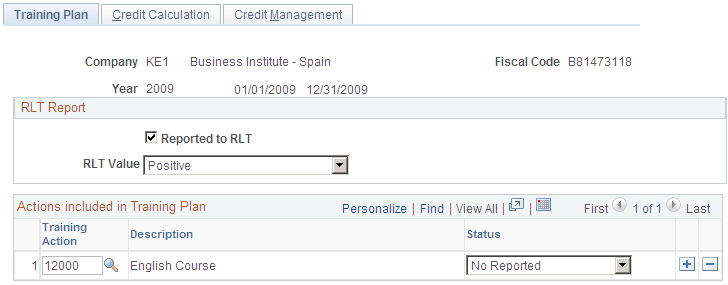

Use the Training Plan page (TRN_T_ACT_PLAN_ESP) to plan your annual training plans.

Navigation:

This example illustrates the fields and controls on the Training Plan page. You can find definitions for the fields and controls later on this page.

Use this page to record information for communicating training actions.

Field or Control |

Description |

|---|---|

Company |

Displays the company for which you are calculating training credit. |

Fiscal Code |

Displays the fiscal code associated with the company. |

Year |

Displays the year for which you are calculating training credit. |

RLT Report

The RLT requires 15 days to issue a report.

Field or Control |

Description |

|---|---|

Reported to RLT |

Select this check if the training plan has been reported to workers' representatives [Worker Legal Representation (RLT)]. |

RLT Value, Discrepancy Date, and Discrepancy Solved in 15 Days |

Select the reply from workers' representatives (RLT). Valid values are Positive, Discrepancy, and No Answer. When Discrepancy is selected, the Discrepancy Data and Discrepancy Solved in 15 Days fields become available. |

Actions included in Training Plan

Field or Control |

Description |

|---|---|

Training Action |

Enter all training actions to be included in the annual training plan for the company. |

Status |

Identify the reporting status of the training action. Values are No Reported or Reported. |

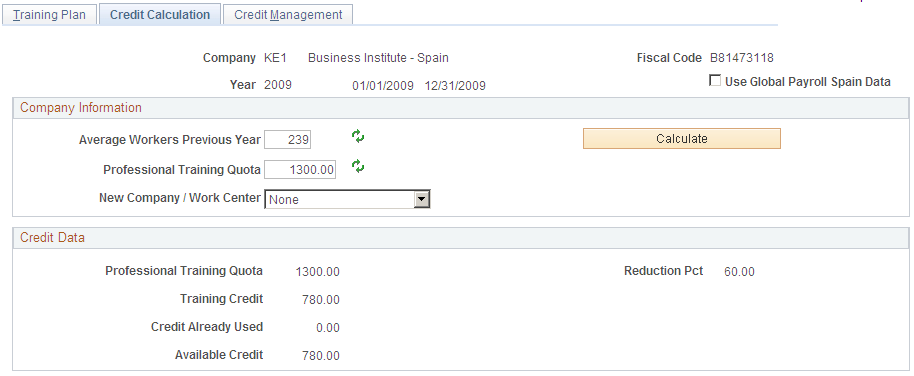

Use the Credit Calculation page (TRN_T_SIMU_CRD_ESP) to calculate training credit for companies.

Navigation:

This example illustrates the fields and controls on the Credit Calculation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Use Global Payroll Plain Spain Data |

Select this check box to have the system retrieve the average worker’s previous year and professional training quota data from GP Spain records to calculate the training credit. This check box is available for selection only if you have installed Global Payroll for Spain. |

Company Information

Field or Control |

Description |

|---|---|

Average Workers Previous Year |

Select the Refresh icon button after this field to have the system enter the average number of workers employed by the company during the year. You can overwrite this value as necessary. |

Professional Training Quota |

Enter you company’s professional training quota. |

New Company / Work Center |

Select from the valid values New Company, New Work Center, or None. Select the New Company value to calculate the training credit for a new company. When you select this value, the Hired Workers Current Year field becomes available and is required for calculation. Select the New Work Center value to indicate that the company created one or more new work centers during the calendar year for which you are calculating training credit. When you select this value, the Hired Workers Current Year field becomes available and is required for calculation. |

Hire Workers Current Year |

This field displays when you select New Company or New Work Center in the New Company / Work Center field. Enter the number of workers hired by the company during the year that should be considered in the training credit calculation. |

Calculate |

Click to calculate the training credit that the company should receive for the year. The system automatically calculates the training credit when you enter values in the Average Workers Previous Year and Professional Training Fee fields. If you select a value in the New Company / Work Center field and enter a value in the Hired Workers Current Year field, you will have to click the Calculate button again to recalculate the credit. This button is available when you select None in the New Company / Work Center field or after you have entered a value in the Hire Workers Current Year field for a New Company or New Work Center. |

Credit Data

Field or Control |

Description |

|---|---|

Professional Training Quote |

Indicates the professional training quote deposited by the company in the previous year. |

Reduction Pct |

Indicates the reduction percentage applied to the professional training quote. The system derives this percentage based on the number you enter in the Average Workers Previous Year field. |

Training Credit |

Indicates the total credit to finance training actions. |

Credit Already Used |

Indicates any credit already used by the company for the year. This field is unavailable for editing if you have PeopleSoft Global Payroll for Spain installed. |

Available Credit |

Displays the credits that are available for the company for the year. |

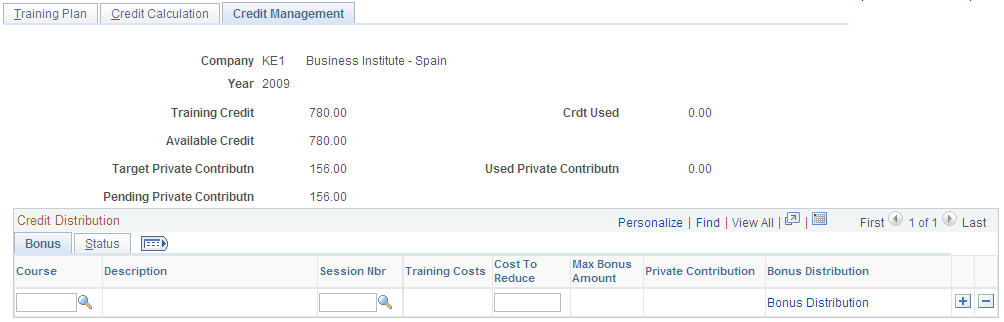

Use the Credit Management page (TRN_T_CREDT_ESP) to manage you training credits.

Navigation:

This example illustrates the fields and controls on the Credit Management page: Bonus tab. You can find definitions for the fields and controls later on this page.

Use this page to view the used credit, credit available as well as the pending private contribution at any time. It is recalculated whenever you add a new training session.

Field or Control |

Description |

|---|---|

Course and Session Nbr |

Enter the course-sessions (training groups) that are completed or finished. The system will display the costs calculated on the FT Session Data page. |

Cost To Reduce |

Displays the maximum bonus amount the system provides by default. You can modify this information; however the value cannot exceed either the Max Bonus Amount or the Available Credit values. |

Bonus Distribution |

Select this link to access the Bonus Distribution page and enter the distribution of the bonus by month. |

This example illustrates the fields and controls on the Credit Management page: Status tab. You can find definitions for the fields and controls later on this page.

Use the Status tab to view the FT status for the selected course-sessions (training groups) you entered on the previous tab. Values may include 4 - Finished No Reported or 5 - Finished and Reported.

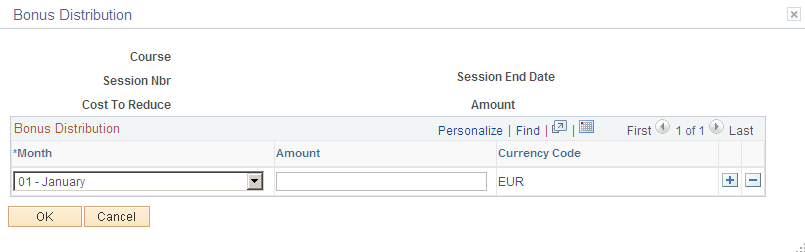

Use the Bonus Distribution page to (TRN_T_REDCTN_SEC) to enter the distribution of the bonus.

Navigation:

Select the Bonus Distribution link on the Credit Management page.

This example illustrates the fields and controls on the Bonus Distribution page. You can find definitions for the fields and controls later on this page.

The system enables you to distribute the bonus in the desired months using the Month and Amount fields.

Enter the month or months in which to apply the cost to reduce. Companies that provide continuous training to their workers can reduce their Social Security monthly contributions through the FAN file (the reduction amount will appear on line EDTCA80 in the file).

This bonus distribution is also reported to Tripartite Foundation (using the XML End of Groups files).