Managing TC Reporting

This section gives you details of the social security TC reports.

PeopleSoft Global Payroll for Spain delivers two TC reports for social security:

TC1: The TC1 report provides a summary of the totals for all Social Security bases, contributions, benefits to refund, reductions, and discounts referred to for employees included in an employer Social Security number.

TC2: The TC2 report provides a list of employees included in an employer Social Security number with their respective Social Security bases, contributions, benefits to refund, reductions, and discounts.

In summary, the TC2 report is a list of employees with their respective Social Security bases and contributions and the TC1 report is a summary of the TC2 report.

Two steps involved in generating these reports:

Data Preparation: To prepare data for the reports, the social security section SS SE PREPARAR TC runs the formula SS FM TC WA during payroll process. That sends data to the writable array SS TC WA during the regular payroll process. This writable array stores data in record GPES_SSTC_RSLT for use in the TC reporting process.

Reporting Process: To generate the reports, the reporting process reads the data in the writable array (see step 1).

See Defining Writable Array Elements

Liquidation Types

PeopleSoft Global Payroll for Spain manages the following liquidation types during FAN reporting:

L00: Regular liquidation. .

L02: Complementary liquidation due to litigation salaries. The surcharge for this liquidation type depends on when the litigation salaries are processed with respect to the sentence date. The payroll process sets the surcharge at 20% or 0% and stores it in the Social Security result table.

L03: Complementary liquidation due to retroactive calculation without surcharge.

L04: Negative complementary liquidation due to retroactive calculation with surcharge. For L04 payments, the surcharge is not a flat value. Rather, the system determines the surcharge based on the number of months the payment is delayed. The surcharge can be 3%, 5%, 10% or 20%. By default, the payroll process automatically calculates the L04 surcharge percentage. The system compares the month for which it is calculating L04 payments with the current month and determines the corresponding surcharge percentage.

Note: This type of liquidation results from Social Security benefits or reductions that were originally reported incorrectly.

L09: Complementary liquidation due to retroactive calculation with surcharge. Global Payroll for Spain calculates the surcharge for this liquidation type (currently 20%) and stores it in the GPES_OOD_PYMT_SUR field of the Social Security result table.

L13: Liquidation of contributions due to vacation paid at termination. The system calculates the surcharge associated with this liquidation type based on the main liquidation to which the L13 payment refers

The default liquidation type for FAN report retroactive payments is L03 (Default value of the variable SS VR RTR L03/L09). The Liquidation Type Override ESP (GPES_PMTRTO_DEF) and Liquidation Type Ovr Setup ESP (GPES_PMTRTR_OVR) components enable you to override the liquidation type with enhanced flexibility.

You can use the Liquidation Type Override ESP (GPES_PMTRTO_DEF) component to indicate that a certain liquidation is being processed out of date. Legal requirement dictate that in this case a company cannot benefit from reductions and cannot request a refund for the money they paid as PAGO DELEGADO. Therefore, if you set up a specific run to be out of date through this component, payroll processing does not generate those lines in the TC result record. The system keeps calculating the company paid benefits (PAGO DELEGADO) and social security reductions. Accumulators for these benefits store values regardless of whether a payment is in period or out of period. In the case of retroactivity, previous values are required. If the system didn't calculate accumulators, the previous values would be 0, and the deltas would be wrong. The system also contains a set of accumulators that store values in cases of payment out of period, with the negative delta values for social security benefits. You should consider all of these accumulators when setting up General Ledger. For example, to store PAGO DELEGADO for IT, we have both SS AC PGO DLGDO PI and SS AC PD IT N PLZO, which stores values when the calculation is out of date.

PeopleSoft Global Payroll for Spain enables you to view the social security contribution data that the FAN file contains to ensure that the collected data is correct. You can view the data for multiple employees within a specific company for a specified period and payment type through the Collective Report ESP component. Or you can view data for individual employees for a specific time period through the Individual Report ESP component. You can view data only through these components. If you need to modify data, you must recalculate the data by running the payroll process again.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_PMTRTO_DEF |

Define payment overrides. |

|

|

GPES_PMTRTR_OVR |

Override liquidation types. |

|

|

GPES_SSTC_COL_DAT |

View the social security contribution data that appears in the DAT (data) segment of the FAN file for multiple employees. You can view data for employees within the social security number of a specific company for a specified month or year and payment type. |

|

|

GPES_SSTC_COL_EDL |

View by element the data that appears in the EDL segment of the FAN file. This data includes the contribution, compensation, and deduction details for the selected employee and specific year. |

|

|

GPES_SSTC_IND_DAT |

View the social security contribution data that appears in the DAT (data) segment of the FAN file for individual employees for a specific period. |

|

|

GPES_SSTC_IND_EDL |

View by element the data that appears in the EDL segment of the FAN file. This data includes the contribution, compensation, and deduction details for the selected employee and period. |

|

|

GPES_RC_SS_TC2 |

Enter the data that is needed to create the FAN file that is submitted to the social security agency. |

|

|

GPES_RC_SS_SURCHRG |

View and update surcharges. |

|

|

GPES_RC_SS1 |

Enter the data that is needed to process TCs. |

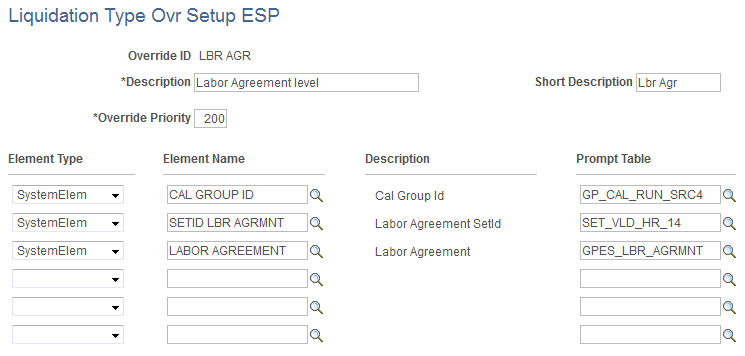

Use the Liquidation Type Ovr Setup ESP page (GPES_PMTRTO_DEF) to define FAN payment overrides.

Navigation:

This example illustrates the fields and controls on the Liquidation Type Ovr Setup ESP . You can find definitions for the fields and controls later on this page.

Use this page to define a set of parameters by which you can override liquidation types. By creating your own Override IDs, you can define any level of setup to specify the type of complementary reporting that you need to run.

Field or Control |

Description |

|---|---|

Override Priority |

Enter a numeric value to indicates the priority of this override ID. Smaller values represent higher priority. |

Element Type |

Enter the type of element you want to add to the override ID. Values are: Date, Formula, System Elem, and Variable. |

Element Name |

Select the element you want to use when resolving overrides. |

Description |

Displays the description of the element you select in the Element Name field. |

Prompt Table |

Select the table from which you want to select values for the selected element name. For example if you select an element name of COMPANY, you would select a prompt table that contained a list of existing companies. |

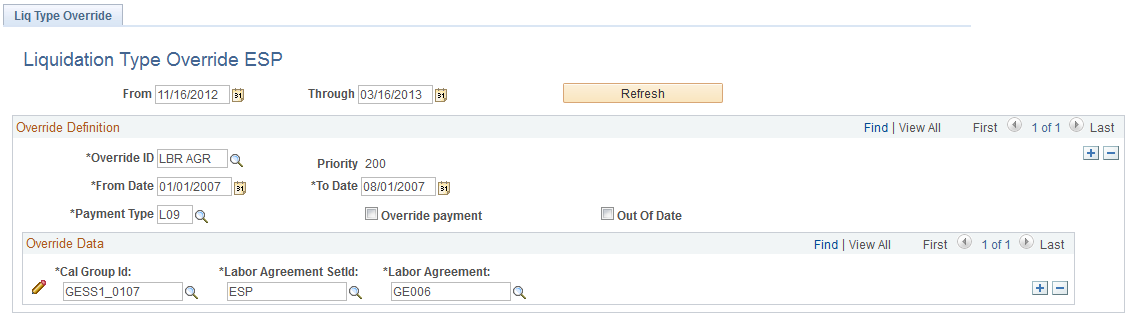

Use the Liquidation Type Override ESP page (GPES_PMTRTR_OVR) to override liquidation types.

Navigation:

This example illustrates the fields and controls on the Liquidation Type Override ESP page. You can find definitions for the fields and controls later on this page.

Override Definition

Field or Control |

Description |

|---|---|

Override ID |

Select the override ID that contains the data for which you want to override the liquidation type. |

From Date and To Date |

Enter the date range for the override data you want to select. |

Payment Type |

Select the liquidation type you want to assign to the override data. Values are:

|

Override Payment |

Select if you are overriding the liquidation type for the specific selection. |

Out of Date |

Select to indicate that you are reporting the specified liquidation type out of date. When you select this check box, the system does not calculate reductions or company paid benefits (PAGO DELEGADO) in the FAN file. |

Control Date |

Enter the control date for L02 and L03 payments that is reported in the TCT segment of the FAN file. If you enter a value in the Control Date field and select the Out of Date check box, the system automatically calculates the overdue surcharge to apply in the FAN file. In this case, you do not need to select the Overdue Payment check box and enter surcharge information when creating the FAN file. Note: The Control Date field is available only if you select L02 or L03 in the Payment Type field. |

After selecting values in the Override Definition group box fields, click Refresh to populate the Override Data group box with fields.

Override Data

The fields that appear in this group box are the ones that are defined for the Override ID you selected in the Override Definition group box. Use these fields to determine the subset of payees whose liquidation types will be overridden with the value you selected in the Payment Type field.

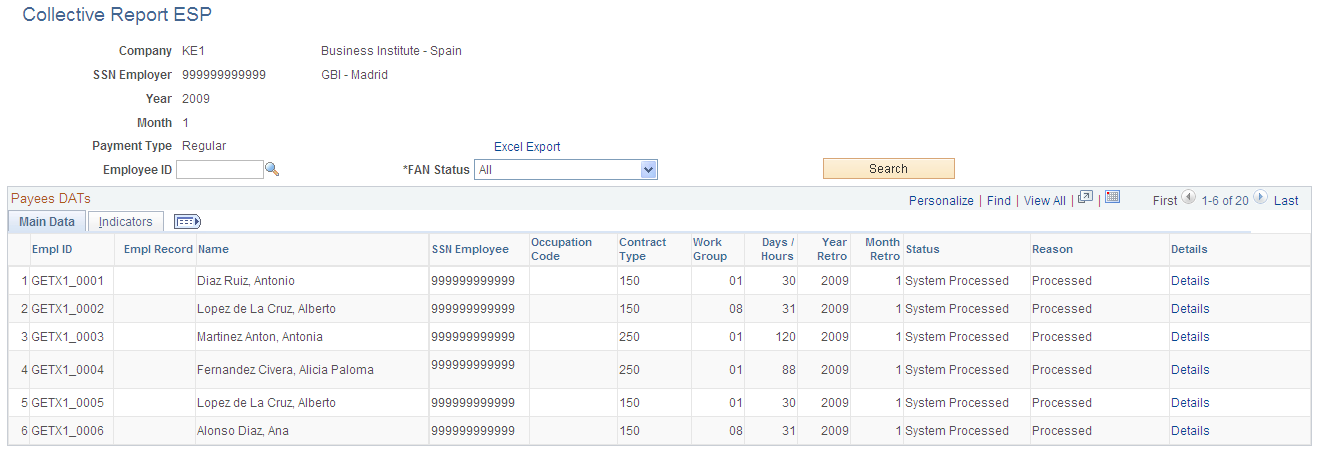

Use the Collective Report ESP page (GPES_SSTC_COL_DAT) to view the social security contribution data that appears in the DAT (data) segment of the FAN file for multiple employees.

You can view data for employees within the social security number of a specific company for a specified month or year and payment type.

Navigation:

This example illustrates the fields and controls on the Collective Report ESP page. You can find definitions for the fields and controls later on this page.

Search Criteria

Field or Control |

Description |

|---|---|

Empl ID |

Enter the employee ID to narrow the search results to a specific employee. This field is available only for the Collective Report ESP page. |

Search |

Click to retrieve data for persons based on the search criteria. The system displays the data in the Detail of Payees (DAT Segment) grid. |

Excel Export |

Click to export the data in the Detail of Payees (DAT Segment) grid to an Excel spreadsheet. |

Detail of Payees (DAT Segment) - Main Data

Use this grid to review the social security contribution data that appears in the DAT (data) segment of the FAN file for the employees that meet your search criteria. The Main Data tab displays the primary social security contribution information that is relevant to each of the employees. If multiple segments exist for the same employee, the system displays each segment on a different row.

Field or Control |

Description |

|---|---|

Empl ID |

Displays the ID of the person for which the data on a given row relates. |

Name |

The first and last name of the person. |

SSN Employee |

The social security number of the person. |

Occupation Code |

The social security occupational code if the employee's industrial activity is different from the one assigned to the company to which he belongs. |

Contract Type |

The contract code for social security. |

Social Security Work Group |

The social security work group. |

Days / Hours |

The days or hours of social security contributions. |

Year Retro |

Identifies the year of the recalculated month in case of retro calculation run from the selected month. |

Month Retro |

Identifies the recalculated month in case of a retro calculation from the selected month. For example, if you run a retro calculation in May for January, the system calculates delta contributions for January through April and displays this information on this page when filtering data by May. This field identifies the month to which the contributions belong. |

Details |

Click to access the Collective Report ESP - Details page, where you can view details of social security contributions for the selected employee. |

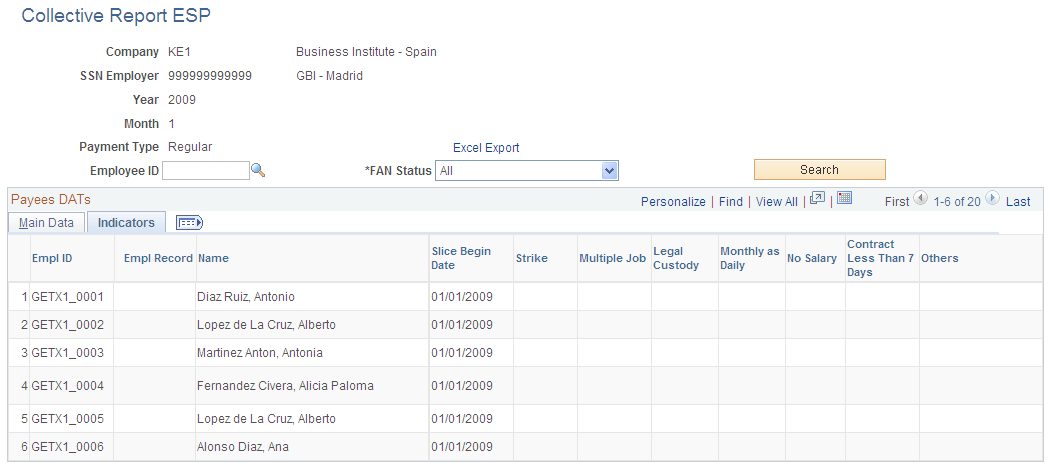

Detail of Payees (DAT Segment) - Indicators

Use the Indicators tab of this grid to view additional employee information that appears in special situations on the DAT segment of the FAN file.

This example illustrates the fields and controls on the Collective Report ESP page: Indicators tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Strike |

Indicates whether the period has been affected by a strike. |

Multiple Job |

Indicates that the employee has multiple jobs. |

Legal Custody |

Indicates that an absence or work schedule reduction exists due to child care (maternity, paternity, or legal custody). |

Monthly as Daily |

Indicates that although the employee has a social security work group that is daily, the employee is contributing as a monthly employee. |

No Salary |

Indicates that the period is not a paid period. |

Contract Less Than 7 Days |

A letter C in this column indicates that a surcharge was added because the employee had a contract with a duration of fewer than 7 days. This indicator appears only if the contract was temporary (not regular) and did not have a contract type of 410 or 510 (interim). |

Others |

Indicates other indicators that are not listed in the grid. Possible values are:

|

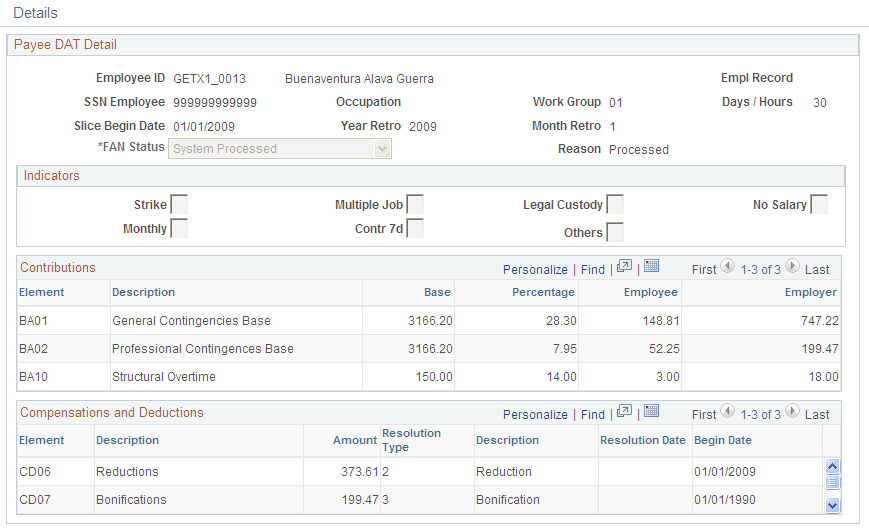

Use the Collective Report ESP - Details page (GPES_SSTC_COL_EDL) to view by element the data that appears in the EDL segment of the FAN file.

This data includes the contribution, compensation, and deduction details for the selected employee and specific year.

Navigation:

Click the Details link.

This example illustrates the fields and controls on the Collective Report ESP: Details page. You can find definitions for the fields and controls later on this page.

Contributions

Field or Control |

Description |

|---|---|

Element |

Displays the element code that appears in the FAN file for the contribution. |

Description |

The description of the contribution element that appears in the FAN file. |

Base |

The monetary value of the contribution element. |

Percentage |

The total contribution percentage that applies to each amount value. This percentage includes both employee and employer contribution percentages. |

Employee |

The amount that the employee pays for social security contributions for the given element. |

Employer |

The amount that the employer pays for social security contributions for the given element. Note that contribution amounts for certain elements are the exclusive responsibility of the employer. |

Compensations and Deductions

Field or Control |

Description |

|---|---|

Element |

The element code that appears in the FAN file for the compensation or deduction. |

Description |

The description of the compensation or deduction element that appears in the FAN file. |

Amount |

The monetary value to subtract from the calculated contributions in order to obtain a net value to pay or appeal to social security. |

Resolution Type |

The resolution type refers to special situations that require an administrative resolution. |

Resolution Date |

The initial date for each detailed resolution type that appears in the FAN file. |

Begin Date |

The initial date for each deduction element. |

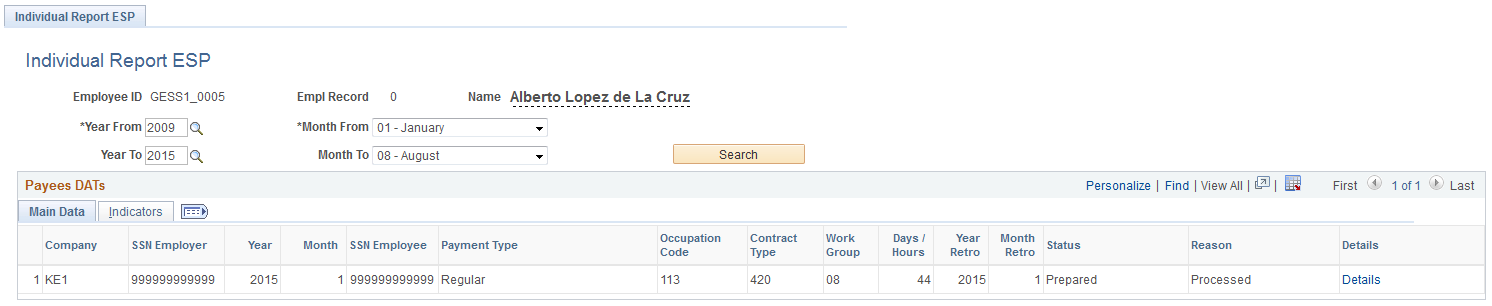

Use the Individual Report ESP page (GPES_SSTC_IND_DAT) to view the social security contribution data that appears in the DAT (data) segment of the FAN file for an employee in a specific period.

Navigation:

This example illustrates the fields and controls on the Individual Report ESP page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Year From and Month From |

Select the month and year from which you want to display the information. |

Year To and Month To |

Select the month and year up to which you want to display the information. |

Search |

Click this button to view the social security distribution data in the specified period. |

Payees DATs

Use this grid to review the social security contribution data that appears in the DAT (data) segment of the FAN file for an employee. The Main Data tab displays the primary social security contribution information relevant to the employee. If multiple segments exist for the same employee, system displays each segment on a different row.

This page is similar to the Collective Report ESP page; the only difference is that this page displays details of a selected employee for a selected period of time. See Collective Report ESP Page topic to know more details about the fields on this page.

Use the Individual Report ESP - Details page (GPES_SSTC_IND_EDL) to view by element the data that appears in the DAT segment of the FAN file.

Navigation:

Click the Details link

This example illustrates the fields and controls on the Individual Report ESP - Details Page. You can find definitions for the fields and controls later on this page.

Note: This page is very similar to Collective Report ESP - Details page. To know more details about the fields on this page, see Collective Report ESP - Details Page topic.

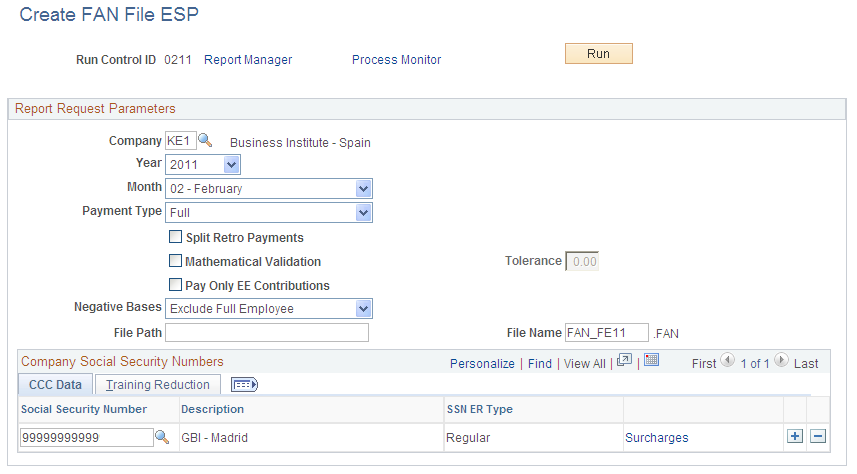

Use the Create FAN File ESP page (GPES_RC_SS_TC2) to enter the data that is needed to create the FAN file that is submitted to the social security agency.

Navigation:

This example illustrates the fields and controls on the Create FAN File ESP page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Company |

Enter the company for which the FAN file is created. |

Year/Month |

Enter the date parameters for the FAN file. |

Split Retro Payments |

Select to split the FAN file for L03 liquidation month by month. Note: This is similar to what Social Security requires for L09. |

Payment Type |

Select the payment type for the report that you want to generate for a specific month for the Employer Social Security numbers that are selected. Values are: Full: Includes everything that was calculated in the month: regular contributions, contributions due to vacations, litigation salaries, and retroactivity. If you select this value, the Complementary FAN Surcharge % field becomes available. Litigation Salary: Runs the report for deltas due to the litigation process. This is a legal process for resolving disputes between employers and terminated employees. Until this process is resolved, salary paid to the employee is identified as tramitation salary and employers must indicate in the TC1 report that the contributions are made during the tramitation period. Regular and Vacations: Includes the regular payroll and the contributions due for vacations that are paid at termination. Retroactivity w/Surcharge: Runs the report for the deltas detected in previous months due to retroactivity, and includes a surcharge. If you select this value, the Complementary FAN Surcharge % field becomes available and required. Retroactivity wo/Surcharge: Runs the report for the deltas detected in previous months due to retroactivity, but does not include a surcharge. Vacations: Include the contributions due for vacations that are paid at termination. |

Mathematical Validation |

Select if you want the system to perform mathematical validation and update the results based on the value you enter in the Validation Tolerance field. By default, the payroll process calculates and rounds to two decimal places for the contribution bases, employer contributions, and employee contributions for each employee. The FAN file generation process sums each base for all employees and sums each contribution for all employees separately. This calculation does not always match the result of multiplying the base by its contribution percentage and then rounding the final result to two decimal places. Mathematical validation enables you to check the FAN file records EDTCA01, EDTCA02, EDTCA11, EDTCA50, EDTCA57, EDTBA10 and EDTBA11 for total contribution aggregated amounts. If you select the Mathematical Validation check box and there is a delta between the sum of the employee/employer contributions and the result of multiplying the base by the contribution percentage is higher than the validation tolerance you specify, the system issues a warning message and overrides the aggregated contribution amount with the one calculated in FAN file. |

Pay Only EE Contributions |

Select to print only employee contributions in the FAN file. |

Validation Tolerance |

Enter the amount that you want the system to consider as maximum tolerance for mathematical validation. This field accepts values greater than or equal to 0, but it represents an absolute value. |

File Path |

Enter the directory in which to store the FAN file. |

File Name |

Enter the file name to be sent to Social Security. The file name needs to comply with the legal requirements. The file naming requirements state that the file extension must be .FAN and the file name must have 8 characters. The system will check whether the file name follows the naming conventions, and show an error message if it's not named correctly. |

Social Security Numbers to Process: CCC Data Tab

Field or Control |

Description |

|---|---|

Social Security Number |

Enter a Employer Social Security number (Codigo Cuenta Cotizacion). |

Surcharges |

Click to access the FAN Payment Surcharges page for a Employer Social Security number. |

Social Security Numbers to Process: Training Reduction Tab

Field or Control |

Description |

|---|---|

FT Reduction (Fundación Tripartita reduction) |

Enter the reduction amount corresponding to the continuous training plan (Tripartite Foundation reduction). For companies that provide continuous training to their workers, you must enter reductions in Social Security training contributions for inclusion in the FAN file. Enter contributions separately for each Employer Social Security number Each reduction amount appears on line EDTCA80 in the FAN file. |

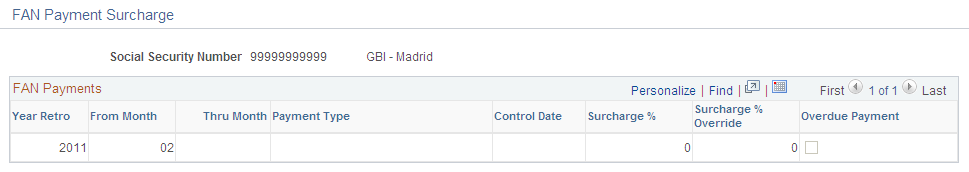

Use the FAN Payment Surcharge page (GPES_RC_SS_SURCHRG) to view and update surcharges.

Navigation:

Click the Surcharges link on the Create FAN File page.

This example illustrates the fields and controls on the FAN Payment Surcharge page. You can find definitions for the fields and controls later on this page.

This page displays data from the GPES_SSTC_RSLT record, grouping by Employer Social Security number (Codigo Cuenta Cotizacion)., payment type, control date and calculated surcharge percentage. This page displays one row for each unique combination of Employer Social Security number, payment type, control date and surcharge percentage and enables you to override the surcharge percentage.

Field or Control |

Description |

|---|---|

Social Security Number |

Lists the Employer Social Security numbers to be included in the FAN file. |

Description |

Lists the descriptions of each Employer Social Security number. |

Payment Type |

Lists the payment types for each row. Values are: Regular, Retroactivity wo/surcharge, Retroactivity w/Surcharge, Reduction Payback, Litigation Salary, and Vacations. These values correspond to liquidation types. |

Control Date |

Lists the control dates entered through either the Manage Terminations ESP page or the Create FAN Pymt. Overrides ESP page. |

Surcharge % (surcharge percentage) |

Lists the surcharge percentage that the system calculated during payroll processing and is to be included in the FAN file. This field displays the value of the field GPES_SSTC_RSLT.GPES_OOD_PYMT_SUR. Therefore, if you enter an override value and later rerun the FAN file process, this field will display the last used surcharge percentage. |

Surcharge % Override (surcharge percentage override) |

Enter a value here to override the surcharge percentage that the system calculated during payroll processing. The system uses this value during FAN file creation. |

Overdue Payment |

Select to indicate that the payment is overdue. When you select this check box, the system excludes the CD lines in the FAN file that correspond to social security reductions and company paid benefits (PAGO DELEGADO). In addition, to facilitate the reconciliation with PeopleSoft General Ledger, the system identifies the excluded lines in the social security result record. The FAN generation process updates the field GPES_SSTC_EXCL_FAN in this record to 01 for excluded lines. |

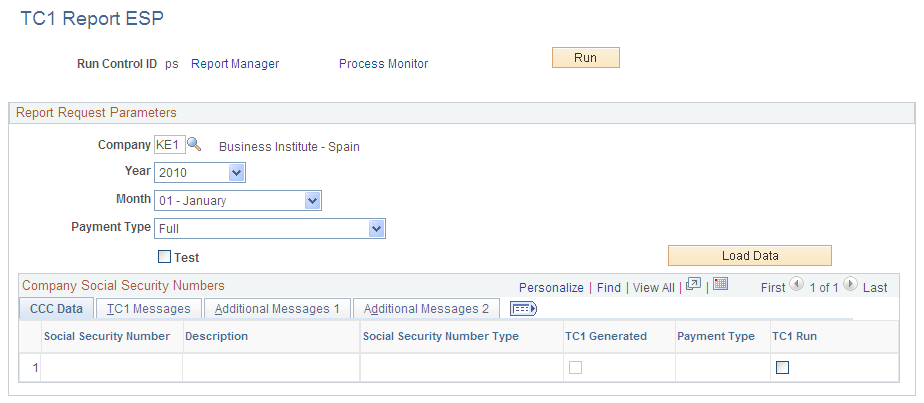

Use the TC1 Report ESP page (GPES_RC_SS1) to enter the data that is needed to process TCs.

Navigation:

This example illustrates the fields and controls on the TC1 Report ESP page. You can find definitions for the fields and controls later on this page.

Report Request Parameters

Field or Control |

Description |

|---|---|

Company |

Enter the company for which the TC1 report is created. |

Year/Month |

Enter the date parameters for the TC1 report. |

Payment Type |

Select the payment type. Note: This field is the same as the Payment Type field defined on the Create FAN File ESP page. |

Test |

Select to run the report in test mode. When you select this check box, the report is printed and columns are completed with XXXX to show that it is a test. |

Load Data |

Click to retrieve the Social Security numbers for the selected company. |

CCC Data Tab

The system populates this group box when you click the Load Data button.

Field or Control |

Description |

|---|---|

Company Social Security Number |

Displays the employer's Social Security number that was assigned to the establishment on the Establishment Address page. |

Social Security Number Type |

Defines the contract type for the selected Social Security number and can be one of these values: Regular, Trainee, or Apprentice. The social security number type is assigned to the establishment on the Establishment Address page in PeopleSoft HR. |

TC1 Generated |

The system automatically selects this check box if you already ran the TC1 report for the Social Security number. |

Payment Type |

Displays the payment type for the social security number. |

TC1 Run |

Select this check box for each social security number that you want to include in the report for the specified month. |

TC1 Messages Tab, Additional Messages 1 Tab, and Additional Messages 2 Tab

Access the TC1 Messages, Additional Messages 1, and Additional Messages 2 tabs.

Field or Control |

Description |

|---|---|

Report Date |

Enter the reporting date of the TC1 report. The default value for this field is the last day of the month following the month and year you select in the Year/Month fields. |

Line 1, Line 2, Line 3, Line 4, Line 5, and Line 6 |

Enter comments to include in the corresponding fields on the TC1 report. |