Running Non-Statutory Reports

This topic discusses how to run non-statutory reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_RNCTL_VE |

Run these reports:

These reports can be run before or after a payroll processing, depending on the information you want to validate. Full validation is only possible when payroll has been processed. |

|

|

GPGB_RNCTL_ES |

Run these reports that summarizes total earnings and deductions for a group of payees:

The elements are grouped by user-defined list sets. |

|

|

GPGB_RNCTL_EOY |

Run the EOY Pre Validation report (GPGBEOY) to identify data that does not meet the requirements of the HM Revenue and Customs validation standards. The report checks payee and pay entity data against the HMRC standards and lists those payees and pay entities that have missing or incorrect data. This includes payees with invalid NINO prefixes, and payees and pay entities with ECON or SCON numbers in the wrong format. There is also an option to check for invalid characters in the payee or pay entity name and address fields. Use this report to identify invalid data before you submit end of year returns. However, you can also run this report at any time during the year to check for invalid data. |

|

|

GPGB_GPSQR_PNL3 |

Run the High/Low Earners report (GPGBHLE). This report evaluates earnings based on an element that you select. For example, you can use this report to display all employees who earned more than 2,000 GBP as basic pay for a specific period, or to display those employees who received a tax refund during a specific period. |

|

|

Gross To Net Reports Page |

GPGB_GPSQR_PNL |

Run the Gross to Net report (GPGBGTNA). Use this report to reconcile your payroll. Run at any time during the tax year. |

Use the Validation Exception GBR page (GPGB_RNCTL_VE) to run the Validation Exception (payroll) and Validation Exception (starters and leavers) reports. These reports can be run before or after a payroll processing, depending on the information you want to validate.

Full validation is only possible when payroll has been processed.

Navigation:

This example illustrates the fields and controls on the Validation Exception GBR page.

Field or Control |

Description |

|---|---|

Calendar Group ID, Pay Entity, Pay Group, Company |

Use these fields to define the group of employees to include in the report. |

Use the Element Summary Report GBR page (GPGB_RNCTL_ES) to run these reports that summarizes total earnings and deductions for a group of payees:The elements are grouped by user-defined list sets.

Navigation:

This example illustrates the fields and controls on the Element Summary Report GBR page.

Field or Control |

Description |

|---|---|

List Set |

Select the list set you want to use for the report. To define list sets, use the Define List Set page PeopleSoft delivers two list sets for the UK, ELEMENT_SUMMARY and ELEMENT_LIST. Modify the delivered list sets to include the elements that you want included in the report. |

From the Process Scheduler Request page, you can select the period report or the year to date report.

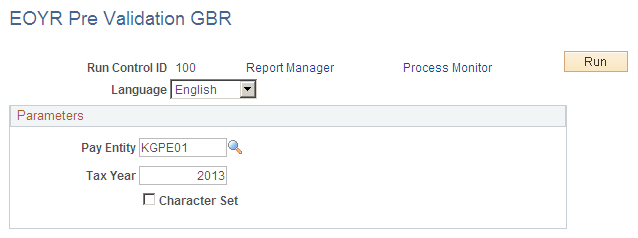

Use the EOYR Pre Validation GBR page (GPGB_RNCTL_EOY) to run the EOY Pre Validation report (GPGBEOY) to identify data that does not meet the requirements of the HM Revenue and Customs validation standards.

The report checks payee and pay entity data against the HMRC standards and lists those payees and pay entities that have missing or incorrect data. This includes payees with invalid NINO prefixes, and payees and pay entities with ECON or SCON numbers in the wrong format. There is also an option to check for invalid characters in the payee or pay entity name and address fields. Use this report to identify invalid data before you submit end of year returns. However, you can also run this report at any time during the year to check for invalid data.

Navigation:

This example illustrates the fields and controls on the EOYR Pre Validation GBR page.

Field or Control |

Description |

|---|---|

Tax Year |

Enter the year in which the tax year starts. When the report runs, it checks payee data for those payees who are in the selected pay entity and who will be included in the end of year return for the tax year you specify. |

Character Set |

Select this check box if you want the report to check for invalid characters, including the payee and pay entity name and address fields. If this check box is selected, the report lists the data fields that contain invalid characters. If you don't select the check box, the report does not check for invalid characters. |

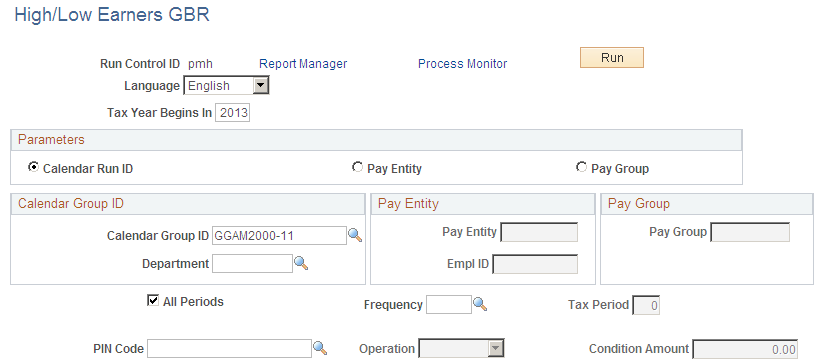

Use the High/Low Earners GBR page (GPGB_GPSQR_PNL3) to run the High/Low Earners report (GPGBHLE).

This report evaluates earnings based on an element that you select. For example, you can use this report to display all employees who earned more than 2,000 GBP as basic pay for a specific period, or to display those employees who received a tax refund during a specific period.

Navigation:

This example illustrates the fields and controls on the High/Low Earners GBR page.

Field or Control |

Description |

|---|---|

PIN Code (pay item name code) |

Select the element that you want to evaluate against the statement. |

Operation |

Select the operator that you want to use in the calculation: <, <=, =, >, or >=. |

Condition Amount |

Enter the amount against which you want to evaluate the element. |