Overriding Loan Repayment Amounts

This topic and discusses how to override loan repayment amounts.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PI_MNL_ERNDED |

Create the positive input entry for a employee for a selected pay period. Select the loan deduction element and specify the override, additional, or exceptional amount. |

|

|

Positive Input - Details Page |

GP_PI_MNL_SEC |

Create supporting element overrides to specify the loan ID and loan type. |

|

GP_PI_BULK_SSN |

Use the template delivered for the UK to enter positive input for loans. |

The amount deducted each pay period to repay a loan is defined on the Employee Loans page. When you enter an employee loan, you either define the repayment amount or the system calculates the repayment amount based on the repayment period.

However, there are times when you need to adjust the repayment amount for one pay period. There are 3 ways in which you can vary the repayment amount. Using positive input, you can enter an:

Override amount

An override specifies the amount to deduct from the payee's net pay. This overrides the normal repayment amount, that is defined on the Employee Loans page, for the selected pay period.

Additional amount

If you specify an additional amount, the system resolves the loan deduction twice. Once for the normal repayment amount and a second time for the additional amount. For example, if the repayment amount is 150GBP but the payee wants to pay 50GBP extra for one pay period, you enter a positive input entry for 50GBP.

Exceptional amount

An exceptional payment is not deducted from a payee's net pay, but is deducted from the loan balance. For example, if a payee repays a lump sum payment of 1000GBP by cheque (in addition to their normal repayment amount), you enter positive input for 1000GBP using the deduction LOA DD EXCEP. This ensures that the amount is not deducted from net pay.

Note: When you enter positive input for loans, you must enter a supporting element override to specify the loan ID and the loan type. Set the variable LN VR LOAN ID to the loan ID and variable LN VR LOAN TYPE to the loan type of the loan id. This is explained in detail in the next two topics.

You can enter positive input in two ways, using the Positive Input page or using the template that is delivered for loans.

Use the Positive Input page (GP_PI_MNL_ERNDED) to create the positive input entry for a employee for a selected pay period.

Select the loan deduction element and specify the override, additional, or exceptional amount.

Navigation:

To create a positive input entry for the selected employee:

Complete the fields on the Action tab as follows:

Field or Control

Description

Entry Type

Select Deduction.

Element Name

Select one of these elements:

LOA DD LOAN: If the amount must be deducted from net pay.

LOA DD EXCEP: If the positive input is for an exceptional payment, which is not deducted from net pay. When this deduction is processed, it reduces the loan balance but is not deducted from net pay.

Action Type

Select one of these options:

Override: To override the repayment amount for the pay period.

Additional: To enter an additional repayment amount or an exceptional amount.

Complete the fields on the Main Components tab as follows:

Field or Control

Description

Amount

Enter the override, additional, or exceptional amount.

Currency

Select GBP.

Click the Details link to access the Positive Input - Details page and enter supporting element overrides to define the loan ID and loan type:

Element Entry Type

Element Name

Character Value

Variable

LN VR LOAN ID.

Enter the loan ID

Variable

LN VR LOAN TYPE

Enter the loan type

Use the Positive Input by Template page (GP_PI_BULK_SSN) to use the template delivered for the UK to enter positive input for loans.

Navigation:

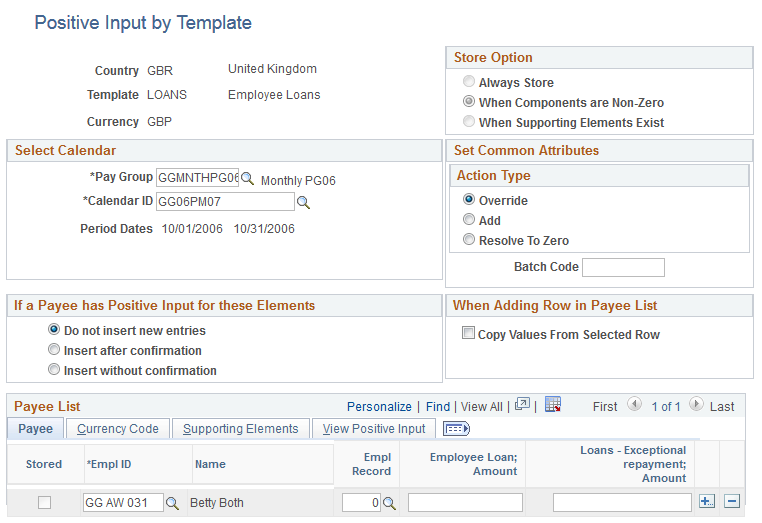

This example illustrates the fields and controls on the Positive Input by Template page.

Field or Control |

Description |

|---|---|

Action Type |

Select one of these options: Override: To override the repayment amount for the pay period. Add: To enter an additional repayment amount or an exceptional amount. |

Employee Loan: Amount |

Enter the override or additional amount. Leave this field blank if the positive input is for an exceptional amount. |

Loan – Exceptional repayment: Amount |

Enter the exceptional amount. Leave this field blank if the positive input is for an override or additional amount. |

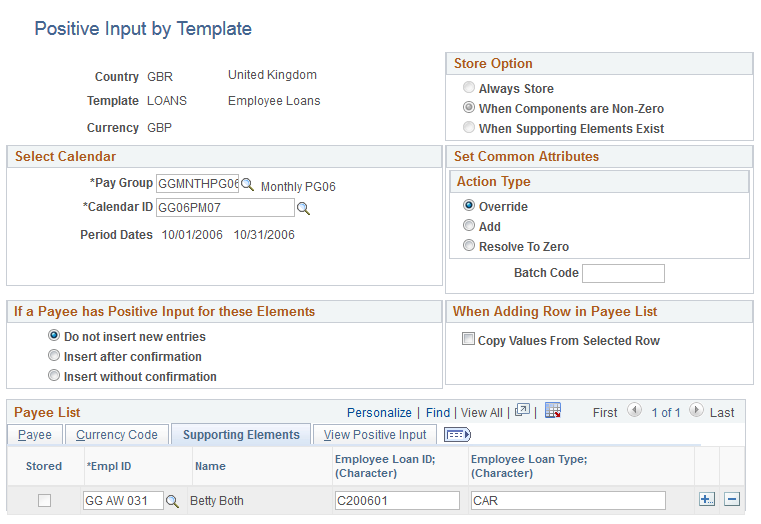

Supporting Elements

Access the Supporting Elements tab.

This example illustrates the fields and controls on the Supporting Elements tab of the Positive Input by Template page.

Field or Control |

Description |

|---|---|

Employee Loan ID (Character) |

Enter the loan ID defined for this loan on the Employee Loans page. |

Employee Loan Type (Character) |

Enter the loan type. |